Pay Off In 6 Years And 2 Months

The remaining term of the loan is 9 years and 10 months. By paying an extra $150.00 per month, the loan will be paid off in 6 years and 2 months. It is 3 years and 8 months earlier. This results in savings of $4,421.28 in interest payments.

If Pay Extra $150.00 per month

| Remaining Term | 6 years and 2 months |

| Total Payments |

| 9 years and 10 months |

| Total Payments |

| $11,188.54 |

Should You Pay Off Your Student Loan Early

If youre thinking ahead, you may have realised that when you’re old enough or earning enough to be thinking about kids, cars and mortgages, you’ll also be making bigger Student Loan repayments.

As a result, you might assume that its better to pay off your loan ASAP but hold fire! Here are a few things to consider if you’re considering paying off your Student Loan early:

Choose An Interest Rate Option Temporary Covid

You have 2 interest rate options to choose from for your Canada Student Loan:

- a floating interest rate equal to the prime rate, or

- a fixed interest rate of the prime rate + 2%

The prime rate comes from the rates of the 5 largest Canadian banks. The highest and the lowest prime rates are removed, then an average of the remaining 3 is used.

Interest rates can change as the prime rate varies. Please log in to your NSLSC account for more information about the current interest rates.

Your student loan has a floating interest rate by default. You can change to a fixed interest rate at any time after you enter repayment. If you switch to a fixed rate, you can not change back to a floating rate. To choose a fixed interest rate anytime during your repayment period, contact us.

Use the repayment estimator to see how interest rates affect your monthly payment.

If you have a provincial part to your loan, it may be under a different interest rate. Contact your province for your current rates.

You May Like: Va Requirements For Manufactured Homes

What Happens To Your Student Loan If You Move Abroad

There are no fees for taking out a Student Loan, but penalty charges will kick in if you try to avoid paying what you owe. The idea that you can ditch your loan by emigrating is just one of the many urban myths of tuition fees!

In reality, Student Finance will find you and make you pay. Not in a Taken sense, but they will want their money back.

The short story is: the Student Loan is fairly flexible. You dont pay if you dont earn enough, and you can overpay whenever you want but you cant skip repayments if you’re earning enough to be making them, no matter where you are in the world.

Is Student Debt Like Other Debt

The news always seems to be full of stories about huge student debt and astronomical interest rates, but what no one tells you is that the Student Loan isnt like other kinds of debt.

If you took out a Tuition Fee Loan and/or a Maintenance Loan , the total amount you borrowed is your Student Loan .

However, Student Finance repayments don’t start until the April after youve left your course AND when you’re earning above a certain amount. Even then, you’ll only repay 9% of your earnings over the threshold .

There are no fees attached to taking out a Student Loan, although interest is constantly being added, and the more you earn, the higher your monthly repayments will be.

Your Student Loan also doesnt affect your the infamous number that decides how generous lenders will be to you .

But perhaps the two biggest differences between regular debt and student debt are that not only are Student Loan repayments automatically deducted from your salary before you get paid , but the total debt is also cancelled after approximately 30 years .

The fact that the debt is eventually cancelled also means that, unlike most other types of debt, it may not be the best idea to make extra repayments and try to clear your Student Loan as early as possible.

Our very own Jake Butler says:

You May Like: Should I Choose Fixed Or Variable Student Loan

What Does A Balance Mean On A Student Loan Account

Understanding how your student loans accrue interest can help you make smart choices about paying off your debt faster.

Your student loan balance is the amount of money owed to your student loan providers, including both the principal and the interest accrued. When you first take out student loans, your balance is just the amount youre borrowing and any origination fees. As time goes on, however, many students loan balances actually begin to grow.

Some loans accrue interest while youre in school, during the six-month grace period after graduation, or in periods of deferment or forbearance. The longer you have student loan debt to your name, the more time interest has to accrue. Once your grace period is over, you might notice that your student loan balance is larger than the amount you initially borrowed.

