How To Get Your Student Loans Forgiven: Three Paths

Cancelling student loan debt is a popular subject in todays climate, but its been a popular topic for more than 20 years and 45 million people still owe $1.7 trillion.

That could change if Biden and Congress reach some sort of compromise on how much to cancel and qualifying requirements.

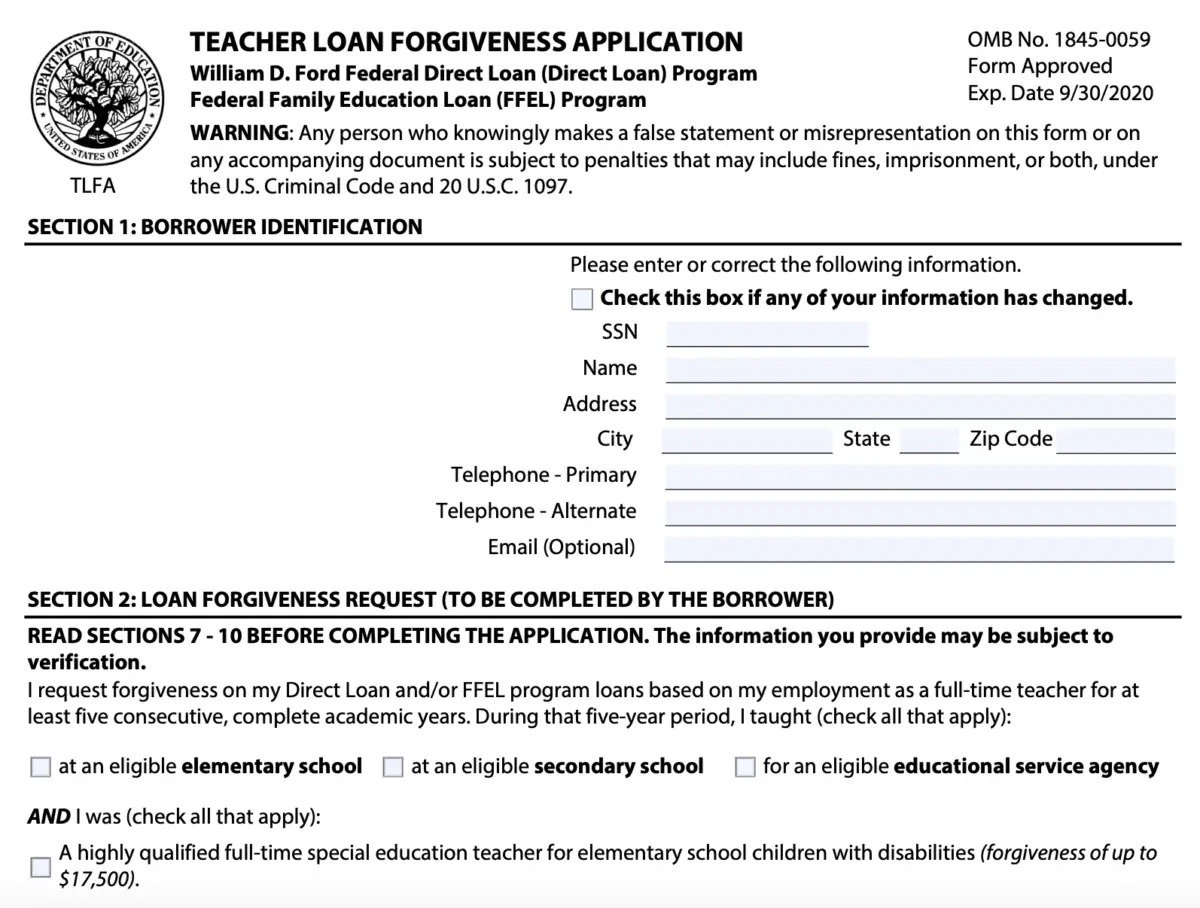

In the meantime, option No. 1 for student loan forgiveness is having a job that serves the public good. If youre a teacher or police officer or firefighter or social worker or health care worker or government employee who kept up with payments for 10 straight years, youve got a good shot. If you are a sign spinner or pet psychic, forget it.

