Can You Combine Other Loans Into Your Student Loans During Refinancing

If you have Federal loans, you can combine them with private loans during the refinancing process. However, if you choose to do this, you will lose any benefits that came with the Federal loan like income-driven repayment plans. You can also choose to combine your loans with your mortgage. By doing this, you would be refinancing your mortgage with a new loan or additional home equity. You would use this money to pay off any student loan debt that you have left.

Pros of Rolling Your Student Loans into Your Mortgage

- Deduction. Your mortgage payment and your student loans are both tax deductible. However, you may not qualify to deduct your student loan payments each year. You will have no problem qualifying and deducting your new mortgage payment on your taxes.

- Lower Interest Rate. The interest rate on a 15-year fixed mortgage is right around 3.32%, and your student loan interest rate is around 4.29%.

- Reduce the Number of Monthly Payments. Your two biggest payments each month are usually your mortgage and your student loans. This process combines them both into one payment.

Cons of Rolling Your Student Loans into Your Mortgage

If You Have A Postgraduate Loan And A Plan 1 Plan 2 Or Plan 4 Loan

You pay back 6% of your income over the Postgraduate Loan threshold . In addition, youll pay back 9% of your income over the Plan 1, Plan 2 or Plan 4 threshold.

Example

You have a Postgraduate Loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 2 threshold of £2,274.

Your income is £650 over the Postgraduate Loan threshold and £126 over the Plan 2 threshold .

You will pay back £39 to your Postgraduate Loan and £11 to your Plan 2 loan. So your total monthly repayment will be £50.

Example

You have a Postgraduate Loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 1 threshold of £1,657.

Your income is £650 over the Postgraduate Loan threshold and £743 over the Plan 1 threshold .

You will pay back £39 to your Postgraduate Loan and £66 to your Plan 1 loan. So your total monthly repayment will be £105.

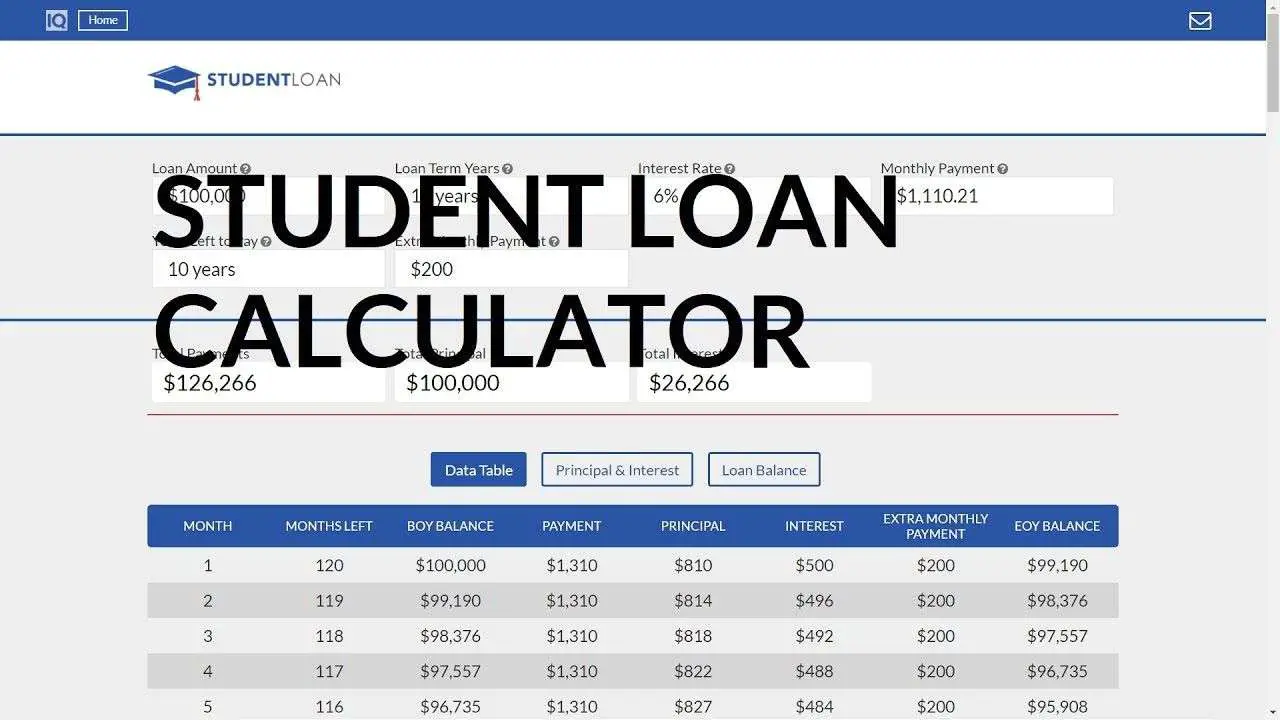

How To Use The Student Loan Payment Calculator

As the first step, you need to choose the available data you have for the calculation.

