Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into because it might be cheaper than the closing costs on a refinance.

How To Interpret The Results

The calculator shows two sets of results:

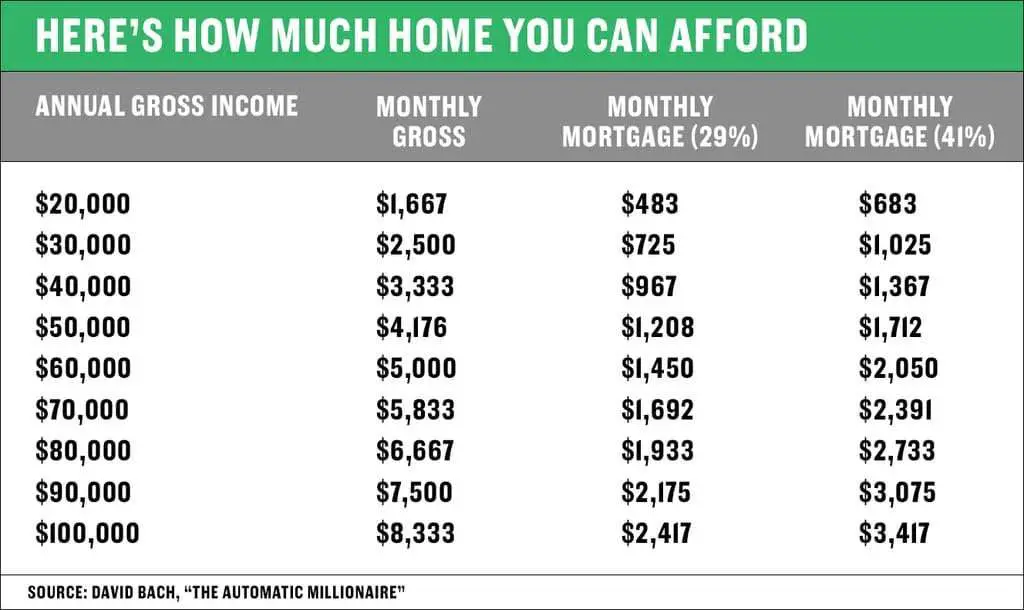

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

Read Also: How To Get Loan Originator License

Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

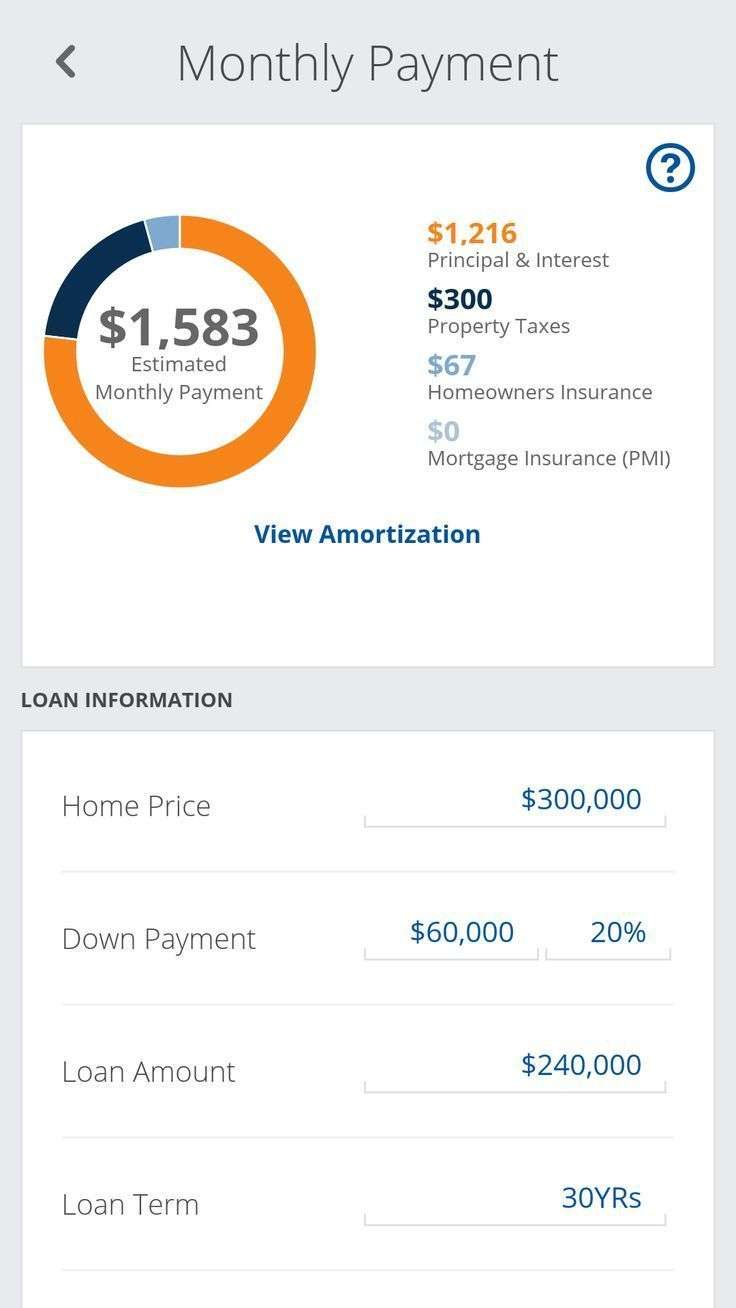

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some people opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

Recommended Reading: How Much Do Loan Officers Make Per Loan

Why You Should Wait To Buy A Home

Along the same lines of thinking, you might consider holding off on buying the house.

The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan.

In the case of a 30-year mortgage the loanâs interest can add up to three or four times the listed price of the house . For the first 10 years of a 30-year mortgage, you could be paying almost solely on the interest and hardly making a dent in the principal on your loan.

Thatâs why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment .

If you can afford a 15-year mortgage rather than a 30-year mortgage, your monthly payments will be higher, but your overall cost will be drastically lower because you wonât be paying nearly so much interest.

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how big your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a one million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

You May Like: Va Loan For Modular Home And Land

Home Equity Loan Calculator

Back to Blog

Home equity loan calculator | how much do I qualify for? Consider using the equity in your home to consolidate debts, complete renos and more. You can leverage the equity in your home to borrow money to pay for significant expenses or consolidate debts by getting a home equity loan.

Equity in your home is calculated by dividing the appraised value of your home by the balance of your mortgage. Using a home equity calculator can help determine how much equity you have.

