Repaying Direct Plus Loans

Parent borrowers are legally responsible for repaying the loan to the U.S. Department of Education and loan payments cannot be transferred to the student. Repayment begins when the loan is fully paid out and payments begin 60 days after disbursement. The service lender will notify the borrower when the first payment is due.

Deferments

Parent borrowers may request a deferment, allowing for payments to be deferred while the student is in enrolled at least half-time, as well as for an additional six months after the student leaves school, graduates or drops below half-time enrollment. It is important to remember interest accrues on loans during periods when payments are not required to be made. Parent borrowers may choose to allow interest to be added to the loan principal when they have to start making payments or they may choose to pay the accrued interest.

You may request a deferment during the loan request process or contact the loan servicer directly to request a deferment on your Direct PLUS Loan.

Interest Rates On Federal Plus Loans

The interest rates on Federal PLUS Loans are fixed rates that change only for new loans each July 1. The new interest rate is based on the last 10-year Treasury Note Auction in May.

The interest rate on the Federal PLUS Loan is the same for both Federal Parent PLUS Loans and Federal Grad PLUS Loans.

Keep in mind, however, that you are not required to pay interest or make payments on any Federal Direct Loan during the current COVID-19 relief period. The relief period is in effect through at least September 30, 2021.

The interest rates are set according to this formula:

| Borrower |

| 4.248% |

Repayment Of Federal Plus Loans

Repayment begins within 60 days of the final loan disbursement during the academic year. Principal and interest payments may be deferred if the borrower meets deferment requirements. In-school deferments may be requested by parent borrowers provided the student is enrolled at least half-time in a degree seeking program.

Also Check: Va Loan For Land And Modular Home

Fill Out The Fafsa And Check Your Student Aid Award

Before you apply for a parent PLUS loan, your student needs to submit the FAFSA and receive their financial award notice. Unlike the parent PLUS loan application, the FAFSA application doesn’t ask about your credit history, and there’s no credit check. So, completing the FAFSA does not impact your credit score in any way.

Schools your child has been accepted to will use the information from the completed FAFSA to determine how much financial assistance your child is eligible for. If your student has been accepted to more than one school, the financial aid awarded will likely differ for each. If at that point you determine you will need more financial assistance for your child to attend the school of their choice, you can apply for a parent PLUS loan.

Keep in mind that your student will need to fill out the FAFSA for each school year, and you will need to apply for a new parent PLUS loan each school year you require it.

Step 3 Complete Master Promissory Note

Complete/Submit “Master Promissory Note.”

Select “MPN for Parents.”

The Master Promissory Note is a legal document in which you promise to repay your loan and any accrued interest and fees to the U.S. Department of Education. The MPN also offers details on the terms and conditions of the loan. Completion of the MPN takes up to 30 minutes and requires the following:

- The names, addresses, and phone numbers of two references

- Your drivers license number

You May Like: How Long Does Sba Loan Take To Get Approved

What Happens If You Dont Pay A Parent Plus Loan

A Parent PLUS Loan will enter default after 270 days of nonpayment. At that point, you could be facing wage garnishment, or having Social Security payments or tax refunds withheld to cover the debt.

The best way to avoid those troubles is to steer clear of debt completely. The next best approach is to pay it all off as fast as possible.

Two Versions Of The Federal Plus Loan

There are two versions of the Federal PLUS Loan: the Federal Parent PLUS Loan and the Federal Grad PLUS Loan.

Other than the differences in the borrower, the purpose of the loan and some discharge provisions, the Parent PLUS and Grad PLUS loans are nearly identical. The Federal Grad PLUS Loan first became available on July 1, 2006, through an amendment to the Federal Parent PLUS Loan.

Read Also: Avant Refinance Loan Application

Review And Accept Your Financial Aid Letter

Once youve filled out the FAFSA, the schools you were accepted at will send you a financial aid offer letter. This letter will arrive by mail and will summarize the financial aid you qualify for.

You should review this letter carefully so you understand what kind of financial aid youll receive. The letter will include the following information:

- The total cost of attendance

- Your expected family contribution

- Any grants and scholarships youre eligible for

- Any subsidized or unsubsidized loans you qualified for

Once youre ready, youll accept your financial aid offer through your schools financial aid office. They can help you work out the details of how your loans will be distributed.

See also:Beginners Guide to Federal Student Loans for 2021

What Occurs During Parent Plus Processing

- Once the loan application has been completed, the servicer performs a .

