How To Apply For A Direct Subsidized Loan

You need to file the Free Application for Federal Student Aid before you can take out federal student loans from the Direct Loans program.

Direct Subsidized Loan Eligibility

Only undergraduate students with demonstrated financial need are eligible to take out Direct Subsidized Loans. Graduate and professional school students are currently ineligible for Direct Subsidized Loans.

- Have demonstrated financial need as determined by the FAFSA

- U.S. citizen, national, or eligible non-citizen

- Have received a high school diploma or the equivalent

- Enrolled at least half time in an eligible degree or certificate program

- Not in default on any existing federal student loans

- Meet general eligibility requirements for federal student aid

Borrowing For College Start With Subsidized Student Loans

Edited byAshley HarrisonUpdated October 8, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youve taken advantage of all the scholarships, grants and other aid available to you and will still have to borrow to go to college, youve probably heard that federal student loans are the best place to start.

But did you know there are four types of federal direct loans?

This article, the first in a two-part series, will summarize the ins and outs of one type of loan federal direct subsidized loans and explain why, if you must borrow for college, they are the best deal around.

Since not everyone will qualify for a subsidized loan, and because there are annual and lifetime limits on how much you can borrow, well also talk about other types of loans you can fall back on.

Lets begin by getting a handle on what exactly a direct subsidized student loan is, and how its different from other loans you might turn to.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

