How To Register Forpag

There are two types of PAG-IBIG members: mandatory members and voluntary members.

Mandatory members refer to those individuals whose membership were made mandatory by the enactment of Republic Act No. 9679 in 2009. Voluntary members, on the other hand, are those individuals whose membership were not mandated by the said law but are still interested in availing of the benefits attached to such membership.

The law provides for certain qualifications for each type of member. However, these qualifications may be said to be strictly applied to mandatory members, considering that their mere inclusion in the enumerated list under the law qualifies and necessarily includes them within the coverage of the HDMF, thereby attaching unto them the appropriate monthly contributions, as well as the benefits.

If you are curious as to how you can be a contributing member of Pag-IBIG Fund, there are 2 ways on how you can do it. One is through their online portal and the other one is through their main and satellite branches.

Benefits Of Being A Pag

You may withdraw your savings in the following cases:

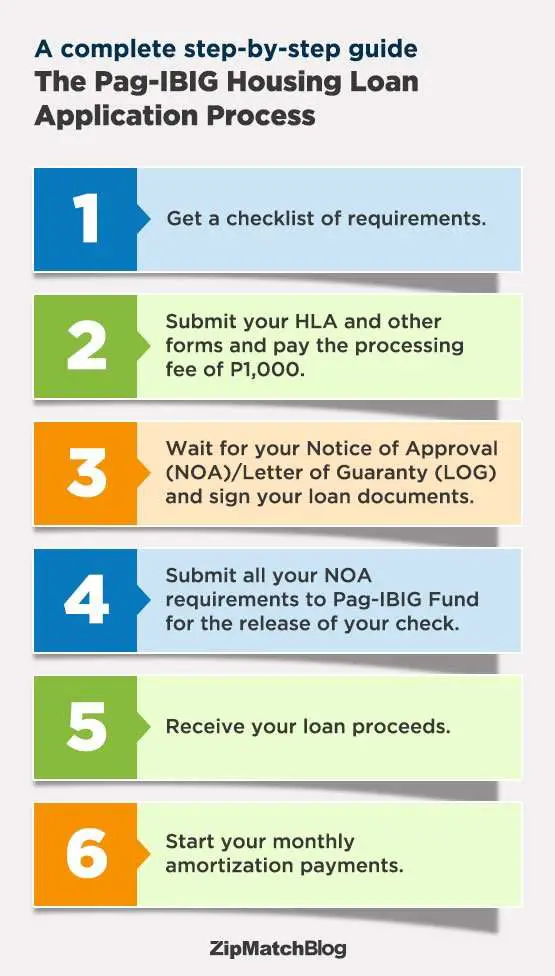

Wait For The Approval Of Your Pag Ibig Housing Loan

Pag IBIG will notify you regarding the status of your housing loan application within 17 days.

In case you get denied, youâll receive a Notice of Disapproval along with your loan documents.

If your application is approved, expect a call from Pag IBIG informing you when you can pick up the Notice of Approval and Letter of Guaranty .

Letâs summarize the procedures youâll go through after getting approved:

a. Receive the Notice of Approval and Letter of Guaranty .

Take note that LOG is not applicable to housing loans intended for house construction or home improvement.

Only the borrower can receive the NOA. For OFWs who canât make it home to personally receive the NOA, Pag IBIG can release it to the authorized representative/Attorney-in-Fact provided that thereâs a notarized Special Power of Attorney .

b. Sign your loan documents.

After receiving the NOA and LOG from the Pag IBIG, go straight to the Members Services Support Division-Servicing Department/Loans Origination-Housing Business Center/Members Services Branch servicing counter.

There, a Pag IBIG officer will discuss your loan obligations as well as the terms and conditions of the following loan documents:

- Disclosure Statement on Loan Transaction

- Loan and Mortgage Agreement

- Promissory Note

Once youâve fully understood their content, affix your signature to these documents. If youâre borrowing with your spouse or a co-borrower, both of you need to sign the documents.

