Calculate Your Monthly Estimated Payment

If you already know your estimated monthly loan payment, you can skip this step. If you dont, you can easily estimate your monthly car payment on a spreadsheet by typing the formula below into a cell.

=PMT

The result is your estimated monthly payment. It will be a negative number, but dont worry. You didnt make a mistake. Keep this number handy for calculating your APR.

Lets say you want to finance $13,000 with a loan term of 60 months and an interest rate of 4%. Heres what your formula would look like with those numbers plugged in.

=PMT

Using this example, your spreadsheet would calculate your monthly payment to be $239.41.

Understanding Auto Loan Calculations

Now that youre aware of why you should care about how auto loans are calculated don’t stop there! Before you get your next auto loan or refinance your current vehicle, you want to be fully knowledgeable about the ins and outs of auto loan financing so you can get the best deal and make the right choices.

Here are additional resources you can refer to that provide helpful information about auto loans:

Get up-to-date information and be the first to know of special offers and promotions.

Calculating Apr For A Car

Youll need to know the amount youre financing, any additional fees you must pay, your interest rate and the loan term before you start.

First, calculate the total interest youll pay over the life of the loan based on your interest rate, and then add to this any additional fees associated with the loan. Now divide this number by your loan amount. Divide this number by the number of days in your loan term and multiply the result by 365 to find your annual rate. Finally, multiply by 100 to get the annual rate as a percentage.

Also Check: Does Va Loan Work For Manufactured Homes

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

How To Calculate Auto Loan Interest For First Payment

When figuring out how to calculate auto loan interest for the initial payment, the steps below can help:

The number you get is the amount of interest you pay in month one.

Don’t Miss: How To Transfer Car Loan To Another Person

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Don’t Miss: What Should You Do If Lender Rejects Your Loan Application

Using Microsoft Excel To Estimate Your Car Payments Credit

Aug 9, 2021 Car loans are never going to cost you only the list price of the vehicle youre The steps for calculating your monthly payment in Excel:.

How to Calculate Car Loan Payments · PMT = loan payment · PV = present value · i = period interest rate expressed as a decimal · n = number of

How to calculate interest on a car loan · Calculate the monthly payment using the monthly payment formula. · Multiply the monthly payment by the number of months

A Little Bit Of Practice

Now you have an idea of how loans work. You feel confident enough to plug some numbers and see if you get the returns you are expecting. The examples below, show how the real cost of a car is determined by the car loan you choose. In every case, the car, the down payment and the amount to be financed are the same: The price is that average $33,652. The down payment is 10%. The amount financed will be $30,287.

A 4% loan for a 5-year period would cost $557.78 a month. At the end of that time, you would have paid $33,466.80 in monthly payments. Add in the $3,365.20 down payment and the real cost of the car will be $36,832. If you stretched that loan to eight years, the monthly payment would drop to $369.18. At the end of that time, your loan payments would total $35,441.28. Including the $3,365.20 down payment, the real cost of the car rises to $38,806.48. Try it. Use the calculator to toy with the numbers and see how important all the input variables really are.

Some people already have an existing car loan. If you are ready to get started, use our car loan calculator, fill our online application form and you will receive the best option for you.

You May Like: Does Va Loan Work For Manufactured Homes

What Is The Difference Between Apr And Interest Rate

The difference between APR vs. interest rate is that APR includes interest plus other loan or credit card fees. As noted above, theres more to a loan than the interest rate. The APR factors in those costs to show you what borrowing will cost you over a year. Thats why youll notice that the APR is usually higher than the interest rate percentage.

Help To Protect Yourself During The What

Youre responsible for paying everything thats included in the APR, even if your vehicle is totaled in an accident or stolen auto insurance may not always cover the full amount you owe. GAP insurance may provide you with financial protection if your car is ever totaled or stolen and the insurance settlement amount does not cover the unpaid principal balance due on your loan. That could mean you wont have to roll the unpaid principal balance of the existing loan into the cost of financing a new vehicle. Shop for your loan before you shop for your vehicle to determine available interest rates, APRs and payback periods.

