Does The Forbearance Period Start Repayment Over

No, your student loans are in limbo. If you havent made any voluntary payments toward your student loan debt, youre in the same position you were roughly a year ago.

For example, if you were on a traditional repayment plan before March 13, 2020, then your repayment status will be for the same total number of months as it would have been before. That means it wont necessarily take longer to pay off your loans, but rather the expected payoff date is pushed back. You always have the option to pay off your student loan debt sooner.

An income-driven repayment plan operates differently and suspended payments during this forbearance period still count toward forgiveness, so be sure to talk to your loan servicer if you have specific questions regarding your repayment status.

How To Calculate Your Monthly Student Loan Payment

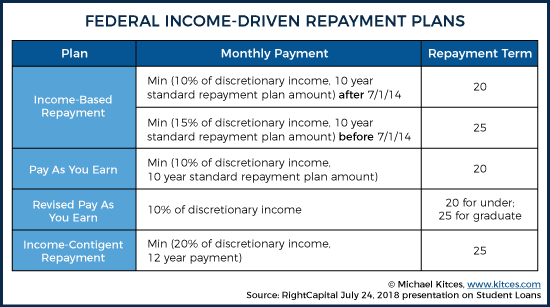

Your monthly payment will depend on how much you borrowed, your interest rate, and the loan repayment term . If you have federal student loans, you can usually enroll in an income-driven repayment plan with monthly payments that are based on a percentage of your income.

Estimate how long itll take to pay off your student loan debt using the calculator below. You can also use the slider to see how increasing your payments can change the payoff date.

Enter loan information

If You Have 2 Or More Jobs

If youre employed, your repayments will be taken out of your salary. The repayments will be from the jobs where you earn over the minimum amount, not your combined income.

Example

You have a Plan 1 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £1,000 a month from one job and £800 a month for the other.

You will not have to make repayments because neither salary is above the £1,657 a month threshold.

Example

You have a Plan 2 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £2,300 a month from one job and £500 a month for the other.

You will only make repayments on the income from the job that pays you £2,300 a month because its above the £2,274 threshold.

Read Also: Auto Loan Calculator Usaa

How Can Budgeting Help You Pay Off Your Student Loans

5 tips to make paying off your student loan easier in your budget planning system. The monthly budget in your head is not really a budget. Make sure your goals fit within your budget. In the last part they talked about starting with a bigger budget and adjusting it gradually. Make sure that your student grant falls within your budget. Be creative with your savings. To win more money.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Usaa Rv Interest Rates

What Is My Nelnetcom Account

Your Nelnet.com account is a secure section of the Nelnet website where you can view your account and loan details, make payments, ask to lower or postpone your payments, sign up for auto debit, and more. To access your account, log in with your username and password. If you havent created your online account, you can create one by clicking the Register button at Nelnet.com.

Start Your Loan Repayment

Six months after you leave school, youll start repaying your loans. Your monthly payment is automatically calculated. Your repayment schedule depends on:

|

Repayment term for Alberta loans |

Repayment term for Canada loans |

|

$0 – $3000 |

Learn more about adjusting repayment details.

Recommended Reading: What Is Bayview Loan Servicing

Ten Things You Should Know About Student Loans

Would My Forgiven Debt Trigger A Tax Bill

Student loan forgiveness is now tax-free, thanks to a provision included in the $1.9 trillion federal coronavirus stimulus package that became law in March.

Formerly, any student loan debt canceled by the government was considered taxable and levied at the borrowerâs normal income tax rate.

According to a rough estimate by Kantrowitz, $10,000 in cancellation would have triggered an extra $2,000 in taxes for the average borrower. If $50,000 per borrower was canceled, the average person would have to write the IRS a check for $10,000.

Borrowers would now be off the hook from these bills.

Recommended Reading: How Long Does The Sba Loan Take

Should I Pay Off My Student Loans 2021

Interest and payments on federal student loans will be suspended until 09/30/2021, so you don’t have to make payments until then if you don’t want to. But once interest rates start to rise again, the payments keep the loan balance from increasing over time. This is important when there is no forgiveness.

What If I Want To Continue Making Payments

Any payments you make during the forbearance period will be applied to principal once all the interest that accrued before March 13, 2020 and any fees are paid.

Making any voluntary payments right now will help you pay down your loan balance faster, but Farnoosh Torabi, editor-at-large of personal finance at CNET and host of the podcast So Money, says you shouldnt worry about paying down your student loans too aggressively this year. You should instead focus on building an emergency fund or paying off high-interest debt.

Even if were to believe that the loans will come due again in early 2021, I dont recommend working extra hard to erase your government loans this year. Pay the minimums, as needed, but not a penny more, Torabi writes.

If youre determined to pay down your student loans right now, these strategies can help you.

You May Like: Usaa Student Loans Refinance

Explore Loan Forgiveness Options

Student loan forgiveness comes with strict eligibility requirements. But if you qualify, its possible to have some or all of your federal student loans forgiven. Several types of forgiveness, discharge, or cancellation are available for borrowers of Direct Loans, FFEL program loans, and federal Perkins loans. But you may have to continue making payments during the application period, which can take several months, and theres no guarantee your application will be approved.

If your application is approved and you qualify for forbearance, cancellation, or discharge of only part of your loan, you must still repay any remaining balance. But if the full amount of your loan is forgiven, discharged, or canceled, you no longer need to make any loan payments.

