How Much Can I Borrow For An Unsecured Loan

Normally, the maximum amount you can borrow on an unsecured loan is £25,000. Beyond this point, you will be unlikely to find a lender who will consider a loan without some form of security.

While £25,000 is normally the most you can borrow for an unsecured loan , this is not a guarantee that you will be approved for a loan of this figure. The lender will take into account your personal and financial details and history to make a decision on the maximum they will be prepared to lend you. This may be less than £25,000.

Consider Alternatives Before Signing Your Name

There are alternatives to commercial personal loans that are worth considering before taking on this kind of debt. If possible, borrow money from a friend or relative who is willing to issue a short-term loan at zero or low interest. Alternatively, if you have high-interest credit card debt that you want to eliminate you may be able to perform a.

What’s a balance transfer, you ask? Some on new purchases and on your old, transferred balance for a year. If you can get one of these deals and manage to pay off your balance while you have the introductory interest rate you may be better off opting for a balance transfer than for a personal loan. It’s important to pay off your balance before your APR jumps from the introductory rate to a new, higher rate.

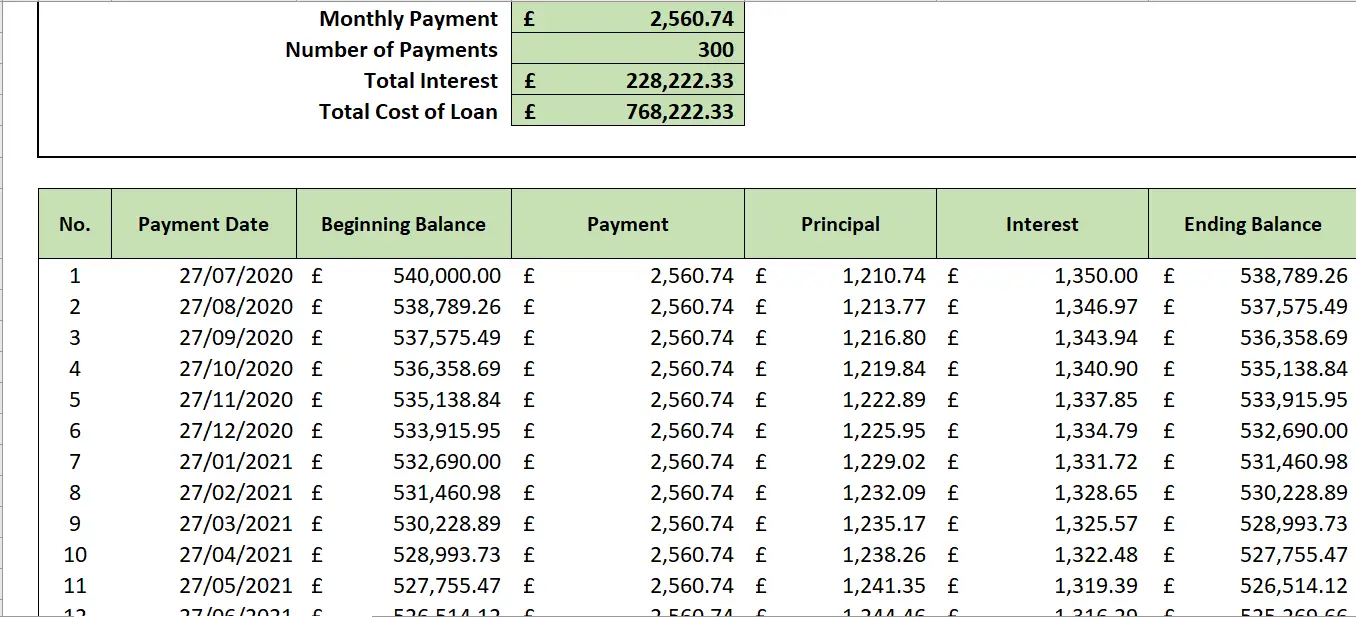

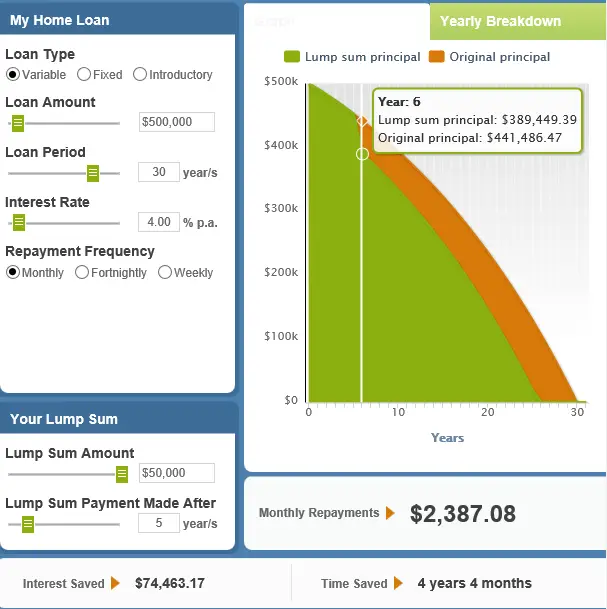

Loan calculators can help you figure out whether a personal loan is the best fit for your needs. For example, a calculator can help you figure out whether you’re better off with a lower-interest rate over a lengthy term or a higher interest rate over a shorter term. You should be able to see your monthly payments with different loan interest rates, amounts and terms. Then, you can decide on a monthly payment size that fits into your budget.

What The Latest Cash Rate Hike Means For You

Homeowners on variable interest rate mortgages could see their lender pass on the rate hike of 50 basis points in full. As your interest rate is one of the most significant factors impacting your repayment costs, a higher interest rate will mean greater mortgage repayments.

For homeowners still locked in at a fixed interest rate, while your home loan repayments will not change this month, its worth keeping in mind that your fixed rate period will end. Your lender will then likely revert your interest rate to its standard variable rate, which may now be much higher than when you first fixed your rate.

And if youre considering just refinancing to a new fixed rate, lenders have been consistently hiking fixed rates for months. Meaning, that when you move to re-fix your home loan rate you may find that the interest rate on offer is also much higher than expected.

Whichever way you look at it, a lender increasing home loan interest rates in line with the Reserve Bank of Australias cash rate means that homeowners will be paying more in interest charges. Whether the homeowner experiences higher rates today or in two years, its always safe to assume interest rates will fluctuate over a 20-30-year home loan.

Read Also: Usaa Certified Dealers List

How To Calculate Home Equity Loan Payments

You usually dont need to calculate your home equity loan payment yourself. During the loan application process, youll get a loan estimate with the monthly payment amount that stays fixed throughout the term. Youll also find your payment amount on your monthly statement and lender portal.

However, you can use a loan calculator to estimate your payment and simply plug in the numbers. Youll need to know the loan amount, interest rate, and term. You also can do the calculation by hand using the following formula for simple interest amortized loans:

Monthly payment= / , where P stands for your original home equity loan principal, r stands for the annual interest rate, n stands for the annual number of payments, and t stands for the term in years.

What To Know About Home Equity Loan Repayment

After you close on your home equity loan, you can expect to start making payments within two months of closing, as you would with a first mortgage.

You should receive a statement from your lender every billing cycle, which is typically monthly and separate from your mortgage statement. This document includes your payment due date, payment amount, interest rate, balance details, and payment coupon. It may also include your escrow and property tax information.

Also Check: Capital One Car Loan Pre Approval Letter

Make The Best Decisions With The Early Repayment Loan Calculator

The Early Repayment Loan Calculators is helpful for managing all kinds of loan repayments be it a personal loan, a car loan or a home loan. It’s natural for a borrower to be concerned about paying back the loan as the repayment involves both the principal amount as well as the interest. Interest is the extra amount of money paid for using the lender’s money. Your lender could be a bank or any non banking financial institution, a private lender or a friend, in all cases it is important to understand how the interest is being charged on your loan so you can easily manage early repayments.

