Should I Use An Auto Loan Calculator

Yes, its always a good idea to use an auto loan calculator before you start shopping. This lets you see how much you can reasonably afford, better prepares you to negotiate at a car lot or dealership, and helps you understand whats the best auto loan for you.

You can also play around with the numbers by changing the variables to see how they affect the monthly payment, total interest, and total paid. For example, try plugging in a shorter loan term to see if you can afford the payments and if youd pay less overall.

Where Can I Get An Auto Loan

Several types of lenders make auto loans, including car dealers, major national banks, community banks, credit unions and online lenders. You may get a particularly good deal from a lender you already have an account with, so check their rates first. Compare auto loan rates across multiple lenders to ensure you get the lowest APR possible.

How To Calculate Auto Loan Interest For The Coming Months

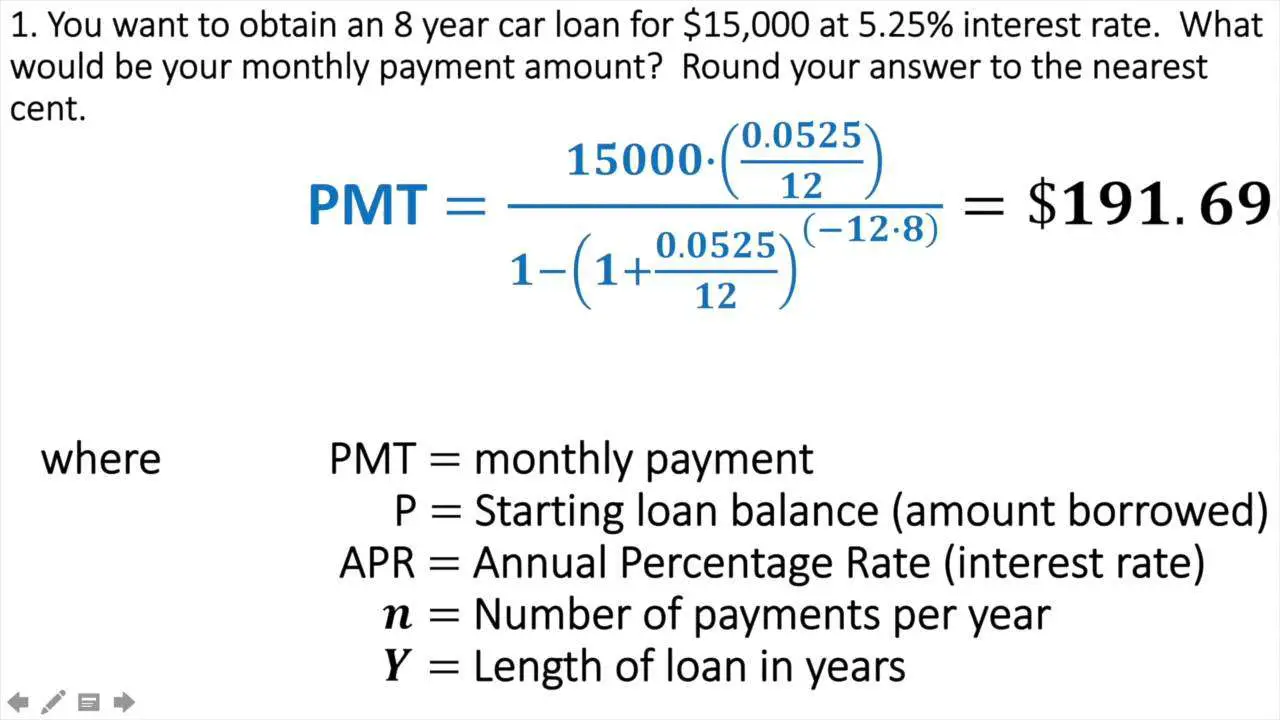

To calculate future auto loan interest payments, you will need a different calculation:

- Subtract the interest from your current debt. The amount left is what you owe towards your loan principal.

- Deduct the above amount from your original principal to get your new loan balance.

The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline it may not be the same amount you receive.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How To Use The Car Loan Calculator

Heres a guide for the information you will need to input into the car loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, plus the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 339,242 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Don’t Miss: Usaa Credit Score

