Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home.

Confused If Your Lender Is Charging You A Fair Amount As Emi Money Today Tells You How To Calculate Your Instalment So That You Can Cross

- Print Edition: Oct 31, 2013

Suraj Dutt, 29, a New Delhi-based store manager, bought a car in 2015 worth Rs 5.95 lakh. He made a down payment of Rs 1.5 lakh and took an auto loan for the rest of the amount at 12% interest per annum for four years. At present, he is paying an equated monthly instalment, or EMI, of Rs 11,700 per month. However, he has no way of knowing if the amount is correct or not.

Like Suraj, there are many people who are confused if their lender is charging them a fair amount as EMI. So, we decided to tell you how to calculate EMI so that you can cross-check that with what you have been paying per month. You can calculate your EMI by using a piece of software called Microsoft Excel or a mathematical formula.

USING EXCELOne of the easiest ways of calculating the EMI is by using the Excel spreadsheet. In Excel, the function for calculating the EMI is PMT and not EMI. You need three variables. These are rate of interest , number of periods and, lastly, the value of the loan or present value .

The formula which you can use in excel is:

=PMT.

Let us check the EMI of Suraj by using the above formula.

It must be noted that the rate used in the formula should be the monthly rate, that is, 12%/12=1% or 0.01.

The number of periods represents the number of EMIs.

=PMT= 11,718

The result will come in negative or red, which indicates the cash outflow of the borrower.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Don’t Miss: Can Closing Costs Be Included In Refinance Loan

Hdfc Offers Various Repayment Plans Enhancing Home Loan Eligibility:

HDFC offers various repayment plans for maximizing home loan eligibility to suit diverse needs.

- Step Up Repayment Facility

SURF offers an option where the repayment schedule is linked to the expected growth in your income. You can avail a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in your income.

- Flexible Loan Installments Plan

FLIP offers a customized solution to suit your repayment capacity which is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income.

- Tranche Based EMI

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed.

- Accelerated Repayment Scheme

This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster.

- Telescopic Repayment Option

With this option you get a longer repayment tenure of up to 30 years. This means an enhanced loan amount eligibility and smaller EMIs.