Option No. 2 is through a repayment plan that is based on your income. You will still have to pay a large chunk of your debt over a long period, but under the current laws, a portion will be forgiven at the end.

Those options are available for federal student loans.

Option No. 3 is called a discharge and its available for federal or private loans, but you probably dont want to go there. A discharge is when you cant repay the loan for a variety of reasons, like death, disability, fraud, identity theft or bankruptcy.

Private Student Loans: Disability Discharge

Some private student loans provide a disability discharge that is similar to the TPD Discharge for federal student loans. These lenders include:

-

Citizens Bank

- Other private student loan lenders

In addition, several state student loans provide a disability discharge, including state student loans from Georgia, Iowa, Kentucky and Texas.

Some of the lenders offering a disability discharge on private student loans provide a disability discharge on private student loans that is more generous than the disability discharge standard for federal loans. For example, some of the lenders will discharge private parent loans if the student becomes totally and permanently disabled, not just if the parent borrower becomes disabled.

Sallie Mae was the first lender to offer a disability discharge on private student loans, starting with the Smart Option student loan in 2009. Other lenders followed their lead within the next few years and started offering disability discharges on new private student loans.

The borrower may also consider refinancing their student loans to switch to a lender who offers disability discharge, or at least a lower interest rate.

You May Like: Va Loan Requirements For Mobile Homes

How Can You Become Eligible

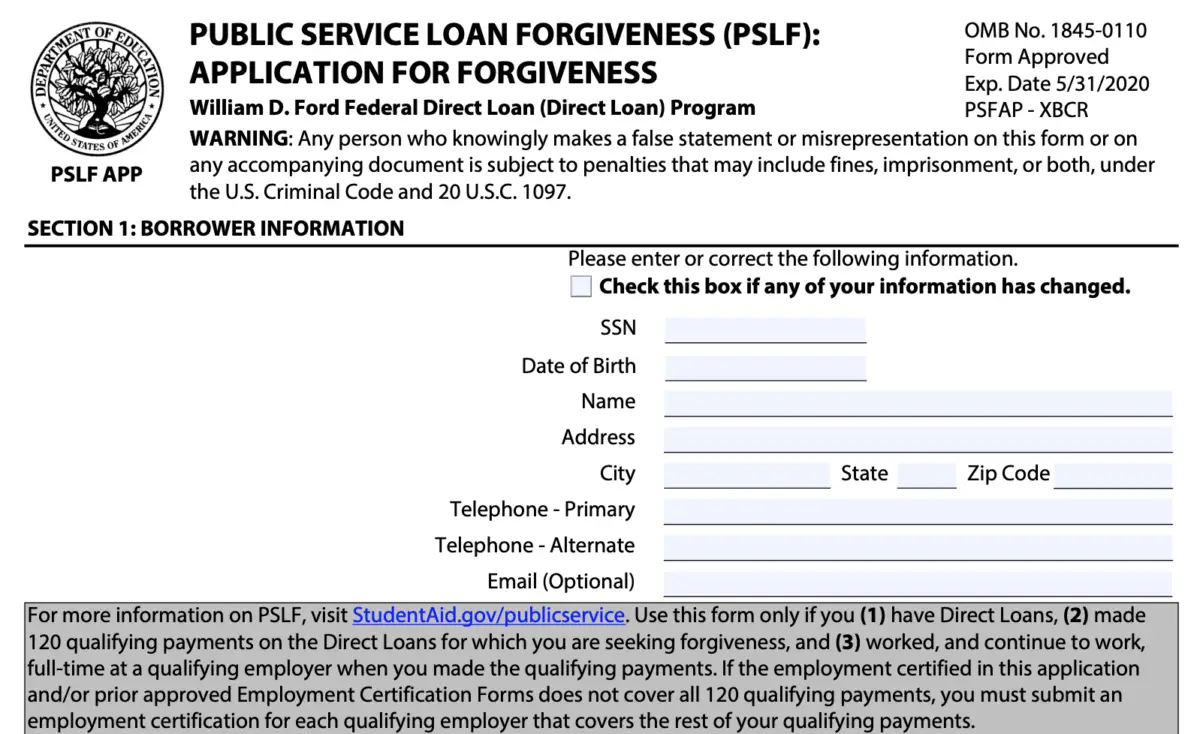

To make sure youre eligible for PSLF, submit the Employment Certification for Public Service Loan Forgiveness form. The program requires this form for every year of service, so submitting it on an annual basis will help ensure youre on track for PSLF.

