What Is A Mortgage Rate Lock

Mortgage rates change daily, and that can be a problem when it can take more than a month to close a refinance loan. The solution offered by most lenders is a mortgage rate lock.

With a rate lock, your interest rate wont change for a set amount of time. If there are delays in closing your loan, and your rate lock will expire before you can complete the refinance, you may be able to get an extension. If that happens, be sure to ask if there are fees for extending the rate lock.

What Is A Discount Point

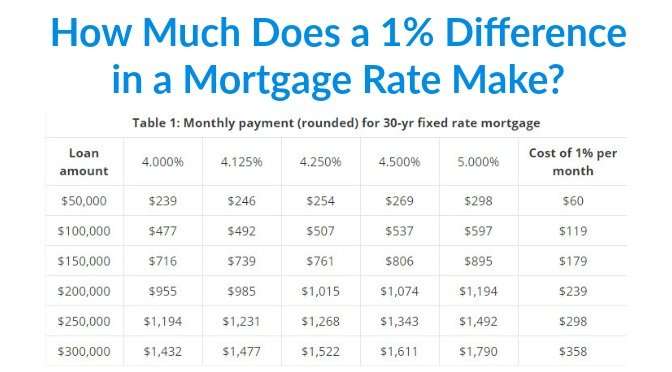

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

You May Like: What Are The Qualifications For Rural Development Loan

Movement Mortgage Best For Quick Closing

Overview

The South Carolina-headquartered Movement Mortgage was founded in 2008. Its a licensed mortgage lender in all 50 states and has over 650 branches nationwide.

What to keep in mind

;It offers all of the most popular types of mortgages from conventional loans to FHA loans, and niche options, such as reverse mortgages. But if you want any type of home equity loan or line of credit, youll have to go with another lender.

Movement Mortgage prides itself on quickly closing loans, and claims that 75% are closed within seven business days. It also gives a large amount of its profits to charity.;

Equation For Mortgage Payments

M = P

- M = the total monthly mortgage payment

- P = the principal loan amount

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

This formula can help you crunch the numbers to see how much house you can afford. Using our mortgage calculator can take the work out of it for you and help you decide whether youre putting enough money down or if you can or should adjust your loan term. Its always a good idea to rate-shop with several lenders to ensure youre getting the best deal available.

Recommended Reading: What Is The Housing Loan Interest Rate

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.;

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.;

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

Here’s how these three types of mortgage interest rates stack up:

| Mortgage type;30-year fixed rate mortgage: | Average APR |

Read Also: What Are Assets For Home Loan

Does My Home Qualify For The Mortgage Interest Deduction

You can only claim the mortgage interest tax deduction if your mortgage is for a qualified home, as defined by the IRS. As long as they qualify, you can write off mortgage interest on both your main home and a second home, as long as each home secures the mortgage debt.

The IRS considers a home to be any residential living space â including houses, apartments, condos, mobile homes, and houseboats â that has âsleeping, cooking, and toilet facilities.â

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable. Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans. Variable-rate mortgages can have lower interest rates up front, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes varies based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

Don’t Miss: Can I Loan Money To My S Corp

What Qualifies As Mortgage Interest

There are a few payments you make that may count as mortgage interest. Here are several you may consider deducting:

Interest on the mortgage for your main home: This property can be a house, co-op, apartment, condo, mobile home, boat or similar property. However, the property will not qualify if it doesnt have basic living accommodations, including sleeping, cooking and bathroom facilities. The property must also be listed as collateral for the loan youre deducting interest payments from. You can also use this deduction if you got a mortgage to buy out an exs half of the property in a divorce.

You can still deduct mortgage interest if you receive a non-taxable housing allowance from the military or through a ministry or if you have received assistance under a State Housing Finance Agency Hardest Hit Fund, an Emergency Homeowners Loan Program or other assistance programs. However, you can only deduct the interest you pay. You cannot deduct any interest that another entity pays for you.

Interest on the mortgage for a second home: You can use this tax deduction on a mortgage for a home that is not your primary residence as long as the second home is listed as collateral for that mortgage. If you rent out your second home, there is another caveat. You must live in the home for more than 14 days or more than 10% of the days you rent it out whichever is longer. If you have more than one second home, you can only deduct the interest for one.

