Fha Streamline Loan Borrowers Arent Hindered By Closing Costs

Even though the FHA streamline refinancing program doesnt allow closing costs to be rolled into the new loan amount that doesnt mean borrowers have to pay those fees out of pocket the high demand for FHA loans gives mortgage lenders more leeway to negotiate a lower rate and fee structure. With mortgage interest rates at historic lows, nows the time to refinance your FHA loan and reduce your mortgage payments. Theres no reason to be paying more for your home loan than necessary and that includes closing costs to refinance.

Tim Lucas

You May Like: How To Pay Home Loan Faster

Qualifying With No Credit History

Ideally, you want at least a year of reliable payments before you apply for an FHA loan. It is important to know that a lender may not reject an application simply because the applicant chose not to use credit in the past. No matter if you have traditional or nontraditional credit, your FHA loan officer will look into it when you apply.

Piggyback Mortgages And Pmi

Some lenders recommend using a second piggyback mortgage to avoid PMI. This can help lower initial mortgage costs rather than paying for PMI. It works like this: You take out a first mortgage for most of the homes purchase price . Then you take out a second, much smaller mortgage for the remainder of the homes purchase price, less the first mortgage and down payment amounts. As a result, you avoid PMI and have combined payments less than the cost of the first mortgage with PMI.

However, a second mortgage generally carries a higher interest rate than a first mortgage. The only way to get rid of a second mortgage is to pay off the loan entirely or refinance it into a new standalone mortgage, presumably when the LTV reaches 80% . However, these loans can be costly, particularly if interest rates increase from the time you take out the initial loan and when youd refinance both loans into one mortgage. Dont forget youll have to pay closing costs again to refinance both loans into one loan.

Also Check: How To Get Approved For Capital One Auto Loan

Make A Larger Down Payment

There are lots of reasons why making a smaller down payment might be the right financial decision for you. But, if you have the money available , consider making a larger down payment. It would reduce the amount of money you would need to borrow from your lender, and, as a result, it would lower your LTV.

And heres another bonus: With a smaller loan, youd pay less in interest throughout the life of the loan, which would help you save a ton of money in the long run.

Ltv And Home Equity Loans: The Combined Loan

A home equity loan or home equity line of credit can help you withdraw money from your home and use it to make home improvements and repairs or pay down higher interest debt.

Home equity loans and HELOCs both offer lower interest rates compared to personal loans and credit cards. And both of these loans will be based on your combined loan-to-value ratio.

Your CLTV is the combined amount of your current mortgage balance plus the amount of the HELOC or home equity loan youre getting divided by the current value of the home. In other words, your CLTV is the total of all the liens on your home and helps lenders assess risk when deciding whether to approve your home equity, HELOC or refinance application.

If your LTV is 80% or more, that wont leave a lot of room for you to meet the CLTV requirement, especially when you add in closing costs between 2% and 5% on a home equity loan.

Thats why knowing your LTV matters. Otherwise, borrowing against your home equity may not be an option, or it may cost you more than its worth.