- Remaining or original loan term – requires the monthly payment with the final payoff date

- Monthly payment – requires the precise date of payoff or

- Desired payoff date – requires your monthly payment.

After this, you need to set the values in the student loan specification.

- Existing loan balance on a given date

- Payback period – the original or the remaining time given for the loan repayment

- Interest rate – annual rate of interest and

- Interest capitalization – the regularity with which the accrued interest is added to the loan principal.

Finally, in the extra payment section, you can specify any additional payments.

- Extra monthly payment from a given date and

- One-time extra payment on a particular day.

After setting the above parameters, you will receive the payment summary immediately, along with two charts and a table.

- Payment summary – you can read the details of your loan, including a comparison with the extra payment schedule

- Balances – you can follow the progress of the payable loan amount and the charged interest

- Loan breakdown in percentage – gives you a visual representation of how the interest expenses related to the loan amount and

- Repayment schedules – you can check the monthly and the yearly amortization schedule.

Read Also: What Is Fha And Conventional Loan

How Student Loan Interest Works

When you take out a student loan, you agree to pay back the loan, plus interest. Your interest rate is the cost of borrowing the money. There are 2 types of rates:

- Fixed interest rates stay the same over the life of the loan.

- Variable interest rates change with the financial markets . Variable rates may seem great at first but can end up costing a lot more over the life of a loan.

If You Enroll In Repaye As A Public Defender

If you begin earning $58,000 as a public defender, your monthly payments in REPAYE will start at $327 and gradually rise to $557 as your salary increases. Over the life of your loan, your payments will average $442 a month, assuming you qualify for more than $170,000 in Public Service Loan Forgiveness.

You May Like: Does Va Loan Work For Manufactured Homes

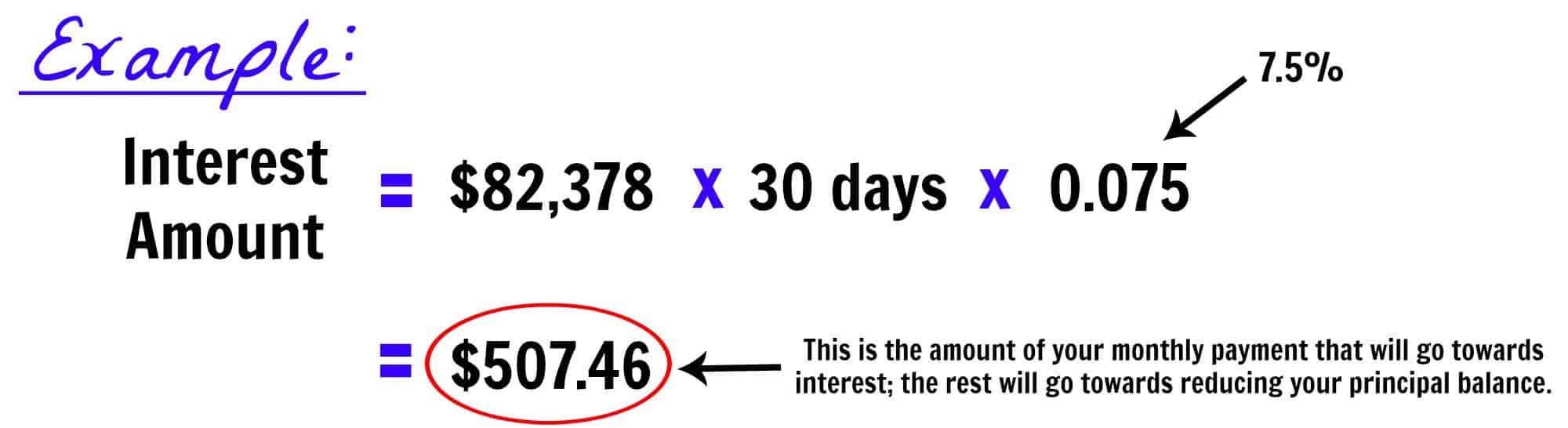

Simple Vs Compound Interest

The calculation above shows how to figure out interest payments based on whats known as a simple daily interest formula this is the way the U.S. Department of Education does it on federal student loans. With this method, you pay interest as a percentage of the principal balance only.

