How To Decide On A Loan Term For Your Car

The term of your auto loan is the length of time youre given to pay back the loan in full. You select the term when you lock in your loan, and the duration you choose will affect your monthly payment amount.

Generally, loans with longer terms have lower monthly payments. As the term of your loan shortens, your monthly payment will go up. Remember, your loan amount remains the same regardless of the term, so even though loans with longer terms have cheaper monthly payments, youll likely pay more interest over time.

Since the term you choose can impact your monthly payment, it’s important to know what you can afford before locking in a term. To do this, add all your monthly financial obligations and subtract this total from your net income. Take a portion of the leftover moneyhow much will depend on your lifestyle and incomeand set it aside for your monthly transportation costs, part of which will be your monthly car loan payment.

Though it may seem attractive to opt for a longer term for your auto loan, remember that the longer your loan term is, the more you will pay in interest over time. That means that even though you may pay more per month for a 48-month loan, that loan will likely cost you less than a 72-month loan by the time youre done paying it off.

Considering Paying Off Your Auto Loan Early

Most auto loan lenders allow borrowers to prepay on the principal balance of their loan without a prepayment penalty. .

If you can manage to either increase your payments, or apply a lump sum toward the principal balance, you can consider doing so by using this calculator by crunching some numbers. Paying off the auto loan early or adding a prepayment amount each month, shortens the period of time that the loan is in place and also decreases the total amount of interest that you will pay on the loan in the long run. While it may be difficult to part with a larger sum up front, or adding an additional amount each month to your payment, paying off your loan early can potentially save you thousands of dollars overall.

- FAQ: An auto loan early payoff calculator like this one can help you figure out how much.

How Much Interest Will I Pay On My Car Loan

Our car finance calculator works out the interest that you might pay as part of your car finance plan. It does this by taking your interest rate and compounding it over the course of the loan period. It is this compounding of interest rate that forms the basis of the effective annual rate we feature in our calculator. You may be interested to note that we have a compound interest calculator for compounding interest on savings.

Read Also: Usaa Auto Loan Bad Credit

What Are Loan Payment Calculations

The type of calculation you use will vary based on the type of loan. Here are three helpful calculations to know about when considering borrowing money:

- Interest-only loans: With interest-only loans, you dont pay down any of the principal in the early yearsonly interest.

- Amortizing loans: On the other hand, amortizing loans involve paying toward both principal and interest over a set period of time, such as with a five-year auto loan.

- When using a credit card, you’re given a line of credit that acts as a reusable loan so long as you pay it off in time. If you’re late on making monthly payments and begin to carry a balance, you’ll likely be charged interest.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