Calculate Your Monthly Estimated Payment

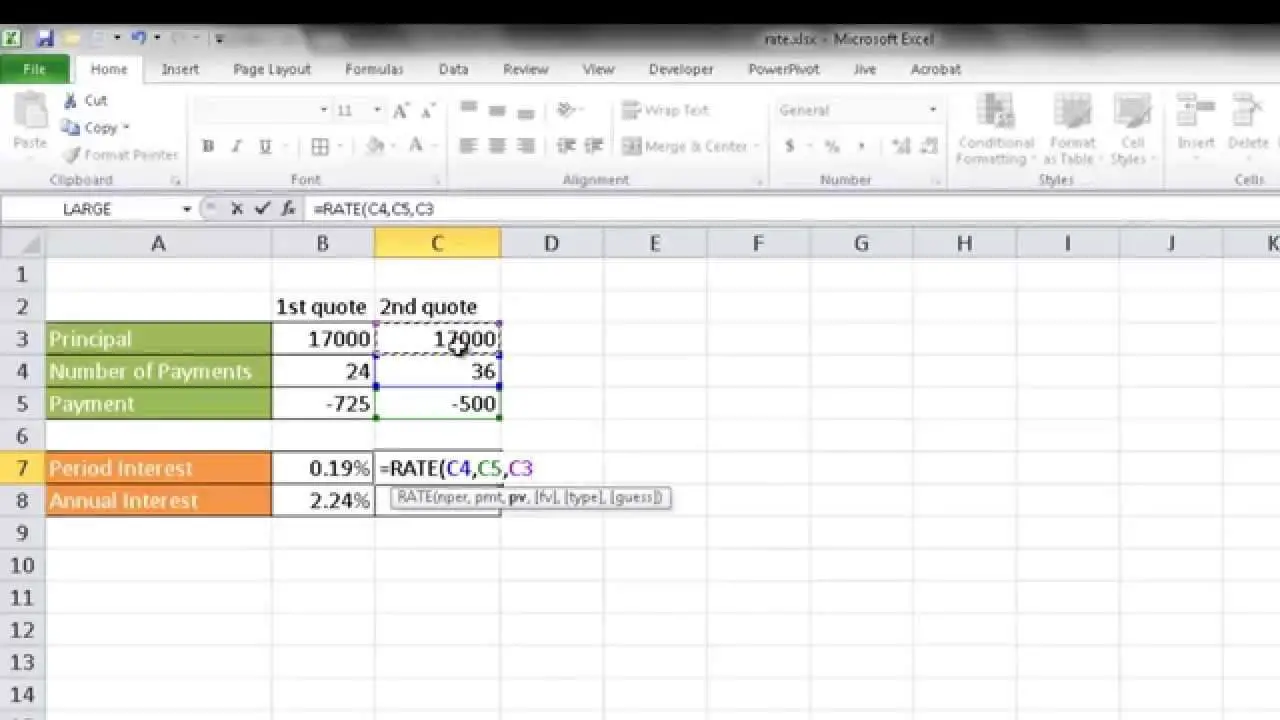

If you already know your estimated monthly loan payment, you can skip this step. If you dont, you can easily estimate your monthly car payment on a spreadsheet by typing the formula below into a cell.

=PMT

The result is your estimated monthly payment. It will be a negative number, but dont worry. You didnt make a mistake. Keep this number handy for calculating your APR.

Lets say you want to finance $13,000 with a loan term of 60 months and an interest rate of 4%. Heres what your formula would look like with those numbers plugged in.

=PMT

Using this example, your spreadsheet would calculate your monthly payment to be $239.41.

How To Figure Interest On A Car Loan For The Future

After you begin to pay down your initial principal, you will then be required to determine your new balance to see what you will be paying going forward. Here is how you can calculate these payments:

Errors in the calculation and the fact that the numbers are rounded will cause you to not have an exact calculation each time, but it does give you a good idea on how to calculate the interest rate on a car loan.

Also Check: 20/4/10 Car Calculator

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

Why Finance Through Becu

Financing is subject to BECU membership, credit approval, and other underwriting criteria not every applicant will qualify.

AutoSMART services are provided by Credit Union Direct Lending and is not affiliated with BECU. BECU specifically disclaims all warranties with regard to dealers’ products and services. Dealer fees apply. BECU loan financing subject to credit and underwriting approval, and may change without notice.

*APR based on borrower’s credit history, 48-month or less repayment term, collateral two years old or newer with up to 90% loan-to-value , and based on wholesale Kelley Blue Book or dealer invoice. Loans with repayment terms that exceed 48 months, 90% LTV, involve lesser applicant creditworthiness, or collateral older than two years are subject to higher APRs and lower loan amounts. Certain conditions apply. The specific amount of the loan shall be based on the approved value of the collateral. Final loan approval is subject to funding review by BECU. Actual rate may be higher. Financing is subject to BECU credit approval and other underwriting criteria not every applicant will qualify. Applicants must open and maintain BECU membership to obtain a loan. Payment Example: $356.20 a month based on a five year, $20,000 loan at 2.64% APR.

*This is a summary of BECU auto loan program. Loans and BECU financing program subject to BECU credit and underwriting approval.

Also Check: Usaa Auto Loan Application

Can I Get An Auto Loan With Bad Credit

Bad credit auto loans are very common. In fact, there are lenders that specifically cater to borrowers with poor credit. Creditors can give bad credit auto loans to consumers with lower risk than bad credit personal loans because the car could just be repossessed if the borrower doesnt pay.

Unfortunately, many auto loan lenders charge unreasonably high interest rates and tack on additional fees for bad credit loans. Make sure the interest rate on your loan is fair and that the monthly payments are affordable or you risk losing the vehicle and further damaging your credit.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is The Commitment Fee On Mortgage Loan

What Are Some Examples Of Simple Interest

Hear this out loudPauseCar loans, amortized monthly, and retailer installment loans, also calculated monthly, are examples of simple interest as the loan balance dips with each monthly payment, so does the interest. Certificates of deposit pay a specific amount in interest on a set date, representing simple interest.