You May Like: Usaa Refinance Auto Loan Rates

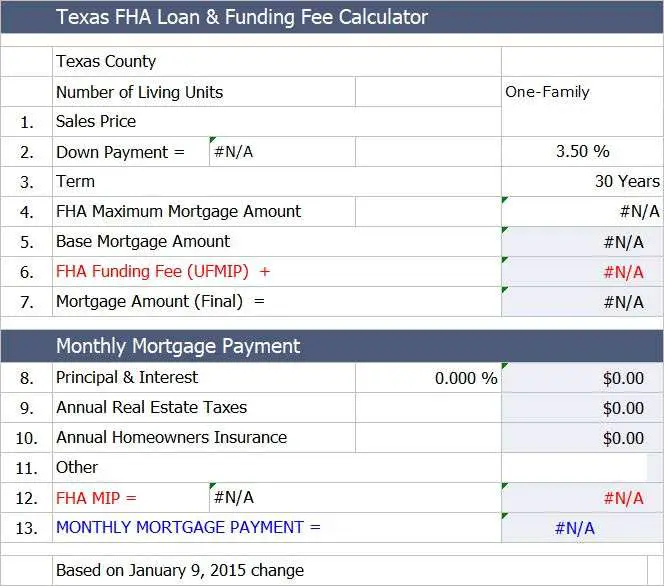

How To Use The Moneygeek Fha Vs Conventional Loan Calculator

All new FHA borrowers pay a premium into an insurance fund that reimburses lenders when a borrower allows a foreclosure. The insurance fund and promise of repayment backed by the U.S. Government gives lenders the confidence to lend money to people who might not qualify for a conventional loan. There are two FHA mortgage insurance premiums new borrowers must pay. The first is a one-time, up-front premium. This is call the “Up-Front Mortgage Insurance Premium” . The second is the on-going, annual fee that’s calculated every year. As your loan balance falls, the annual premium is recalculated and decreases.

The calculator above shows you how much your UFMIP will be, and how much you can expect to pay during the first year of your loan. As mentioned, expect your annual amount due to decrease with each passing year.

| Input |

|---|

Do I Qualify For An Fha Loan

FHA loans are an option for first-time and experienced homebuyers. While credit standards and down payment requirements are not as stringent as a conventional loan, not everyone will qualify.

FHA guidelines are available via HUDâs website. However, sifting through them to find your particular situation can be overwhelming. A lot of factors go into whether or not a homebuyer qualifies for an FHA loan. As with all mortgage alternatives, obtaining a pre-approval is recommended.

Recommended Reading: Transferring An Auto Loan

Streamline An Fha Loan

1

Locate your original FHA loan file, including your application, title insurance policy, and conveyance documents, including the. The FHA streamline process will reuse most of this paperwork, saving you time and money.

2

Verify that current interest rates are lower than your existing FHA loan interest rate. You can only streamline if you will lock in a lower interest rate.

3

Identify several HUD-approved mortgage lenders in your area. The reference link provided below can lead you to approved lenders in your area.

4

Contact at least three HUD-approved lenders to obtain a good faith estimate on streamlining your FHA loan. Lenders do not always charge equal closing costs and transaction fees, so contacting several approved lenders can help you to identify a low-cost provider.

5

Select a lender and provide him with your original FHA loan application. Because of the streamline process, your lender will have very little work to do and you should be able to close on your new loan within about one week.

6

Attend a closing with your lender. This is where you will sign new documents, including a new promissory note and mortgage, sometimes called a âdeed of trustâ instead of a mortgage.

References

How Much Of A Down Payment Do You Need For A 300k House

If you are purchasing a $300,000 home, youd pay 3.5% of $300,000 or $10,500 as a down payment when you close on your loan. Your loan amount would then be for the remaining cost of the home, which is $289,500. Keep in mind this does not include closing costs and any additional fees included in the process.

Recommended Reading: Usaa Used Car Loan Restrictions

What Is Anfha Loan

FHA loans are mortgages backed by the Federal Housing Administration , an arm of the federal government. Backed means the government insures your lender for part of your loan. So your lender will get some of its money back in case of loan default.

This insurance, often referred to as the FHA guarantee, lets lenders approve FHA loans for borrowers with only fair credit and a relatively small down payment.

Its why these home loans are so popular with first-time buyers and those who have issues in their credit history.

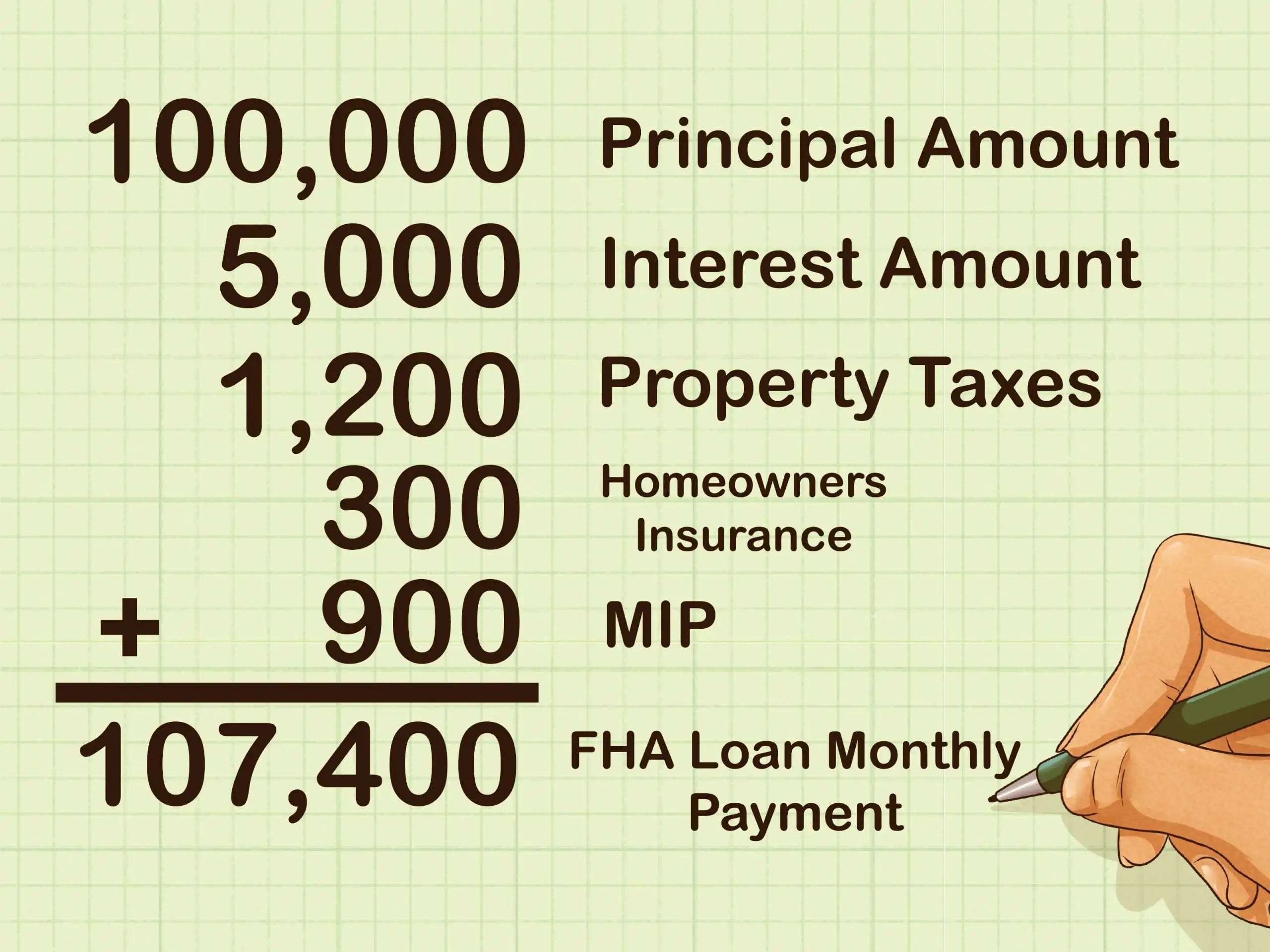

Mortgage Calculator: Fees And Definitions

The above mortgage calculator details costs associated with loans or with home buying in general. But many buyers dont know why each cost exists. Below are descriptions of each cost.

Principal and interest. This is the amount that goes toward paying off the loan balance plus the interest due each month. This remains constant for the life of your fixed-rate loan.

Private mortgage insurance . Based on recent PMI rates from mortgage insurance provider MGIC, this is a fee you pay on top of your mortgage payment to insure the lender against loss. PMI is required any time you put less than 20% down on a conventional loan. Is PMI worth it? See our analysis here.

Property tax. The county or municipality in which the home is located charges a certain amount per year in taxes. This cost is split into 12 installments and collected each month with your mortgage payment. Your lender collects this fee because the county can seize a home if property taxes are not paid. The calculator estimates property taxes based on averages from tax-rates.org.

Homeowners insurance. Lenders require you to insure your home from fire and other damages. This fee is collected with your mortgage payment, and the lender sends the payment to your insurance company each year.

Loan term. The number of years it takes to pay off the loan . Mortgage loans most often come in 30- or 15-year options.

Interest rate. The mortgage rate your lender charges. Shop at least three lenders to find the best rate.

Recommended Reading: Fha Refinance Fees

How To Calculate The Maximum Loan Amount On An Fha Streamline With Appraisal

Homeowners with mortgages insured by the Federal Housing Administration have the opportunity to obtain an expedited refinance. An FHA streamline refinance involves paying off an existing FHA loan with a new FHA loan with better terms. Designed to lower monthly principal and interest payments, the FHA streamline can be completed with or without an appraisal. Borrowers who order an appraisal can use a new, higher appraised value to increase their loan amount and cover refinance closing costs. To calculate the maximum loan amount on an FHA streamline refinance with appraisal, use the home’s newly appraised value.

Obtain an appraisal report from an FHA-approved appraiser. Your lender, which also must have FHA approval, orders the appraisal on your behalf. The appraiser completes an interior and exterior property inspection and compares your home to similar nearby homes that recently sold in order to estimate the value. An FHA appraisal costs the same as or more than standard appraisals, but the appraisal company, property size and property location affect appraisal price. FHA appraisal reports usually cost between $350 and $450.

The FHA charges the UFMIP on all loans, and borrowers usually roll it into the new loan amount. Most FHA loans required a 1.75 percent UFMIP fee as of 2013. Streamline refinances on loans made on or before May 1, 2009 require only a 0.01 percent UFMIP charge. When you refinance, the FHA may refund a portion of the UFMIP you previously paid.

Fha Doesnt Allow Closing Costs To Be Added To A New Refinance Loan

Many mortgage loans like a conventional refinance or FMERR allow borrowers to finance closing costs into the new mortgage refinance loan to reduce out-of-pocket expenses. The rules for loans backed by the Federal Housing Administration are a little different. The maximum loan amount for an FHA streamline refinance is calculated by subtracting the FHA MIP refund from the current unpaid principal balance, then adding the new upfront MIP costs.

+ = New maximum loan amount

FHA streamline refinance maximum loan calculation

For example, assuming a current FHA loan closed 12 months ago with a current loan balance of $150,000, the new loan amount would be as follows:

- Current balance: $150,000

- Upfront MIP refund due to borrower: $1,522

- New upfront MIP due: $2,625

- Max new loan amount: $151,103

The new maximum loan amount does not include an allowance for closing costs. For an FHA streamline refinance, typical closing costs range between $1,500 and $4,000. Though, closing costs can vary widely depending on the lender, borrower characteristics, and the loan amount.

The good news is that you dont always have to pay these closing costs out of pocket.

You May Like: Vehicle Loan Calculator Usaa

How To Apply For An Fha Loan

If you meet the requirements to qualify for an FHA loan, you will need to provide your personal and financial documents to apply with an FHA-approved lender. Your lender can be either a bank, credit union, or other financial institution.

-

The lender will evaluate your qualification using your work and previous payment-history records such as credit reports and tax returns. For most lenders, you will not qualify if:

- You are delinquent on your federal student loans or income taxes.

- You are still within two years from a bankruptcy event

- You are still within three years of a previous mortgage foreclosure event.

You will be required to provide details of your social security number, proof of U.S. citizenship, legal permanent residency or eligibility to work in the U.S., and Bank statements for the last 30 days at a minimum.

Finally, if you are making a down payment with gift money, you will need to provide a letter from your donor that you don’t need to repay the money.

Is It Worth Putting More Than 20 Down

Its not always better to make a large down payment on a house. Its better to put 20 percent down if you want the lowest possible interest rate and monthly payment. But if you want to get into a house now and start building equity, it may be better to buy with a smaller down payment say 5 to 10 percent down.

Recommended Reading: Fha Limits Texas

Two Kinds Of Mortgage Insurance

You can expect to pay two mortgage insurance premiums to the FHA: the Upfront Mortgage Insurance Premium paid only once at closing and an annual mortgage insurance premium which you pay to your lender in monthly installments. You can pay the upfront premium out of pocket in lump sum at closing, or finance it, meaning you add it to the base loan amount. The FHA alters mortgage insurance rates periodically, so you need the latest rates to get an accurate calculation. The annual mortgage insurance premium varies by loan amount and down payment, with the lowest loan amounts receiving the lowest rates. Also, 15-year loans receive lower mortgage insurance rates than 30-year loans.

Fha Net Tangible Benefit Calculator

The Federal Housing Administration updated the underwriting criteria for the FHA streamline loan program on April 18, 2011.The ânet tangible benefitâ is the most noticeable improvement.

New streamline loans originated after April 18, 2011 must show a 5-fixed-ratepercent reduction in the principal and interest of the mortgage payment plus the annual mortgage insurance premium , or if refinancing from an Adjustable Rate Mortgage to a fixed-rate mortgage, the interest-rate must be reduced by at least 2 percent or be no higher than the current interest-rate.The FHA Benefit Calculator will determine whether or not the new streamline loan meets the net tangible benefit criteria. Mortgagee Letter.pdf is a PDF file that you may download and print. Please send me an email if you discover a mistake, have a comment, or want to make a purchase.9/2018 was the most recent update.

Read Also: Sss Loan Requirements

How To Find An Fha Lender And Apply For An Fha Loan

FHA borrowers get their home loans from FHA-approved lenders, which can have different rates, costs and underwriting standards even for the same loan. FHA loans are available through many sources, from the biggest banks and credit unions to community banks and independent mortgage lenders.

Applying for an FHA loan requires a few key steps:

- Know your budget: Before you submit an application for an FHA loan, youll want to know how much you can afford to spend on a home. Consider your current income, expenses and savings, and use Bankrates mortgage calculator to estimate your monthly payments based on different home prices and different sizes of down payment.

- Compile your documents: Applying to borrow a large chunk of money means handing over a complete look under the hood of your finances. Before you apply for an FHA loan, have all these documents ready to go: two years of tax returns two recent pay stubs your drivers license and full statements of your assets and any other places where you hold money).

- Compare your offers:Getting preapproved with multiple lenders is helpful so you can compare different refinance rates and terms to make sure youre getting the best deal.

What Is Fha Mortgage Insurance

To get an FHA mortgage, you need FHA mortgage insurance. learn how FHA mortgage insurance works and what it costs.

FHA loans, insured by the Federal Housing Administration , are one of the most popular choices for people who want to buy a home or refinance an existing mortgage.

FHA loans require a very small down payment and have relatively relaxed guidelines for borrowers to qualify. But FHA loans arent the best choice for every borrower, in part because they require mortgage insurance, which adds an additional cost to the loan. Mortgage insurance is different from mortgage life insurance and the mortgage coverage that life insurance policies offer.

Use MoneyGeek’s FHA Mortgage Insurance Calculator to learn how much you will be paying to the FHA for the privilege of borrowing a loan under the FHA program.

Don’t Miss: Usaa Rv Loan Terms

Fhas Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers werenât able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHAâs MIP apply only to new loans. Borrowers whoâve closed their loans donât need to worry that their MIP will get more expensive later.

- Company