However, some private loans use compound interest, which means that the daily interest isnt being multiplied by the principal amount at the beginning of the billing cycleits being multiplied by the outstanding principal plus any unpaid interest that’s accrued.

So on Day 2 of the billing cycle, youre not applying the daily interest rate0.000137, in our caseto the $10,000 of principal with which you started the month. Youre multiplying the daily rate by the principal and the amount of interest that accrued the previous day: $1.37. It works out well for the banks because, as you can imagine, theyre collecting more interest when they compound it this way.

The above calculator also assumes a fixed interest over the life of the loan, which youd have with a federal loan. However, some private loans come with variable rates, which can go up or down based on market conditions. To determine your monthly interest payment for a given month, youd have to use the current rate youre being charged on the loan.

Repaying Your Student Loan

Student loans must be paid back. Many students have two loans that need to be managed separately. Heres what to expect after you leave school.

On this page:

Most students leave school with an Alberta student loan and a Canada student loan.

Having two loans means you need to handle twodebts and two payment schedules.

Your Alberta loan is managed through MyLoan and your Canada loan is managed through the National Student Loans Service Centre Online Services. You must create individual accounts through these websites and handle your repayments separately.

This is what the lifecycle of student loans looks like:

|

While youre a student |

Loans are interest-free and you dont need to make payments. |

|

Grace period The first 6 months after you leave school, beginning the first day of the month after your end date |

Loans are interest-free, and you dont need to make payments. |

|

Repayment Begins 6 months after you leave school |

Interest is added to your loan balance monthly. |

|

Repayment begins. A monthly repayment schedule is set up for you automatically. |

Don’t Miss: Transferring An Auto Loan

Estimate Your Monthly Payments

The interest rates on your first payment date are used to figure out the monthly payment for your loan .

If interest rates change, your monthly payment stays the same. However, the amount applied to your loan balance will change.

With your account, you can:

Pay Private Student Loans First

Private student loans come from commercial lenders, not the federal government. These loans generally have fewer repayment options or opportunities for forgiveness than federal loans and higher interest rates.

Youll likely want to get any private loans off your plate first. Consider doing the following to help with this:

-

Pay the minimum on federal loans. If youre going to make extra student loan payments, put them toward your private loans. To increase the amount you can overpay, consider enrolling in an income-driven repayment plan to decrease your federal loan bills. More interest will accrue on those loans if you do that, so calculate your total costs.

Always pay at least the minimum on all your student loans.

Read Also: How To Apply Loan In Sss

Lowering Your Student Loan Interest Rate

If thinking about your daily interest is giving you the heebie-jeebies, student loan refinancing may help you decrease your interest rate. Lowering your interest rate can lead to paying less in interest over the life of your loan .

Lets go back to our example from above. If you have a $20,000 loan with a 7% interest rate, youre accruing $3.80 in interest costs per day. If you have a $20,000 loan with a 5% interest rate, however, you would accrue only $2.74 per day. While the difference between $3.80 and $2.80 might not seem like much, you can really see the savings when you look at how interest accrues monthly.

A $20,000 loan with a 7% interest rate might accrue $114 in interest every month. A $20,000 loan with a 5% interest rate, however, might only accrue $82 in interest every month. Over a year, that could add up to $384 in savings. Yup, an interest rate that is only lower by a percent or two can save you serious cash over the life of your loan.

So how does student loan refinancing actually work? When you refinance your student loans, a lender offers you a new private loan to replace your existing student loans.

Your new refinanced loan will hopefully offer you a better interest rate than the current rate on your student loans. Learning how to calculate student loan interest can help you see exactly how much you might save by securing a lower interest rate on your student loans by refinancing.

Learn more about refinancing your loans with SoFi today!

What Is A 1098

OVERVIEW

If you’re currently paying off a student loan, you may get Form 1098-E in the mail from each of your lenders. Your lenders have to report how much interest you pay annually. Student loan interest can be deductible on federal tax returns, but receiving a 1098-E doesn’t always mean you’re eligible to take the deduction.

Read Also: Arvest Construction Loan

Claiming Student Loan Interest On Your Tax Return

The Canada Revenue Agency recognizes that repaying student loans can be financially difficult in some cases. To help offset some of that burden, the CRA offers a deduction for qualifying student loan interest payments.

There are a lot of variables, but TurboTax Online can help walk you through step by step to figure this out. If you feel a bit overwhelmed understanding deductions like this, consider TurboTax Live Assist & Review and get unlimited help and advice as you do your taxes, plus a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

If You Declare Bankruptcy

If you declare bankruptcy, you still have to pay your OSAP loan. This means you must continue to make a regular monthly payment.