Get approved to refinance.

Deductions Claimed By Individuals Under Section 80eea

Mentioned under the newly inserted section 80EEA of the Income Tax Act, the government has extended the limit of deduction up to Rs. 1,50,000 applicable to the interest paid by any individual on the loan against residential property. As per the policies, the deduction is available for individual residents only and for the property having a stamp value of less than Rs. 45 Lakhs. Also, the loan needs to be sanctioned between 1 April 2019 to 31 March 2020 and the individual should not own any other residential property at the date of sanctioning the loan. Lastly, the person should not be eligible for claiming any deduction U/S 80EE.

Read Also: Can You Get An Fha Loan To Buy Land

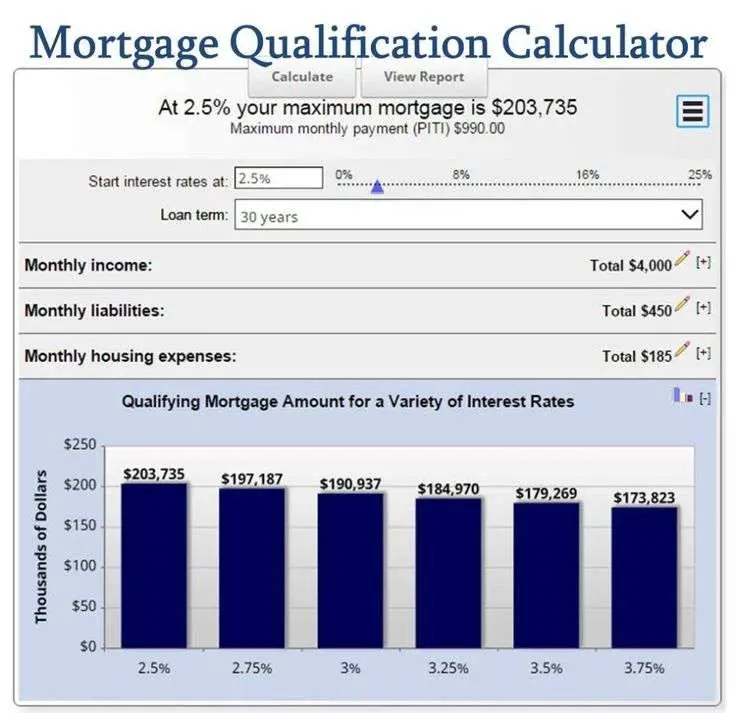

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

Points You’ve Paid On Your Mortgage

Points paid on acquisition debt for primary and secondary homes are fully deductible for the tax year in which they were paid, if you itemize your deductions. They aren’t always reported on Form 1098, but you should be able to find them on your mortgage settlement statement. You can also ask your mortgage lender.

Also Check: What Is The Max Home Loan I Can Get

Special Home Loan Offers Announced By Leading Banks As Part Of The Festive Season Offers

As part of the upcoming festive season in the country, leading banks are offering special home loan offers to attract customers to avail home loans. State Bank of India is offering attractive interest rates starting at 6.90% p.a. for home loans of up to Rs.30 lakh and 7.00% p.a. for home loans above Rs.30 lakh. Those applying through the banks YONO mobile application get an additional interest rate concession of 5 basis points. Applicants across 8 metro cities in India will get a concession in interest rate of 20 basis points for home loans of up to Rs.3 crore. In the rest of the country, this will be applicable for home loans ranging from Rs.30 lakh to Rs.2 crore. For home loans of above Rs.75 lakh, there will be an interest rate concession of 25 basis points. All interest rate concessions are also linked ot the credit scores of applicants.

23 October 2020

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the course of your term. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower credit score requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan, and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes. In exchange for this security, the rate can be a bit higher than with a similar adjustable rate mortgage . ARMs have a set interest rate for a certain number of years , and then the rate adjusts annually. An ARM might make sense if you plan on refinancing your mortgage in the future, or you might sell the house before the rate adjusts.

