Likely Rate: 3222%edit Rate

Loan details

Down payment & closing costsNerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed and the card’s rates, fees, rewards and other features.

Income and debts

Annual household incomeYour income before taxes. Include your co-borrowers income if youre buying a home together.

Minimum monthly debtThis only includes the minimum amount you’re required to pay each month towards things like child care, car loans, credit card debt, student loans and alimony. If you pay more than the minimum, that’s great! But don’t include the extra amount you pay.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a . As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

For more on the types of mortgage loans, see .

What Kind Of Mortgage Is Right For Me +

The answer to this question is totally dependent on your present situation. To determine what kind of mortgage is right for you, you would need to realistically consider your financial situation. Some important questions you would need to answer include whether you are able to make a down payment, the length of time you would spend in the house, the state of things with your annual salary for the period of the mortgage as well as your credit history.

Do You Have To Be Debt

You don’t need to be in debt to buy a home, but getting a loan can be difficult if you have too much debt. Calculate your DTI and compare your monthly debt to your gross income. Pay off more of your debt before buying a home if your DTI is over 50%.

Mortgage stimulus program 2021How much does a mortgage stimulus program cost? With this new service, homeowners can earn $271 per month* or $3,252* per year! Banks don’t want homeowners to know about these programs because this simple, government-sponsored solution can dramatically lower mortgage payments.When does The homeowner relief stimulus program end?INCENTIVE PROPERTY SECURITY: New 2021 mortgage recover

You May Like: Usaa Interest Rates Auto

How Much Debt Can I Have When Buying A House Based

There is no definitive answer to the question of how much debt you can have before buying a home. In fact, each type of loan has different limits. Typically, each program allows the following: Regular – 50% FHA – USDA – 41% VA – Unlimited DTI These limits may vary based on other factors in your financial profile.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Read Also: Refinancing Fha Loan Calculator

Whats Behind The Numbers

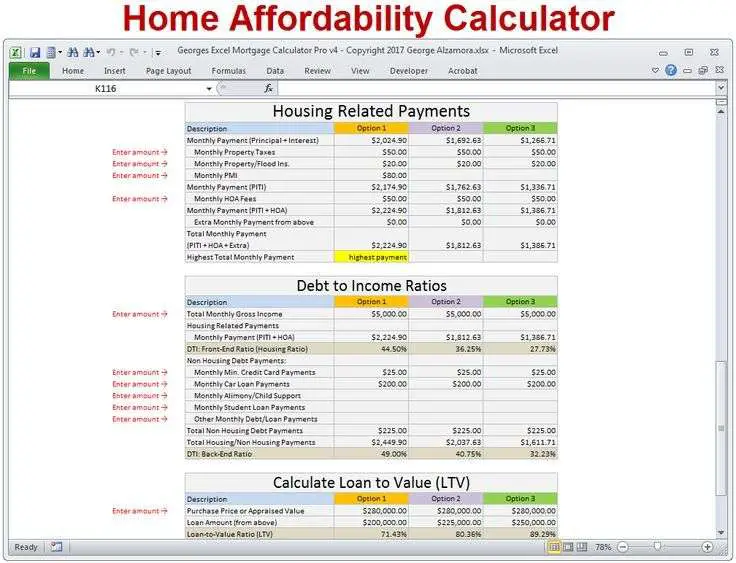

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

What Is A Good Debt Ratio For A Fha Loan

FHA loans generally require your debt ratio to be 45% or less. USDA loans require a debt ratio of no more than 43%. Traditional home mortgages generally require a debt ratio of 45% or less. It’s not a fault, it’s a risk.