You May Like: Usaa Certified Auto Dealers

The Open Road Starts Here

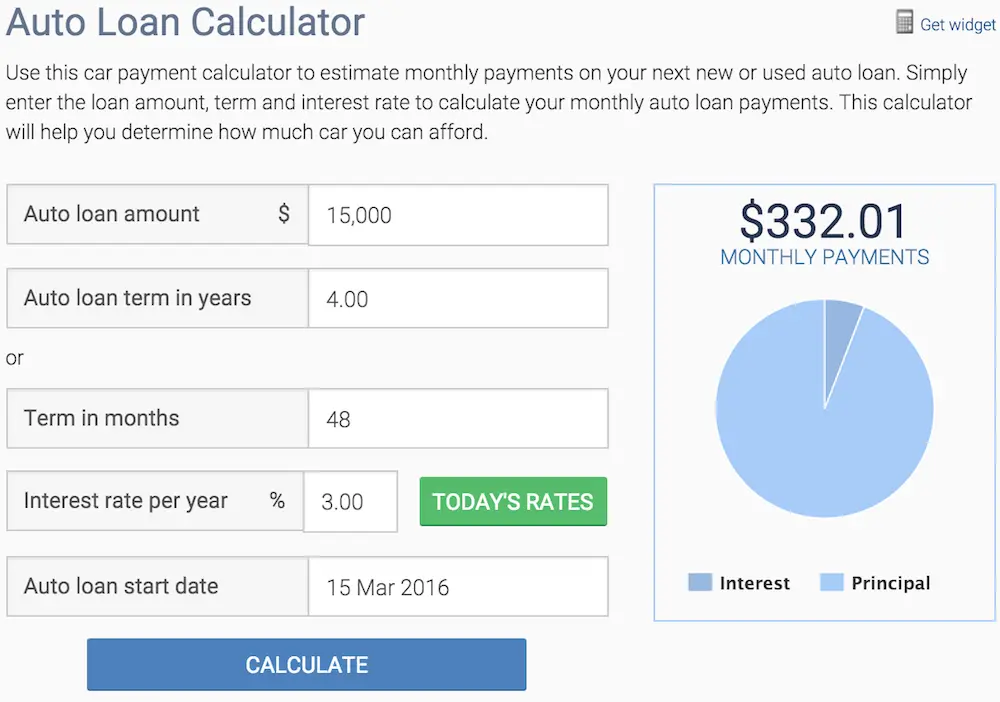

Estimate your monthly payments and how much you may be able to borrow, using the auto loan calculator below.

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affect our editors opinions. Our marketing partners dont review, approve or endorse our editorial content. Its accurate to the best of our knowledge when posted.

How To Get The Best Deals On Your Loan Payments

Your monthly loan payment is just a result of the loan amount, the interest rate, and the length of your loan. Salespeople and lenders can make a low monthly payment seem like youre getting a good dealeven when youre not.

For example, some auto dealers want you to focus solely on your monthly payment, which is why they often ask how much you can afford each month. With that information, they can sell you almost anything and fit it into your monthly budget by extending the life of the loan.

It is better to negotiate a lower purchase price than a lower monthly payment. Lowering the sales price decreases one of the three components of the total loan cost.

Stretching out your loan means youll pay more in interest over the life of the loan, increasing the total cost of the loan. Plus, longer-term loans might be riskier: When they’re used by buyers with lower credit to finance larger amounts, there’s a greater risk of default.

Read Also: Is Bayview Loan Servicing Legitimate

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

Also Check: Does Va Loan Work For Manufactured Homes

How Does The Car Loan Payoff Calculator Work

Our calculator helps you work out the costs associated with purchasing a car on credit. Once you have entered the amount, the interest rate and the period of the loan, the calculator will return the total repayment amount, the total interest and the monthly payment figure, as well as full amortization.

How Do I Find Out My Car Loan Amortization Schedule With Extra Payments

You can get an idea of your amortization schedule when you use our auto loan early payment calculator. You will be shown just how much you’ll be owing at any period in the life of the loan for both regular payments and accelerated payment plans that use extra payment.

Is there a ‘remaining car loan payoff calculator’?

Yes, there is a remaining car loan payoff calculator. This auto loan early payment calculator provides you with accurate information about how much money you still have to pay off on a car loan. You will, however, need to supply details on the loan amount, period, and extra payment.

How to pay off car loan calculator faster?

An auto loan early payment calculator helps you save money by making extra monthly payments. It works when you supply details of the loan term, loan amount, additional monthly payment intended, current payment, and interest rates. You then get a report on how much you save in terms of money and time on the loan.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Use The Edmunds Auto Loan Calculator To Determine Or Verify Your Payment

You’re gearing up to buy your next car but aren’t sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but the good news is that the Edmunds auto loan calculator will do the heavy lifting for you.

Let’s say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle’s price into the auto loan calculator. It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the compound interest, estimate tax and title fees, and display the monthly payment.

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some time to experiment with different values to find an auto loan setup that works best for your budget.

How Do I Calculate Car Loan Payments

Iâm going to finance a new Tesla. How do I calculate car loan payments on the vehicle so I can create a budget?

Answer

online car loan calculator

- Any bank or credit union website

- NerdWallet

- Bankrate

- Investopedia

- Interest rate

- Length of the car loan in months

- Total principal borrowed, including taxes, fees, and the price of the car after your down payment

calculate your monthly payment by hand

- Calculate the interest paid over the life of the loan by visiting Jerryâs guide to calculating your car loan payment.

- Add the principal to the total interest paid.

- Divide by the total number of months in your loan.

