Is Rent Included In The Debt

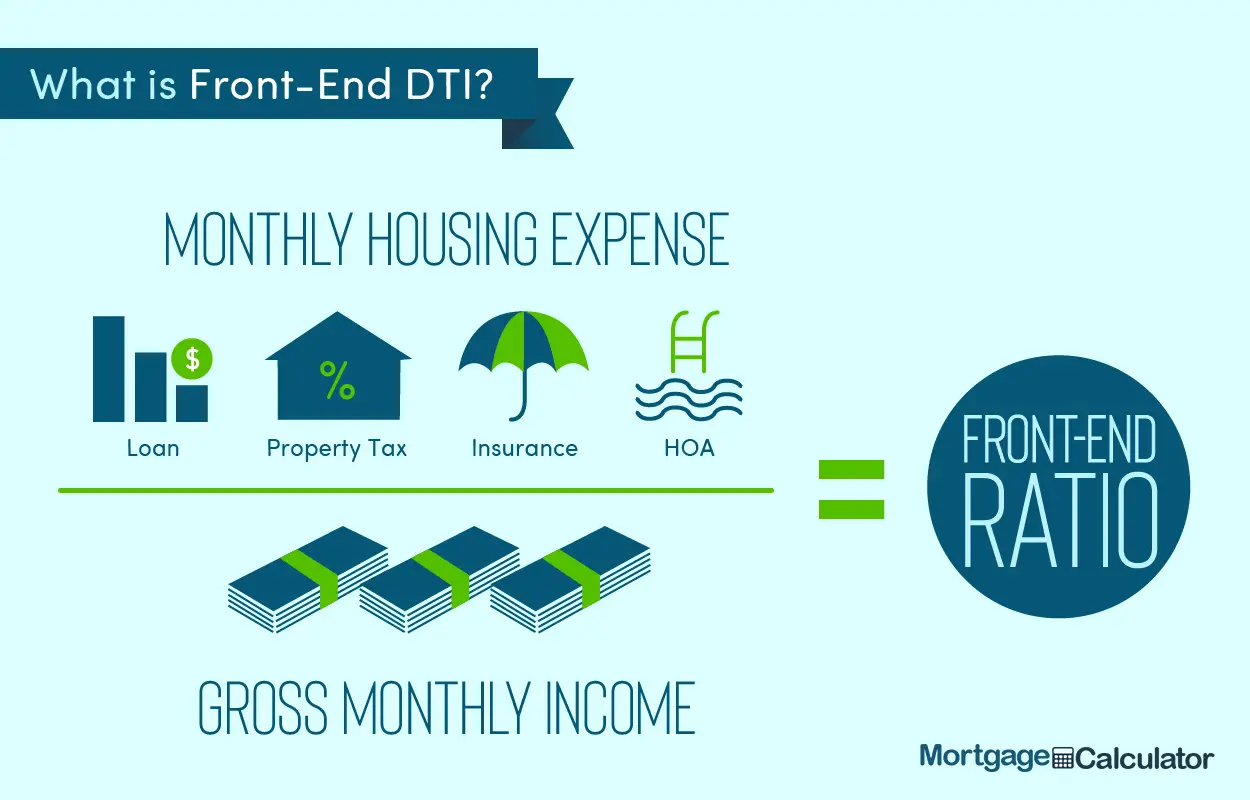

Rent is not included in debt-to-income calculations for purposes of a mortgage loan. Lenders expect you to move out of the house you are renting, so they use the anticipated mortgage payment, property taxes, and homeowners insurance, as well as mortgage insurance and homeowners association dues, to determine your DTI ratio. They will usually verify that you consistently paid rent on time, though.

Why Your Mortgage Dti Ratio Matters

Your debt-to-income ratio helps to determine whether you can afford to repay a mortgage. A low DTI ratio demonstrates your ability to manage your existing debt and a new home loan. But a higher DTI ratio can make it harder to qualify for a mortgage because it shows your budget is stretched too thin. In other words, you dont have enough income to cover more debt.

Mortgage lenders establish maximum DTI ratios as part of their loan approval process. The often-cited rule of thumb is to keep your back-end ratio at or below 43%, according to the Consumer Financial Protection Bureau.

Here are the maximum back-end DTI ratios by loan type:

- Federal Housing Administration : 43%

- U.S Department of Agriculture : 41%

- U.S. Department of Veterans Affairs : 41%

Some lenders may allow a slightly higher DTI ratio up to 50% in many cases if you have compensating factors, such as a higher credit score or larger down payment.

The Debt Ratio Isnt The Only Issue

Dont focus solely on your debt ratio, though. Yes, its a big deal, but not the only one. The lender looks at the big picture. Think of your credit score and your employment history. You could have the best debt ratio but the worst credit score. You wouldnt qualify in this case. You could also have the best debt ratio but not have consistent employment. Each of these factors plays a role in your ability to secure a loan.

