How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will generally range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

Don’t Miss: When Can I Drop Pmi On An Fha Loan

How Does The Down Payment Affect How Much House I Can Afford

Its crucial to consider your down payment before determining how much house you can afford because the money you put down will drain a considerable amount of your savings. If you use up your savings on a down payment and have earmarked too much of your income for paying off your mortgage and other debts, youll find yourself in serious financial trouble should any emergencies or unforeseen expenses occur.

The higher the down payment you can make, the more equity youll have in your home after you purchase it. Lets take a look at how the size of your down payment would impact your home equity if you were purchasing a home for $450,000.

Although down payments can be lower than 20% of the purchasing price, you should really try to stay as close to that number as possible, especially if youre in the market for a conventional loan. You dont want to get stuck paying PMI fees. But more importantly, you need to remember that the less you put down now, the more youll have to spend each month on your mortgage payments and the less equity youll have in your home.

Whats A Dti And The 28/36% Rule Of Thumb

Your debt-to-income ratio helps lenders determine whether youre able to afford a house. They look at your monthly debts and divide that number by your monthly gross income.

A healthy DTI can be up to 43%, but the best DTI for you depends on your specific financial circumstances.

Many financial advisors would suggest following the 28/36 principle. This means that your mortgage payments shouldnt exceed 28% of your pre-tax income, and your total debt shouldnt be more than 36% of your pre-tax income. By following the 28/36 rule, you can avoid finding yourself underwater with too much debt.

So, lets say you make around $6,000 per month. Your monthly mortgage payment shouldnt be over $1,680 and your monthly debt including monthly mortgage shouldnt exceed $2,160.