- The servicer notifies the parent of acceptance or rejection of the loan.

- If the loan is approved, funds are sent directly to MSU and applied against the student’s bill.

- Any PLUS funds that exceed MSU charges are given as a refund by the Student Accounts division of the Controller’s Office.

You May Like: Usaa Car Loans Credit Score

How Long Does It Take To Student Loan Forgiveness

If you meet all requirements and apply for the limited student loan forgiveness waiver, the Education Department may take several months to cancel your student loans. That said, the Education Department announced $2 billion of student loans will be cancelled within weeks. Its possible that your student loan forgiveness may not be processed prior to the end of student loan relief on January 31, 2022. In this case, you would need to keep making student loan payments even if you reach 120 monthly payments and you will be refunded any overpayments.

Should You Apply For A Parent Plus Loan

Parent PLUS loans may be a viable option if your child needs assistance covering their higher education expenses. The application process is relatively simple and you’ll be able to borrow up to the cost of attendance if necessary. If you’re denied due to adverse credit history, you can request to be reconsidered by adding a cosigner to your loan application or notating the reason for your credit issues. You can also take measures to improve your credit so you have more likelihood of being approved next time.

Recommended Reading: Usaa Prequalify Auto Loan

Your Career Might Qualify You For Repayment Assistance Programs

While public servants could qualify for Parent PLUS loan forgiveness through PSLF, professionals in other sectors might be eligible for state-run repayment assistance programs. Some common careers that qualify include doctor, nurse, teacher, lawyer, pharmacist and dentist.

Some private companies also help their employees pay off their loans with a student loan matching benefit. Similar to a 401 match, these companies pay off their employees student loans up to a certain amount.

Depending on your career or employer, you could qualify for student loan assistance and get rid of your Parent PLUS Loans ahead of schedule.

How To Apply For A Parent Plus Loan

Parent PLUS loans are issued by the federal government to help offset the cost of higher education. They are given to parents with children who are enrolled at least half time in a qualifying college or university. The funds can be used to pay for education expenses not covered by financial aid.

Once your student applies for assistance through the Free Application for Federal Student Aid and accepts their financial aid award, you can apply for a parent PLUS loan. Your child’s college or university will notify you of the next steps if you qualify.

Here’s an overview of the eligibility guidelines, how to determine your loan amount, the loan application process and what to do if you’re denied a parent PLUS loan.

Also Check: Defaulting On Sba Disaster Loan

When Do I Begin Repaying My Plus Loan

Repayment of the Parent loan begins within 60 days of the full disbursement of the loan. For a full year loan repayment will generally begin sometime in February. Information about repayment terms and timing will be provided to you by your federal loan servicer. Repayments are made directly to the loan servicer. Borrowers generally have from 10 to 25 years to repay the Parent PLUS Loan. To calculate estimated loan payments, use the Direct Loan Repayment Calculator. Additional information is also available on the Federal Student Aid website under Repayment.

Loan Limits On Federal Plus Loans

The Federal PLUS Loan has an annual limit equal to the colleges cost of attendance, minus other aid received. The Federal PLUS Loan does not have an aggregate loan limit. The students college will determine how much the parents can borrow through the Federal Parent PLUS loan or a graduate student can borrow through the Federal Grad PLUS loan.

If the parent of a dependent undergraduate student is denied a Federal PLUS Loan, the student becomes eligible for higher unsubsidized Federal Stafford Loan limits, the same limits as are available to independent undergraduate students.

Since the Federal Parent PLUS Loan allows a parent to borrow almost unlimited amounts of money for their children, they need to be careful to avoid over-borrowing. Parents should borrow no more for all their children than their annual income. If total Federal Parent PLUS Loan debt is less than the parents annual income, the parents should be able to repay the loans in 10 years or less. If retirement is less than 10 years away, they should borrow proportionately less money. For example, if retirement is in just 5 years, the parents should borrow half as much.

See also:Complete Guide to Parent Loans

You May Like: Does Va Loan Work For Manufactured Homes

Interest Rates And Loan Fees

The interest rate on loans disbursed between July 1, 2020 and June 30, 2021 is 5.30%. Remember that interest begins to accrue as soon as funds are disbursed. Please note that loans for the 2021-22 academic year cannot be disbursed earlier than 10 days prior to the beginning of the fall term which begins August 18, 2021.