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

Recommended Reading: Usaa Car Loan Number

How Do I Find My Student Loan Balance

The first step in tackling your student loan balance is knowing exactly what youre up against. The quickest way to determine your total federal student loan balance is to visit the National Student Loan Data System , which is the central database of student aid for the U.S. Department of Education. This database is the main repository of all federal student loan information, including what loans you owe.

The National Student Loan Data system uses information gathered from government loan agencies and loan servicers to keep their data up to date and is a reliable source if youre looking for a detailed overview of your federal student loans. Their info typically includes the dates your loans were disbursed, any grace periods, and even the date you paid off any old loans.

NSLDS does not, however, aggregate data about private student loans. This means that if you took out any loans to finance your education that didnt come from the federal government, you may need to use other means to track down your total student loan balance. For your private loan information, reach out directly to your lender. You can also review your credit report find information on all your debts, including student loans.

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

You May Like: Refinancing A Fha Mortgage

Other Opportunities To Pay Off Debt

You can use extra money to pay down student loan debt, but if youre trying to save on interest, consider paying off any high-interest debt first. You may also want to use the money to pay yourself by adding to your emergency and retirement funds.

If you cant spare more money each month for your student loans now, here are three times when extra funds in your life could mean a bigger, one-time payment.

-

Windfall money. Unless you win the lottery, windfall money usually comes in the form of a gift, job bonus, legal settlement or inheritance. You can use this money to make an extra student loan payment.

-

Tax refund. When you file your tax return each year, you might get a federal or state tax refund. The average refund for the 2019 filing season is $2,729, according to the IRS. Thats a healthy chunk of change that could go toward student debt.

-

Pay raises. If you get a raise, you could hold off on increasing the size of your budget and use the additional money in your check toward your student loans.

About the author:Anna Helhoski is a writer and NerdWallet’s authority on student loans. Her work has appeared in The Associated Press, The New York Times, The Washington Post and USA Today. Read more

Update Your Enrollment In Automatic Payments

Prior to the pandemic, it might have been easier to just set up autopay for your student loan debt so you wouldn’t have to think about manually sending payments each month. But there are some circumstances where automatic monthly payments may no longer suit you.

For example, maybe you previously had a steady paycheck each month so you were able to automatically pay the same amount every time but now, your income varies from month to month, and the amount you can afford to pay toward your loans will be different each time. Or maybe you can no longer afford your monthly payments at all. In these cases, it’s crucial to remember to remove yourself from your autopay settings so payments you can’t afford aren’t taken out of your account.

If you turned autopay off while loans were on hold and can afford your payments, you should remember to turn this setting back on so you don’t accidentally miss your first payment.

You May Like: Avant/refinance/apply

Consider Refinancing Your Federal Loans For A Lower Interest Rate

Once payments resume, the interest rate you paid on your loans prior to the pandemic will be the interest rate you continue to pay. For some people, high interest charges can make it difficult to feel like they’re making progress toward paying down their balance.

Refinancing allows you to swap your current loan for a new loan with a lower interest rate. Companies like SoFi and Earnest have options for those who are interested in refinancing their loans.

While your monthly payments might be lower, when you refinance, your federal student loan becomes a private loan, and you won’t be entitled to any of the same protections you get with federal student loans. For example, federal borrowing allows you to request payment pause periods for a multitude of circumstances, including beginning graduate school and being unemployed with private loans, though, you must continue making payments under these circumstances.

Pursue Student Loan Forgiveness

Best for: Borrowers in low-earning public service careers.

Students with advanced degrees are often highly indebted. Specific loan forgiveness programs are in place for many of these professionals including nurses, teachers, dentists, lawyers and doctors.

Public Service Loan Forgiveness cuts across all jobs. It forgives borrowers remaining federal student loan balance tax-free if they work for the government or a 501 nonprofit while making 10 years worth of monthly payments.

PSLF is designed to encourage workers to pursue relatively low-paying jobs. But if your income is high enough, PSLF wont help you.

To get PSLF, you must make at least some qualifying payments on an income-driven repayment plan, and those payments must be lower than what you would pay on the standard, 10-year plan. Otherwise, youll have paid off the debt by the time youre eligible for forgiveness.

Best for: Borrowers who have a high income or anticipate one.

The higher your student loan balance, the more you can save by refinancing.

With $200,000 in student debt averaging a 7% interest rate, for example, youd save $200 a month and more than $24,000 total by refinancing to a 5% rate assuming you had 10 years remaining before refinancing and maintained the same repayment schedule.

To qualify for refinancing, you typically need good credit and enough income to cover your expenses, other debts and full student loan payments.

Recommended Reading: How Does Getting Pre-approved For A Car Loan Work

How Much Are Plan 1 Student Loan Repayments

Youll only start making Student Finance repayments once youve left your course and are earning enough.

The repayment threshold for Plan 1 loans is currently £19,895/year before tax.

This threshold has risen in April of each year since 2012, so make sure you keep up to date with the figure. And remember: if you earn less than that in taxable income , you wont pay anything back until youre back above the threshold.

Once you earn more than the threshold, repayments kick in and you pay 9% on the amount above the threshold. So, if you earn £24,895 , youll pay 9% of £5,000, which is £450 for the year.

Heres what your monthly repayments could look like. If youre self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | |

|---|---|

| £50,000 | £226 |

Student Loan repayments come with weekly and monthly thresholds, too. This means that even if you have a salary that falls below the annual threshold, receiving a bonus or completing extra shifts could mean you end up crossing the threshold and making a Student Finance repayment.

However, if at the end of the financial year your annual earnings are still below the annual repayment threshold, you’ll be entitled to a refund. Head over to our guide to Student Loan refunds to find out how to go about claiming your money back.

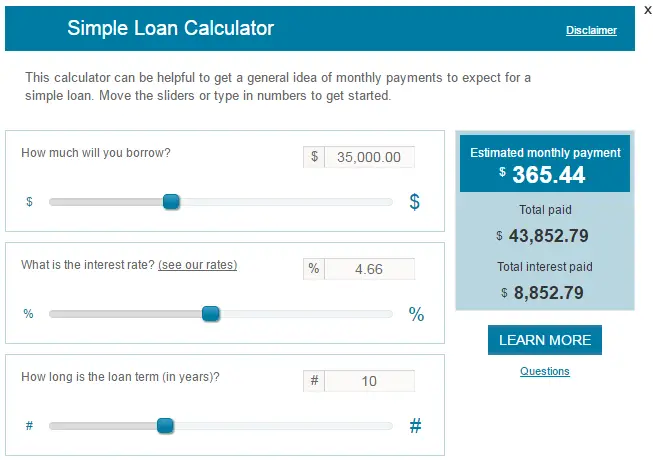

How To Use This Student Loan Payment Calculator

It is important to understand how student loans work and what your monthly payments will be after graduation. This student loan payment calculator allows you to see what your student loan payments will be based on your loan amount, interest rate, and loan term.

First, input your total student loan balance, interest rate, and repayment term into the calculator. With these simple details, you can see your monthly payment, the total interest paid over the life of the loan, and the total cost of the loan including principal and interest payments added together.

Recommended Reading: Usaa Auto Loans Review

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your six-month grace period.

You will be charged interest on the Ontario portion of your loan during your six-month grace period. This interest will be added to your loan principal .

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

Repaying student loans is an excellent way to establish and improve your credit score. You can make additional payments on your loan at any time if you want to repay it faster.

Get repayment assistance:

If you’re having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you can’t attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9½up to 14½ years. Log in to your National Student Loans Service Centre account.

Before Repayment Begins: Exit Counseling

Before repayment begins, you have to complete an exit counseling session. Exit counseling reviews the terms and conditions of the loans, including repayment options, as well as your rights and responsibilities. Some colleges wont release your official academic transcripts and diplomas if you fail to complete exit counseling.

Also Check: Chfa Loan Colorado

If You Don’t Repay Your Loans

If you don’t make your loan payments, you will be in default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further OSAP until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and HST rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Read Also: How Much Loan Officer Commission