Understand The 5 Cs Of Credit Before Applying For A Loan

The five Cs of credit offer lenders a framework to evaluate a loan applicants creditworthinesshow worthy they are to receive new credit. By considering a borrowers character, capacity to make payments, economic conditions and available capital and collateral, lenders can better understand the risk a borrower poses.

Recommended Reading: Does Va Loan Work For Manufactured Homes

A Few Additional Tips About Using The Car Loan Calculator

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the calculator’s total amount paid result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

How Does Interest Work On A Car Loan

Interest on a car loan generally accrues every day based on the principal balance or amount you borrow. As you make loan payments, part of your payment amount goes toward principal and part of it goes toward paying accrued interest.

The higher your interest rate, obviously, the more total interest youll pay but the length of your loan also affects your car loan payment. If you choose a loan with a longer repayment term, youll have lower monthly payments because of the longer repayment timeline. If you opt for a loan with a shorter term, your monthly payments will be higher, but youll pay less interest over the life of your loan.

Say, for example, you borrow $20,000 using a loan with a 5% interest rate and 48-month loan term. In that scenario, your monthly payments will be around $461. But if you take 60 months to repay your loan with the same interest rate, your monthly payment will be just $377 at the same interest rate for the same vehicle.

Don’t Miss: How To Transfer Car Loan To Another Person

Car Loan Terms You Need Know

Before we get into it, here are a few terms you need to know:

- Interest rate: The cost of taking out a loan. This depends on the prevailing Base Rate, which can go up or down depending on how the economy is doing.

- Down payment: An upfront payment that youll need to make that covers part of the cost of the car. Youll typically need to pay a minimum of 10% or 20% .

- This refers to the proportion of the cars cost that the bank will lend to you.

- Loan period: This is the length of time that youll have to pay off your loan. Banks usually offer a loan period of up to nine years.

- Instalment: The payment you will need to make every month to clear your loan.

- Guarantor: A guarantor is someone who is legally bound to repay the loan if you are unable to.

Which Loan Is Easiest To Qualify For

Secured loans are typically the easiest loans to qualify for. Because lenders require something of valuecollateralto back the loan, it reduces the risk an applicant poses to the lender, which allows the lender to offer flexible qualification requirements. Unsecured loans, like most personal loans, typically require more stringent qualification requirements, including minimum credit scores of 670.

Read Also: How To Refinance An Avant Loan

Home Equity Line Of Credit

A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan. The interest rate is usually variable and tied to an index such as the prime rate. Our home equity calculators can answer a variety of questions, such as: Should you borrow from home equity? If so, how much could you borrow? Are you better off taking out a lump-sum equity loan or a HELOC? How long will it take to repay the loan?

How And When Do I Pay Car Loan Interest

Lets say you take out a car loan for $12,000 to be paid back over five years at an interest rate of 10%. Your monthly payments for this loan would be $254.96. You can calculate the payment yourself using the following equation:

It is a common belief that over the 60 months of such a loan that the borrower would pay down the loan principal evenly as the graph below shows.

The above graph incorrectly depicts the loan being paid down by $200 per month until the balance reaches $0. This graph would imply that for each payment $54.96 goes towards paying interest, because $254.96 minus $200 is $54.96. Car loan interest does not work this way.

The correct payoff graph actually looks like the following.

Notice how the payoff curve is bowed so that it is less steep at the beginning of the loan than at the end. The reason that car loans behave this way is that monthly payments at the beginning of a car loan include more interest charge than the payments at the end of a car loan. Lets look more closely at why car loans work this way.

For the second months payment, you will pay a slightly smaller interest charge, because the first months payment will have paid down the principal by $154.96. So, the second payment will include $98.71 of interest charge , and will pay down the principal by $156.26 .

Read Also: Refinance Avant

Controllable Factors That Determine Interest Rate

While many factors that affect the interest rate are uncontrollable, individuals can, to some degree, affect the interest rates they receive.

Individual Credit Standing

In the U.S., credit scores and credit reports exist to provide information about each borrower so that lenders can assess risk. A credit score is a number between 300 and 850 that represents a borrower’s creditworthiness the higher, the better. Good credit scores are built over time through timely payments, low credit utilization, and many other factors. Credit scores drop when payments are missed or late, credit utilization is high, total debt is high, and bankruptcies are involved. The average credit score in the U.S. is around 700.

The higher a borrower’s credit score, the more favorable the interest rate they may receive. Anything higher than 750 is considered excellent and will receive the best interest rates. From the perspective of a lender, they are more hesitant to lend to borrowers with low credit scores and/or a history of bankruptcy and missed credit card payments than they would be to borrowers with clean histories of timely mortgage and auto payments. As a result, they will either reject the lending application or charge higher rates to protect themselves from the likelihood that higher-risk borrowers default. For example, a credit card issuer can raise the interest rate on an individual’s credit card if they start missing many payments.

How to Receive Better Interest Rates