PLUS loans carry a loan fee that is deducted from the gross loan proceeds. The loan fee for PLUS loans with the first disbursement after October 1, 2020 is 4.228%. For example, the net proceeds on a $10,000 loan would be $9,577. Due to federal sequestration the loan fee is expected to change after October 1, 2021.

Do You Have To Apply For A Parent Plus Loan Every Year

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

College is expensive and costs continue to rise. In 1989, the average cost of a 4-year degree school term was $1,730. As of 2020, the average cost increased to an average of $10,440 per school term.

With college costs continuing to skyrocket, many parents apply for federal Parent PLUS loans. Since these loans are issued in the parents name, it is important that parents understand the details of what these loans entail and how often you have to apply to ensure students receive proper funding.

So, to avoid missing an application deadline, heres some helpful information about Parent PLUS loans and their application process.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Parent Plus & Graduate Plus Loans

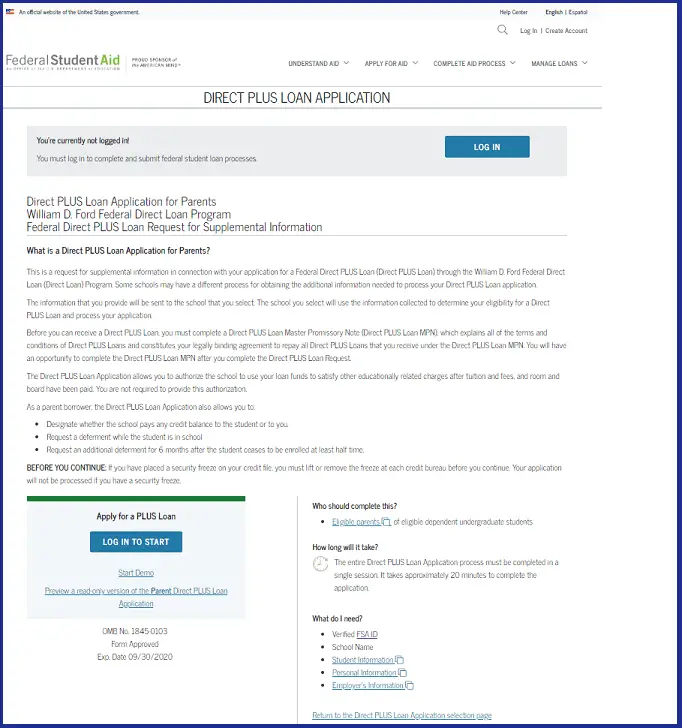

The U.S. Department of Education offers the Direct PLUS Loan to eligible parents and graduate or professional students to supplement the cost of educational expenses not covered by other financial aid. Eligibility is determined through an online application and the students cost of attendance as determined by the University.