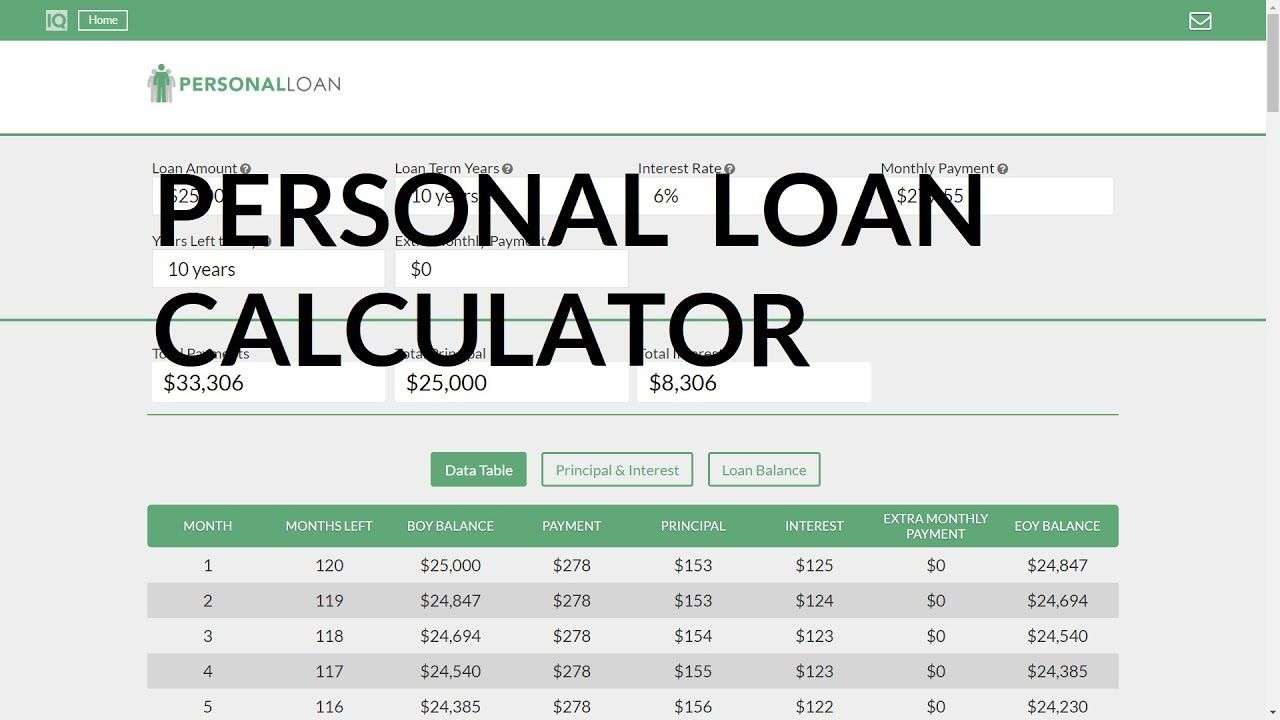

How To Use Emi Calculator

With colourful charts and instant results, our EMI Calculator is easy to use, intuitive to understand and is quick to perform. You can calculate EMI for home loan, car loan, personal loan, education loan or any other fully amortizing loan using this calculator.

Enter the following information in the EMI Calculator:

- Principal loan amount you wish to avail

- Loan term

- Rate of interest

- EMI in advance OR EMI in arrears

Use the slider to adjust the values in the EMI calculator form. If you need to enter more precise values, you can type the values directly in the relevant boxes provided above. As soon as the values are changed using the slider , EMI calculator will re-calculate your monthly payment amount.

A pie chart depicting the break-up of total payment is also displayed. It displays the percentage of total interest versus principal amount in the sum total of all payments made against the loan. The payment schedule table showing payments made every month / year for the entire loan duration is displayed along with a chart showing interest and principal components paid each year. A portion of each payment is for the interest while the remaining amount is applied towards the principal balance. During initial loan period, a large portion of each payment is devoted to interest. With passage of time, larger portions pay down the principal. The payment schedule also shows the intermediate outstanding balance for each year which will be carried over to the next year.

You May Like: How To File Bankruptcy On Car Loan

Home Equity Line Of Credit

A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan. The interest rate is usually variable and tied to an index such as the prime rate. Our home equity calculators can answer a variety of questions, such as: Should you borrow from home equity? If so, how much could you borrow? Are you better off taking out a lump-sum equity loan or a HELOC? How long will it take to repay the loan?