My Parent Or Another Third Party Is Making Payments On My Account How Can Third Parties Continue Making Payments On My Account If They Dont Receive A Statement

Your parent, co-signer, endorser, or other third parties can quickly and easily make payments by logging in to a free online authorized payer account at Nelnet.com. First, you need to set up the third party as an authorized payer. Remember that authorized payers have access to your account details, including account number, due date, amount due , payment amount, payoff amount, accrued interest, account balance, interest rate, loan type, and payment history.

Follow these easy steps one time to set up an authorized payer:

If you would like to give copies of your Nelnet statements and correspondence to a third party, print or save the documents from your Nelnet.com account inbox and send them by email or post office mail.

Recommended Reading: Usaa Pre Approval Auto Loan

Is $50000 In Student Loan Debt A Lot

The resounding answer is yes, $50,000 is a lot of student loan debt. But when you consider the cost to attend college and that most students take four to five years to graduate, that figure isnt a surprise.

That said, most undergraduates complete college with no debt, and about 25% of students graduate with less than $20,000, according to the Brookings Institution. Only 6% of all student borrowers actually owe more than $100,000 upon graduation. For many borrowers, the high cost can seem worth it Brookings also notes that the typical 25-year-old full-time worker with a bachelors degree can expect to earn nearly $1 million more over their lifetime than a peer with just a high school diploma.

Although student loans now account for the second-largest share of debt next to a mortgage, a college education can open doors to new careers and offer a better chance for professional growth in the future.

Consolidate Federal Student Loans

If you have multiple federal student loans, you may want to consider consolidating them into one fixed-rate loan at no cost to you. Consolidating into a Direct Consolidation Loan doesnt guarantee you a lower rate. Your new interest rate will be an average of the rates on the loans youre consolidating. But you may benefit from the simplification of having just one loan payment to keep track of.

If you have outstanding Perkins or FFEL loans, you may also want to consider a Direct Consolidation Loan, especially if you want to take advantage of the limited-time PSLF Waiver where you receive credit for past payments on Direct Loans. But this only applies if you have Direct Loans, if youve already consolidated loans into the Direct Consolidation Loan program, or you want to consolidate your loans into this program by Oct. 31, 2022.

Also Check: Va Second-tier Entitlement Calculator 2020

How Can I Pay Less Interest

In general, to pay less interest over the life of your loan, you can make payments toward your student loan when they arent due . You can also make extra payments or pay more than your regular monthly payment amount when youre in repayment. All of these scenarios cause less interest to accrue overall. To learn more about how interest accrues and capitalizes, and how to minimize the interest you pay, see What Does It Mean That Interest Is Capitalized?.

What If I’m Behind On Payments Is Delinquent At The Time Im Requesting A New Repayment Plan

To bring your account up to date, you have the option to make a payment anytime, anywhere. See How to Make a Payment If you cant make the payment to bring your account up to date, Nelnet may be able to grant you a loan forbearance to cover the delinquency. Interest may continue to accrue during a forbearance, and may be capitalized at the end of the forbearance period. Log in to your Nelnet.com account and select Repayment Options to explore your options.

Don’t Miss: Refi An Fha Loan

Should You Save Or Pay Your Student Loans Free

A good reason to cancel your student loan is that it lowers your debt-to-income ratio . It measures the amount of your monthly debt payments versus your monthly income. Paying off your student loan not only frees you from those monthly payments, but it also makes it easier for you to achieve other financial goals.

How Much Are Plan 1 Student Loan Repayments

Youll only start making Student Finance repayments once youve left your course and are earning enough.

The repayment threshold for Plan 1 loans is currently £19,895/year before tax.

This threshold has risen in April of each year since 2012, so make sure you keep up to date with the figure. And remember: if you earn less than that in taxable income , you wont pay anything back until youre back above the threshold.

Once you earn more than the threshold, repayments kick in and you pay 9% on the amount above the threshold. So, if you earn £24,895 , youll pay 9% of £5,000, which is £450 for the year.

Heres what your monthly repayments could look like. If youre self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | |

|---|---|

| £50,000 | £226 |

Student Loan repayments come with weekly and monthly thresholds, too. This means that even if you have a salary that falls below the annual threshold, receiving a bonus or completing extra shifts could mean you end up crossing the threshold and making a Student Finance repayment.

However, if at the end of the financial year your annual earnings are still below the annual repayment threshold, youll be entitled to a refund. Head over to our guide to Student Loan refunds to find out how to go about claiming your money back.

You May Like: What Credit Score Do You Need For Usaa Credit Card

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

How Often Do You Report My Loan Information To The Consumer Reporting Agencies

Nelnet reports credit information monthly to the four consumer reporting agencies . Until an account reaches 90 days past due, it’s reported as up to date. When an account reaches 90 days past due, it’s reported as delinquent. Once your account has been reported to the consumer reporting agencies as delinquent, the information may remain on your credit history for as long as seven years.

Don’t Miss: Maximum Fha Loan Amount In Texas

Q Which Student Loan Borrowers Are Most Likely To Default

A. Accordingto researchby Judy Scott-Clayton of Columbia University, Black graduates with abachelors degree default at five times the rate of white bachelors graduates21%compared with 4%. Among all college students who started college in 200304 , 38% of Black students defaulted within 12 years, comparedto 12% of white students.

Part ofthe disparity is because Black students are more likely to attend for-profitcolleges, where almost half of students default within 12 years of collegeentry. And Black students borrow more and have lower levels of family income,wealth, and parental education. Even after accounting for types of schoolsattended, family background characteristics, and post-college income, however, thereremains an 11-percentage-point Blackwhite disparity in default rates.

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

Also Check: Can You Refinance A Fha Loan