Read Also: When To Apply For Ppp Loan Forgiveness

What Are The Factors Affecting Home Loan Interest Rates

;The following factors can impact your home loan rates:

CIBIL score

Your CIBIL score represents your creditworthiness and repayment capability, and it significantly affects the interest rate you have to pay. The higher your CIBIL score, ideally over 750, the more competitive housing loan rates you can get.

Job profile

A steady source of income, secure job and employment with a reliable employer assure the lender of your repayment capacity and ultimately affect your housing loan interest rates.

Income

Besides your job profile, lenders consider your monthly income to evaluate your financial fitness. The greater your income is, the better your home loan eligibility. Thats why if you have any additional income sources like rental income, part-time business, etc., highlight them. You can also apply with a co-applicant, and by pooling your incomes together, you can easily qualify for a low interest home loan.

Debt-to-income ratio

To review your ability to pay off additional debt, lenders check your debt-to-income ratio. If your monthly debt payments are significantly draining your monthly income, you will become a high-risk borrower. In that case, the lender may charge you a higher interest on house loan.

What Are Hdfc Home Loans Key Features And Benefits

-

Home Loans for purchase of a flat, row house, bungalow from private developers in approved projects

-

Home Loans for purchase of properties from Development Authorities such as DDA, MHADA etc

-

Loans for purchase of properties in an existing Co-operative Housing Society or Apartment Owners’ Association or Development Authorities settlements or privately built up homes

-

Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority

-

Expert legal and technical counselling to help you make the right home buying decision

-

Integrated branch network for availing and servicing the Home Loans anywhere in India

-

Special arrangement with AGIF for Home Loans for those employed in the Indian Army.

Our tailor made home loans caters to customers of all age groups and employment category. We provide longer tenure loans of up to 30 years, telescopic repayment option, under adjustable rate option that specifically caters to younger customers to become home owners at an early stage of their life.

With our experience of providing home finance for over 4 decades, we are able to understand the diverse needs of our customers and fulfill their dream of owning a home .

Recommended Reading: Is It Easy To Get Loan From Credit Union

When Does My Home Loan Emis Start

EMI’s begins from the month subsequent to the month in which disbursement of the loan is done. For loans for under-construction properties EMI usually begins after the complete home loan is disbursed but customers can choose to begin their emis as soon as they avail their fist disbursement and their emis will increase proportionately with every subsequent ;disbursement.For resale cases,since the whole loan amount is disbursed in one go,emi on the whole loan amount start from the subsequent to the ;month of disbursment

Tata Housing Offers Fixed Home Loan Rates For Buyers For A Year

Tata Housing Development Company has announced ‘Wow is Now’ scheme for homebuyers under which they will pay only 3.99% interest rate for a period of 12 months and the rest would be taken;care of;by the company. The scheme is applicable to;ten;projects until November 20.

The scheme has been launched after taking into;consideration;7%;rate of interest per annum from the bank as the maximum limit.

As per;the scheme, the;borrower;will also receive a gift voucher ranging from Rs.25,000 to Rs.8 lakh depending on the property,;after;the booking. The voucher would be issued after the payment of 10%;of the amount;and the registration of property.

The campaign is extended across 10 Tata Housing projects.

22 October 2020

Don’t Miss: What Is My Monthly Loan Payment

Cardinal Financial Company Best For Low

Cardinal Financial Company, which also runs Sebonic Financial, is a mortgage lender available across the U.S., offering an array of loan products including FHA loans.

Strengths: Like many mortgage lenders, Cardinal Financial Company offers FHA loans to borrowers with lower credit scores , as well as other types of loans with some credit flexibility . One key benefit: The lenders proprietary system, Octane, guides borrowers throughout the home loan process with a customized to-do list.

Weaknesses: While you can easily learn Cardinal Financials credit and down payment requirements for specific products online, you wont be able to find information regarding interest rates or fees. To receive a quote and cost details, youll need to contact a loan officer.

Heloc Interest Tax Deduction

With a HELOC, you can spend the equity, pay it back, and spend it again, as often as you need to during the years-long draw period. Youâll be charged interest on the amount you withdraw.

If you use the HELOC as home acquisition debt â that is, for buying, building, or renovating your home â that interest will be tax-deductible.

Read Also: How Much Business Loan Can I Get