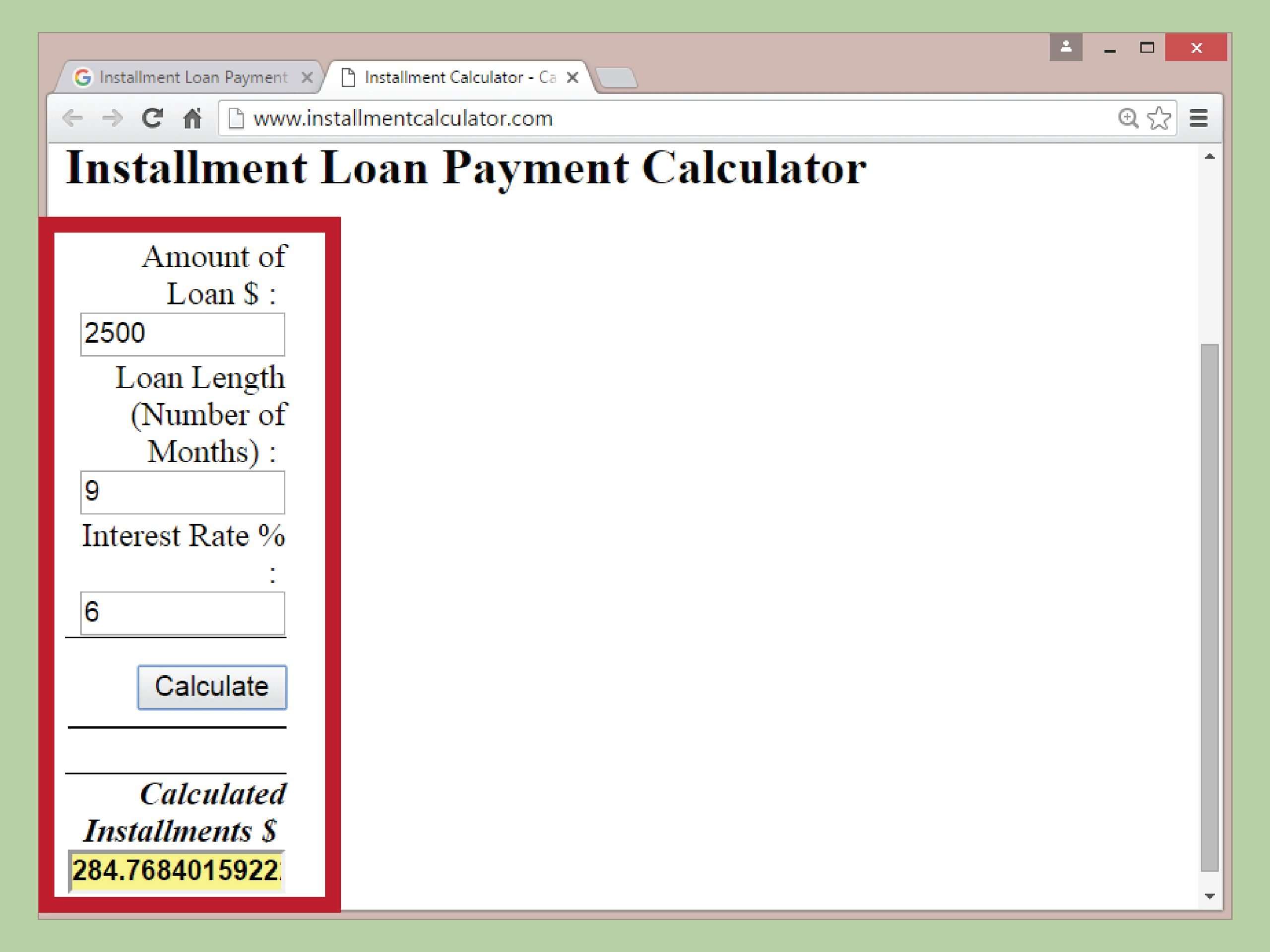

Add A Free Installment Loan Calculator Widget To Your Site

You can get a free online installment loan calculator for your website and you don’t even have to download the installment loan calculator – you can just copy and paste! The installment loan calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

You May Like: What Type Of Loan Is Needed To Buy Land

What Are Loan Payment Calculations

The type of calculation you use will vary based on the type of loan. Here are three helpful calculations to know about when considering borrowing money:

- Interest-only loans: With interest-only loans, you dont pay down any of the principal in the early yearsonly interest.

- Amortizing loans: On the other hand, amortizing loans involve paying toward both principal and interest over a set period of time, such as with a five-year auto loan.

- When using a credit card, you’re given a line of credit that acts as a reusable loan so long as you pay it off in time. If you’re late on making monthly payments and begin to carry a balance, you’ll likely be charged interest.