The information in this article was obtained from various sources not associated with State Farm® . While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Example: How To Calculate Apr For A Car Loan

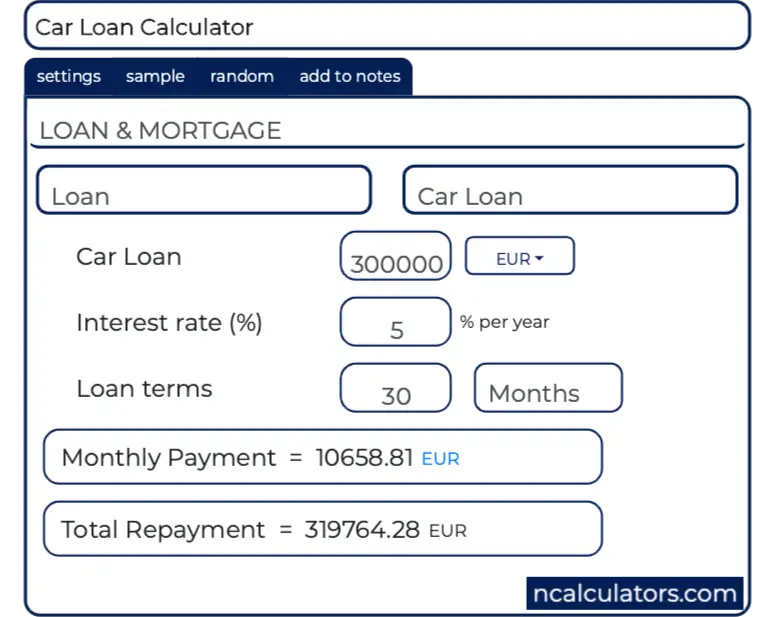

Suppose you want to purchase a car for $15,000. Using a car loan service, you find a lender that agrees to give you a 60 month car loan for this amount at a 6% interest rate . Your loan will come with $200 in prepaid finance charges, meaning your principal will be $15,200 . What would your APR be?

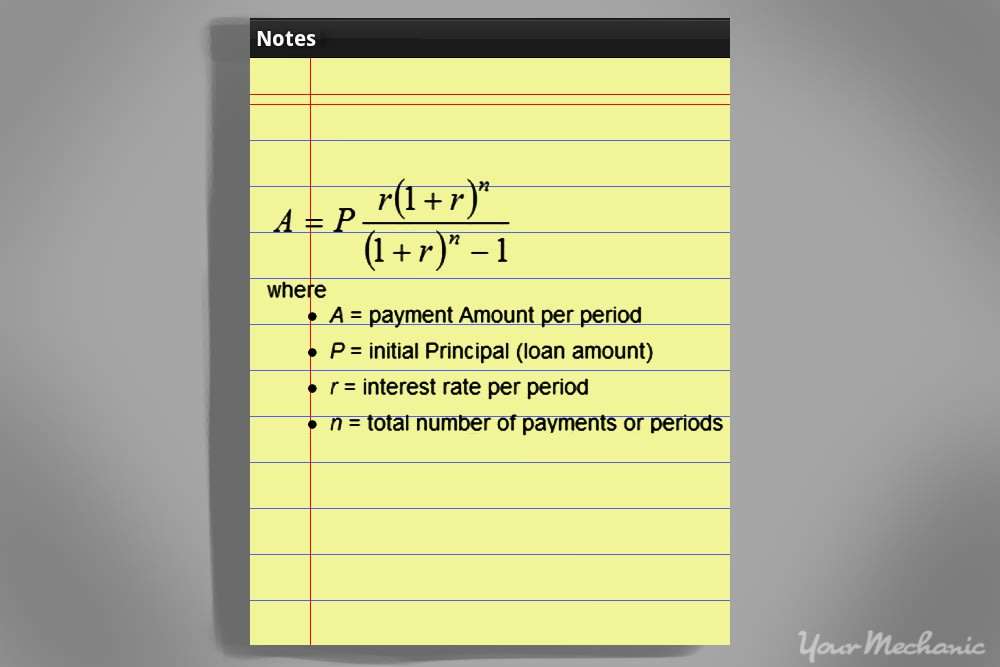

To figure out your APR, first track down your monthly payment. If you are curious how car payments are calculated, here is the formula:

Basically, all you need to know to calculate your car loan payment is the length of your loan in months, your principal, and your note rate . If you plug in the numbers , you will find that your monthly payment for this loan is about $293.86.