The repayments that you will make on any loan consists of two parts. The first that reduces the balance in order to pay off the loan and the other part covers the interest on the loan. There are certain factors or rather certain key terms that affect the amount of interest to be paid off, let’s learn about them first.

How To Pay Off A Loan Faster

Everyone wants to be debt-free as soon as possible and if we follow certain steps, we can pay off our debt loans much faster.

- Round off the payments: Rounding off the payments is a very good way to pay extra without even missing the funds. If the budget permits, adding an extra amount always helps in saving interest money as well as shortening the loan term.

- Making Bi-weekly payments: You can submit half the payments to the lender every two weeks rather than making the regular monthly payment. Three things will happen due to this practice. There will be less accumulation of interest because the payments get applied more often. You will also make extra payments. Practising making bi-weekly payments could reduce several months.

- Finding extra money: This can be done by engaging in two habits. Firstly, never engage in buying things which are not necessary. Secondly, never buy anything out of impulse. This will always result in you saving a lot of money to pay off your loan early.

- Refinance the loan: This is a very easy way to lower the payment, pay the loan back in a much less time and save interest. Many local financial institutions offer very low interest rates. You can take advantage of these low interest rates to refinance the loans.

- Take advantage of paperless statements: In some cases, additional discounts are offered when you opt for auto payments and paperless statements.

Also Check: Usaa Auto Financing

Benefits Of Paying Off Loan Early

The moral of the story is that paying off a loan or any kind of debt early is always a great way of saving the amount of money paid in interest as well as decreasing the overall loan term. This extra money can be used to meet other imminent or long-term needs. There are many benefits of paying off loans early. The most beneficial of them is less risk and less stress.

Repay Debts Or Invest

What’s more important: Paying off loans or investing? The issue depends on your financial situation and several factors.

Some people want to do both at the same time. Others demand paying off debts as a first priority. However, you should assess your situation so that you can make the most appropriate decision based on the information you have. Consider the following:

- If you have debts and investments, are you paying more interest on your debts than youâre making on your investments? Invest only when you can reasonably expect returns that significantly exceed the interest on your debts otherwise, you would be better off repaying your debts before investing.

- Are there any risks involved? Which of the two gives you greater risk â your debts or investments? If the investment doesn’t go well, you may find yourself miserably paying off the debts while having little or nothing to show for your savings.

- Are you figuring in matches? If you are receiving a match , it might be more attractive to pay into your retirement account knowing you’ll at least make a 100% return â more than you’d save by putting that money toward debt.

- What if you lose your job next month? Do you have an emergency fund to support your household needs if you temporarily lose your income? Many experts recommend that you save enough to cover at least three months of your household expenses. Of course, depending on your personal preference or financial situation, this calculation may be adjusted.

Read Also: Fha Land Loan

Identify How Much You Need To Borrow

Before you begin studying potential interest rates and loan qualification requirements, you must understand what a loan means with regards to your future. With a loan, someone provides you goods or services in exchange for a future repayment, presumably including some amount of interest to incentivize the lender to agree to the transaction.

The primary focus of the research phase should be personal. You will need to decide whether you actually need a loan prior to your first contact with a lending business. Your lender will be discussing countless potential transactions when you engage them in negotiations. While most major lenders provide expert analysis from quality loan professionals, they only make money by selling you their services.

Before you enter into such negotiations, you must identify exactly how much money you need to borrow. If you are taking out a personal loan to consolidate debt, you will obviously need less money than if you are acquiring a business loan, purchasing a vehicle, or buying a home.

Simply understanding the amount of the loan needed is not enough, though. What you must show precisely is how much money you can afford to pay back. If you miscalculate this amount, you could have your credit score ruined. Even worse, if you put up collateral for your loan, you will lose that property as well.

