Check Your Credit Scores And Reports

Its a good idea to check your credit scores and reports before you apply for a car loan.

If you have poor credit, youll probably qualify for higher rates than if you had better credit. Youll have to decide whether to proceed with getting a car loan, or whether its a better idea to wait and work to improve your credit first.

If you already have excellent credit, congratulations! You may be able to use your good credit as a bargaining chip with lenders to negotiate better terms on your car loan.

How To Create An Electronic Signature For Putting It On The Auto Loan Application Wilderness Adventure Books In Gmail

Below are five simple steps to get your car loan application pdf designed without leaving your Gmail account:

The sigNow extension was developed to help busy people like you to reduce the stress of signing legal forms. Start signing auto loan application form pdf by means of tool and join the millions of satisfied clients whove previously experienced the benefits of in-mail signing.

Current Auto Loan Rates For 2021

Auto loans are secured loans that help borrowers pay for a new or used car. They are available from dealerships and a variety of lenders, so it’s important to shop around in order to find the best interest rates and terms for your vehicle. The lenders profiled on this page are a great place to start.

You May Like: How Can I Refinance My Car With Bad Credit

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

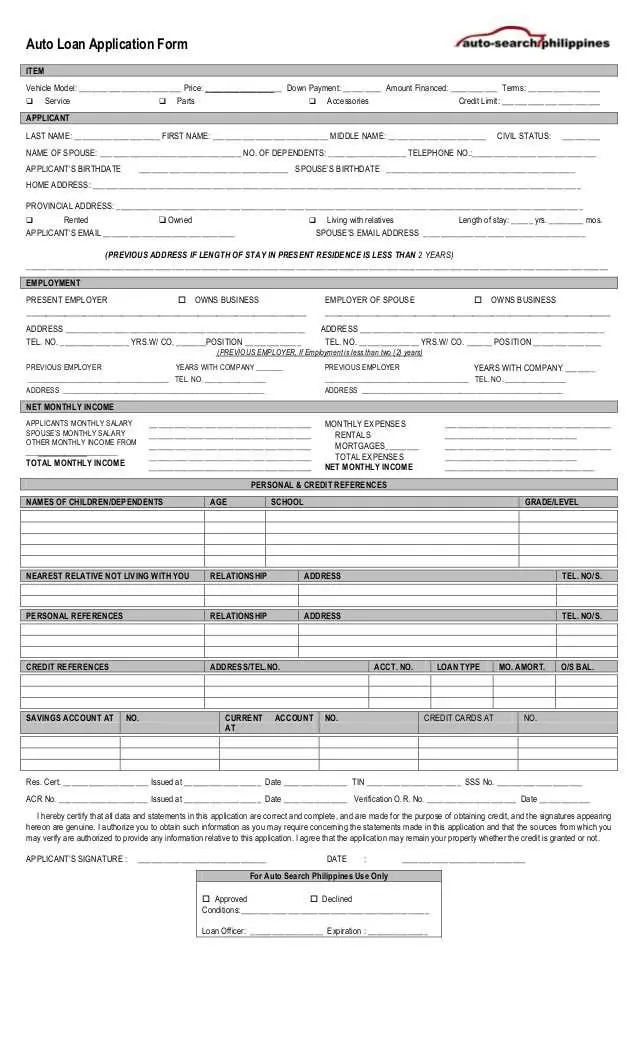

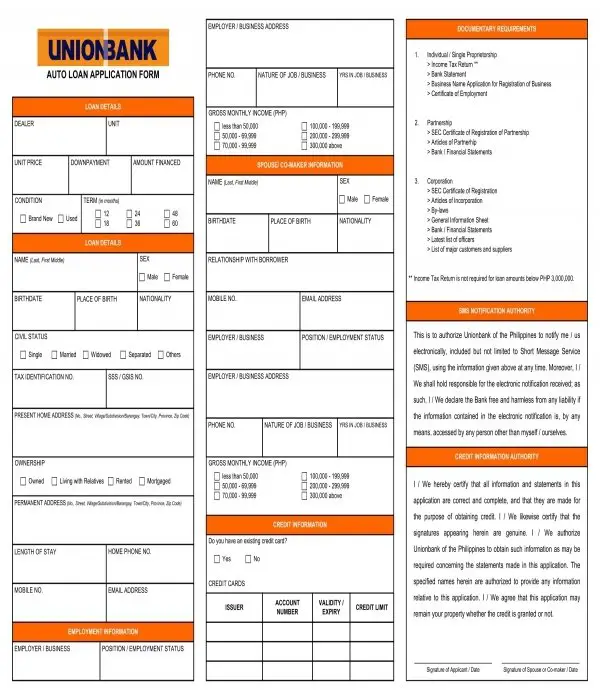

What Paperwork Is Involved With The Auto Loan Process

You may be able to complete the auto loan process over the phone or online, but sometimes youll need to send documentation or bring it with you to the dealership when you purchase a vehicle. The required information varies by lender, but typical documentation required with a loan application includes paycheck stubs, proof of residence and a valid drivers license.

