Who Qualifies For A Student Loan Interest Deduction

Not all student loan interest payments will qualify for the deduction. The interest that you pay on your student loan needs to be for a qualified student loan:;a loan that you took out for yourself, your spouse, or your dependent to cover qualified education expenses. These qualified education expenses include necessary expenses like tuition, books, room, and board during the academic period.

In addition to this, the IRS has a few more criteria that you need to meet in order to take the deduction:

- You must be legally obligated to pay the student loan interest. If you took out the loan for your child and are legally required to repay it, you qualify for the deduction.

- You cant be claimed as a dependent on someone elses tax return.

- If you are married, you and your spouse cant file your taxes separately.

- Your modified adjusted gross income must be under the maximum income threshold of $85,000 .

If your MAGI is below $70,000 youll be able to take the full deduction for your student loan interest paid, up to $2,500. If your MAGI is between $70,000 and $85,000 , you can take a reduced deduction. If your MAGI is above the income limits, you cant take any deduction.

Where To Go For More Help With Student Loan Tax Deduction

To learn more specific tax information, see Chapter 4 of Publication 970: Tax Benefits for Higher Education at www.irs.gov.

To get hands-on guidance, get help from H&R Block. At H&R Block, you can find the expertise you need. Whether you file on your own with;H&R Block Online;or file with a;tax pro. Well be there with you every step of the way.

Free tax filing for students; Did you know some students can file for free with H&R Block? Its true! Learn more who can file for free with;H&R Block Free Online.

Related Topics

Learn what to do if you e-filed and mailed in a tax return with help from the tax experts at H&R Block.

What You Need To Know About The Deduction For Student Loan Interest

Whenever you pay off your student loan, its not a case of just paying off the amount you borrowed. Youre also paying the interest rates. When you take advantage of the student loan interest tax deduction, youre essentially taking off the interest paid against any taxable income, which ultimately means you pay less in tax to the Federal government.

For example, lets say your income came in at under $65,000 for the previous year. You will qualify for the maximum interest rate deduction. From $65,000 to $80,000, this deduction is reduced.

You can take this deduction without itemizing. So, you can also take the standard deduction.

Take note that if your parents took out the student loan in their name, they will have to claim the deduction on their tax return. However, if your parents registered you as a dependent, then neither of you can claim the deduction.

Finally, you can also take this deduction if youre paying off your student loan while still in school full time.

Also Check: How Much Can I Borrow Personal Loan Calculator

Common Deductions And Credits For Students

The most common deductions that apply to students are:

- child care expenses

The most common non-refundable tax credits that apply to students are:

- Canada employment amount

- interest paid on student loans

- tuition, education, and textbook amounts

Some of common refundable tax credits are:

For more information on other types of deductions and credits, see the Federal Income and Benefit Tax Guide.

Paying Off College Debt Can Take Decades 20 Years On Average According To A 2019 Report By Education And Technology Company Cengage

The student loan interest deduction could help you reduce your federal tax liability for every one of those years provided you meet income limits and other qualifications for claiming the federal income tax deduction.

Lets take a look at how the student loan interest deduction works, how to qualify for it and how much you could save if youre eligible to take the deduction.

Whats next? Check out other education-related tax breaks.

You May Like: Is My Home Loan Secured

Employer Student Loan Repayment Assistance

Employers are recognizing that their employees are struggling under the weight of student loans. According to the Society of Human Resource Management, a growing number of them are offering student loan repayment assistance programs. These programs may offer a matching contribution or a flat contribution to loans, to help employees pay off their debt.

While this is a great benefit, the downside is that the amount your employer repays is considered taxable income to you. If your employer paid $3,000 towards your student loan and youre in the 22% tax bracket, you could end up owing an additional $660 in taxes.

There is proposed legislation to have up to $5,250 of employer repayment assistance excluded from taxable income, but for now, youll need to pay taxes on anything that your employer pays.

American Opportunity Tax Credit

The American Opportunity Tax Credit allows taxpayers to receive a credit for qualified expenses paid for the higher education of an eligible student during their first four years at a post-secondary institution. The total credit is capped at $2,500 per student per year. Taxpayers receive 100% of the credit for the first $2,000 spent in expenses and 25% for the next $2,000 spent for that student.

Read Also: How To Get Sba 7a Loan

Example : Single But Over The Phaseout Limit

Bob is projected to pay $750 in student loan interest this year. His total income is $120,000. He is a single filer and contributed the max to both his HSA and Traditional 401k . That means his MAGI is $96,900. Because his MAGI is above the Phaseout Limit of $85,000 as a single filer, he cannot deduct any of his student loan interest.

What Paperwork Is Required To File Your Taxes

There are three documents youll need to fill out your taxes. These are:

Form W-2 This is your tax statement detailing your earnings. Youll get the W2 form through your employer

Form 1098-T Students will receive this from their school. Its a tuition statement.

Form 1098-E Your statement for any interest paid on your student loan. If you happened to pay interest on your student loan, youll get one of these. If you paid at least $600, youll receive this through email or via the mail.

If you paid less, youre still able to take this deduction, but youll need to contact your loan provider to receive it.

We also recommend that you save any receipts from any educational purchases you made. This includes books and tuition. You should also have a record of any scholarships as youll need these figures to file your tax return.

Also Check: What Is Certificate Of Eligibility Va Home Loan

The Student Loan Interest Deduction Allows You To Deduct Up To $2500

If you meet all of the eligibility criteria, the maximum amount of interest you can deduct per year is $2,500. If you paid more than this amount, you cannot deduct the additional interest paid.

This is a deduction, not a credit. That means you subtract the amount of deductible interest from your taxable income. For example, if you had $45,000 in taxable income last year and paid the full $2,500 in deductible student loan interest, your deduction would reduce your taxable income to $42,500.

Deductions arent worth as much as , but they can still save you money. If youre still in school, you may be eligible for tax credits such as the American Opportunity Tax Credit. However, there are no tax credits for student loan interest; the deduction is your only option to save on your taxes based on paying your student loans.

Find Out How Much Interest You Paid

To find out how much interest you paid on your student loans during the tax year, look for the Form 1098-E, Student Loan Interest Statement from your loan servicers. Any loan servicer that collected at least $600 in interest from you is required to send you a Form 1098-E by Jan. 31, either electronically or by mail.

If you paid at least $600 in interest during the tax year but made payments to multiple servicers, you can request a Form 1098-E from each servicer even if they collected less than $600 in interest from you. If you paid less than $600 in student loan interest, you can contact each of your servicers for the exact amount of interest paid during the tax year.

Read Also: How To Calculate Amortization Schedule For Car Loan

What Is Your Magi

MAGI is one of those acronyms in the tax code that you dont hear about often. This is because the MAGI is rarely used as its very similar to your AGI, and really only used for specific corner cases such as how much of your student loan interest you can deduct! Calculating MAGI can be a bit confusing, but our AMT CalculatorAMT Calculator does all the work for you!

Otherwise, you can get your MAGI, or get a good rough estimate of your MAGI, simply by taking your total income and subtracting contributions to your traditional 401k and HSA Contributions. If you are self employed, there are a few extra things you can take off as well.

How Much Is The Deduction Worth

You find out the good news that youre eligible. Great! But, how much will it actually save you? Well, its important to note this is an above-the-line deduction, not a tax credit. So, it only helps you reduce your taxable income.

For example, suppose you have $60,000 in taxable income last year and paid $2,500 in student loan interest. Since your income is below the income phase-outs, the student loan interest deduction is not reduced. Your taxable income would become $57,500. This then reduces your tax liability.

To understand how much that will ultimately save you on your tax bill, multiply the amount student loan interest youre eligible to deduct by your tax bracket.

If you are single and your modified adjusted gross income is $60,000, you are in the 22% tax bracket. If you paid $1,000 in student loan interest, which is about the average deduction, the student loan interest deduction will save you about $220. The maximum anyone might save is $550.

Also Check: Can I Use Personal Loan For Education

How To Claim The Student Loan Interest Tax Deduction

If you paid more than $600 in student loan interest throughout the year, your lender is required to send you a 1098-E form, listing how much you paid in interest throughout the year. Youll find this number in Box 1. You can still write off the interest even if you didnt receive a 1098-E, but its up to you to figure out how much you actually paid in interest. If you arent sure, reach out to your lender directly to ask. Hold on to any records you have showing how much you paid in interest. If the government audits you, youll need these to prove your deduction was legitimate.

Youll enter your total student loan interest deductions on Line 33 of your Form 1040. If youre using a tax filing software, it should prompt you to enter the amount you paid in student loan interest. It will also calculate the amount of the deduction youre entitled to if your MAGI is too high to qualify for the full student loan interest deduction. You dont have to itemize your deductions in order to claim the student loan interest tax deduction, though you can if you want.

If you run into any questions about deducting your student loan payments, its best to consult with an accountant or your student loan servicer before filing your taxes. The wrong answer could lead you into trouble with the IRS.

Income Limits For Claiming The Deduction

The IRS uses your modified adjusted gross income to determine whether or not you qualify to take the student loan interest deduction.

MAGI is your gross income for the year minus certain deductions. Common deductions include charitable donations and health savings account contributions.

For your 2020 taxes, which you will file in 2021, the student loan interest deduction is worth up to $2,500 for a single filer, head of household, or qualifying widow with MAGI of less than $70,000.

For single filers, once your MAGI hits $70,000, the deduction begins to phase out, meaning the maximum amount you can deduct is less than the full $2,500. Once your MAGI reaches $85,000, you can no longer claim the deduction.

Joint filers can deduct up to the maximum if their MAGI is less than $140,000. Then the deduction phases out and is eliminated completely once your income reaches $170,000.

The IRS typically increases these phase-out ranges each year to account for inflation. However, for tax year 2020, the taxes for which you’ll file in 2021, the MAGI phase-out ranges will remain the same as the previous year.

Keep in mind that the deduction applies per return. That means the maximum deduction if youâre married and filing jointly is $2,500, even if both spouses could have individually qualified for a $2,500 deduction.

You May Like: What Is Portfolio Loan In Real Estate

How Do Tax Deductions Work On Student Loans

The U.S. tax code allows you to deduct up to $2,500 in student loan interest on your tax return every year, depending on how much you paid and your income level. You should receive what’s called a 1098-E form from your student loan servicer or lender, which shows how much interest you paid during the year.

To qualify for the deduction, you need to meet the following eligibility requirements:

- You paid interest on a qualified student loan during the tax year.

- You’re legally obligated to pay interest on the loan.

- You aren’t married and filing separately from your spouse.

- Neither you nor your spouse can be claimed as a dependent on someone else’s tax return.

- Your modified adjusted gross income is less than a certain amount, which is determined each year .

The loan itself also needs to meet certain criteria for you to qualify for the deduction:

- It was taken out to pay qualified higher education expenses for you, your spouse or a person who was your dependent when you borrowed the money.

- The expenses were incurred for education provided during an academic period for an eligible student.

- The expenses were paid or incurred within a reasonable period of time before or after you took out the loan.

Remember, this is your MAGI, which is lower than your gross income. If you’re using tax preparation software or you’ve hired a professional, they can figure out what your MAGI is for you. If you’re filing taxes on your own, you can use a worksheet provided by the IRS.

Other College Education Tax Breaks

Not everyone qualifies for the student loan interest deduction. If you dont have qualifying loans, you dont have the right filing status or your MAGI is too high, theres a chance you may not be able to lower your taxable income this way.

But there are other educational tax breaks you might be able to take advantage of.

You May Like: How To Return Ppp Loan

How Do I Claim The Deduction

You can claim the student loan tax interest deduction when you file your tax return.

If you paid $600 or more in interest on any of your student loans, your student loan servicer will send you Form 1098 E-Student Loan Interest Statement. Youll either receive the form in the mail, or you can download it online from your student loan account. This form will list exactly how much you paid in interest over the past year on that loan.

If you didnt pay enough to get a Form 1098-E, you can still claim the deduction. Youll just have to look up your loan account information and manually calculate how much interest you paid.

To claim the deduction, enter the full amount of interest you paid on line 33 on Form 1040 or Form 1040NR. If youre filing a Form 1040A, it will be on line 18. Lastly, if youre filing a Form 1040NR-EZ, it will be line 9.

Deducting items on your taxes can be a little confusing, especially if youre filing taxes for the first time or if your financial situation has changed since the last time you filed. It can be good to have a professional, such as an accountant, help you out if youre not sure the best way to proceed. Moving forward, youll know the most efficient way to deduct your student loan interest when you file your taxes.