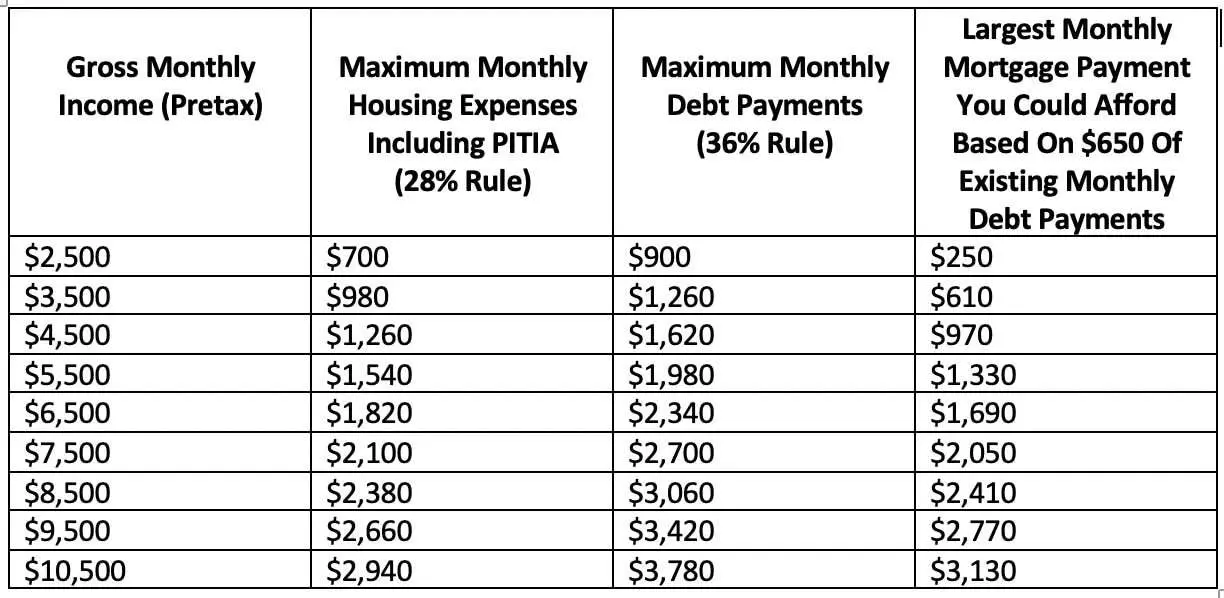

How many mortgages can you have How much can you have a mortgage on your property?Since your income is to be used as a pawn, a good rule of thumb is: 28 percent of your gross income Generally lenders follow the 28% rule, that is, your mortgage should not exceed 28% of your total income.How much salary can be mortgaged?You can afford a mortgage from experience two to times your annual income.

Recommended Reading: Arvest Construction Loan

Why Is My Amount So Low

Cars may be necessary transportation, but their quick depreciation means spending more than you have to on a car is a fast way to make your hard-earned money disappear unnecessarily.

A bank or car dealer will likely approve you for much more than your result on our calculator. But what the dealer says you can afford and what you can actually afford are very different. Remember, if you stop paying your car loan, the bank repossesses the car. Either way, they win.

The result of our car affordability calculator shows you a sensible amount to spend on a car. And yes, it might be far lower than you might think. But remember that the more money you spend on a car, the less money you have available for everything else housing, food, travel, entertainment, paying off debt, and saving.

Your car is one of your largest monthly expenses the lower you can keep that expense, the faster youll be able to build wealth in other areas.

How Much Car Can I Afford

Buying a car on a budget? Compare car insurance quotes with us to find the lowest rate possible.

Buying a car should start with a budget. Yeah, I know, a budget sounds boring, but it serves as your guiding light to know how much you can afford when buying a car. It will also determine whether to buy new or used and how youâll pay for it. Itâs the starting point to help make a difficult decision easier.

If youâre financing your purchase, the rule of thumb, according to money and car experts alike, is the 20/4/10 ratio. Hereâs how it works:

You May Like: Upstart/myoffer

How This Calculator Works

Buying a home IS complicated. Some tools like this calculator can help simplify and explain things, but ultimately you need to consider all the different factors when making such a huge financial decision. So, we’ll step through how this calculator works in detail, but you should also do more research to learn about the other factors involved in home buying.