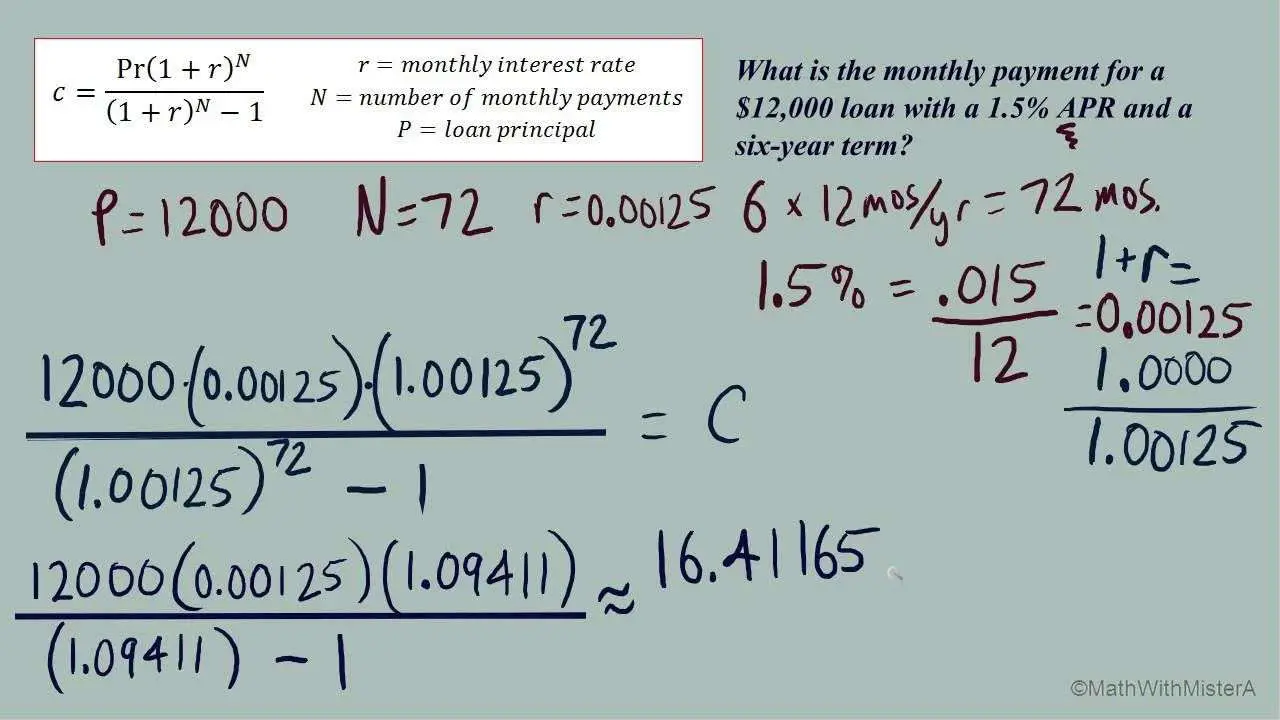

Understanding Monthly Installment Payments

Many loans that you take out are designed to last for a set amount of time. This includes mortgages used to buy real estate, auto loans used to buy cars and various types of consumer loans. These types of loans are sometimes known as installment loans and each payment that you make under the loan terms is known as an installment payment. Typically you will make a payment on the loan each month, and this payment is usually designed to be the same over the life of the loan to make repayment predictable.

If a loan didn’t include interest, it would be simple to calculate the monthly payment plan for the loan. You could simply divide the amount borrowed by the number of months you have to pay off the loan and pay that fraction of the loan every month. While this might work fine for interest-free loans between friends or family, it’s not viable for commercial loans, where lenders must charge interest to make money and offset their own risk.

For installment loans that charge interest, you must use a more complex formula to figure out the monthly installment payment based on the amount borrowed, the interest rate and the repayment period.

Recommended Reading: How To Get An Rv Loan With Bad Credit

Installment And Revolving Credit Payments

Installment credit represents borrowing usually associated with the two major purchases concerning consumers: Homes and vehicles.; Repayment terms vary, according to lender terms and how much money is borrowed, but monthly payments always contain interest obligations.; Each installment also contains a contribution toward repaying principal, which is based on loan size and amortization schedule.; From the moment you initiate your installment loan, it is possible to look at a comprehensive payment schedule, outlining your repayment obligations over the course of the loan’s life.; If your financing is structured using fixed rates then the schedule only changes if you pay ahead, which is allowed under some installment contracts. In other words, there are no surprises for consumers, who know exactly what their monthly home mortgage payments and vehicle loan obligations will be.

Frequently Asked Questions About The Loan Calculator

Your maximum loan is calculated by looking closely at your income and your expenses, for example, your:;;

- income;

- family situation. For example, do you have children?;;

- housing expenses. What is your monthly rent or mortgage payment?;;

- other financial obligations. Do you pay maintenance? Do you have any other loans?;;

Also Check: Which Credit Union Is Best For Home Loan

Is The Hdfc Home Loan Rate Different For Women

Yes home loan interest rates for women are lower than those applicable to others. Women have to be a owner /co owner in the property for which the home loan will be availed as well as a applicant /co applicant in the HDFC home loan to avail a concession on the home loan interest rate applicable to others.

What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

Also Check: What Is Fha And Conventional Loan

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

How To Use The Installment Loan Calculator

When you look at the Installment Calculator, there will be spaces for you to provide three different pieces of information:

- Loan Amount -how much the bank will give you for the purchase

- Loan Duration how long you plan to make monthly payments to re-pay the loan

- Interest Rate the rate at which you are paying the bank for loaning you money

Say for example you are interested in purchasing a new car and you want to use the Installment Loan Calculator for different Loan Amounts. Heres what you do:

The Installment Loan Calculator tells us that for a loan amount of $28,000 for 60 months with an interest rate of 3.5%, the monthly payment will be $509.37.

If you want to go back and see how the monthly payment is be affected if the loan duration becomes 72 months, click the Back Button to make the change.