To find your APR, you theoretically could use the same equation. Your payment under your note rate and APR should be the same. All that changes when calculating APR in this equation is that you would use the amount financed in place of your principal. Ultimately, you would plug in your monthly payment and amount financed and solve for the interest rate part of the equation which is not easy to do mathematically since the interest rate appears twice in the equation.

Still, the APR you would get if you did this would be about 6.55%. The graphic below illustrates how the note rate and APR will give you the same monthly payment and finance charge for your loan.

What’s The Difference Between Apr And Interest Rate

The difference between a loan’s can depend on the type of financial product.

For installment loans, such as personal, auto, student and mortgage loans, the APR and interest rate may be the same if there are no finance charges. However, if there is a finance charge, such as an origination fee, the APR will be higher than the interest rate because your cost of borrowing is more than the interest charges alone. The difference between the APR and interest rate can also increase if the loans term is shorter, as youll be repaying the entire finance charge more quickly.

On credit cards, the APR and interest rate are the same because a credit card APR never takes the cards fees into account. As a result, you may want to compare not only cards APRs, but also their annual fees, balance transfer fees, foreign transaction fees and any other fees when deciding on a credit card. Keep in mind that you can generally avoid paying interest on your credit card if you pay off the balance in full every month.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Calculating Your Estimated Apr

For the estimated APR, you will require the following formula entered into a cell in your spreadsheet.

=RATE *12

Note that to calculate the estimated APR, you have to have already calculated the monthly payments and have the complete breakdown of all additional fees. The negative figure from the monthly estimated payments formula should be entered as-is.

How To Use This Calculator

The APR calculator determines a loans APR based on its interest rate, fees and terms. You can use it as you compare offers by entering the following details:

- Loan amount: How much you plan to borrow.

- Finance charges: Required fees from the lender, such as an origination fee or mortgage broker fee. Situational fees, such as a late payment fee, generally arent included in APR calculations.

- Interest rate: The interest rate that the lender charges on the loan.

- Term: The number of years you have to repay the loan.

Often, the Federal Truth in Lending Act requires lenders to tell you the APR, so you wont have to calculate it on your own. In some cases there are even templates that lenders must use, such as the Loan Estimate form for mortgages. When reviewing that form, you can find the interest rate on the first page and the loans APR on page three.

However, if youre comparing loan offers from different lenders, its sometimes helpful to look into the details and do the APR calculations on your own. For example, mortgage lenders might be able to exclude certain fees from their APR calculations, and you want to make sure the APRs youre comparing are based on the same financing charges.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How To Calculate Auto Loan Interest For The Coming Months

To calculate future auto loan interest payments, you will need a different calculation:

- Subtract the interest from your current debt. The amount left is what you owe towards your loan principal.

- Deduct the above amount from your original principal to get your new loan balance.

The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline it may not be the same amount you receive.

Recommended Reading: What Does A Car Thermostat Do

Auto Loan Length Still Matters

Even with an identical APR, youll end up paying more in interest over the course of a longer term loan. For instance, a buyer who takes out a $25,000 loan with a 3 percent APR for 48 months will have a higher monthly payment by more than $100, but will end up paying nearly $400 less in additional interest versus the same loan at 60 months. Use an auto loan calculator to decide which is the better deal.

You May Like: Can I Refinance My Car Loan With The Same Lender

How To Use The Car Loan Calculator

Heres a guide for the information you will need to input into the car loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, plus the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

Determining The Amount To Finance

Read Also: Becu Lienholder Address

Calculating Auto Loan Payments