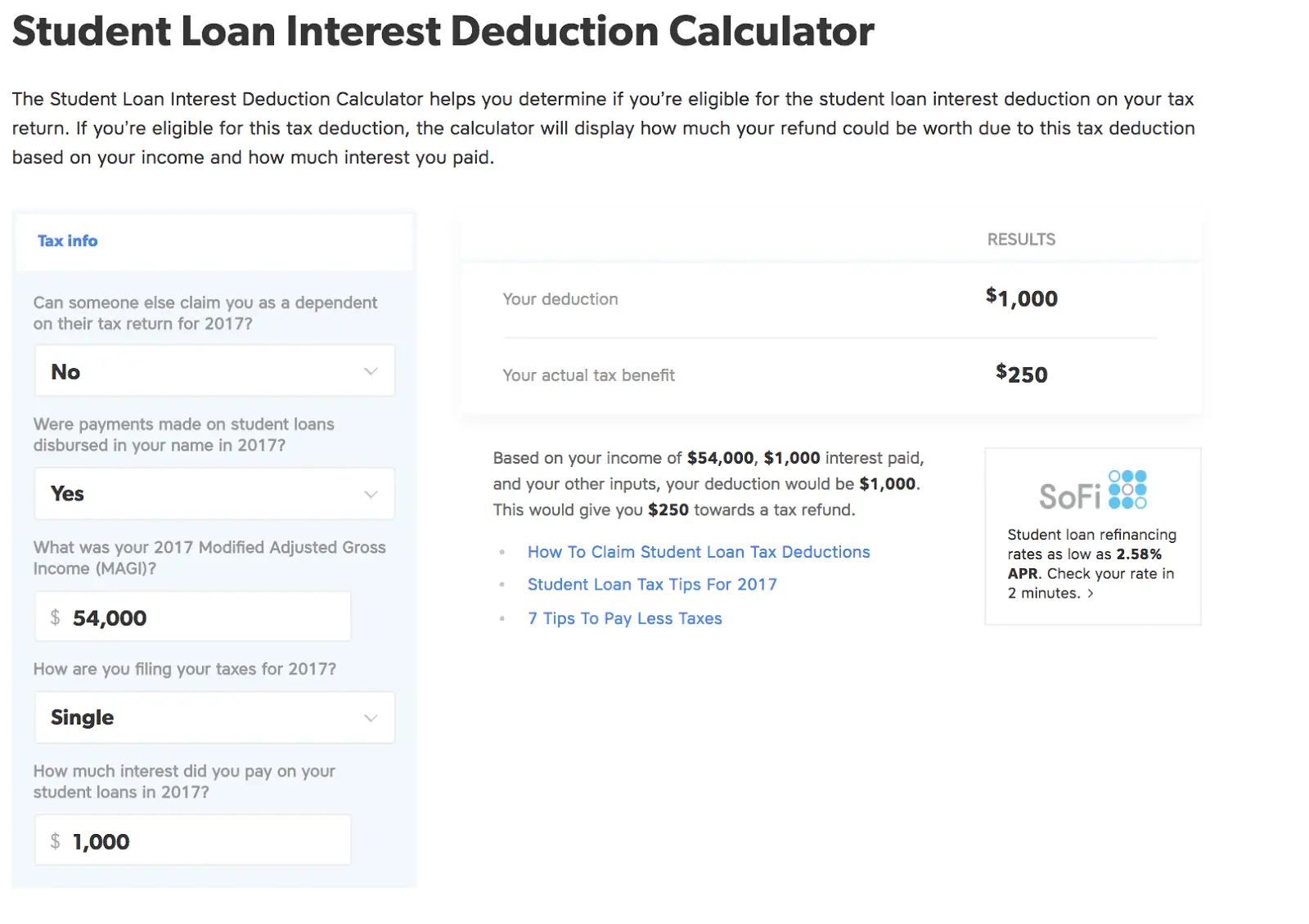

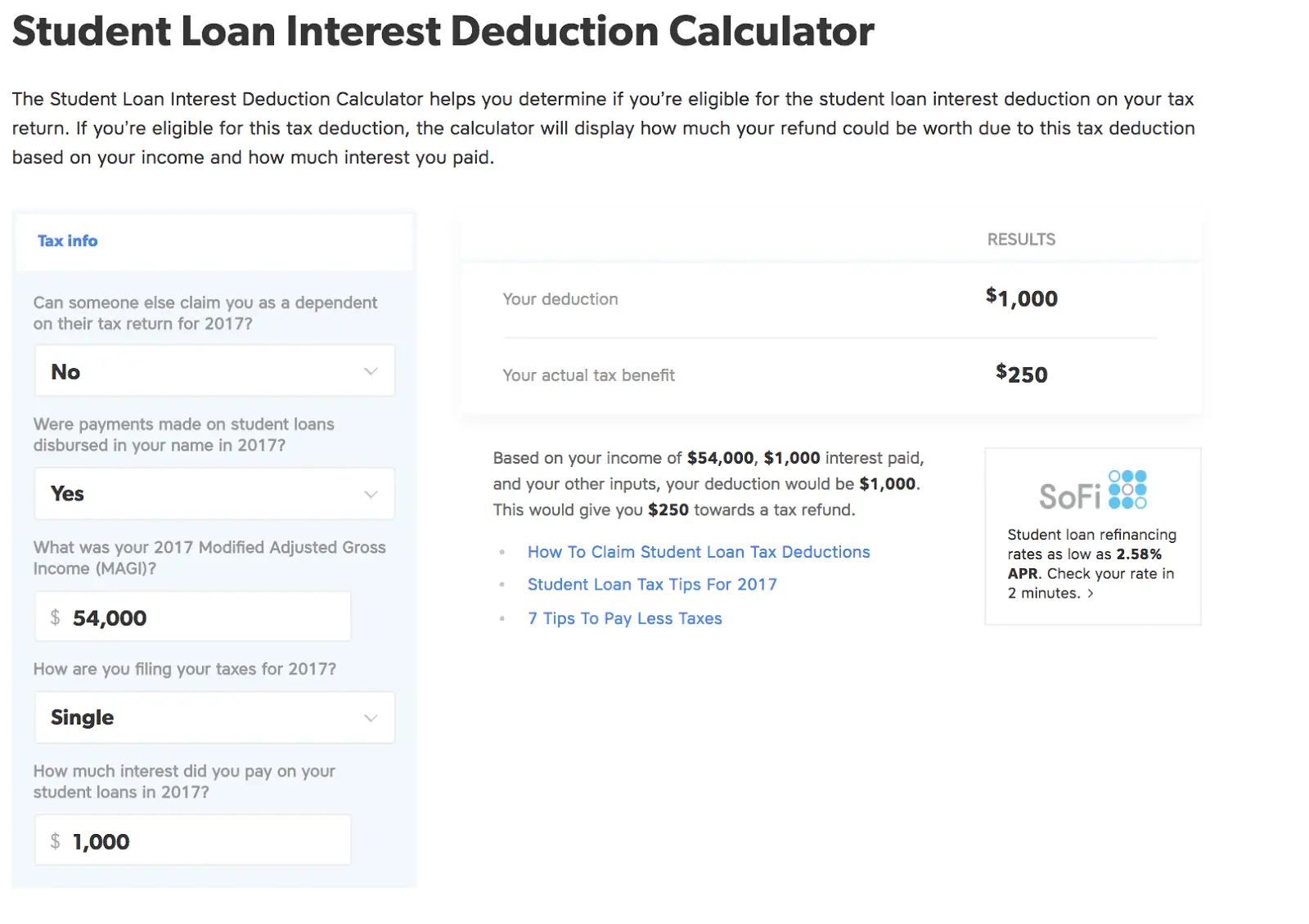

If youre still not sure if youre eligible for the student loan interest tax deduction or how much you can deduct on your taxes use the IRS tax assistant calculator for help.

What About Income Requirements

Your modified adjusted gross income is calculated on your federal tax return before any student loan interest deduction is made. The eligible ranges are recalculated annually.

For tax year 2020 , the student loan interest deduction was worth as much as $2,500 for a single filer, head of household, or qualifying widow/widower with a MAGI of under $70,000.

For those three kinds of filers who exceeded a MAGI of $70,000, the deduction began to phase out, meaning the most they could deduct was less than $2,500. Once their MAGI reached $85,000, they were no longer able to claim the deduction.

For married couples filing jointly, the phaseout began after a MAGI of $140,000, and eligibility ended at $170,000.

Confused by all these requirements? If so, consider going to a tax professional to help with your return to make sure you can take advantage of the deduction. That way you can enjoy the tax benefit without having to spend hours combing through the IRSs website for answers.

Don’t Miss: What Is The Largest Student Loan I Can Get