Another important step is switching to an income-driven repayment plan. Youll lower your monthly payments while extending your term to 20 or 25 years. If you stay on the standard plan, you wont have any balance left to forgive after 10 years of payments.

Finally, consider consolidating your student loans into a direct consolidation loan. This step is helpful if you have Perkins or FFEL loans. Plus, it simplifies your monthly payments, so youll only have one loan to pay each month. You can estimate your possible forgiveness through our PSLF calculator.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Parent Plus Loan Deferment

Repayment on a Parent PLUS Loan usually begins no later than 60 days after the loan is absolutely disbursed. However, debtors can defer reimbursement of a Parent PLUS Loan whereas the student is in class and through a six-month grace interval after the student graduates or drops beneath half-time enrollment standing. Parent PLUS Loans may also be deferred whereas the mum or dad borrower is enrolled on at the least a half-time foundation in an eligible program. However, curiosity continues to accrue throughout these deferment durations.

Who May Qualify For Federal Student Loan Forgiveness

There are several federal programs that offer student loan forgiveness based on certain criteria, such as employment.

If you have a parent PLUS loan, you should explore discharge options in the event of the death of the student, if you become permanently and totally disabled, if the loan gets discharged in bankruptcy, or if the school engages in activities like falsely certifying for the loan or closing while the student is studying. If one of these events occurs, you can apply for a discharge. Upon acceptance, youd no longer be responsible for the loan.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Air Force College Loan Repayment Program

The main Air Force College Loan Repayment program is paused in 2018 . This program allowed you to get up to $10,000 in student loan debt paid off in 3 years.

However, the Air Force JAG student loan repayment program is still active. You can receive up to $65,000 in student loan forgiveness if you go into JAG in the Air Force.

You can learn more about this program here.

Many Healthcare Workers Are Eligible For Federal Student Loan Forgiveness

If you are a healthcare worker, you may qualify for federal student loan forgiveness. Student loan forgiveness programs can provide significant debt relief. In order to qualify for federal student loan forgiveness, you must:

-

Be employed by a U.S. federal, state, local, or non-profit organization

-

Work full-time

-

Have direct loans

-

Repay your loans under an income driven repayment plan and

-

Make 120 qualifying payments .

Healthcare workers at public hospitals or not-for-profit hospitals may be able to take advantage of public service loan forgiveness . Be sure to check with your loan servicer to determine whether you have eligible loans. For example, healthcare workers who have private student loans do not qualify for public service student loan forgiveness for their non-federal loans neither do healthcare workers who work for for-profit organizations.

Don’t Miss: Usaa 10 Day Payoff

Us Military Student Loan Forgiveness Options

Serving our country can be a great career. And there are good incentives to sign up and serve. Student loan forgiveness has been one of these programs.

If you’re considering a career in the military, find out if they will help pay down or eliminate your student loan debt. You can also look at our full guide to military and veteran education benefits.

Public Service Loan Forgiveness Program

This program is designed to help borrowers who have large student loans but earn less working in the public service or for 501c3 nonprofits than they could earn in other sectors. For those who qualify, the PSLF program forgives the remaining balance on certain federal loans after borrowers have made 120 on-time payments on a qualified repayment plan. However, whether a borrower will have a loan balance after making 120 payments depends on many factors, including their income and the size of their loan debt some borrowers may not have a balance left to forgive.

The PSLF program has many variables, including the types of federal student loans you have, the repayment plan you selected, and the type of job you hold. PSLF forgiveness is not taxable in the year forgiven under current IRS rules.

- Learn more about the Public Service Loan Forgiveness Program, including eligibility requirements and whether you qualify.

- Use the loan simulator on studentaid.gov to determine whether PSLF may be a good option for your circumstances.

