What Does Ltv Mean

Your loan to value ratio compares the size of your mortgage loan to the value of the home.;

For example: If your home is worth $200,000, and you have a mortgage for $180,000, your loan to value ratio is 90% because the loan makes up 90% of the total price.

You can also think about LTV in terms of your down payment.;

If you put 20% down, that means youre borrowing 80% of the homes value. So your loan to value ratio is 80%.;

LTV is one of the main numbers a lender looks at when deciding to approve you for a home purchase or refinance.;

What If Your Ltv Ratio Is High

If your LTV ratio is considered high, the underwriter at your lender may take other factors into consideration or adjust other things to minimize the risk in your loan. These include:

- High credit scores.

- Satisfactory mortgage history .

- Tax returns/transcripts to show steady employment history.

- W2 income, verified by pay stubs.

- Cash reserves.

Va Loan: Up To 100% Ltv Allowed

VA loans are guaranteed by the U.S. Department of Veterans Affairs.;

VA loan guidelines allow for 100 percent LTV, which means that no down payment is required for a VA loan.;

The catch is, VA mortgages are only available to certain home buyers, including:;

- Active-duty military service persons

- Members of the Selected Reserve or National Guard

- Cadets at the U.S. Military

- Air Force or Coast Guard Academy members

- Midshipman at the U.S. Naval Academy

- World War II merchant seamen

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Learn more about the benefits of 100% LTV VA financing here.;

You May Like: What Is The Current Sba Loan Interest Rate

What Is Loan To Value Ratio

Loan to value ratio or LTV denotes the percentage of a propertyâs actual price that can be obtained as a loan. It denotes the maximum amount of financing you are entitled to receive against the pledged property. The LTV ratio ranges between 40% and 75% for a loan against property. This ratio can vary depending on whether the pledged property is residential or commercial, and self-occupied, rented, or vacant.

LTV ratio calculation is strictly based on the propertyâs recent valuation report, which shall not be more than 3 months old. Otherwise, the property must be valued a new to that end. You can obtain an amount lower than what the loan to value ratio tells. Use a loan against property EMI calculator to determine the amount and tenure you are comfortable with to make an informed decision. Besides the highest loan amount eligibility, the LTV ratio is a measure of the perceived risk of lending.’

What Are The Prime Factors That Lenders Consider

Loan-to-value is just one element lenders look at when deciding whether an applicant will qualify for a loan. It is definitely among the most important, but other factors include:

-

Down payment. The bigger your down payment, the more attractive youll seem to a lender. It means it will take less risk in lending you the money to buy a home. Thats why loan-to-value plays such a major role in lending decisions.

-

Cash flow. The amount of money you have left over at the end of the month after paying your recurring debts and expenses is a key indicator of your ability to repay a mortgage.

-

Liquidity. Having money in the bank, in the form of savings or investments, lets the lender know that you can not only pay the closing costs required to complete a loan but have a cash cushion necessary for homeownership expenses, as well.

Don’t Miss: Can The Bank Loan You Money

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

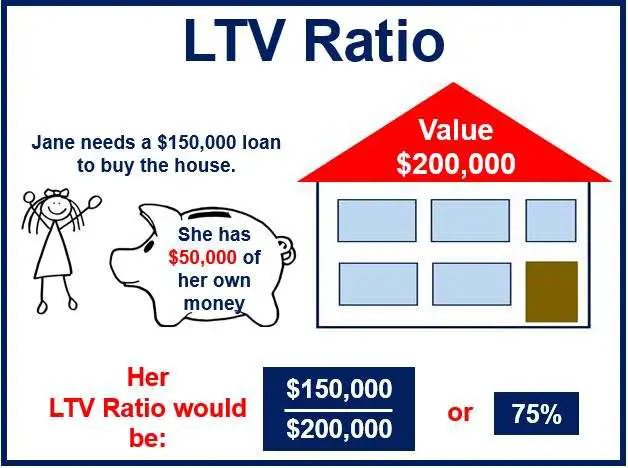

What Is Loan To Value

Loan to value is all about how much your mortgage borrowing is in relation to how much your property is worth. It’s a percentage figure that reflects the proportion of your property that is mortgaged, and the amount that is yours .

For example, if you have a mortgage of £150,000 on a house that’s worth £200,000, you have a loan-to-value of 75% therefore you have £50,000 as equity. Loan-to-value becomes a key consideration when you come to buy or sell your property, remortgage or release equity.

Read Also: How Many Times Can You Refinance An Auto Loan

Fha Loan: Up To 965% Ltv Allowed

FHA loans are insured by the Federal Housing Administration, an agency within the U.S. Department of Housing and Urban Development .;

FHA mortgage guidelines require a downpayment of at least 3.5 percent. Unlike VA and USDA loans, FHA loans are not limited by military background or location there are no special eligibility requirements.;

FHA loans can be an especially good fit for home buyers with less-than-perfect credit scores.

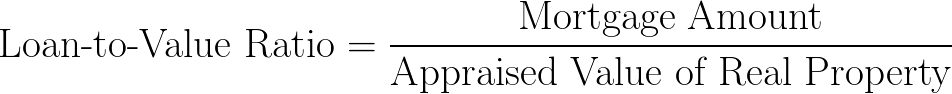

How To Calculate Ltv For Mortgage Loan

The LTV ratio for a mortgage loan is calculated by dividing the available loan quantum by the pledged propertyâs current value and then multiplying it by 100. It is expressed in percentage mostly. If the eligible loan amount is Rs.1 crore and the mortgaged propertyâs value is Rs.2 crore, the loan to value ratio is 50%. One may use a loan to value ratio calculator to compute the same.

This online calculator requires three inputs primarily to that end, namely, employment type, property type and its current market value. Select whether you are salaried or self-employed, if the property is commercial or residential, and then enter its latest value to check the loan amount for which you are eligible. Divide that sum by your propertyâs value and multiply it by 100 to calculate the loan to value ratio for a mortgage loan.

The sum differs based on whether the mortgaged property is a house or a commercial property. Depending on whether itâs self-occupied, rented, or vacant, a house fetches a high loan to value ratio compared to a commercial asset. The LTV ratio for a mortgage loan on a self-occupied property is significantly higher than one that is vacant or rented.

Also Check: Are Va Loan Interest Rates Lower

Why Ltv Is Important In Real Estate

LTV is important when you buy a home or refinance because it determines how risky your loan is.;

The more you borrow compared to your homes value, the riskier it is for lenders. Thats because if you default on the loan for some reason, they have more money on the line.;

Thats why all mortgages have a maximum LTV to qualify. The maximum loan to value can also be thought of as a minimum down payment.;

For example, the popular FHA loan program allows a down payment of just 3.5%. Thats the same as saying the program has a max LTV of 96.5% because if you make a 3.5% down payment, the most you can borrow is 96.5% of the home price.;

Does Loan To Value Affect Mortgage Interest Rates

Most mortgage lenders price their mortgages in LTV bands, and this allows them to offer lower mortgage rates for lower LTV mortgages. They do this because a lower LTV means there is more equity in the property.;Should house prices fall, there is the risk that the value of the property is less than the amount of the mortgage. If the lender needs to recover the mortgage debt by selling the property, they prefer to be more certain they can recover the full debt. For example, at 60% LTV, house prices have to drop by 40% before the lender will lose money compared to 90%, where a 10% drop would result in negative equity.

Read Also: What Are Assets For Home Loan

Fannie Mae And Freddie Mac

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. However, they require mortgage insurance until the ratio falls to 80%.

For FHA, VA, and USDA loans, there are streamline refinancing options available. These waive appraisal requirements so the home’s LTV ratio doesn’t affect the loan. For borrowers with an LTV ratio over 100%also known as being “underwater” or “upside down”Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance are also available options.

Does The Ltv Vary As Per The Type Of Property

The loan to value ratio is generally higher for a residential property than it is for a commercial property. On average, can expect the LTV ratio to be around 10% higher for residential spaces. However, certain industrial properties can also fetch a high LTV. Moreover, the LTV ratio depends on occupancy status as well. Occupied premises tend to yield higher loan amounts than rented or vacant ones, irrespective of whether its a residential or commercial property.

Recommended Reading: Who Do I Talk To About An Fha Loan

Higher Ltv Means Missing Out On The Best Deals

There is no doubt that financial loan grant companies prefer customers who pay a large percentage as down payment. When the down payment amount is high, it would be hard to get the best deals on the table. Loan giving companies review the application thoroughly before the loan amount is disbursed. People who have 75 to 80 per cent LTV get the least attractive deals. Hence, it is always encouraged to pay a higher percentage as down payment so that you can get your hands on the best offers.

How To Use The Loan To Value Calculator

Enter the principal amount and property value into the fields and click on calculate in a LTV calculator. For instance, if the loan amount is Rs.1 crore and the property value is worth Rs. 2.5 crore, then enter these figures into the appropriate fields. Click on Calculate to know the maximum LTV ratio of the loan, which in this case comes to 40%.

You May Like: What Car Loan Can I Afford Calculator

How Ltv Affects Your Ability To Get A Home Loan

In order to get approved for a home loan, its generally good to plan to make a down payment of at least 20% of the homes valuethis would create an LTV of 80% or less. If your LTV exceeds 80%, your loan may not be approved, or you may need to purchase mortgage insurance in order to get approved.

LTV is also important because, if youre buying a home and the appraised value of the home turns out to be substantially lower than the purchase price, you may need to make a larger down payment so that your LTV doesnt exceed limits set by your lender.

If you already own a home and are thinking about taking out a home equity line of credit , most lenders will let you borrow up to 90% of your homes value, when combined with your existing mortgage. If the value of your home has fallen since you purchased it, you may not even be able to get a home equity loan;or HELOC.

Lets say you own a home that you bought five years ago and is worth $100,000. If you have a mortgage with an outstanding balance of $65,000, that means that your current LTV is 65%. If your credit is good and you qualify for additional financing, you may be able to borrow up to an additional $25,000 through a HELOC, bringing your total LTV up to 90%.