Lenders want to know that you can afford the loan, but also that you have good habits. A low credit score shows that you dont pay your bills on time. It could also mean you overextend yourself. There are many variables that play into your credit score. The key is not focusing on one factor, but looking at the big picture.

Knowing how lenders calculate the debt to income ratio can help you get a head start. If you know your debt ratio is high, you can work it down. Start paying debts off or figure out how to increase your income. Maybe you need a 2nd job for a while. Youll need it for at least 6 months before a lender can use the income. But it might be just enough to help push you into the approval zone.

You May Like: Usaa Car Loans Review

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

- Categories

Also Check: What Credit Score Is Needed For Usaa Auto Loan

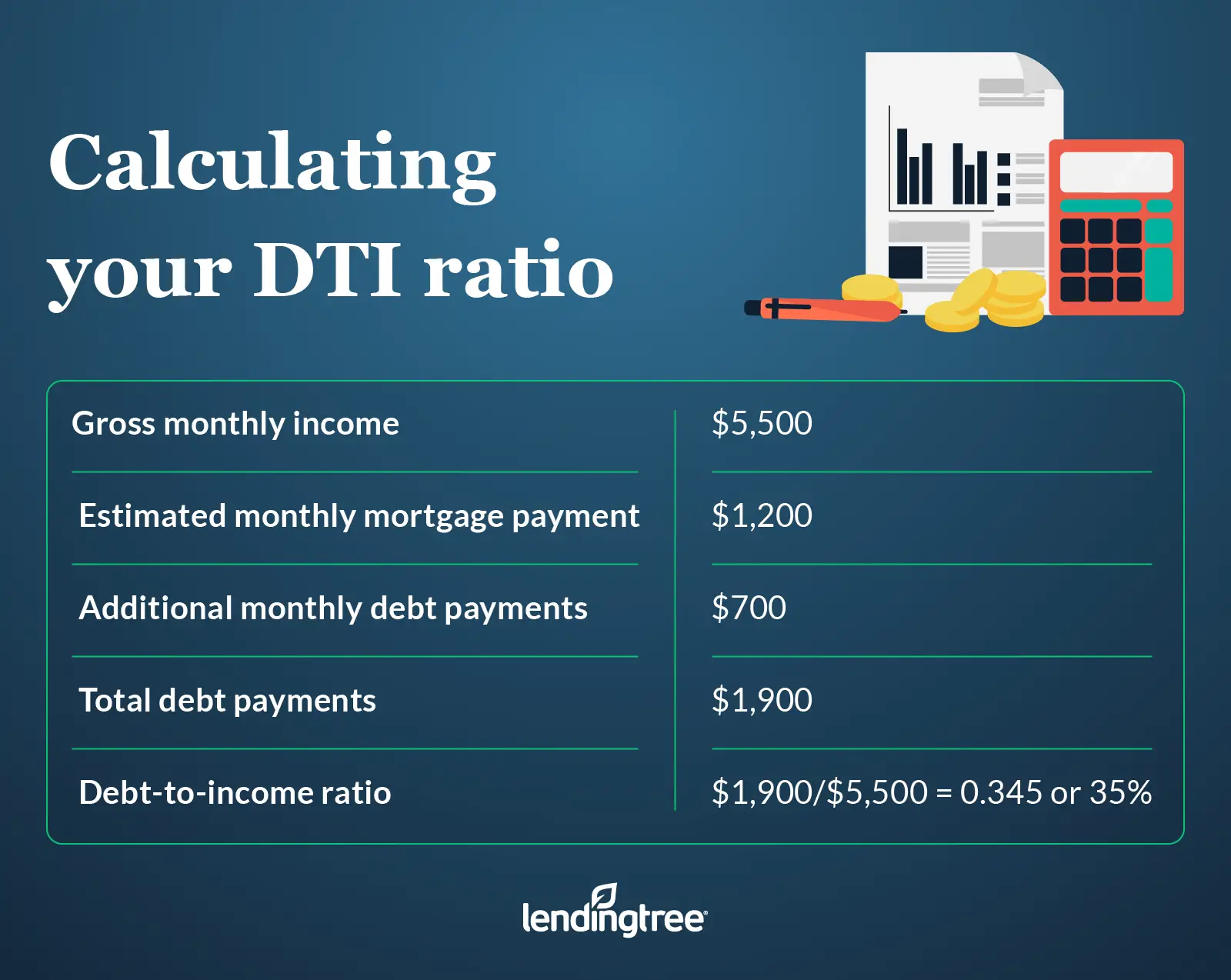

How To Calculate Debt To Income Ratio

Okay easy enough, but your ratio is likely not as clear-cut as half your income . How do you calculate your exact DTI? Theres math involved, but thankfully its pretty basic .