Don’t Miss: How Much Interest Rate For Auto Loan

Calculate Your Mortgage Payment

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

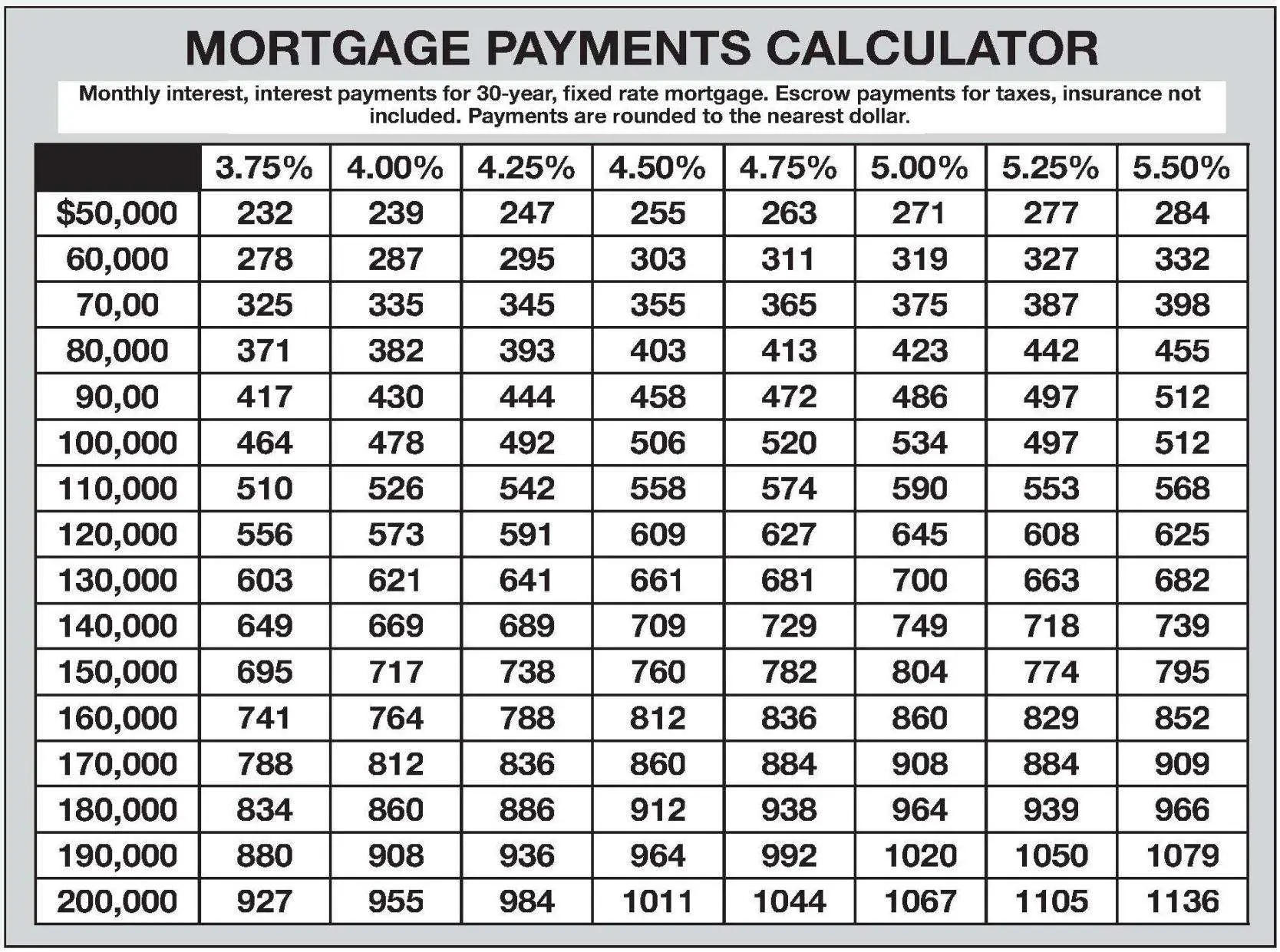

You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment.

To calculate your monthly mortgage payment, heres what youll need:

- Interest rate

Is A House Affordability Or Loan Calculator Perfect

No, because the title agency handling your closing is the only company that can tell you exactly how much the house costs. It shows you how much the payment is and what the exact closing costs are. Only your mortgage lender can tell you exactly how much house you can afford.

However, the house affordability calculator is a useful reference that you should bookmark on all your electronic devices.

Also Check: How Much Can I Get From Fha Loan

Find Your Home Buying Budget

Its definitely possible to buy a house on $50K a year. For many borrowers, lowdownpayment loans and down payment assistance programs are making homeownership more accessible than ever.

But everyones budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

Thats because your budget doesnt just depend on your annual salary, but also on your mortgage rate, down payment, loan term, and more. Heres how to find out what you can afford.

In this article

How Much House Can I Afford Rule Of Thumb

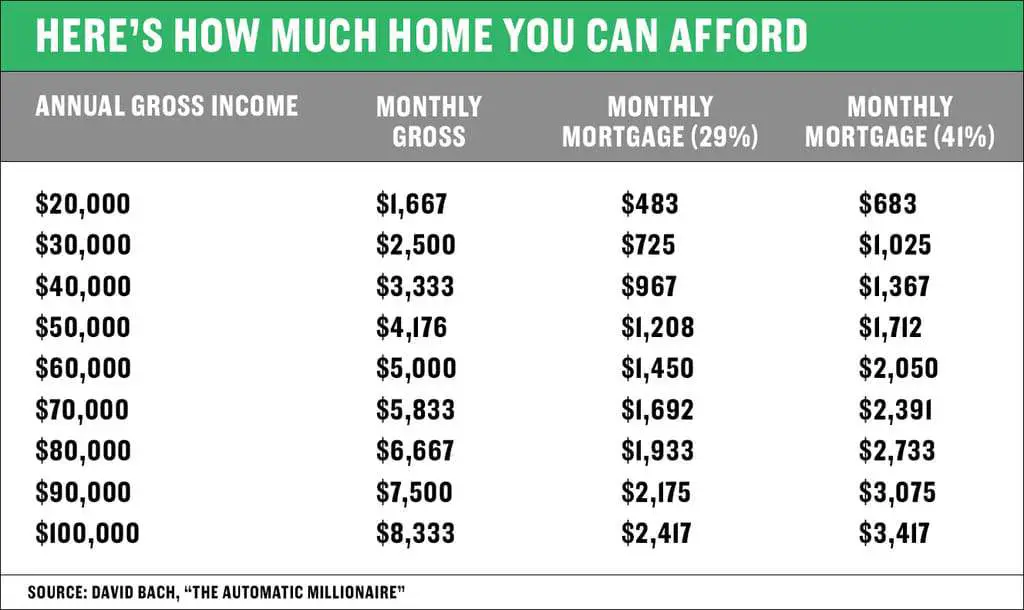

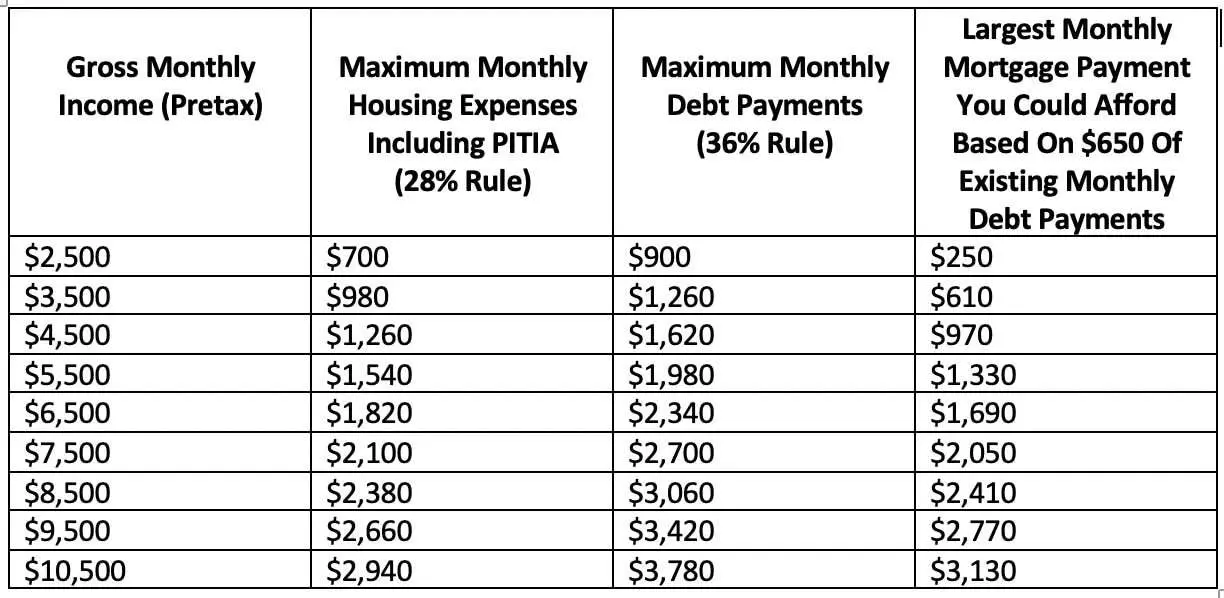

When deciding how much house you can afford, the general rule of thumb is known as the 28/36% rule. This rule dictates that individuals should avoid spending beyond 28% of their gross monthly income on housing expenses and 36% on their total monthly debt payments.

The highest possible front-end ratio, represented by the 28%, is the largest percentage of your income that should be allotted to mortgage payments. And 36% represents the highest possible back-end ratio, also referred to as the debt-to-income ratio, which you now know is the percentage of your income thats set aside to pay off debt.

Before asking how much house can I afford, its necessary to have a firm grasp of what falls into the category of housing expenses, the real cost of buying a home. These costs are the various components of your monthly mortgage payment, which are often referred to as the PITIA:

- Principal: This portion of the payment goes toward paying off the money that was borrowed to purchase the house.

- Interest: This portion is the fee that the lender charges you for borrowing the money to purchase the house.

- Taxes: This portion is the property taxes you pay to the local government based on the value of your house. These real estate taxes are used to pay for local infrastructure, improvements, municipal salaries, etc.

/ 100 = Maximum Total Monthly Debt Payments

The chart below illustrates the maximum monthly mortgage payment you could afford based on different income levels.

Recommended Reading: How To Get Instant Loan Online

Be Conscious Of Changes In Employment

If you lose your job, how will you pay your mortgage? When you apply for a mortgage, your lender ideally will want to see a 2-year work history before they grant approval. If you choose to take the largest loan you qualify for, will you be able to make those higher monthly payments during a period of unemployment?

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Read Also: Does Student Loan Consolidation Affect Credit Score

How Much House Can I Afford Calculator

Maximum Mortgage Payment

How Much House You Can AffordBased on a interest rate on a -year fixed mortgage.

Now that you know what you can afford, get your mortgage here or try our full mortgage calculator.

As you can see from our calculator, how much house you can afford really depends on the relationship between your income and mortgage.

To figure out how much mortgage you can afford with your income, different lenders use different guidelinesbut most lenders dish out mortgages that are way too expensive and keep borrowers in debt for decades!

We want to help you buy a home thats a blessing, not a burden. And the only way to do that is to calculate your home-buying budget the smart wayand stick to it!

Thats what our calculator does for you. How does it work? Well show youget ready for some math!

How Much House Can I Afford Home Affordability Calculator

To determine how much house you can afford, use this home affordability calculator to get an estimate of the property price you can afford based upon your income and debt profile. Generally, lenders cap the maximum monthly housing allowance to lesser of Front End Ratio and Back End Ratio .

Prequalifying for a mortgage is simple, and is intended to give you a working idea of how much mortgage you can afford. Combine this amount with your down payment, and you’ll answer your question of how much house can I afford? This is not the same as being preapproved for a loan, which involves placing an application and providing documentation to a lender.

Remember — this is just a guide. Your final amount will vary depending on a number of factors, especially interest rate, which will be based on your credit score. When you’re ready, a lender can give you a more exacting figure.

Read Also: Will Refinancing My Auto Loan Help My Credit

Sometimes It Pays To Aim Low

Armed with that kind of information, youre way ahead of the game. And Chris Copley, a regional mortgage sales manager with TD Bank, says sometimes its a good idea to aim low.

If someone can afford, on paper, a payment of $2,000 a month, as an educated loan officer, I would still recommend them trying to stay in the $1,500 to $1,600 a month ,” he says.

And he recommends that a buyer looking in the $200,000 to $250,000 range ask lenders what the monthly payments would be on both ends of the price range.

In Copleys experience, borrowers sometimes worry about putting as much money down as they can, then “they have no money to furnish the place once theyre settled into their new home.

“Don’t feel like you have to empty the wallet,” Copley adds. “And make sure that you’ve saved enough money that when you get into a house, you can live there.”

Ready To Start Your Home Buying Journey

Whether you’re just thinking about buying or you’re ready to buy, you can get started online!

The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and information you enter. The results are intended for illustrative and general purposes only, and do not constitute, nor should they be relied upon as financial or other advice. To discuss your full range of home-buying options, please contact your branch or call

The results are calculated and generated based on the accuracy and completeness of the data and information you have entered and provide an estimate only. The results are intended for illustrative and general information purposes only, and do not constitute, nor should they be relied upon as, financial or other advice. The interest rate shown is calculated either semi-annually not in advance for fixed interest rate mortgages or monthly not in advance for variable interest rate mortgages. These rates are only available for already built, owner-occupied properties with amortization periods of 25 years or less. Any application is subject to credit approval. For more information, please contact us to discuss your home-financing options.

Also Check: What If Student Loan Is Not Enough

If I Make $50k A Year How Much House Can I Afford

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000.

Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Just to show you how much these different variables can affect your home buying power, take a look at a few examples below.

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

You May Like: How To Calculate Loan Installment

Home Buying Examples: See You Much You Can Afford On $100k Per Year

The amount you can borrow for a mortgage depends on many variables and income is just one of them.

That means two people who each make $100,000 per year, but have different credit scores, debt levels, and savings, could have vastly different home buying budgets.

Here are a few examples of how much home someone might afford on a $100K salary when those other requirements are factored in.

Buying a house with a $100K salary and low credit

First, lets look at an example of a homebuyer who makes $100,000 per year, but has a lower credit score and relatively high debts.

This could be someone who recently graduated with student loans and hasnt had a chance to build up their credit yet. Or, someone who has existing debt from a few different lines of credit like credit cards and an auto loan.

Whatever the case, a lower credit score and higher debts mean your home buying budget will be on the lower end of the spectrum.

$100K salary and low credit buys a home below $300K

- Income: $100,000/year

*Interest rates shown are for sample purposes only. Your own rate will be different

This borrower makes a $100k salary and has a 650 credit score.

They are looking for an FHA mortgage with a low down payment. And, they owe about $1,000 in nonmortgage debts each month.

Assuming that the lender offers a 4.5% interest rate which is higher than current averages because of their credit score and debts this borrower may be able to buy a $288,500 home.

- Income: $100,000/year

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

You May Like: When To Apply For Ppp Loan Forgiveness

Home Affordability By Debttoincome Ratio

Your debttoincome ratio measures your total monthly debts including your mortgage payment against your monthly income. The higher your existing monthly debts, the less youll be able to spend on your mortgage to maintain a healthy DTI.

For example, say you make $50,000 a year and want to stay at a 36% DTI.

In that case, your total debts, including mortgage and any other debt payments cant exceed $1,500. Heres how that affects your home buying budget:

| Annual Income | How Much House You Can Afford |

| $50,000 | |

| $1,000 | $180,406 |

The examples above assume a 3.75% fixed interest rate and 3% down on a 30-year mortgage. Your own rate and monthly payment will vary.

So Should I Buy A Home

The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesnât necessarily mean that you have to jump into homeownership. Itâs a big responsibility that ties up a large amount of money for years.

Itâs important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. Only you can decide whether you should make that purchase.

Don’t Miss: When Are Student Loan Payments Due