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how big your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a one million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Don’t Miss: Is Student Loan Refinancing Worth It

What Does High And Low Loan To Value Mean

If you are interested in getting the right loan deals to buy a house, simply knowing the basic definition of LTV is not enough. It is important to know about the impact of LTV ratio. Does a high LTV value help you getting the correct deals? Do you need to emphasize on reducing the LTV value? The LTV value would obviously depend on the mortgage payment made and the appraised value of the property. These two constituents are used in the formula to determine the LTV value.

Let us go into further depth of high and low LTV

How To Work Out Ltv

The easiest way to work out your loan to value ratio is to take away your deposit amount from the value of the house, then work out the difference as a percentage.

For example, if your house is valued at £250,000 and you have a deposit of £50,000, you would need a mortgage of £200,000.

To calculate your LTV ratio:

200,000 ÷ 250,000 = 0.8

This gives you an 80% loan to value ratio

The larger your deposit, the lower your LTV. Think about how much you can afford upfront before applying for a mortgage.;

Read Also: When To Take Home Equity Loan

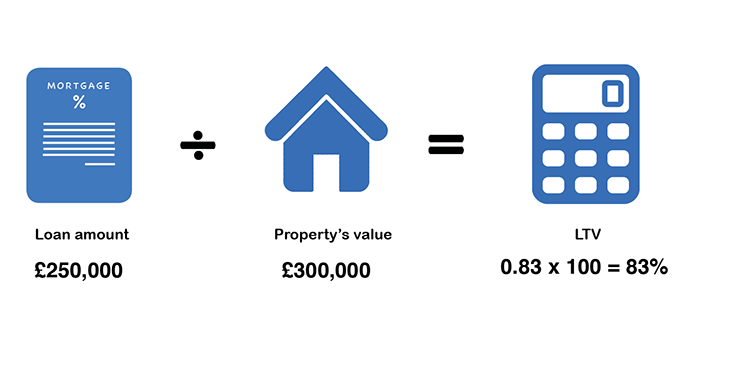

Loan To Value Example

Mr John wants to buy a new house and has applied for a mortgage at a bank. The bank needs to perform its risk analysis by determining the loan to value of the loan. An appraiser of the new house shows that the house is worth $300,000 and Mr John has agreed to make a down payment of $50,000 for the new house. What is the loan to value ratio?

- Loan amount: $300,000 $50,000 = $250,000

- Value of asset: $300,000

Using our formula we can substitute;the values for the variables in the equation:

$$LTV = \dfrac000}000} = 0.83333$$

For this example, the loan to value amount is 0.83333. However, you would express the ratio in percentage by multiplying by 100. So the loan to value amount would be;83.33%. The loan to value ratio is above 80%, so analysts would consider it high.

Consider another scenario where the owner of the new house Mr John wants to buy is willing to sell the house at a price lower than the appraised value, say $280,000. This means that if Mr John still makes his down payment of $50,000, he will need only $230,000 to purchase the house. So his mortgage loan will now be $230,000.

Let us calculate the loan to value of the new loan application.

- Loan amount;= $230,000

- Value of house;= $300,000

$$LTV = \dfrac000}000} = 0.7667$$

Ltv And Its Calculation

To start with, lets us go through the definition of LTV. When a financial organization gets loan applications, it does not approve or reject them immediately. Financial organizations and loan giving firms execute complex financial procedures to check the chances of application approval. In simple terms, LTV defines the risk percentage of lending the amount of money. On a maximum scale, the LTV ratio should be 80 per cent. Financial companies mostly do not approve loan requests that have an LTV of more than 80 per cent.

Recommended Reading: How Much Does My Loan Cost

What Is The Ltv Ratio Used For

LTV ratios are important when it comes to getting a mortgage. Generally, the lower the ratio, the lower the risk you present to your lender.

Lower LTV ratios often qualify for cheaper interest rates. Generally, a loan of 80% or less is recommended, as borrowing more leads to more fees and charges and the possibility of higher interest rates.

If you have an LTV ratio above 80%, which means you put less than 20% down, youll likely need to take out private mortgage insurance .

Less Down Payment Increases Ltv

If you are purchasing a property and you want financial assistance for it, get a complete understanding of this formula. Mortgage payment is the difference between appraised value and down payment. In other words, it highlights the amount taken as loan. The higher the Mortgage Payment, the higher will be the LTV. It is obvious that when the LTV is high, it points to the fact that you have more financial burden on your head.

Read Also: How To Pay Down Student Loan Debt

What Is A Loan

A loan-to-value ratio basically measures the loan amount against the value of the asset being purchased with the loan. The loan balance is divided by the value of the asset to calculate the loan-to-value ratio.

A higher LTV ratio means that you need a higher loan amount to pay for the purchase of the asset. Over time, your LTV will decrease as you continue making loan payments and as the assets value appreciates.

Do you know what the true cost of borrowing is? Find out here.

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Recommended Reading: How Much Loan Can I Get With 800 Credit Score