For Refinancing.

Read Also: Can I Refinance My Sofi Personal Loan

Employed Or Mandatory Members

Mandatory members are employees who must be working in a private company and covered with by the Social Security System . Private employees must not be older than 60 years old or those individuals who possess the qualifications stated below.

In most cases, you dont even have to bother about it since your employer will file your membership to the Pag-IBIG Fund and remit your contributions on your behalf but if your company, you can always take control and take the necessary steps yourself. This is especially true if you are considering getting a housing loan anytime soon.

Qualifications:

Employees who are ought to be covered by SSS, including but not limited to:

- Private employees not over 60 years old

- Household helpers whose monthly earnings are at least Php 1,000

- Filipino seafarers, upon entering into a contract of employment with the manning agency and the foreign shipowner as employer

- Self-employed individuals not over 60 years old, with monthly earnings of at least Php 1,000 and

- Expatriates who are not over 60 years old and are compulsory members of the SSS.

- Employees who are mandatory members of the GSIS, including members of the Judiciary and the Constitutional Commissions .

- Uniformed members of the AFP, BFP, BJMP, and PNP.

- Filipinos employed by foreign-based employers, whether deployed in the Philippines or abroad.

Applying for Pag-IBIGif you are currently employed

Step 2. Proceed to the Marketing and Enforcement Division of the concerned branch.

How You Can Fill Out The Pagibig Loan Form On The Web:

By using SignNow’s complete service, you’re able to perform any important edits to PAG ibig loan form, generate your personalized digital signature within a couple of quick actions, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

You May Like: How To Get Loan Without Proof Of Income

How To Apply For A Pag Ibig Housing Loan

29 January 2021

One of the first considerations, and the biggest problem in achieving the dream of owning a home, is budget. No matter how prepared they are to live independently or how much they wanted to have their own home, many Filipinos still struggle to find financial assistance or allocate their home investment funds.