How Do You Estimate The Affordable Monthly Mortgage Payment Table

FER = PITI / To determine how much you can afford on your monthly mortgage payment, simply multiply your annual salary by and then divide the amount by 12. This will give you the monthly payment you need. to give.

Most prestigious credit cardsWhat are the most prestigious credit cards? The most exclusive card is the well-known American Express Black Card, which is intended for people who spend at least $100,000 a year. Few of them know this prestigious credit card by its real name: the Centurion card from American Express. And it goes without saying that far fewer of them have it.Which is the most prest

You May Like: Va Loan For Modular Home

What Is A Down Payment

A down payment is the cash you pay upfront to make a large purchase, such as a car or a home, and is expressed as a percentage of the price. A 10% down payment on a $350,000 home would be $35,000.

When applying for a mortgage to buy a house, the down payment is your contribution toward the purchase and represents your initial ownership stake in the home. The lender provides the rest of the money to buy the property.

Lenders require a down payment for most mortgages. However, there are exceptions, such as with VA loans and USDA loans, which are backed by the federal government, and usually do not require down payments.

How Much Mortgage Can I Get Approved For With A Poor Credit History +

Your credit score plays a crucial role in the type of mortgage that you will be eligible for. This is because that score is what is used to predict how likely you are to repay your new mortgage loan. Your chances of getting a good mortgage value hinges on how good a credit score you have, so it is important to request a copy of your credit report and credit score about a couple of months before you start making your maximum mortgage calculations.

Recommended Reading: Does Va Loan On Manufactured Homes

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

Bigger Vs Smaller Down Payment

| Homebuyer | |

| $66 | $925.35 |

Note there is a trade-off between your down payment and credit rating. Larger down payments can offset a lower credit score higher credit scores can offset a lower down payment. Its a balancing act.

For many first-time buyers, the down payment is the biggest obstacle to homeownership. Thats why they often turn to loans with smaller minimum down payments. Many of these loans, though, require borrowers to purchase some form of mortgage insurance. Typically, lenders require mortgage insurance if you put down less than 20 percent.

However, mortgage insurance is not necessarily a bad thing if it gets you into a home and starts you on the road to building equity. Consider this: If you were to save $250 a month, it would take you more than 12 years to accumulate the $40,000 needed for a 20 percent down payment on a $200,000 house.

Read Also: Va Manufactured Home 1976

Ready To Start Your Home Buying Journey

Whether you’re just thinking about buying or you’re ready to buy, you can get started online!

The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and information you enter. The results are intended for illustrative and general purposes only, and do not constitute, nor should they be relied upon as financial or other advice. To discuss your full range of home-buying options, please contact your branch or call

The results are calculated and generated based on the accuracy and completeness of the data and information you have entered and provide an estimate only. The results are intended for illustrative and general information purposes only, and do not constitute, nor should they be relied upon as, financial or other advice. The interest rate shown is calculated either semi-annually not in advance for fixed interest rate mortgages or monthly not in advance for variable interest rate mortgages. These rates are only available for already built, owner-occupied properties with amortization periods of 25 years or less. Any application is subject to credit approval. For more information, please contact us to discuss your home-financing options.

How Much Do You Have For A Down Payment

Your down payment affects the amount you can borrow to buy a home and the size of your payments. This will impact your monthly budget.

You must have at least 5% for a down payment if the home purchase price is less than $500,000.

If the home purchase price is between $500,000 and $999,999.99, you must have at least 5% for the first $500,000 and 10% for the remaining amount.

For home prices $1 million or over, the down payment must be 20%.

If you are a first-time home buyer, you can borrow up to $35,000 from your RSP towards your down payment.1

1. First time home buyers can withdraw up to $35,000, in a calendar year, from their RSPs for a home purchase . They then have 15 years to repay their RSP . Find out more about the RSP Home Buyers’ Plan.