During the final stage of the car-buying process, you may also need to send the purchase agreement, registration, title and lease buyout instructions to the lender. Youll probably also need proof of auto insurance if you plan to drive the vehicle off the lot.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Proprietary And Intellectual Property Rights

The copyright, trademarks, logos, slogans and service marks displayed on the website are regis-tered and unregistered intellectual property rights of the Bank or of the respective intellectual property right owners. Nothing contained on the website should be construed as granting, by implication, estoppels, or otherwise, any license or right to use any intellectual property displayed on the website without the written permission of the Bank or such third party that may own the intellectual property displayed on the website.

The Bank grants the right to access the website to the User and to use the SBI Apply Online servic-es in accordance with the Terms of Service mentioned herein. The User ac-knowledges that the Services including, but not limited to, text, content, photographs, video, audio and/or graphics, are either the property of, or used with permission by, the Bank and/or by the content providers and may be protected by applicable copyrights, trademarks, service marks, international treaties and/or other proprietary rights and laws of India and other countries, and the applicable Terms of Service .

The User should assume that everything he/she views or reads on the website is copyrighted/ protected by intellectual property laws unless otherwise provided and may not be used, except as provided in these Terms of Service , without the prior written permission of the Bank or the relevant copyright owner.

S To Take Before You Apply For A Car Loan With Bad Credit

Credit scores are one of the factors lenders consider when deciding whether to approve a person for a car loan. A score is considered fair or poor if it falls below 670 on the FICO® Score range, which goes from 300 to 850.

You may not be eligible for all loans with a score like thisand you might pay more for the loans you are able to getbut with proper planning and research, you should be able to find a loan that works for you. Here are five things you can do to improve your chance of getting approved, and reduce how much you’ll pay to borrow:

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Choose A Car

This is the tricky part. You need to find a car that works for you. But there are so many factors that affect the decision. Here is a list of factors you need to consider:

- Reliability You dont want a car thats prone to breaking down. You might end up spending more on repairs and services than the actual price of the car.

- Functionality Whether you want something that gets you from point A to B or you need something that can do some heavy lifting. You must get the vehicle that serves the purpose for which you buy it.

- Value for money Price is what you pay and value is what you get. You need to make sure you get what you pay for. Buying an overpriced vehicle with an auto loan will lead to expensive debt settlement. It might even tarnish your financial wealth. Be wise and buy the car that serves your needs and also fits your budget.

Youll know what you need to buy. Remember there is sometimes a big difference between what you want and what you need. Buy smart and dont become over-indebted because of a car loan.

Secure Your Down Payment

When you buy a car, you’ll typically provide a down payment. This payment goes directly toward the purchase of your vehicle, and the remaining amount of the purchase will be financed and paid back over time. When buying a car, the more you can put down, the lower your loan amountand monthly paymentcan be. Additionally, a larger down payment reduces risk to your lender, which may help you secure a lower interest rate on your loan and save you money over time.

Coming up with a down payment isn’t always easy, though, so you may consider delaying your car purchase to save for a larger one. Doing this could make you a more competitive applicant, lower the amount you owe and help you lock in a lower interest rate.

Recommended Reading: How Much Commission Does A Mortgage Loan Officer Make

Tips On How To Fill Out The Get And Sign Car Loan Application Pdf Wilderness Adventure Books Form On The Internet:

By making use of SignNow’s comprehensive solution, you’re able to perform any important edits to Get And Sign Auto Loan Application Wilderness Adventure Books Form, generate your personalized electronic signature in a couple fast actions, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

Where Should You Applyfor An Auto Loan

Some car buyers spend hours researching different vehicles online before setting foot on a car lot and taking a test drive. But when it comes to choosing a car loan, the same person might simply go with one of the financing options offered by the dealership.

While getting financing through a dealership can be convenient, you might end up paying a higher interest rate than you would have if youd gone directly to a lender for a loan. This is because the dealer may add a financing fee on top of the interest rate it offers on your loan.

Where else can you look for auto loans? Online lenders are one place to start, as well as banks and .

Also Check: Usaa Preferred Car Dealers

How Is Your Credit Involved When You Apply For An Auto Loan

To get the best auto loan rates, you may need excellent credit scores. Some auto lenders approve loans for people with less-than-perfect credit histories, but if you have rough credit you likely wont get the best loan terms.

Its a good idea to check your credit scores and reports before you apply for a car loan.

If you have weaker credit, youll probably end up with higher interest rates than if you had better credit. Youll have to decide whether to proceed with getting a car loan, or wait and work to improve your credit first.

Rich Hyde is chief operating officer of Prestige Financial Services, which considers auto loans for people with poor credit. According to Hyde, the lender doesnt have a minimum credit score requirement. Instead, it looks at the applicants entire financial picture, including the applicants job and residency stability, income versus monthly payments and total debt, and payment history.

Other lenders may have minimum credit score requirements, and your credit scores could play a larger role in determining what loan terms you may be approved for.

Before applying for a loan, you may want to review your credit reports and dispute any errors that could be affecting your scores. You can check some of your credit scores as well, but keep in mind that auto lenders might use specialized credit scores created for auto lending.

Why Finance Through Becu

Financing is subject to BECU membership, credit approval, and other underwriting criteria not every applicant will qualify.

AutoSMART services are provided by Credit Union Direct Lending and is not affiliated with BECU. BECU specifically disclaims all warranties with regard to dealers’ products and services. Dealer fees apply. BECU loan financing subject to credit and underwriting approval, and may change without notice.

*APR based on borrower’s credit history, 48-month or less repayment term, collateral two years old or newer with up to 90% loan-to-value , and based on wholesale Kelley Blue Book or dealer invoice. Loans with repayment terms that exceed 48 months, 90% LTV, involve lesser applicant creditworthiness, or collateral older than two years are subject to higher APRs and lower loan amounts. Certain conditions apply. The specific amount of the loan shall be based on the approved value of the collateral. Final loan approval is subject to funding review by BECU. Actual rate may be higher. Financing is subject to BECU credit approval and other underwriting criteria not every applicant will qualify. Applicants must open and maintain BECU membership to obtain a loan. Payment Example: $356.20 a month based on a five year, $20,000 loan at 2.64% APR.

*This is a summary of BECU auto loan program. Loans and BECU financing program subject to BECU credit and underwriting approval.

Read Also: Manufactured Home Va Loan

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Documents Required For Transaction Processing

The User shall be responsible for submitting necessary documents and information as the Bank may require along with any request for any service under SBI Apply Online. If any request for a service is such that it cannot be given effect to unless it is followed up by requisite documentation, the Bank shall not be required to act upon the request until it receives such documentation from the User.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Are The Requirments For Bdo Auto Loan Application

1. At least 1 valid ID

- For Filipino Citizens Passport, Drivers License, SSS, PRC, OWWA ID, OFW ID, Seamans Book, etc.

- For Foreigners Alien Certificate of Registration with Work Permit

2. Proof of Income

- Latest Income Tax Return, or BIR Form 2316, or latest payslip

- Certificate of Employment with Salary

- Additional for Foreigners: current employment contract

- Latest Crew Contract

- Certificate of Employment with Salary, or Employment Contract

- Statement of Account from the Bank

- Certificate of Business Registration

- Proof of other income

Check Your Credit Report And Score

Once you apply for an auto loan, the lender is going to check your credit score. They may also look at your to see the status of previous auto loans, the amount of debt you carry, and other factors that may help determine your creditworthiness.There are several resources online where you can view your credit score and monitor your report online for free. Additionally, Truliant offers a no-cost, no-obligation credit review, where well sit down with you to review your credit and help you find ways to save. Either of these are great first steps.The credit scores you see will likely differ from the scores seen by potential lenders. There are different models and scoring systems that dealers have access to. It’s still important to check your score because it will determine how much you may need to put down and what interest rate you could pay on any new or used car loan.If you have the luxury to wait a few months if your credit isnt where youd like it to be, its not a bad idea to take that time and pay down debt, correct any errors, settle collections and anything else possible to get that score up. It could save you thousands in interest.

Don’t Miss: Does Collateral Have To Equal Loan Amount

How To Apply For Bdo Auto Loan

Are you planning to buy your dream car this year but youre having second thoughts because you dont have enough money for the down payment?

Well, if you really need it badly and you think you can pay the monthly amortization without sacrificing your basic needs and other priorities, you can have your dream car sooner by applying for BDO Auto Loan.

Depending on your needs or lifestyle and capacity to pay, you can apply a loan for a brand-new car, a second-hand vehicle, or even an imported car.

How Should You Determine Your Budget Before Applying For A Loan

A good way to approach a car loan is to focus on the overall cost of the car meaning the final price tag, including total number of payments and interest youll pay. That way, youre comparing apples to apples while you shop around. This could make it easier to avoid letting a dealer pack your loan with unnecessary features that might fit your monthly budget but could have you paying more in other ways .

If youre focused on just how much car you can get for the monthly payment you feel you can afford, you may overlook the fact that your loan is for a longer term than you wanted. That longer term may mean a lower monthly payment, but youll make more of them and probably pay more interest than you would have with a shorter-term loan.

The Consumer Financial Protection Bureaus auto loan worksheet or may help you decide how much car you can afford to buy.

Recommended Reading: How To Calculate Amortization Schedule For Car Loan

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |