Example : Undergraduate Borrower With A Family Size Of 1 With An Agi Of $25000 Per Year And An Eligible Federal Student Loan Balance Of $50000

This borrower would have somewhat different monthly payments under the various IDR plans, because each plan excludes a different amount of initial income under federal poverty guidelines:

- Income Contingent Repayment : ICR has an initial poverty exclusion based on 100% of the federal poverty limit for the borrowers family size. This is the least-generous poverty exclusion available under the existing IDR plans. The borrowers monthly payment in this example would be around $215 per month.

- Income Based Repayment :IBR has a larger initial poverty exclusion of 150% of the federal poverty limit for the borrowers family size, and a less expensive repayment formula. The same borrowers monthly payment under IBR would be around $85 per month.

- Pay As You Earn and Revised Pay As You Earn : PAYE and REPAYE also exclude an initial income amount equal to 150% of the federal poverty limit for the borrowers family size, but these plans have a cheaper formula than IBR. The same borrowers monthly payment under PAYE and REPAYE would be around $58 per month.

- Expanded Income Contingent Repayment : The Departments proposed new EICR plan has a larger poverty exclusion of 200% of the federal poverty limit for the borrowers family size more generous than the other IDR plans. Under EICR, this borrowers income would be just at that limit, resulting in no payment obligation .

If You Have 2 Or More Jobs

If youre employed, your repayments will be taken out of your salary. The repayments will be from the jobs where you earn over the minimum amount, not your combined income.

Example

You have a Plan 1 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £1,000 a month from one job and £800 a month for the other.

You will not have to make repayments because neither salary is above the £1,657 a month threshold.

Example

You have a Plan 2 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £2,300 a month from one job and £500 a month for the other.

You will only make repayments on the income from the job that pays you £2,300 a month because its above the £2,274 threshold.

What Are The Differences Between Income

Below, read more about the general tradeoffs between Income-Based Repayment plans and Standard Repayment of student loans when your grace period comes to an end.

| Income-Based Repayment Plans | |

|---|---|

| Youll pay more over time than you would under Standard Repayment. | Youll pay less over time than you would under other IBR plans. |

Don’t Miss: Average Apr For Motorcycle

Can This Proposal Help Over 44 Million Borrowers With $14 Trillion In Student Loans

This article also appeared in Forbes.

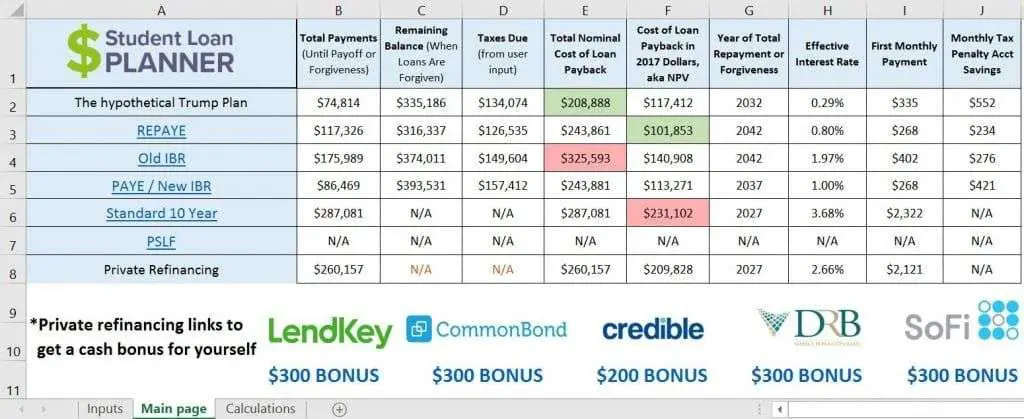

If President-elect Donald Trump implements his proposed student loan plan, there may be good news on the horizon for millions of student loan borrowers.

On October 13, Trump proposed an income-based repayment plan that allows borrowers to cap their monthly student loan payments based on their income and then have their student loans forgiven after a certain period of time.

Under Trumps plan, if you are a student loan borrower, your monthly student loan payments would be capped at 12.5% of your income. After 15 years of monthly payments, your remaining student loan debt would be forgiven.

Students should not be asked to pay more on the debt than they can afford, Trump said then in Columbus, Ohio. And the debt should not be an albatross around their necks for the rest of their lives.

How Does This Income

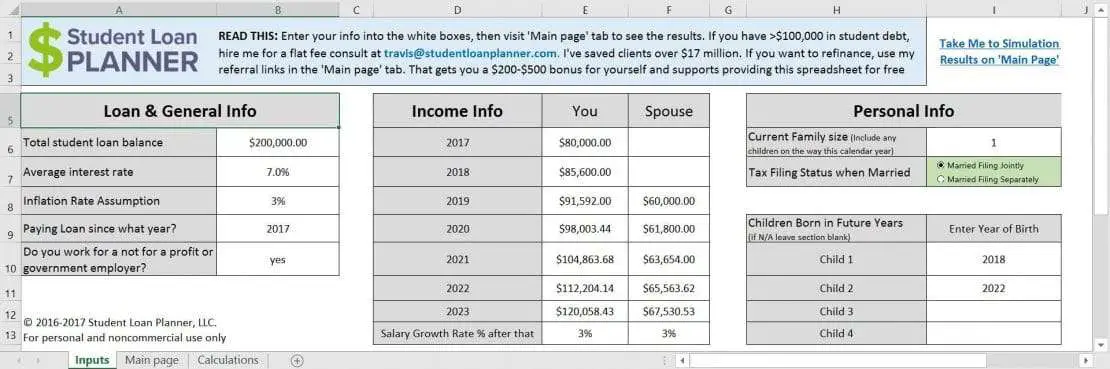

This calculator reveals what your monthly payments would be if you put your student loans on IBR. It also compares your loans on IBR with your loans on the standard 10-year plan, so you can see how your monthly payments, loan term and overall balance would change.

The calculator makes a few assumptions, which might not apply to every borrower. First, it assumes your family size will stay the same over the life of your loan. If your family grows, your student loan payment would be adjusted to reflect that.

Second, it assumes an annual income growth of 3.5%, but you can adjust this figure if it doesnt match your circumstances. Finally, it assumes your loans are unsubsidized and accruing interest from the date of disbursement. If you have subsidized loans, they will not accrue interest during periods of deferment.

Read Also: Can Mortgage Lenders Verify Bank Statements

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Recommended Reading: Usaa Car Loan Bad Credit

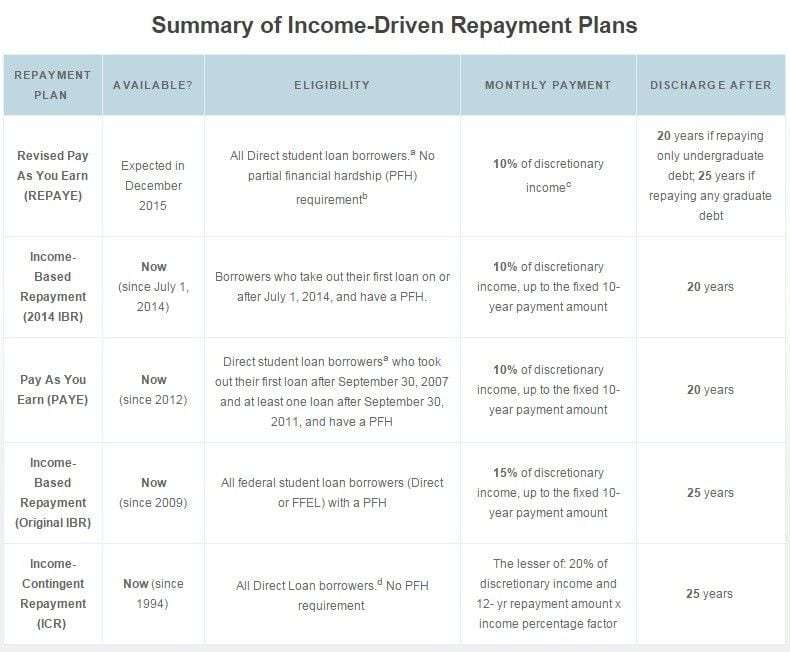

What Is An Income Driven Repayment Plan

Income driven repayment plans allow student loan borrowers with federal student loans to make monthly payments based on their income. Gauging required monthly payments from your income may allow you to exceed the minimum payment while also allowing you to make manageable monthly payments. There are a number of income driven repayment plans accessible to you. Below are the eligibility requirements for each IDR plan:

What Are The Benefits And Risks To Income

There are benefits and risks to income-driven repayment plans, including PAYE and REPAYE.

The benefit: you save money upfront from lowering your monthly student loan payment or extending the repayment period.

The risk: you will pay more interest over time because lower monthly payments means you are reducing less principal each month. You also may be required to pay ordinary income tax on the loan amount forgiven.

Recommended Reading: Usaa Classic Car Loan

Other Potential Changes To Student Loans

With respect to other federal student loan policies, expect more details to emerge from Trumps nominee for Secretary of Education, Betsy DeVos, as well as congressional leaders such as Sen. Lamar Alexander , chairman of the Senate Health, Education, Labor and Pensions Committee, and Rep. Virginia Foxx , incoming chairwoman of the House Education and Workforce Committee.

- Risk sharing between the federal government and universities with respect to students who default on their student loans

- Potential reduction of the federal governments role in student lending and a corresponding increase in the role of private lenders

- Amount of profit the government generates from student loans, which may result in a reduction of interest rates for federal student loans

How Does Agi Affect My Student Loan Payment

Your adjusted gross income is your total gross income minus certain deductions. The income driven repayment plans will use your AGI to calculate your monthly payment.

Thereâs a direct relationship between your AGI and the monthly payment due on your federal student loans. The lower your AGI, the lower your monthly payment. Likewise, the higher your AGI, the higher your monthly payment.

Because thereâs a direct relationship between your AGI and your student loans, the easiest way to lower your monthly payment is to lower your AGI.

Read Also: Usaa Proof Of Residency Request Form

What About Loan Forgiveness

If you work in the government or nonprofit sector, you may be able to have your loan balance forgiven after 10 years with income-based repayment. With public service loan forgiveness, the amount forgiven is not taxable.

If you dont work in public service, your loan may be forgiven in 20 to 25 years but the loan balance will be taxed, which could result in a considerable tax bill that year.

Whether income-based repayment is right for you depends on a variety of factors. If youre still in school and applying for loans, dont let the allure of possible loan forgiveness available under income-based repayment cause you to take on more student debt than you otherwise would.

If youve already graduated, you need to weigh the benefits of a lower payment now against the potential impact of a higher debt load over a longer period of time. You might also consider refinancing your student loans to reduce your overall interest rate and pay off your balance faster.

Income Based Repayment Plans For Student Loans

Many people graduate from colleges in the United States with debt. According to EducationData.org, the average 2020 student loan debt was $32,731 per graduate. This means that many people are paying over $400 per month on their student loan debt when first entering the workforce. However, many entry-level jobs, especially those in education and social services, do not pay well enough for recent graduates to balance their student loan payments with rent and other expenses. This is where income-based repayment plans for student loans come in.

You May Like: Car Loan Transfer To Another Person

How Do I Qualify For An Income Re

You are eligible for an income re-driven payment plan if you are a federal student loan borrower. To qualify, you must submit a repayment plan request to your loan servicer and recertify your income for your loan servicer each year. One way to recertify your income for your loan servicer is by providing your tax return. Note that some plans are restricted to certain types of federal student loans, the number of loans you have, and when you took out your loan. Your income may also affect the type of plan that you are eligible to enter into.

Calculating Your Monthly Interest Charge

Here is how to calculate the estimated monthly interest charge

Take the weighted average interest rate of your Federal student loans and multiply it by the total balance that you owe. Then divide that by 12 and the result is your estimated monthly interest charge.

The picture below shows you were you can get this information very easily on your free FitBUX membership profile.

Read Also: Usaa Personal Loan Approval Odds

Assumptions That Change The Tax Liability

A lot can change over 20 or 25 years. The important thing to remember is that your estimated tax liability will change over time. Thus, how much you need to save each month will change over time.

You cant simply start saving your initial recommended savings amount each month and forget about it. You have to make sure to stay on top of it and adjust it accordingly!

Below are the three most common items that change the liability associated with income-based repayment plans that you need to be aware of:

- Your income: When we do projections, we assume a 3% annual growth rate. Your income will not grow by exactly three percent every year. In fact, there may be a few years were you dont work at all! Conversely, you may get a new job or a promotion and this could impact the amount youll ultimately owe.

- Your family status: Marriage and children will change your monthly payment. You will have to account for your spouses income, their student debt load, and a change in household size when you have children. Thus, your tax liability will change. To see how . It details what happens when filing taxes separately vs. jointly while on an income based student loan repayment plan.

- Tax rates: We project the amount owed using a 35% tax bracket. However, nobody can predict what the rate will be in 20 or 25 years.

The three items above are risks you face when using one of the income-based repayment plans. The only way to mitigate these risks is to save.

The Definition Of Debt

Your debt-to-income ratio is the amount of your income that goes towards debt payments and other financial necessities.

According to Howard Dvorkin, a certified public accountant , lenders view your overall DTI ratio as an indicator of your financial strength, just like your credit score or credit utilization.

Lenders didnt invent complicated formulas like debt-to-income ratios because they want to confuse you. They did it because the DTI ratio really works, Dvorkin said. Think about it this way: You might be making all your monthly payments with an easy smile, but you could easily be one missed payment from disaster.

According to the Consumer Financial Protection Bureau , mortgage studies show that borrowers with a higher debt-to-income ratio are at greater risk of not making their payments. Most lenders will only give mortgages to applicants who have a DTI ratio of 43% or lower.

Also Check: California Loan License

Can Your Budget Handle A Non

Under income-based repayment, youre required to recertify your income and family size every year so your servicer can recalculate your monthly payment based on program guidelines.

Certain life changes including a new marriage and filing taxes jointly can cause your monthly payment to increase substantially or even make you ineligible to make payments tied to your salary.

If that happens, its important to know your monthly payments will never exceed what you would pay with the standard 10-year plan however, non-fixed student loan payments meaning payments that could change every year based on your annual income can make it difficult to manage your budget, especially if youve taken on other debt, such as a mortgage or car loan.

Summary Of Our Student Loan Payment Calculator

Use this calculator to estimate what your payment could be, how much you would pay in total on the loan, and how much forgiveness you might receive. Understand that this calculator makes some assumptions and in the end the final determination for all of the above is made by the department of education and your student loan servicer.

Provide us with your loan info

Don’t Miss: Usaa Vehicle Loan Rates

Student Loan Income Based Repayment Plans: How They Work Now

Income-Driven Repayment plans a broad term that describes a collection of similar plans that base a student loan borrowers monthly payment on their income and family size can be a crucial option for borrowers, and sometimes these plans are the only way a borrower can have a manageable monthly student loan payment. IDR plans include Income Contingent Repayment , Income Based Repayment , Pay As You Earn , and Revised Pay As You Earn .

IDR plans rely on a formula applied to the borrowers income and family size to calculate their monthly payment. Payments are based on whats known as a borrowers discretionary income which, for purposes of these plans, is defined as the amount of the borrowers AGI above a 100-150% of the federal poverty exemption, depending on the specific plan, adjusted for family size. Monthly payments are typically 10% to 20% of a borrowers monthly discretionary income .

Rapid Fire Questions & Answers About Income

What are the income-based repayment plan disadvantages?

The two primary disadvantages are interest accrue and the tax that is owed when the loans are forgiven.

How does income-based repayment plans work?

Payments are based as a percentage of your income. Most will differ interest. After a given time the loans are forgiven. At that point your owe a tax on the amount forgiven.

Can you make too much money for income-based repayment plans?

No. However, PAYE is capped at your would be 10 year monthly payment.

Is income-based repayment a good idea?

This all depends on your understanding of these plans and your personal situation. What is good for one person maybe bad for another.

How long do income-based repayment plans last?

20 years, 25 years, or if your balance on your loans hits $0 before those time periods. Also, if you qualify for PSLF then they can be finished within 10 years.

Will income-based repayment plans hurt my credit score?

Directly no. Indirectly, maybe as you still show a large loan balance. Also, it may be hard to qualify for a mortgage.

What is the difference between income-driven and income-based repayment?

Income-based repayment is a type of income-driven repayment plan. Income-driven repayment is a catch all phrase the government uses to describe 5 different repayment plans.

Is PAYE better than IBR?

IBR for old borrowers, yes. However, you may not qualify for PAYE. In regards to IBR for new borrowers, PAYE and IBR is the same exact thing.

Recommended Reading: Usaa Used Car Loan