Simply divide all your monthly debt payments by your gross income, and then multiply that number by 100. This will give you your DTI percentage.

In some cases, what constitutes income and debts is clear-cut. In other cases, not so much. Generally, lenders follow these guidelines for what to include for each.

Debt includes:

-

Minimum required credit card payments

Income includes:

-

Pre-tax monthly salary

-

Income from additional jobs or side hustles

-

Revenue from rental property or other investments

-

Regular income from annuities, trust funds, and retirement accounts

-

Any child support or alimony payments you receive

Lets look at a real-world example:

Auto loan: $350 per monthStudent loans: $220 per monthCredit cards: $130 minimum monthly paymentExpected housing costs: $1,800 per month= $2,500 monthly debt obligation

Monthly salary: 5,000 Monthly side-gig income: $1,500

x 100 = 38% DTI

The above scenario is for illustrative purposes only.

Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Popular Articles

You May Like: What Happens If You Default On Sba Loan

How Can I Improve My Debt

There are a number of ways you can try to improve your debt-to-income ratio. The basic idea is lowering your debt or increasing your income. Here are some ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts each month so that you pay them down faster. For example, pay more than your minimum credit card payment every month.

- Cut monthly expenses to pay off more debt. Look at your budget and consider ways you can adjust your spending so that you have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you cant make extra payments on your debt or trim your budget, a debt-consolidation loan could be a good option. This may help you reduce the amount of interest you pay while you work to pay down your debts.

- Get a side hustle or ask for a raise. Extra income from side jobs can count toward your income when you calculate your debt-to-income ratio. The boost in salary youd get from a raise could also help to lower your DTI.

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt ratio means.

Don’t Miss: Usaa Auto Refinance

Max Dti Ratio For Fha Loans

- General guideline is max ratios of 31/43

- Though it can potentially be much higher

- Based on the findings from an automated underwrite

- Potentially as high as 55%

The max DTI for FHA loans depends on both the lender and if its automatically or manually underwritten. Some lenders will allow whatever the AUS allows, though some lenders have overlays that limit the DTI to a certain number, say 55%.

These limits can also be reduced if your credit score is below a certain threshold, such as below 620, a key credit score cutoff.

For manually underwritten loans, the max debt ratios are 31/43. However, for borrowers who qualify under the FHAs Energy Efficient Homes , stretch ratios of 33/45 are used.

These limits can be even higher if the borrower has compensating factors, such as a large down payment, accumulated savings, solid credit history, potential for increased earnings, a minimal housing expense increase , and so on. Yet another reason to build credit and save up money before applying for a mortgage!

To sum it up, if you can prove to the lender that youre a stronger borrower than your high DTI ratio lets on, you might be able to get away with it. Just note that this risk appetite will vary by mortgage lender.

Also note that mortgage insurance premiums are included in these figures.

How To Calculate A Personalized Debt

Your personalized debt-to-income ratio should account for recurring, unavoidable personal or family expenses not included in the Step 2 definition of debts. Such expenses might include:

- Health insurance

- Home insurance, if not bundled in escrow

- Childcare costs, if you have young kids in a single-parent or two-earner household

- Income taxes, if not wholly withheld from your paycheck

- Utility and communications expenses

- Groceries

Obviously, the more expenses you include, the closer youll come to simply rehashing your households budget.

You can avoid that by concentrating on the largest obligations: in most cases, health insurance and childcare. Before calculating your personalized debt-to-income ratio, subtract your health insurance costs and childcare costs from your gross income.

If you qualify for tax credits or deductions related to either expense, add those back in. Depending on your income, you may qualify for a tax credit equal to 20% to 35% of qualifying daycare or other supervisory expenses for children and dependents under age 13, capped at $3,000 in expenses for one child and $6,000 in expenses for two or more children. The full credit is only available to lower-income parents. If you earn more than $43,000 per year, your credit is capped at 20%.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Whats Included In A Debt

There are many monthly expenses that wont make it into your DTI ratio calculations even though part of your income is allocated toward them. Thats because your DTI ratio typically only includes the accounts that show up on your not everything you pay monthly is part of the equation.

DTI-applicable expenses include:

Not every bill you pay will appear on your credit, though. Basic living expenses like utilities, cable, cell phone bills and monthly fees for any subscription services wont show up.

This doesnt mean there wont be any consequences for your credit if you dont pay these bills. Unpaid bills of this type can end up being reported as collections, which can have a big negative impact on your credit score. However, theres no effect from these types of accounts on your DTI.