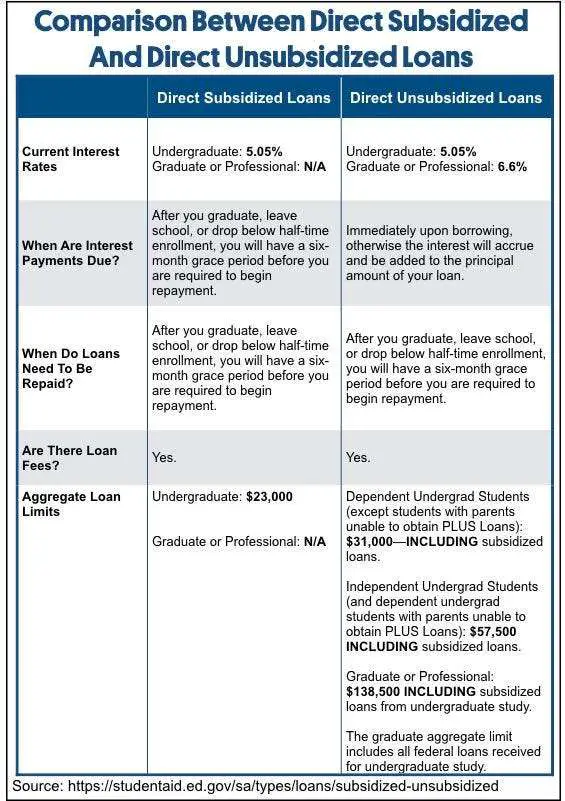

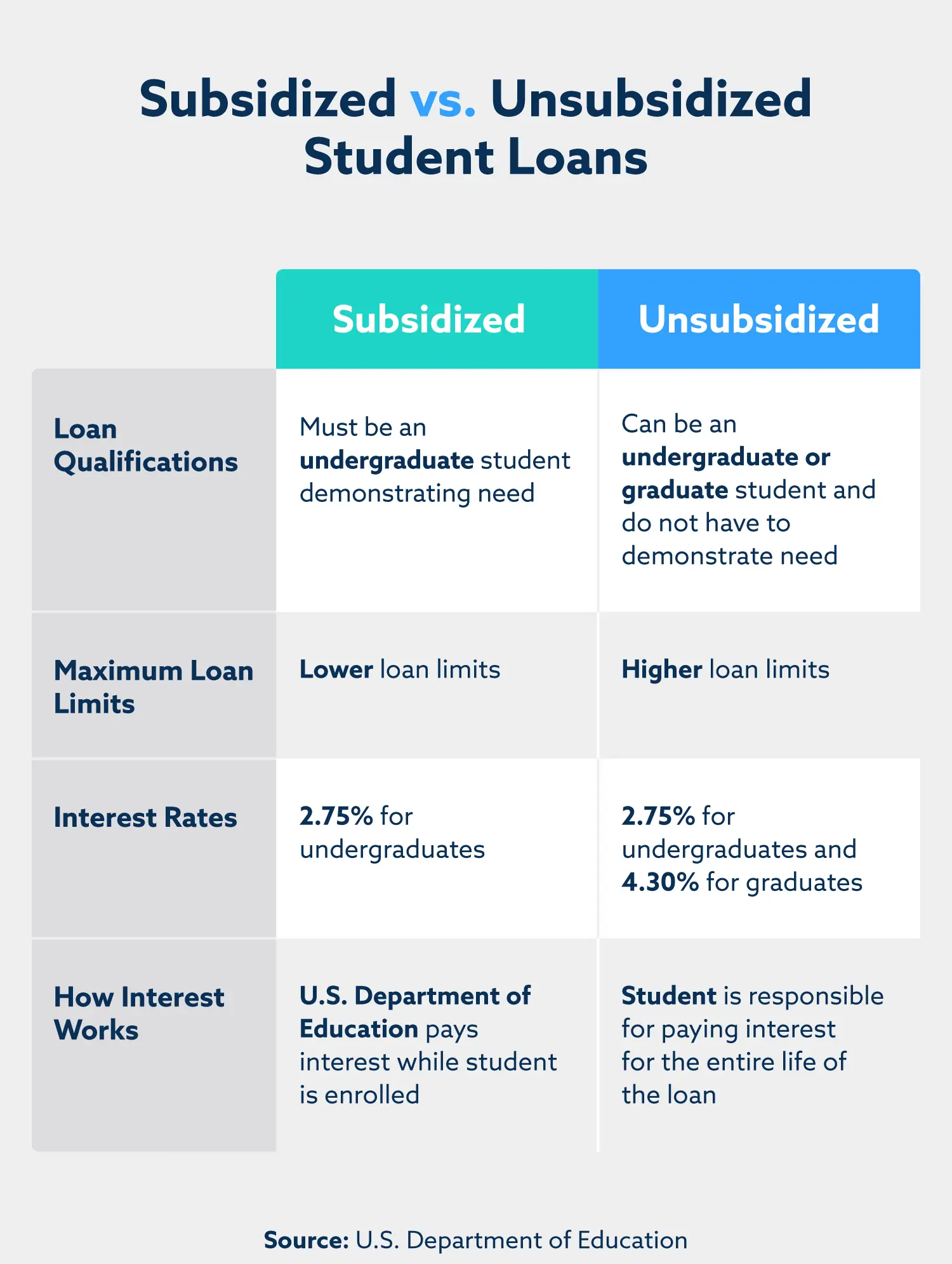

What Is The Difference Between Subsidized And Unsubsidized Loans

Subsidized Loan

The federal government does not charge interest on subsidized loans while a borrower is attending school at least half-time , during the six-month grace period and during deferments . Financial need must be shown to receive this type of loan.

Unsubsidized Loan

For students without financial need, the Direct Loan Program offers Direct Unsubsidized Loans. Unlike the subsidized loan, the federal government charges interest on unsubsidized loans while borrowers are attending school, during the six-month grace period and during deferments. If borrowers do not wish to pay the interest while in school, the interest amounts will be capitalized to the principal loan balance.

Applying For A Direct Loan

Also Check: Usaa Loan Approval

Review And Accept Your Financial Aid Letter

Once youve filled out the FAFSA, the schools you were accepted at will send you a financial aid offer letter. This letter will arrive by mail and will summarize the financial aid you qualify for.

You should review this letter carefully so you understand what kind of financial aid youll receive. The letter will include the following information:

- The total cost of attendance

- Your expected family contribution

- Any grants and scholarships youre eligible for

- Any subsidized or unsubsidized loans you qualified for

Once youre ready, youll accept your financial aid offer through your schools financial aid office. They can help you work out the details of how your loans will be distributed.