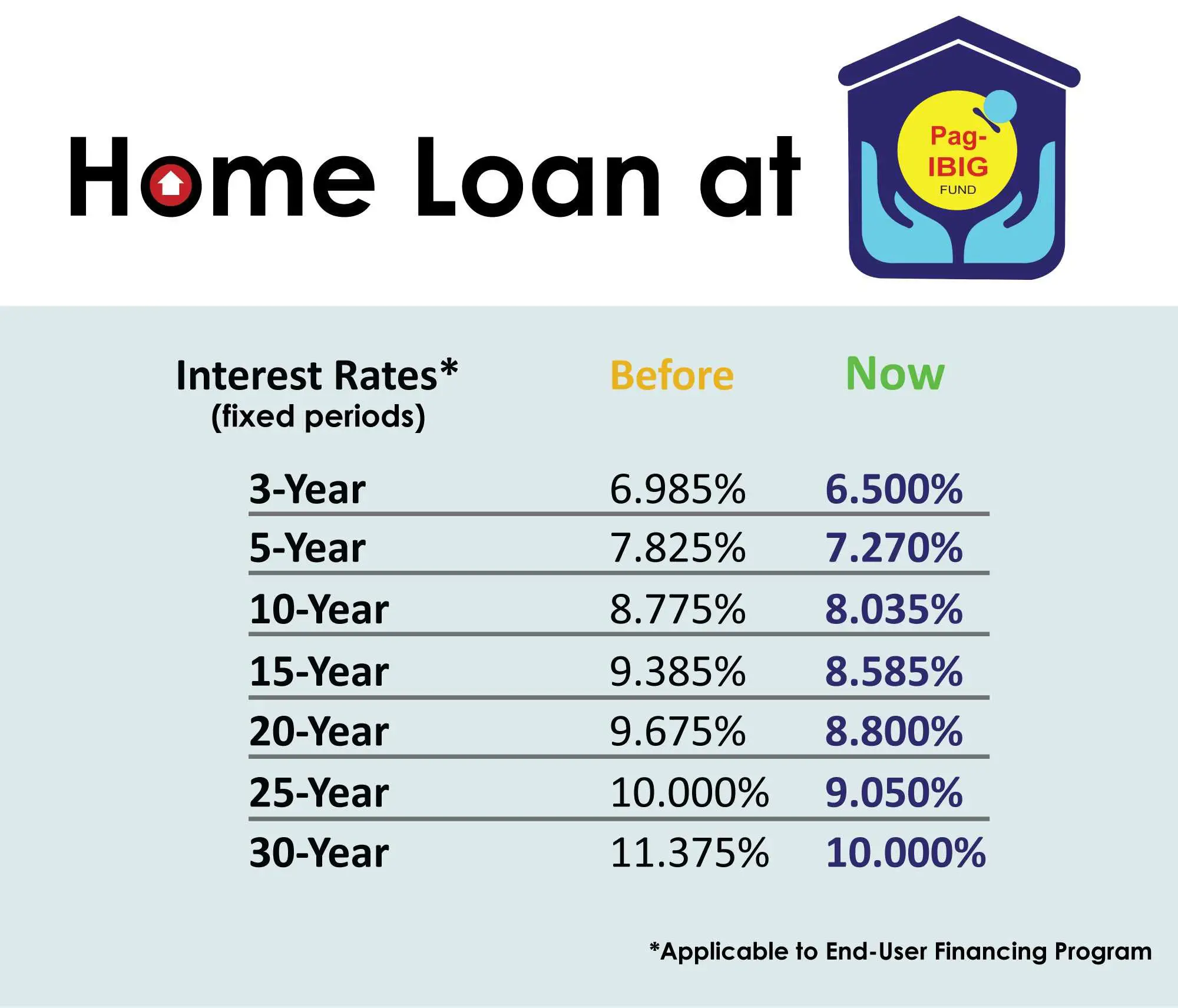

It is like a perfect solution that pag ibig fund or the Housing Loan Development Mutual Fund offers a housing loan program that allows members who already have at least 24 monthly savings and with age not more than 65 years old to borrow up to six million pesos. The qualified Pag-IBIG members can use this borrowed amount to purchase either a residential unit of house and lot townhouse or condominium unit. Another great thing about pag-ibig fund housing loan is that their interest rates remain at the lowest levels, including their affordable housing loan for minimum wage-earners, which still stays 3% per annum. This lowest interest rates offer started on May 01, 2017, and continues to ensure that our low-income earners can also afford to purchase their real estate investment.

In addition to their thirty years loan maximum payment period, pag ibig housing loan also carries insurances, whichever is applicable, by a Mortgage Redemption Insurance , Sales Redemption , and even a Fire and Allied Perils Insurance . It’s very easy toto do the pag ibig fund housing loan program application. All you need to do is to follow these six steps:

Guide On How To Apply For Pag

APPLY PAG-IBIG LOAN ONLINE Here is a guide on the online application for a loan to Pag-IBIG Fund.

Are you a member of a government agency? There are options that you can turn to in case you are a member of a public agency. One of these agencies is the Pag-IBIG Fund.

A huge part of the populace is a member of Pag-IBIG Fund. This state-run institution is mainly known for its housing loan offers. It aims to help its members attain affordable housing options.

Now, housing loans are not the only offers of Pag-IBIG Fund. It also has a multi-purpose loan offer that can aid you in funding projects, in paying urgent bills, in paying for education, etc.

Aside from the housing and the multii-purpose loan offers, the state-run institution also offers a calamity loan. Members who are living in communities declared under a state of calamity may apply for it.

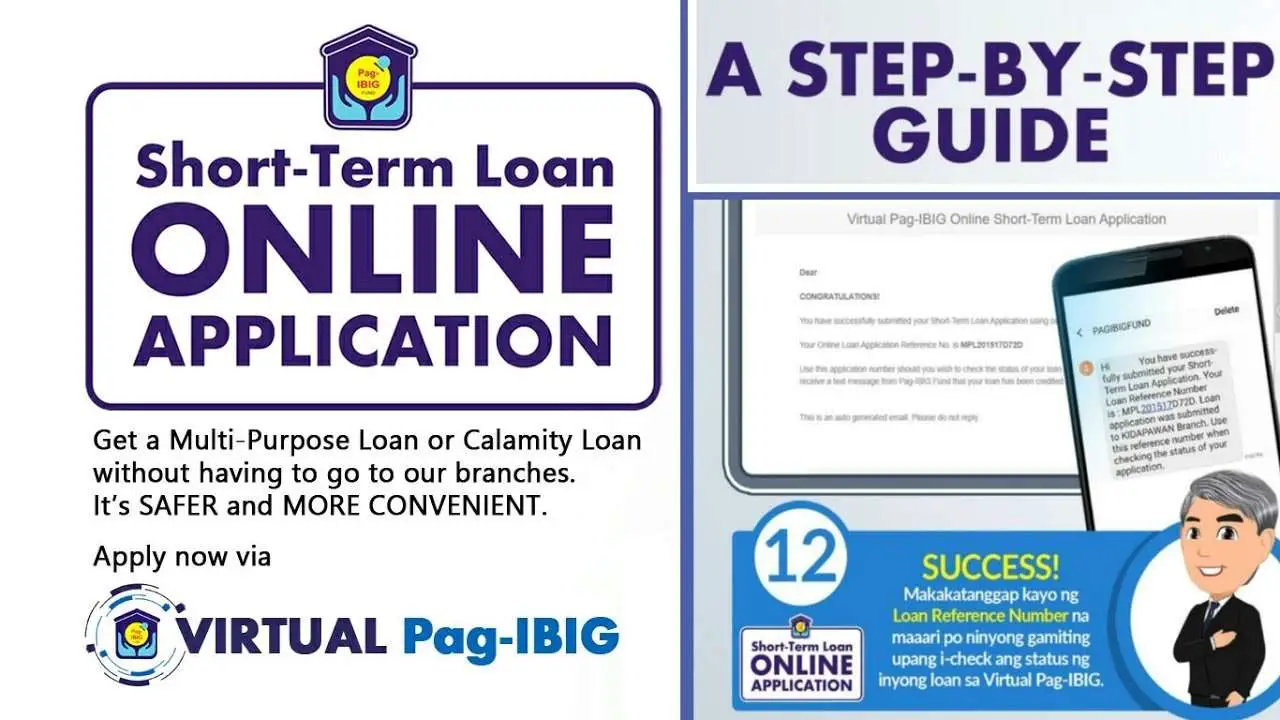

Currently, the Philippines is dealing with the impacts of the COVID-19 pandemic. Many institutions offer online loan applications for the safety and convenience of the members and clients.

Among those that you can apply online are the Pag-IBIG loan offers. The state-run institutions got an online application for short-term loans like the multi-purpose loan and the calamity loan.

If you want to apply online, there are documents that you must prepare. The following are what you will need:

- Application Form

- scanned copy of one valid ID

- cash card

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Is The Pag

Established in 1978, the Home Development Mutual Fund or the Pag-IBIG Housing Fund, is a government-owned agency under the Human Settlements and Urban Development department. It manages the national savings program and offers affordable house financing for Filipinos. You can get a housing loan from Pag-IBIG as an alternative to mortgages offered by banks.

Below are the two housing loan programs offered by Pag-IBIG:

Am I Eligible And What Should I Prepare

Pag-IBIG has its standards in choosing who can be granted a loan. The eligibility is listed below.

- an active member with at least 24 months savings

- not more than 65 years old at the date of the loan application and is not more than 70 years old at the date of loan maturity

- legally capable to acquire and encumber real property

- no Pag-IBIG housing loan foreclosed, canceled, bought back, or voluntarily surrendered

- If with existing Pag-IBIG Housing account or Short Term Loan , payments must be updated

There are also documentary requirements for you to avail of funding. They vary depending on the purpose of the loan . Here are whats generally required.

| FROM BORROWER | |

|

1. Housing Loan Application with recent ID photo of borrower/co-borrower 2. Proof of Income ) 3. One valid ID of Principal Borrower and Spouse, Co-Borrower and Spouse, Seller and Spouse, and Developers Authorized Representative and Attorney-In-Fact, |

1. Transfer Certificate of Title . For Condominium Unit, present TCT of the land and Condominium Certificate of Title . 2. Updated Tax Declaration and Updated Real Estate Tax Receipt 3. Vicinity Map/Sketch Map leading to the Property subject of the loan |

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Where Can I Use The Pag

Apart from buying your dream house, you can get a Pag-IBIG housing loan for the following purposes:

- Purchase a residential house and lot, condo unit, or townhouse

- Buy a fully developed residential lot or adjoining lots of not more than 1,000 square meters

- Home improvement or alteration of an existing unit which will improve the houses durability and value

- Construction or completion of a residential unit

- Refinance an existing mortgage with an institution acceptable to the Pag-IBIG Fund

- And to combine loan purposes, limited to: Purchasing a fully developed lot of up to 1,000 square meters and building of a residential unit thereon Purchasing an old or new residential unit with home improvement Refinancing an existing home loan with home improvement Refinancing an existing mortgage, particularly a lot loan, with the construction of a residential unit thereon

Pag-IBIG has two types of housing programs you can avail. Check the video below from Pag-IBIG for more details.

How To Download The Pag Ibig Loan Form

- Open the template in the editor by clicking Get Form or the template preview.

- Begin filling in the essential information in the available fields.

- Select responses in the list boxes using the cross or checkmarks in the upper toolbar.

- Use the Circle symbol for more Yes/No questions.

- Repeatedly check the document for accuracy.

- The icon represents the current date.

- Sign the document electronically for legal effect. Place your signature anywhere you need it by selecting Sign -> Add New Signature and typing, drawing, or uploading an image of it.

- Use the Done button to submit the form after filling it out.

- You can download, save to the cloud, print, or share it right from the editor itself.

FAQs

Recommended Reading: Mortgage Loan Officer Salary Plus Commission

Where To Pay Pag Ibig Housing Loan

Here are the payment options available for you:

- Verified collection partners.

- Payments via an accredited developer with a collection service agreement from the Pag IBIG agency.

Ensure Your Income Document Reflects All Your Earnings

Your Certificate of Employment and Compensation can make or break your Pag-IBIG housing loan application. This income document, which shows your gross monthly income and other monetary benefits, proves your capacity to repay your loan.

Your CEC must contain accurate and updated information. For instance, if youve recently got a raise, it should indicate your latest monthly salary. If youre receiving de minimis benefits or non-taxable allowances, request your HR manager to include such details as well.

Recommended Reading: Refinancing Auto Loan With Same Lender

Why Choose The Pag

Read Also: Pag-IBIG Fund Contributions Withdrawals and Claims

How To Apply For Pag

The Home Development Mutual Fund , popularly known as Pag-IBIG Fund offers Short-Term Loan such as Calamity Loan and the Multi-Purpose Loan .

The Pag-IBIG Multi-Purpose Loan provide short-term financial assistance to qualified Pag-IBIG Members for any of the following purposes:

- Minor home improvement/home renovation/upgrades

- Livelihood/additional capital for small business

- Tuition/educational expenses

- Purchase of appliance, furniture or electric gadgets

- Payment of utility/credit cards bills

- Vacation/ travel

Below are Guidelines and Instructions to apply for Pag-IBIG Multi-Purpose Loan

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Can I Reprint My Pag

How to Get Pag-IBIG MDF for Existing Members. If you already have a Pag-IBIG MID number or RTN, you may request a printed copy of your MDF at the nearest Pag-IBIG Member Services Office. Thats the only way to retrieve your Pag-IBIG MDF and MID number. Just present your valid ID and RTN if you have it.

What Does Loan Maturity Date Mean

Loan maturity date is when you are already at the end of your payment agreement. If you signed up to get a loan, it is crucial that you have a clear understanding of what is going to happen when your loan reaches maturity.

Can a member with an outstanding PAG-IBIG housing loan apply for additional loans?

Yes. A member with an updated monthly contribution as well as monthly loan amortization on the date of the application can apply for additional loans.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Requirements Upon Approval Of Loan

- TCT/CCT under the name of the borrower/co-borrower with appropriate mortgage annotation that is in favor of PAG-IBIG

- Recent Tax Declaration and Real Estate Tax Receipt

- If on loan mortgage agreement that had been registered with the RD and should have RDs original stamp

- Completely filled-out and notarized Promissory Note

- Disclosure Statement on Loan Transaction

Kung Ikaw Ay Kasalukuyang May Housing Account Kailangan Ito Ay Updated Sa Araw Ng Pag Apply Ng Loan

Paano malalaman ang number mo sa pag ibig. What is my Pag-IBIG ID Number. Enter your complete name date of birth and the code on the box then click Proceed. Ikaw ay dederetso sa page na kung saan kailangang punan ang mga hinihinging karagdangang mga impormasyon.

Ang Biblia ay nagsasabi na kapag ang dalawang tao ay nagpakasal sila ay magiging isa ng laman Genesis 224. Maganda at mabilis ang serbisyo ng Pag-IBIG hotline. Kung ikaw ay pasok sa requirements pwede ka nang mag-apply para sa Pag-IBIG Housing Loan.

You need this in two copies. Walang Pag-IBIG Fund short term loan at arrears sa araw ng pag apply ng loan. That is how to get Pag-ibig number.

Most likely yong Pag-ibig branch na malapit sa company mo na yon ay andon ang bulk ng records mo at doon ka puedeng mag-follow-up. Kelan ko kaya madarama ang tamis ng iyong halik Kung lagi mong inaatrasan ang sugod ng nagmamahal Sana namay pagbigyan mo hiling ng puso ko chorus Subukan mong magmahal o giliw ko Kakaibang ligaya ang matatamo Ang magmahal ng ibay di ko gagawin Pagkat ikaw lang tanging sasambahin Wag ka ng mangangamba Pag-ibig koy ikaw wala ng iba. Paano Ma-Retrieve ang Pag-IBIG MID Number Para sa mga walang RTN Registration Account Number.

Knowing your Pag-IBIG ID Number is one of the most important things you can do. Isang bagay na dapat ding isaalang-alang ay kung ang iyong napupusuan ay magiging mahusay na kapareha sa buhay. If you live in Tacloban mas okay siguro na tawagan mo na lang ang Pag-ibig from there.

Read Also: What Is The Maximum Fha Loan Amount In Texas

What Is A Salary Loan

Salary Loan has been defined as a small amount of money which, when calculated, may be equivalent to the monthly salary that you are earning in your present work. You can borrow this amount for certain purposes like medical assistance, car repair, improvement of your house, some education expenses or emergency purposes. Many people are using this kind of loan offer or program because it affords lower interest compared to that of any other loan programs or schemes. Furthermore, the repayment methods or the ability to reloan are easier compared to those of other schemes.

How To Repay Pag

The loan is payable within three years or 36 months and comes with a deferred first payment. Members may also opt to pay their loans in two years or 24 months.

If you are an employed member, you may pay your loan amortizations via a salary deduction arrangement with your employer. Should you wish to accelerate or advance your payments, you may do so via Virtual Pag-IBIG, at any Pag-IBIG Fund branch near you, or through any of our accredited collecting partners outlets or their online payment channels.

If you are a self-employed individual or an Overseas Filipino Worker , you may pay your loan amortizations via Virtual Pag-IBIG, at any Pag-IBIG Fund branch near you, or through any of our accredited collecting partners outlets or their online payment channels.

Don’t Miss: How Much To Loan Officers Make