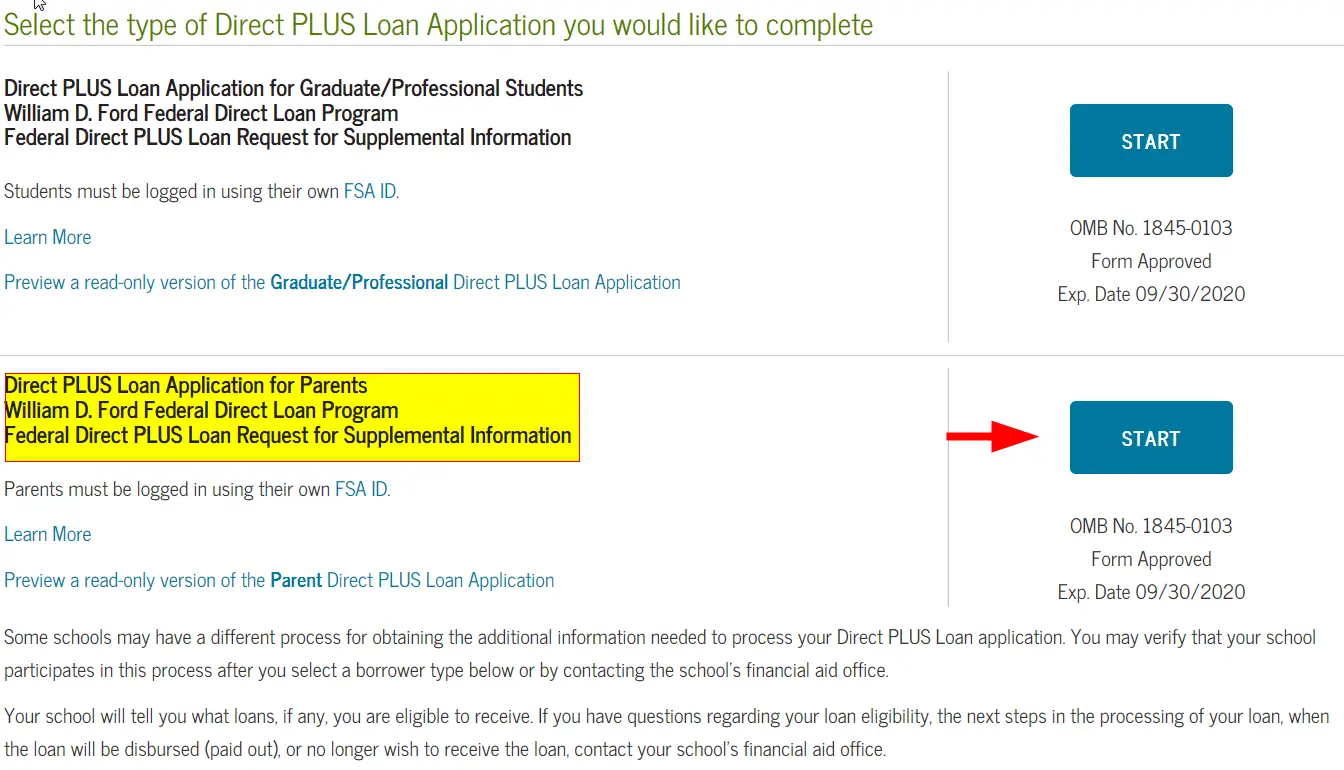

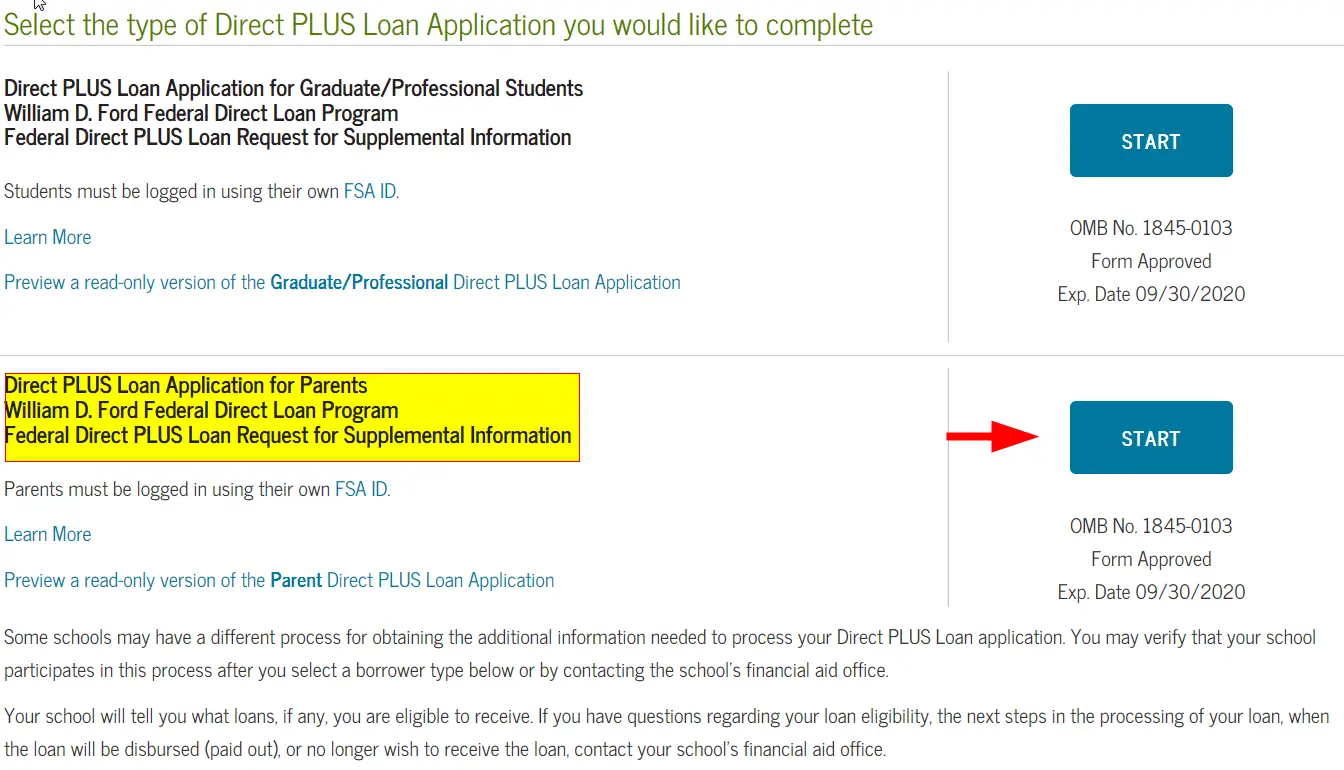

S To Complete The Online Plus Application:

- The parent borrower must sign in to with their FSA ID.