- If you are considering applying for PSLF or wonder if you qualify and you have been making payments on your student loan for some time, take time to review the PSLF waiver information. The U.S. Department of Education recently announced changes that could help more borrowers qualify for PSLF. The waiver program is only available through Oct. 31, 2022, so applying now is a good strategy, even if you arent sure if you will complete the PSLF process.

Don’t Miss: Usaa Auto Refinance Rate

Parent Plus Loan Master Promissory

The Master Promissory Note is the official loan settlement that describes the phrases and situations for repaying the loan. The similar mum or dad who completes the PLUS Loan Request should signal the MPN earlier than the loan funds may be despatched to the varsity. The MPN can be accessible in your StudentAid.gov account.

Note that an MPN is nice for 10 years, so you could solely have to signal this on the primary utility. However, in subsequent years, every request for a Parent PLUS Loan will begin a brand new credit verify.

If two totally different dad and mom wish to apply for Parent PLUS Loans, every should full this utility course of individually. If requesting funds in the identical yr for a similar student, the entire mixed quantity is probably not larger than the varsitys Cost of Attendance.

Guidelines for requesting a Parent PLUS Loan:

- Same mum or dad who will full and signal the Master Promissory Note ought to request the loan.

- Parent, not the student, should request the loan.

- A mum or dad should signal into the StudentAid.gov with their FSA ID. If you do not have already got one, you will want to create your personal FSA ID.

Circumstances For Student Loan Discharge

- Permanent disability or death

- Unauthorized signature of the loan by the school without your knowledge

- False certification of student eligibility

- Unpaid refund, which is when you withdrew from school and it didnt return the required loan funds to your loan servicer

- School closure while you were enrolled

Discharging student loans through bankruptcy is extremely rare. It is technically not impossible, but demonstrating undue hardship is very difficult. Read more about the differences between forgiveness and discharge.

Don’t Miss: Va Home Loan For Manufactured Home

$10000 Student Loan Forgiveness Program

Since resuming office, President Biden has expressed support for canceling up to $10,000 per student in Federal loan debt. A recent cnet.com Some Democratic leaders are looking to go higher, to $50,000. Unlike the long-term forgiveness indicated in his other proposals, this student loan cancellation wouldnt be conditional on service.

For some borrowers, $10,000 in forgiveness may seem like a small fraction. However, a recent report by the Department of Education found that about 15 million borrowers have federal student loan debt of $10,000 or less meaning around a third of federal student loan borrowers would see all of their federal debt erased.

According to an online publication, Biden did forgive $1 billion in loans for students defrauded by for-profit institutions in March, but he has yet to present a plan for reducing the roughly $1.7 trillion in student debt across the board.

Biden in April asked Education Secretary Miguel Cardona if he has the legal authority to cancel student debt. Under the American Rescue Plan Act, eligible Americans received a third stimulus check and plus-up payments where applicable, more money for unemployed individuals, thousands of more dollars for families with the new child tax credit and changes to health care savings. But students who are in debt werent included in the bill.

Resolve Student Loan Disputes

If you and your loan servicer disagree about the balance or status of your loan, follow these steps to resolve your disputes:

1. Talk with your loan servicer

You may be able to solve a dispute by simply contacting your loan servicer and discussing the issue. Get tips on working through an issue with your loan servicer to resolve the dispute.

2. Request help from the FSA Ombudsman Group

If you have followed the guide and still cannot resolve your issue, as a last resort, contact the Federal Student Aid Ombudsman Group. The FSA Ombudsman works with student loan borrowers to informally resolve loan disputes and problems. Use FSA’s checklist to gather information youll need to discuss the dispute with them.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Repayment Plans Are Eligible

As long as the borrower was working for a qualifying employer, federal student loan payments made on any repayment plan will qualify for PSLF. This change is also retroactive to October 1, 2007.

Previously, payments had to be made under the standard 10-year plan or an income-driven repayment plan. Payments made on the extended or graduated repayment plans did not qualify. TEPSLF allows payments made on any repayment plan to count.