Home Loan Eligibility Criteria

Don’t Miss: Usaa Car Loans Reviews

How To Calculate Your Mortgage Amount Based On Monthly Payments

If you want a mortgage loan, you’ll have to prove you can pay it back. Lenders typically check your income, employment, debts and credit history–including past bankruptcies or foreclosures–before they agree to write a mortgage they’ll also want the house appraised to be certain that it’s good collateral for the loan. One of the steps in qualifying for a loan is deciding how high a PITI payment– principal and interest on the mortgage, plus taxes and insurance–you’ll be able to pay each month.

1

Calculate your maximum monthly PITI payment. The general rule, according to the Investopedia website, is that PITI should be no more than 28 percent of your monthly income, though some lenders will go higher. Your total debts, including PITI, plus car loans, student loans and credit-card payments, should be no more than 36 percent. If your gross annual income is, for example, $84,000, divide by 12 to get your monthly income of $7,000. Your maximum PITI would be $1,960 your total debt-to-income ratio would be $2,520.

2

Subtract taxes and insurance from your monthly PITI payment. If you’re thinking of buying a $150,000 house, your real estate agent or local government can help you figure out the taxes an insurance agent can give you a rough quote on homeowners insurance premiums. If you have a PITI of $1,960 and insurance and taxes equal around $400, that leaves you with $1,560 a month for paying interest and principal.

3

4

References

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Recommended Reading: How To Get Loan Without Proof Of Income

What Are My Options If The Result Is Less Than I Need

In this case, you may find that adjusting the loan term enables you to meet your requirements. Although it will mean repaying more in total over the course of your loan, the lower monthly repayments could help you to afford more than your initial result suggests.