- Once signed in, select Apply for Parent PLUS Loan.

- Select Parent PLUS for the loan type.

- Fully complete the application and submit it. Make sure to select the correct aid year.

- Once submitted, you will receive notification immediately of your approval or denial.

- Next, complete the Parent PLUS Master Promissory Note at the same website, . Make sure to complete all 4 steps and receive notice that your MPN is successfully submitted. Print a copy of the MPN for your records.

Both application methods will generate a credit check on the parent who is applying for the loan. The credit check is valid for 180 days.

If your parents application is denied due to adverse credit history, contact the LSSU Financial Aid Office to discuss your options. Beginning March 29, 2015, PLUS loan counseling will be required if you are determined to have adverse credit history, but qualify for a PLUS loan by documenting extenuating circumstances or obtaining an endorser. This can be completed at .

Please note: PLUS Loan applications must be completed every year as part of the Federal Student Aid Application process.

You May Like: Can I Refinance My Sofi Personal Loan

Sign A Plus Master Promissory Note

After you submit your parent PLUS application, your childs college financial aid office will process it, determine if youre eligible and notify you upon approval . You also can contact the aid office at any point to check on the progress of your application.

If youre approved, theres a final step to complete the parent PLUS loan process: signing a PLUS Master Promissory Note . This legal document works as your loan agreement, fully outlining the terms of your repayment, including the loan period, interest rates and fees.

You can complete a PLUS MPN here. The process takes about 30 minutes, and the MPN must be completed in one sitting. Youll need to provide much of the same identifying information you included in the application.

Additionally, youll need to supply two references on your MPN. They must be two different people who:

- Live at two different U.S. addresses

- Dont live with you

- Have known you for at least three years

For each reference, youll need to list a full name and contact information.

Once you submit the parent PLUS MPN, your student loans should be disbursed soon after its processed, per your directions on the initial application.

You will need to submit a new parent PLUS loan application to take out additional loans in the future, but you have to sign an MPN only once. Most schools are authorized to make multiple federal student loans under one MPN for up to 10 years, according to the Federal Student Aid office.

If Federal Direct Parent Loan For Undergraduate Students Is Denied

If a Federal Direct Parent PLUS Loan Application is denied, the borrower may obtain a qualified endorser or it may be possible for a student to borrow an additional amount of unsubsidized loan. In that case, the dependent student annual maximum allowable loan limit will be replaced by the independent student maximum allowable loan limit at the same class level. If the application is denied, the student should access their Financial Aid Award Letter, select “Request Changes” and ask to be re-packaged for additional unsubsidized loan if the box was not checked on the PLUS Application form.

Don’t Miss: Usaa Rv Loans

The Parent/plus Loan Application Process

The application process consists of completing three steps:

Note: All required paperwork must be completed and the school informed before the school can consider and/or certify your loan request.

If you choose to not complete the process online, you will need to:

If you are completing a paper application, the parent and the student must complete each of their sections on the form and you will need to forward the form according to the instructions provided. Keep in mind that the paper process usually requires more time to process.

What Is The Maximum Amount Of Student Loans You Can Get

Federal direct loans are easier to qualify for than private student loans but there are limitations on how much you can borrow. These loan limits depend on how far along in school you are and whether your parents are contributing to your education.

Dependent undergraduate students

Graduate students have a $20,500 annual limit and a $138,500 lifetime limit.

Recommended Reading: Usaa Auto Loans Review

Revised Pay As You Earn Repayment

The REPAYE program is only open to PLUS loans for graduate students, not parents. Its an income-drive plan that holds your payment amount to 10% of your monthly discretionary income, which is money left over after you pay for housing, food, clothing, and medical care.

Each year your payment amount will be recalculated based on your income and family size. Under this plan, youll also count any of your spouses loan debt, if applicable.