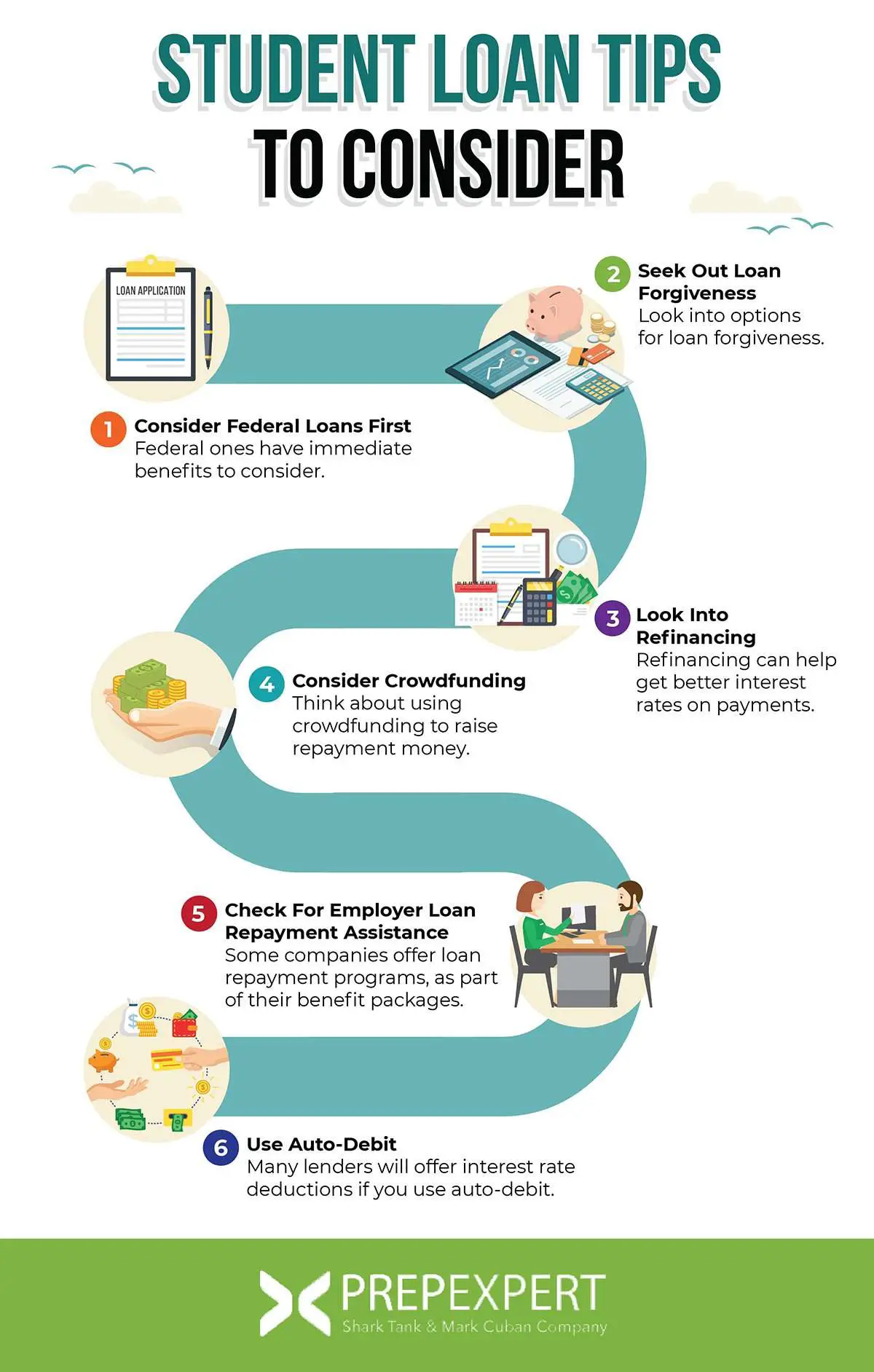

How To Apply For Student Loan Forgiveness

There are many options for student loan forgiveness and discharge, but each has different eligibility restrictions and a different application process. Learn how to apply for student loan forgiveness.

Borrowers want to know how to apply for student loan forgiveness.

getty

Student loan forgiveness and discharge options include:

- Public Service Loan Forgiveness

- Total and Permanent Disability Discharge

- Death Discharge

- Borrower Defense to Repayment Discharge

- False Certification Discharge

- Discharge after 20 or 25 years in an income-driven repayment plan

Some student loan forgiveness is automatic. Other student loan forgiveness requires the borrower to submit an application form. Application forms can be obtained by contacting the loan servicer or by calling the U.S. Department of Educations Federal Student Aid Information Center at 1-800-4-FED-AID .

There is no fee to apply for loan forgiveness. You do not need to pay anyone for help in applying for loan forgiveness.

The American Rescue Plan Act of 2021 made all student loan forgiveness and student loan discharge tax-free through December 31, 2025. This legislation is likely to be extended or made permanent before it sunsets.

You May Like: Refinance My Fha Loan

John R Justice Student Loan Repayment Program

The John R. Justice Student Loan Repayment Program provides loan repayment assistance for state public defenders and state prosecutors who agree to remain employed as public defenders and prosecutors for at least three years.

This program provides repayment benefits up to $10,000 in any calendar year or an aggregate total of $60,000 per attorney.

You can learn more about this program here.

What Is Public Service Loan Forgiveness How Did It Originate

The Public Service Loan Forgiveness is a program that was launched in 2007 in an effort to steer more college graduates into public service. As long as they made 10 years of payments on their federal student loans, the program promised to erase the remainder.

The program, however, has proved anything but forgiving. Before Wednesdays announcement, only 16,000 borrowers had seen their debt forgiven via the program, according to the Education Department. About 1.3 million people are trying to have their debts discharged through the program.

One of the most problematic pieces of Public Service Loan Forgiveness: Many borrowers had the wrong type of loan and didn’t realize they weren’t eligible for relief.

When the loan forgiveness program was first introduced, many of the loans offered from the federal government were Family Federal Education Loans , or loans made through private entities but insured by the federal government.

The government stopped offering those loans in 2010 and now relies on direct loans the kind eligible for forgiveness. The Education Department said about 60% of borrowers with an approved employer hold FFEL loans.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Happens If Your Application Is Denied

Many options for both traditional loan forgiveness as well as assistance based on income or occupation or other factors exist. They all come with specific qualifications for applying. If a particular program denies you, its critical to explore all other options both federal and by state that make sense for your circumstances.

National Guard Student Loan Repayment Program

Qualifications

To qualify for the National Guard Student Loan Repayment Program, you must score 50 or higher on the Armed Services Vocational Aptitude Battery, enroll with eligible jobs through the Guard, and enlist for at least six years of service. The maximum amount you could receive in federal principal student loan repayments is $50,000, and you could earn up to $7,500 annually.

Loans Eligible

Only Federal student loans are eligible. Federal Parent Loans for Undergraduate Students that are in the name of anyone other than the Soldier applying are not eligible for repayment.

How it Works

Non-prior service soldiers are eligible for SLRP if enlisting for a critical skills vacancy in the grade of E-4 or below.

Also Check: Can You Refinance An Fha Loan

Extend Student Loan Relief: Us Senators

A group of U.S. senators including Senate Majority Leader Chuck Schumer and Sen. Elizabeth Warren say that Biden must extend student loan relief to avoid financial disaster for more than 40 million student loan borrowers. . The senators say that restarting student loan payments will cause significant financial stress in the wake of the ongoing Covid-19 pandemic. Specifically, they cite a Roosevelt Institute study that shows that failure to postpone student loan payments beyond January 31, 2022 will cost student loan borrowers $85 billion. They argue that 9 million student loan borrowers in default could be subject to wage garnishment and other debt collection methods if student loan payments resume. In addition to seriously damaging the economy, the senators note that Black and Latinx households would face a disproportionate burden from resuming student loan payments. .

Explore All Your Options For Paying Off Student Loans

Depending on where you live and work, you could qualify for partial or total forgiveness of your student loans. If you arent eligible, look into other options for dealing with your student loans, and check for any new developments or programs.

Even if you started out on a certain plan, you dont have to stick with it forever. Instead, feel free to adjust your plan as your circumstances and goals change over the years.

By exploring all your options, you can find the best student loan solution for you, and move towards a debt-free life.

Also Check: Does Va Loan Work For Manufactured Homes