Important Information About This Website

finder.com.au is one of Australia’s leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don’t cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn’t a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you’re unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Where our site links to particular products or displays ‘Go to site’ buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

You May Like: Rv Loan Rates Usaa

How Is Interest Calculated

Interest is calculated based on the unpaid daily balance of your loan. For example, if you had a loan balance of $150,000 and your interest rate was 6% p.a., your interest charge would be: $150,000 x 6% divided by 365 days = $24.66 for that day. For most ANZ Home Loans, interest is usually calculated daily and charged monthly. For details refer to the ANZ Consumer Lending Terms and Conditions and your letter of offer.

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

You May Like: Stilt Loan

An Introduction To Personal Loans

A personal loan, also known as an unsecured loan, allows you to borrow a certain amount of money in exchange for paying a certain amount of interest, which will be charged as long as it takes you to pay off the loan. Once youve taken out such a loan, you will need to make a set repayment every month for a period of time that is previously agreed upon with your lender.

The representative is the rate that at least 51% of borrowers will be charged the actual rate your lender offers you could be quite a bit higher, depending on your credit score. This means that the monthly repayment and total amount repayable listed alongside any personal loan example should only be used as an indication of the minimum you will be asked to pay back.

You can use a personal loan for any number of things to help pay for a car or other large purchase, to consolidate debts, or for some necessary home renovations.

Unsecured loans also tend to come with lower interest rates than credit cards and allow you to borrow more than on cards. Most loans will furthermore offer a fixed APR and will set the repayments in advance, which means that you can be sure of how much you need to pay back each month, and plan accordingly.

In the same vein, many unsecured loans will charge a penalty not just for missing a payment , but also if you want to pay off the loan early. This early repayment charge is a maximum of two months interest so it is something to consider but not a deterrent to early repayment.

Your Credit Score Is Crucial

Armed with this information, your point of attack is clear. You must attempt to find the lowest rate possible for your loan. In order to do that, you have to take a hard look at your personal history. Specifically, you need to know your credit score and understand exactly what this information means to a lender.

Your history of payments is considered by potential lenders as an indication of your character. You see your monthly payments as an aggravating process that drains money out of your bank account. A lender sees it as indicative of whether you are a person of your word. If you sign a contract with your utility company to pay for the amount of water and electricity that you use during a given month, how well you live up to your end of the bargain is important.

A lender wants to know that you have a track record of honoring your scheduled payments as much as possible. Your credit score has been monitored by a third party who then relays this information to the would-be lender. What goes into your credit score calculation is a subject of some speculation. There are fluctuating variables depending upon the credit service used.

The three major credit services are Equifax, Transunion, and Experian. Each of them will have a slightly different score for you. Learn each one to be best prepared for negotiations with lenders. Surprisingly, most creditors do not use all three, instead selecting one company as their exclusive credit score provider.

Recommended Reading: Usaa Car Loan Interest Rates

How Does The Home Loan Repayment Calculator Work

Home loan repayments are influenced by several factors including the loan amount and length of the loan term, the fixed or variable interest rate that applies, whether youre paying principal and interest or interest-only, and whether or not you intend to live in the property youre buying.

Based on the combination of factors that you select, the loan repayment calculator will automatically adjust the interest rate per annum and estimate your repayments accordingly. Estimated repayments are calculated on a monthly basis by default, but you can adjust the frequency to weekly or fortnightly if youd like to compare the difference.

Keep in mind that the interest rates in the calculator are subject to change, which can impact on repayment amounts. If a variable rate loan is selected, the interest rate will be subject to change throughout the term of the loan. For a fixed rate loan, once the fixed rate period expires, the loan reverts to a variable rate loan and repayment amounts may change. The repayment calculator doesnt include all interest rates, fees and charges. See our home loan rates and offers for all available rates.

If youd like to know how to calculate stamp duty and other upfront costs, use our deposit, costs and stamp duty calculator.