What Should Your Dti Be To Buy A Home

The lower your DTI, the betterthis means less of your income is tied to recurring debt payments, and youll likely be more able to continue making payments on time even if you experience a minor financial setback. Borrowers with higher debt obligations relative to their incomes are less able to absorb those setbacks, and are at greater risk of defaulting on their loan. This is why high DTI is the #1 reason mortgage applications get rejected.

So, whats the magic number when it comes to DTI? Well, it varies slightly based on the type of mortgage, the lender, and other aspects of your financial profile.

Typically, though, most lenders prefer to see a DTI of under 36%. In other words, the total of your monthly debts, including your estimated monthly mortgage payment, will be less than 36% of your monthly gross income. However, it may be possible to get a mortgage with a DTI of up to 50% depending on the lender. If you have a DTI of 50% or higher, then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio.

Conventional loan DTI requirements

While many lenders require a DTI of no more than 43%, some lenders, including Better Mortgage, can provide mortgages to borrowers with DTIs up to 50%. This means even if your DTI is 49.999%, you could be eligible for a home mortgage loan.

FHA loan DTI requirements

Read Also: What Credit Score Is Needed For Usaa Auto Loan

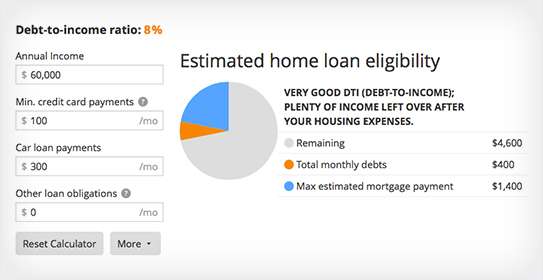

How To Use Our Debt

Your DTI ratio is an important part of the how much house can I afford decision. Knowing your DTI provides a good indication of what to expect from the mortgage preapproval process.

For example:

-

If your housing-related monthly debts are below 28%, you may qualify for a larger loan amount than originally expected

-

If your total debts are above 36%, it may explain why you werent approved despite good credit

-

If your DTI is 50% or above, you may have to pay down a substantial portion of your debts before you can purchase a home

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Recommended Reading: Drb Student Loan Refinance Reviews

Do You Have To Declare Student Loan On Mortgage Application

Do you have to tell a mortgage lender about your student loan? Yes. You need to tell the lender everything they ask. Usually you, or your Mortgage Broker, would declare your student loan by inputting the monthly amount in the student loan payment or other committed expenditure box on your mortgage application.

How To Qualify With A High Dti

If you have a DTI above 43%, you may find it more difficult to qualify for a mortgage loan. And if you are approved, your loan may be subject to additional underwriting that can result in a longer closing time.

Overall, higher DTI ratios are considered a greater risk when an underwriter reviews a mortgage loan for approval.

In some cases, if the DTI is deemed too high, the lender will require other compensating factors to approve the loan, explains DiBugnara.

He says compensating factors can include:

- Additional savings or reserves

- Proof of on-time payment history on utility bills or rent

- A letter of explanation to show how an applicant will be able to make payments

A higher credit score or bigger down payment could also help you qualify.

Cook notes that, for conventional, FHA, and VA loans, your DTI ratio is basically a pass/fail test that shouldnt affect the interest rate you qualify for.

But if you are making a down payment of less than 20 percent with a conventional loan, which will require you to pay mortgage insurance, your DTI ratio can affect the cost of that mortgage insurance, adds Cook.

In other words, the higher your DTI, the higher your private mortgage insurance rates.

Also Check: Becu Used Car Loan

How Can Knowing My Dti Ratio Help Me

One of the best uses of the DTI for an individual is as a way of avoiding decisions that will create too much of a pinch. One common situation that a good understanding of DTI calculations can help you to avoid is becoming house poor. Being “house poor” means that you are paying an uncomfortably high percentage of your income into your mortgage. Knowing your DTI ratio can also be great motivation to begin paying off debt to lower your DTI.

Of course, there are certainly exceptions to every rule. Some people are willing to make sacrifices to live in a location they either love or need to live in to sustain a location-limited career.

Are Student Loans Included In Dti For Mortgage

Just like any other debt, your student loan will be considered in your debt-to-income ratio. The DTI ratio considers your gross monthly income compared to your monthly debts. Ideally, you want your outgoing payments, including the estimate of new home cost, to be at or below 41 percent of your monthly income.

Recommended Reading: How Much Car Can I Afford For 500 A Month

What Is The Best Debt

Long term, the answer is as low as you can get it.

However, hard numbers are better tools for comparison. Take a look at the following DTI ranges:

- 35% or less = Good

- 36-43% = Acceptable but Needs Work

- 44% and up = Bad

If youre trying to get a home loan, 36% is the most recommended debt-to-income ratio. If you dont have a significant down payment saved up, 31% is a better target.

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Read Also: How Much Do Mortgage Officers Make