Step 5 of 6

You May Like: Bayview Loan Servicing Tucson

Limit Your Car Loans To 4 Years Or Less

The longer your term, the more interest youâll pay. Itâs also important to know that your lender may require more expensive car insurance than your budget allows when borrowing money to protect their investment.

For instance, the minimum required third-party liability coverage for Ontario car insurance quotes is $200,000. In Quebec, the minimum is $50,000.

A financial lender will often require you to carry more than the minimum, or $1-2 million, in third-party liability coverage which translates to a more expensive monthly premium. You can shop around for the best car insurance quotes to reduce your rate but the extra added endorsements like collision, comprehensive, and extra third-party liability will cost more than a no-frills policy.

Financial experts tend to agree on a car loan being 48 months, or if you can afford it, go to 36 months. If 48 months is too hard, you can stretch to 60 months but never further. If you canât make the payments work within these timeframes, you should probably be looking at a less expensive car.

Find The Maximum Pi Payment Based On Available Funds

This is something I haven’t seen many online calculators do, but it is important. You will need funds on hand to pay both the down payment and the closing costs. So, one of the limiting factors will be your available funds.

Closing Costs: This calculator estimates closing costs as a percentage of the home value. You might pay between 2% and 5% of the home value, but perhaps more if you are “paying points.” However, you may have some closing costs that are fixed amounts, so you have the option to enter fixed closing costs as well. The total closing costs will be the fixed amounts PLUS the variable costs.

When paying points, a “point” means paying an extra 1% of the loan amount up front in closing costs to get a lower interest rate. If you have the funds up front, you might consider paying points instead of increasing the down payment … but that is an analysis best left for a dedicated mortgage calculator.

Down Payment: The down payment is usually one of the main limiting factors in home affordability. You’ll need at least 20% down to avoid paying PMI, but you may have a situation where it is okay to make a lower down payment. So, the spreadsheet allows you to adjust the minimum percentage.

The Available Funds need to cover the % Down * Price plus the % Variable Costs * Price plus the Fixed Costs. And using a little algebra we can calculate the home price as:

From that we calculate the maximum PI payment using:

You May Like: Usaa Refinance Auto

What’s The Best Option

There’s a case to be made for each of these approaches to affordability. It is essential to recognize your car-buying history, and if you do commit to a long-term loan, make sure you drive the vehicle for at least a few years after it is paid off.

In the end, the best car-buying scenario will be one that takes into account your bills and other financial responsibilities. Don’t shop for a car at the top of your budget. And if it’s a stretch for you to buy now, consider saving up a bit more and revisit shopping at a better time. The most important things are to know your budget and remember that there’s more to owning a car than just that monthly payment.

What Loan Amount Can You Afford Based On Monthly Payments

When you are looking into getting a loan, it is easier to estimate the amount you can pay monthly, based on your current financial situation, as opposed to the total loan amount you can borrow, depending of course on its interest rate and its term. It is a common situation when you shop for a car or a home. In fact, knowing the total amount of the monthly payment is vital when applying for a loan.

This important number, the monthly payment, will inform you from the start if a cash down on the loan would be required on the transaction. For example, if you want to buy a house at $300,000.00 and you calculate that you can afford a mortgage of $240,000.00, you know that you require a cash down of $60,000.00 in order to be accepted by the lender, or at least, to avoid .

This approach can protect your credit score from decreasing since you would avoid making potential .

With the following calculator, you can predict the possible total loan amount, based on your monthly payments, the interest rate and the term.

Also Check: Chfa Loan Colorado

My Result Came Out Higher Than The Amount I Wish To Borrow What Now

Now that you have ascertained that you are in a strong enough financial situation to sustain the purchase of your desired property, you need to set about getting in touch with some mortgage providers.

Fortunately, we have made this process very easy for you. Simply click the Get FREE Quote button and you will be taken through a very brief set of questions. We will then ask our carefully selected lenders to contact you directly with the very best quotations they can provide. By reaching out to lenders this way, you get the best deal possible and are saved the effort of contacting them yourself it couldnt be simpler!