See also:Beginners Guide to Federal Student Loans for 2021

Gather The Documents Youll Need

Youll need quite a bit of information to complete the Free Application for Federal Student Aid , especially if its your first time. Its a good idea to gather this information before you get started so you dont miss anything.

Here is a list of some of the documents youll need:

- Your Social Security Number

- Any other record of previous income earned

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Is The Difference Between A Subsidized Loan And A Unsubsidized Student Loan

Direct subsidized loans tend to be a better choice for some students. They may help students with better terms than other loan options. With subsidized loans, the government may pay interest on the loan while the student is enrolled. These loans may be suitable for those with financial need. Direct unsubsidized loans are also federal loans. The main difference is that unsubsidized loans are not based on need. Students are responsible for the interest on these loans. Interest starts accruing and starts adding to the principal loan amount while the student is in school.

Moreover, many students could qualify for either. That is why it is so important to know the differences. It is also important to know what is perfect for you. For either type of loan, students must be eligible. Students fill out the Free Application for Federal Student Aid or FAFSA. This application gathers info about the students and family finances.

Will Canceling A Loan Hurt My Credit

No, cancelling a loan application before the amount is disbursed will not have any impact on your credit score. … No, cancelling a loan does not impact your credit score. The reason for this is simple when you cancel a loan application, there is nothing that your lender has to report to the credit bureau.

There are four types of federal student loans available:

- Direct subsidized loans.

Read Also: What Car Loan Can I Afford Calculator

How To Decline Subsidized Loan

Asked by: Mr. Stuart Davis

To decrease an award, first check the “Accept” checkbox then you can decrease the award under the “Accepted” column. Also, if you decrease or decline any awards, you cannot increase them after clicking “Yes.” To decline an award, check the “Decline” checkbox next to the award name.

Yesas long as it’s within that academic yearcontacting the Financial Aid Officea portion of your student loans canceled31 related questions found

What Are The Pros And Cons Of Direct Subsidized Loans

There may be a lot of benefits to direct subsidized loans. For example, the government is paying a portion of the loan cost for you. That means the student may end up paying less on their student loans over time.

Sometimes students may need help making payments on their loans later. This may happen after a student graduates. He or she may not have the funds to make payments on time. They may put the loan into deferment at that time. They may also choose to put the loan into forbearance. Interest may be paid by the government during these periods of time as well. It may also apply to some instances of repayment plans. The student typically does not have to make interest payments. The federal government does during this time. Once this period ends, the student could go back to making interest and principal payments again.

Direct subsidized loans often do not require payment during the college enrollment period. The student may need to start making payments six months after leaving school. Payment is typically not owed until they are out of school. The benefit is that the student may be, hopefully, working in their career choice. That could make it possible for the student to start making payments on their loans.

Another key factor usually includes eligibility. The longest eligibility period is 150 percent of the length of their college program. That means if the student is enrolled in a four year undergrad program, they may receive loans for up to six years.

Cons

You May Like: Can I Refinance An Fha Loan

How Do I Qualify For Subsidized Loans

Another key factor usually includes eligibility. The longest eligibility period is 150 percent of the length of their college program. That means if the student is attending a four year undergrad program, they may receive loans for up to six years. This allows a student to continue to obtain funds for a longer period of time.

There may be some cons to direct subsidized loans. Students who are considering them, need to recognize these limitations. First, these loans are only available for undergrad students. Graduate students generally cannot receive them at all.

Second, the loans are available to those who can demonstrate financial need. If a student cannot do that, he or she cannot may not obtain the loan. This can may happen if a parent earns too much money. The FAFSA information determines this. Students whose family earns too much may not be eligible for this type of financial aid at all.

There is also a loan limit to consider. The annual loan limit for these loans is lower than for direct unsubsidized loans. That may limit the access to funds to cover all college costs for some students.

What Do Subsidized And Unsubsidized Mean

There are two types of Federal Direct Loans: subsidized and unsubsidized.

Subsidized loans

Direct Subsidized Loans are available to undergraduate students whose Expected Family Contribution shows that they need money for college. If you get a Direct Subsidized Loan, the U.S. Department of Education pays any interest that accrues while youre enrolled at least half time.

There is a time limit on how long you may receive Direct Subsidized Loans: up to 150 percent of the published length of your program.

Unsubsidized loans

Direct Unsubsidized Loans are available to both undergraduate and graduate students. You do not need to show financial need to qualify. Youre responsible for paying all interest on the loan.

Don’t Miss: Can I Refinance My Sofi Personal Loan

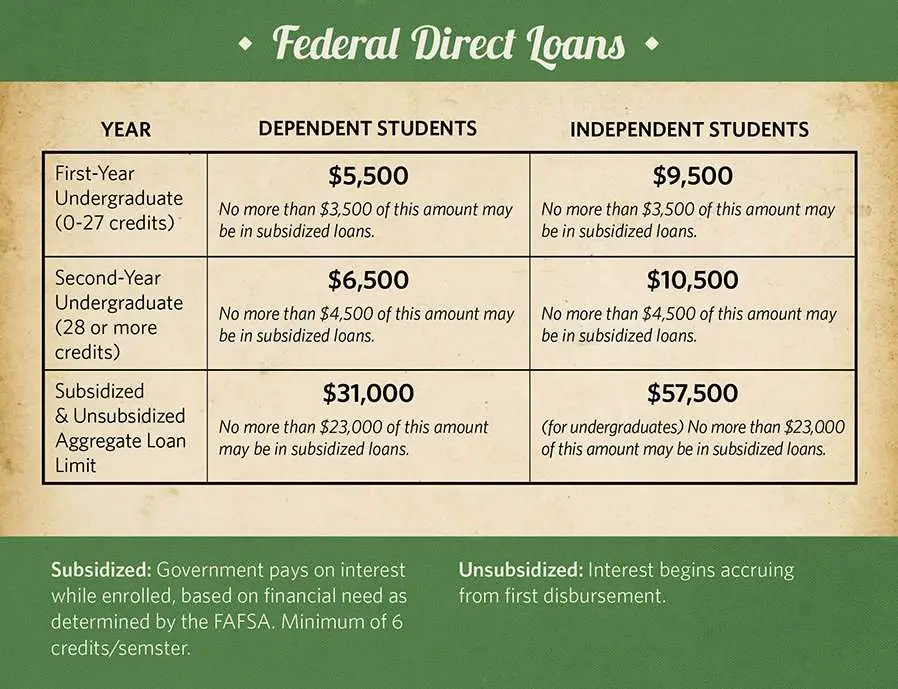

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

Can I Get More Direct Subsidized Loan Funds

Direct Subsidized Loans have annual and aggregate limits that cannot be increased. However, if you received less than the maximum Subsidized Loan award for your academic level and your financial situation has changed significantly since you filed your FAFSA, you should talk to the financial aid administrator at your school to find out if the subsidized loan award can be increased.

Also Check: How To Get Loan Originator License

How To Apply For Federal Student Loans

Filling out the FAFSA qualifies you not only for student loans, but for other types of federal financial aid. Depending on your financial need, you may qualify for federal grants, such as the Pell Grant, that can help cover your education costs without needing to be repaid.

If you need to borrow money, federal loans typically have lower interest rates and more flexible repayment options than private loans, so borrow up to the maximum allowed in federal loans before turning to private loans. Heres how to do it.

Repaying Federal Direct Loans

Youll begin repaying your loans six months after you graduate or drop below half-time status. First, youll be asked to complete exit counseling, which will provide you with information on repaying your loans. Well send you email with the details when its time for you to go through exit counseling.

You May Like: Usaa Auto Loans Rates

Loan Adjustment And Reinstatement

The online Loan Adjustment Request kind can be obtained in the beginning of each semester up to the adjustment/reinstatement due date.

If you wish your PLUS loan eligibility evaluated for either a growth or reinstatement, you could submit an on line Loan Adjustment Request Form because of the due dates detailed.

How To Apply For A Direct Loan

Set out below are the steps you need to take to make an application for a Direct Loan to help cover your educational costs at the University of Sussex for the 2021/22 academic year.

- FAFSA applications for 2021/22 can be submitted from 1st October 2020.

- The Financial Aid Office will be accepting loan application documents for the 2021/22 academic year from 4th May 2021. Please note that applications will be processed in strict order of receipt.

- Notification of Student Loan Letters will be issued from July 2021 to eligible students who have submitted a complete application.

Application Steps:

You May Like: Can You Refinance An Fha Loan

Compare Offers From Multiple Lenders

Private loan interest rates, repayment terms and benefits can vary widely from lender to lender, so its a good idea to shop around at several different companies to find the best loan for you.

When comparing loans, consider the following factors:

To find the right financing option for you, start by exploring our picks for the best private student loans.

To Receive Your Subsidized Or Unsubsidized Loan:

You May Like: Usaa Apply For Auto Loan

To Apply For A Federal Plus Loan:

How To Apply For A Federal Direct Unsubsidized Loan

Please allow three weeks for the processing of your loan request.

Requesting Your 2021-22 Loan :

Step 2: Visit our Application Page.

Step 3: Complete the Appropriate Loan Request Form

Details to keep in mind when completing your loan request:

- The number of credits for which you plan to enroll helps determine your budget and loan eligibility.

- The University may decrease your loan amount if your actual enrollment is fewer credits than the number you reported on your loan request.

- If you choose a loan period that includes more than one term, your total loan amount will be spread evenly across the number of terms you choose

- If you would like to make any changes to your request, email us at from your Fordham Email Address.

- Recommended Subject Line “Federal Unsubsidized Loan Request Adjustment”

- Recommended Body: “Please my Federal Unsubsidized Loan by for the “

Cost of Attendance

Recommended Reading: Genisys Loan Calculator

Net Vs Gross Amount Of Loan

Your Direct Subsidized or Unsubsidized Loan will appear on both the Award Summary and Bursar Tuition Bills section on LionPATH however, the loan amounts will be different.

The loan amount on the Student Aid Award Summary is the gross amount.

The Bursar Tuition Bills section will reflect the net amount after the loan origination fees have been deducted.

Once you have accepted your loan, the funds will automatically disburse to your student account after classes begin.

Are Subsidized Loans Better Than Unsubsidized

Subsidized loans offer many benefits if you qualify for them. While these loans are not “better” than unsubsidized loans, they offer borrowers a lower interest rate than unsubsidized loans. The government pays the interest on them while a student is in school and during the six-month grace period after graduation. However, subsidized loans are only available to students who demonstrate financial need, and you can use them for undergraduate studies.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

To Accept Your Federal Direct Subsidized Loan:

Once students receive their SU Financial Aid Award Notice listing a loan estimate, they must complete the Master Promissory Note , Annual Student Loan Acknowledgement and Entrance Counseling session to complete the application process for a Direct Loan. Visit your MySlice Financial Aid To Do List for instructions.

Annual And Maximum Federal Direct Loan Limits

The amount of Federal Direct Loan funds that you are eligible to borrow each academic year is limited by your grade level , whether you are a dependent or an independent student, your financial need and your cost of attendance. You cannot borrow more than your cost of attendance for the academic year.

Annual Loan Limits

Learn more about borrowing student subsidized and unsubsidized loans.

Read Also: Arvest Construction Loans

What Are The Eligibility Requirements

Here are the requirements youll need to meet to qualify for a federal direct loan:

- Undergraduate at qualified school.

- Have demonstrated financial need as determined by the FAFSA.

- U.S. citizen or eligible non-citizen.

- Have received a high school diploma or GED.

- Enrolled at least half time in an eligible school.

- Not in default on any existing federal student loans.

- Meet general eligibility requirements for federal student aid.