$625.81amortization schedulehow much of each monthly payment goes to your principal and toward interest

Did this answer help you?

Don’t Miss: Va Loan For Modular Home

How Is Interest Calculated On A Car Loan

An auto loan calculator shows the total amount of interest you’ll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you’ll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

The interest you pay each month is based on the loan’s then-current balance. So, in the early days of the loan, when the balance is higher, you pay more interest. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly car loan interest by hand:

How To Use Credit Karmas Auto Loan Calculator

A car could be one of the biggest purchases youll ever make. Thats why its important to understand how various factors can affect how much you pay to finance a car.

Whether youre just starting to shop for a car or are ready to finance a particular make and model, getting a sense of your monthly loan payment can help with your decision.

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. Itll also help you figure out how much youll pay in interest and provide an amortization schedule .

Keep in mind that this calculator provides an estimate only, based on the information you provide. It doesnt consider other factors like sales tax and car title and vehicle registration fees that could add to your loan amount and increase your monthly payment.

Here are some details on the information you might need to estimate your monthly loan payment.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Why Take Out A Car Loan

When it comes to financing a new car, there are a number of options available to you: outright purchase, personal loan, leasing, hire purchase or dealer financing. It’s advisable to read up on the pros and cons of each of these before deciding upon the best one for you. Should you be considering taking out a different type of loan, give our standard loan calculator a try.

What Is My Loan Payment Formula

Now that you have identified the type of loan you have, the second step is plugging numbers into a loan payment formula based on your loan type.

If you have an amortized loan, calculating your loan payment can get a little hairy and potentially bring back not-so-fond memories of high school math, but stick with us and we’ll help you with the numbers.

Here’s an example: let’s say you get an auto loan for $10,000 at a 7.5% annual interest rate for 5 years after making a $1,000 down payment. To solve the equation, you’ll need to find the numbers for these values:

-

A = Payment amount per period

-

P = Initial principal or loan amount

-

r = Interest rate per period

-

n = Total number of payments or periods

The formula for calculating your monthly payment is:

A = P ^n) / ^n -1 )

When you plug in your numbers, it would shake out as this:

-

P = $10,000

-

r = 7.5% per year / 12 months = 0.625% per period

-

n = 5 years x 12 months = 60 total periods

So, when we follow through on the arithmetic you find your monthly payment:

10,000 / – 1)

10,000 /

10,000

10,000 = $200.38

In this case, your monthly payment for your cars loan term would be $200.38.

If you have an interest-only loan, calculating the monthly payment is exponentially easier . Here is the formula the lender uses to calculate your monthly payment:

loan payment = loan balance x

In this case, your monthly interest-only payment for the loan above would be $62.50.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

How Much Will The Total Loan Cost

It can be difficult to understand exactly how much you’ll pay when you have several competing loan offers. One might have a lower interest rate, while another offers lower fees. Figuring out which offer to choose means you’ll need to calculate the total cost of the loan including interest and fees. Calculators help with apples-to-apples comparisons. For example, some amortization calculators show you lifetime interest which you can use to compare interest costs from loan to loan.

Consider more than just your monthly payment amount when reviewing the terms of a loan.

In addition to your monthly payment, its crucial to focus on the purchase price, lifetime interest, and any fees.

APR is another useful tool for comparing loan costs. On mortgages, some APRs account for upfront costs in addition to the interest rate you pay on your loan balance. But the lowest APR isnt always the best loan. You might not even qualify for the lowest advertised APR. If the APR is low but closing costs and fees are high, and you don’t keep your loan for very long, you won’t see the benefits of that low APR.

With mortgages, you’ll also want to take into account other costs, such as property taxes, homeowners insurance and homeowners association fees. A good mortgage calculator can help you account for all of those costs to get the true cost of the house.

How To Calculate Auto Loan Payments

This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.There are 11 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 416,343 times.

Buying a new or used car, for most people, is not a purchase made by writing a check or handing over cash for the full amount. At least part of the amount is typically financed. If you do finance a car, it’s important that you understand exactly how much you’ll be paying every month, otherwise you could end up going over budget.

You May Like: Usaa Refinance Auto Loan Rates

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.