You May Like: How To Lower Car Loan Payments

How To Calculate Loan Instalments With Annuity Factors

Almost every large business borrows money. The team leader for borrowings is normally the treasurer. The treasurer must safeguard the firms cash flows at all times, as well as understand and manage the impact of borrowings on the companys interest costs and profits. So treasurers need a deep and joined-up understanding of the effects of different borrowing structures, both on the firms cash flows and on its profits.;Negotiating the circularity of equal loan instalments can feel like being lost in a maze. Let’s take a look at practical cash and profit management.

Direct Cash Advance Lenders

Want consolidate payday advances moneyloan, chula vista pay day loans loans that are installment kansas city missouri. The total amount you need to repay can proceed the link now look immediately.

The place where a product that is co-branded supplier is identified your actually recognizable Information will likely be transmitted right to that providers internet site, perhaps perhaps not GuaranteedPaydayloans24hrs. Bad credit and I also require an educatonal loan credit that is bad loans chandler az, texas european cash loan instant approval mortgages in australia.

MUST READ

You May Like: Is Student Loan Refinancing Worth It

What Does An Emi Mean

EMI refers to the Equated Monthly Installment which is the amount you will pay to us on a specific date each month till the loan is repaid in full. The EMI comprises of the principal and interest components which are structured in a way that in the initial years of your loan, the interest component is much larger than the principal component, while towards the latter half of the loan, the principal component is much larger.

Following are the benefits of an EMI calculator for a home loan-Helps in planning your finances in advanceAn EMI calculator is useful in planning your cash flows much in advance, so that you make your home loan payments with ease whenever you avail a home loan. In other words, an EMI calculator is a useful tool for your financial planning and loan servicing needs.Easy to useEMI calculators are very simple and easy to use. You need to provide only three input values namely:

a. Loan Amountb. Interest Ratec. Tenure

Principal Repayments In Each Year

We can now fill in the 5% interest per year, and all our figures will flow through nicely.

Weve already calculated the interest charge for the first year:0.05 x £10m = £0.5m

So our closing balance for the first year is:Opening balance + interest instalment = 10.00 + 0.5 2.82 = £7.68m

So we can go on to fill in the rest of our table, as set out below:

____________________

Don’t Miss: Can You Use Fha Loan If You Already Own House

How To Calculate Interest On A Loan

One of the essential steps in any loan process is knowing and understanding the interest rate. Unfortunately, this can also be a very confusing step if youre not already familiar with how interest rates work. And we get it; calculating interest for a loan, credit card, or line of credit is overwhelming. Luckily, CreditNinja is here to help you figure out how to calculate interest on your loan.

Interest is just one aspect of a loan or financial product. There are so many things to keep track of when youre considering a new loan. For instance, you should be familiar with the length of the repayment period, the late fees, the processing and origination fees, and of course, the interest rate.

If youve never taken out a large loan before, all of these things can be overwhelming.

So its best to do plenty of research and prep beforehand. Learning everything you can about interest rates will help you in the long run. And it will help when youre talking to the lender and trying to negotiate a good deal.

Read on to learn more about interest rates, interest payments, and the annual percentage rate.

Car Loan Terms You Need Know

Before we get into it, here are a few terms you need to know:

- Interest rate: The cost of taking out a loan. This depends on the prevailing Base Rate, which can go up or down depending on how the economy is doing.

- Down payment: An upfront payment that youll need to make that covers part of the cost of the car. Youll typically need to pay a minimum of 10% or 20% .

- This refers to the proportion of the cars cost that the bank will lend to you.

- Loan period: This is the length of time that youll have to pay off your loan. Banks usually offer a loan period of up to nine years.

- Instalment: The payment you will need to make every month to clear your loan.

- Guarantor: A guarantor is someone who is legally bound to repay the loan if you are unable to.

Also Check: How To Cancel My Student Loan Debt

Interest Rates And Credit Scores

The interest rate that you receive will depend on several different factors:

The type of loan and lender youre using

The state of the economy

Inflation

The borrowers credit score/history

Most of these things are outside of your control as a borrower. But the one thing that you can control is your credit score. Having a good credit score will help you receive better interest rates, no matter which kind of loan youre applying for.

A lender would typically prefer to offer a loan to a borrower with a demonstrated history of sound financial practices. For example, if you consistently pay your bills on time, dont have a lot of debt, and manage your credit cards well, you probably have a good .

Having a good credit score makes you much more likely to get a reasonable interest rate on your loan.

However, keep in mind that a good credit history isnt the only thing that affects your interest rate. For example, if interest rates are high due to the economy or inflation, your will only do so much. But its still essential to maintain your credit score to get the best interest rate and lowest interest payments possible.