Apply to the Repayment Assistance Plan if you cant make these monthly payments.

If youve been out of studies for more than five years, you can ask a bankruptcy court to have your OSAP loan included in your discharge. Contact your bankruptcy trustee for help.

Recommended Reading: Does Va Loan Work For Manufactured Homes

When Box 2 Is Checked

If Box 2 of Form 1098-E is checked, it means that the amount reported in Box 1 doesn’t include the loan’s origination fees and/or any capitalized interest. Only loans you took out before September 1, 2004, however, should have box 2 checked.

An origination fee is typically a percentage of your loan that’s withheld from the disbursed funds. You can include a portion of this fee as deductible interest. Dividing the origination fee by the number of years you have to pay off the loan gives you the amount you can treat as student loan interest each year. And if the lender capitalized for unpaid accrued interest, you calculate the portion that’s deductible each year in the same way as the origination fee.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

Youll be making payments to the National Student Loans Service Centre , not to OSAP.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

Don’t Miss: Does Collateral Have To Equal Loan Amount

Understanding The Impact Of Student Loans On Income Taxes

Do you have student loan debt? If you do, you’re not alone. The currently student loan debt is a staggering $1.4 trillion, and this amount is spread over 44 million borrowers. This amounts to roughly 70% of all college students, and this number is continuing to grow as students try to afford the ever increasing cost of their tuition. This article will go over how to get tax deductions on your student loans, along with the relative cost of the different schools. We will also talk about refinancing options that are available.

Estimate Your Student Loan Payment

Estimate your student loan payments under a standard repayment plan using the calculator below.

- This is only an estimate! Your actual payment amount is determined by your loan holder based on the amount that you borrowed. However, most student loan programs require at least a $50 payment each month, no matter how small your loan amount.

- Your interest rate depends on your loan type and when you received the loan. for a chart with Direct Loan interest rates.

- The calculator is preset to 120 months and an interest rate of 6.8 percent. You may adjust these.

- It is recommended that your student loan payment be less than 8 percent of your gross income. The minimum salary field is based on this recommendation.

- If you have not made payments while in school or during your grace period, you may have capitalized interest Accrued interest that is added to the principal of your loan that will be added to the principal amount of your loan. This amount should be included in the principal amount in the calculator below in order to give a more accurate estimate of the loan repayment information.

Enter your Principal Amount of Loan, Simple Interest Rate, and Number of Monthly Payments.

Recommended Reading: How To Get Loan Originator License

Average Graduate School Student Loan Payment

- Standard repayment plan $723

- Graduated repayment plan $824

- REPAYE $613

The average grad school debt is $84,300. But that number skews high because it includes costlier professional degrees in fields like law and medicine. So lets look at what monthly loan payment you might expect if you earned a masters degree and took on the typical level of debt for that degree .

Graduate students not only take on more debt, but typically pay higher interest rates. In addition to $29,000 in federal direct loans for undergraduates at 4.79% interest, lets say you have $37,000 in federal direct loans at 6.36%. Thats a weighted average of 5.7%.

| Repayment plan | |

|---|---|

| 10 years | $83,640 |

| Monthly payments for $29,000 in undergraduate and $37,000 in graduate school debt at weighted average interest rate of 5.7%. REPAYE assumes starting salary of $62,491, the median for younger workers with master’s degrees. |

How Much Interest Is Deductible

Regardless of how much interest you paid, the maximum you can deduct is $2,500. If you’re eligible to deduct student loan interest, your deductible amount goes on Schedule 1 as an adjustment to income. Your 1098-E forms will provide the amounts reported but you can also add student loan interest payments you made that aren’t reported on Form 1098-E to this total as long as the interest is paid on a qualified loan.

Also Check: Manufactured Homes Va Loans

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your 6-month grace period.

You will be charged interest on the Ontario portion of your loan during your 6-month grace period. This interest will be added to your loan balance .

Interest Accrues Even During Periods Of Non

Most student loans, especially federal student loans, dont require payments while the student is enrolled in school on at least a half-time basis and during a grace period after enrollment ends.

However, interest starts accruing for many loans as soon as the money is disbursed, even before you begin making payments.

Interest continues to accrue on a student loan even when the student loan borrower isnt making payments on the loan. So, if the student loan borrower is in a deferment or forbearance interest can still rack up.

Interest continues to be charged even under income-driven repayment plans if you have an eligible loan in that program. Likewise, if the borrower is late with a payment or in default, interest will continue to be charged.

You May Like: Becu Car Loans