Alternatively, you can experiment with different interest rates to get the best options delivered directly to you, click the Get the FREE Quote button to get in touch with lenders who will be able to assist you.

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

You May Like: Does Va Loan Work For Manufactured Homes

How We Calculate Home Affordability

The first step is figuring out what you can actually afford. You want to look for the perfect backyard and kitchen, but you should also understand what your monthly mortgage payments, property taxes, and home expenses will look like.

Our calculator takes into account your income, debts , and the savings you have for the down payment.

Still, even if your monthly payments are consistent, you need to consider your overall savings and how much you can set aside for emergencies. Your down payment and monthly expenses shouldn’t empty your entire bank account. Make sure you have a healthy reserve in liquid assets for life events you can’t plan.

Jumbo Loan: 10 Percent

Jumbo loans are a specific type of conventional loan that dont conform to Fannie Mae and Freddie Mac standards for loan amounts. In 2021, that means any conventional loan not backed by a government agency that exceeds $548,250 though high-cost areas have higher limits. Jumbo loans typically require 10 percent down or more.

You May Like: Which Bank Is Best For Construction Loan

How Much House Can You Afford

| Monthly Pre-Tax Income | |

|---|---|

| $3,000 | $523,000 |

The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results. Since interest rates vary over time, you may see different results.

In practice that means that for every pre-tax dollar you earn each month, you should dedicate no more than 36 cents to paying off your mortgage, student loans, credit card debt and so on. This percentage also known as your debt-to-income ratio, or DTI. You can find yours by dividing your total monthly debt by your monthly pre-tax income.

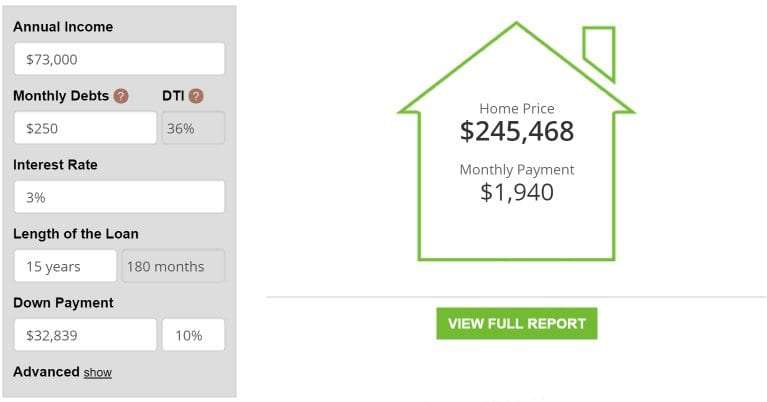

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Also Check: Usaa Auto Loan Application

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

What Factors Help Determine ‘how Much House Can I Afford’

Key factors in calculating affordability are 1) your monthly income 2) cash reserves to cover your down payment and closing costs 3) your monthly expenses 4) your credit profile.

- Income Money that you receive on a regular basis, such as your salary or income from investments. Your income helps establish a baseline for what you can afford to pay every month.

- Cash reserves This is the amount of money you have available to make a down payment and coverclosing costs. You can use your savings, investments or other sources.

- Debt and expenses Monthly obligations you may have, such as credit cards, car payments, student loans, groceries, utilities, insurance, etc.

- Your credit score and the amount of debt you owe influence a lenders view of you as a borrower. Those factors will help determine how much money you can borrow and themortgage interest rateyoull earn.

More:

For more information about home affordability, read about thetotal costs to consider when buying a home.

Don’t Miss: How To Get Loan Originator License

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Factors For Married Couples To Consider

When you file a tax return jointly with your spouse, the Department of Education will determine eligibility for IDR plans based on your combined income. It will also take combined student loan debt into account.

As a result, deciding to get married and file a joint tax return could have a big impact on your monthly student loan payment.

However, while married filing separately can keep student loan payments lower under some circumstances, this filing status has other consequences. It may make sense to talk with a tax expert about what filing option makes sense.

Recommended Reading: Does Va Loan Cover Manufactured Homes

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee