How To Calculate Auto Loan Interest For First Payment

When figuring out how to calculate auto loan interest for the initial payment, the steps below can help:

The number you get is the amount of interest you pay in month one.

Why Using A Car Loan Calculator Is Important

Buying a car can be an expensive endeavor, and most people cant afford to pay cash outright. Luckily, consumers who need cars can obtain auto loans through car dealerships, banks, credit unions, and even online lenders.

Auto loans are secured personal loans, with the car acting as collateral. This means if you fail to make payments, your lender can repossess the vehicle and sell it to make its money back. Because the loans are secured, the interest rate is often lower than what youd find with other types of consumer debt, such as credit cards and personal loans.

Your interest rate will be affected by various factors, however, such as whether youre buying a new or used car if you have a trade-in the amount of your down payment your credit score and income and the length of your repayment loan term. Comparison shopping among lenders is also important for finding the best deal and an auto loan calculator can help by estimating your monthly payments and total costs of borrowing.

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it’s important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

Read Also: Can I Refinance My Car Loan With The Same Lender

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Auto Loan Payment Calculator Results Explained

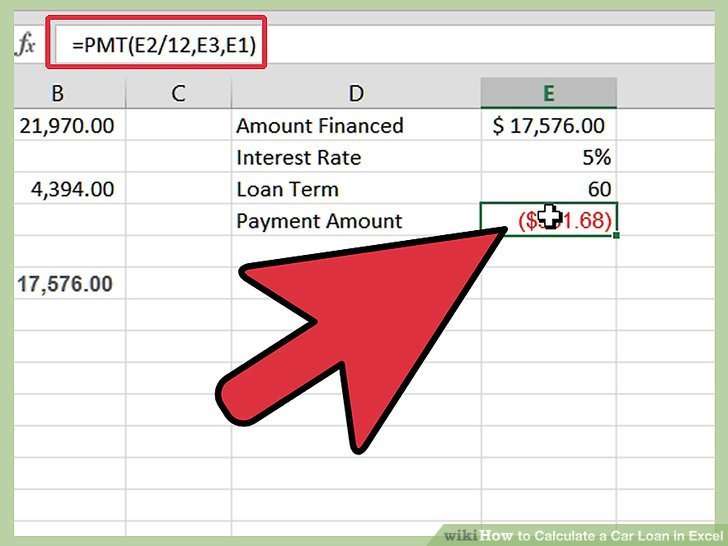

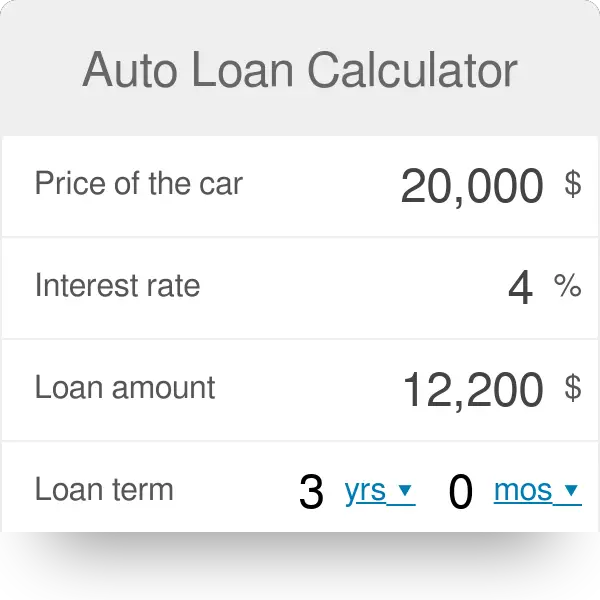

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

You May Like: How To Qualify For Loan Modification

How Do I Know What My Apr Is

Once youve received a formal and final offer on a loan, you can find out what the APR is in one of two ways.

Capital One Review Details

Capital One is a well-known lender that works with an established network of car dealerships. You can pre-qualify to refinance with Capital One, which has no effect on your credit score.

Pre-qualification decisions are typically returned within 24 hours your loan offer will show a new rate, term and monthly payment. If you select the offer, youâll submit a complete credit application. At that point, a hard credit inquiry is required and your final terms could change.

Capital One does not offer cash-out refinancing or lease buyouts.

- Not available in every state.

- Only available at participating dealerships.

Best for borrowers who plan to buy from a dealership in Capital One’s network.

Also Check: Classic Car Loans Usaa

A Few Additional Tips About Using The Car Loan Calculator

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the calculator’s total amount paid result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

Find More Finance Help With The Experts At Weir Canyon Acura

After learning how to calculate auto loan interest, you can take advantage of even more car buying tips at Weir Canyon Acura such as good mileage for a used car, how to trade in a financed car, how financing works, or buying vs. leasing. And, our finance team is always on hand to walk you through all of your options, answer any questions, and show off our inventory to help you find a vehicle that matches your budget and your needs. Contact us today to learn more and to schedule a visit to our dealership near Montclair!

Also Check: Refinance Avant

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

You May Like: How Long Does Sba Loan Approval Take

How To Calculate Interest On A Car Loan

To take a car loan means commonly that to buy a car. Car loan also is known as a hire purchase loan. Here in this article, you will see how it works and how to calculate our monthly installment for a car loan.

Calculation

How To Use The Car Loan Calculator

Heres a guide for the information you will need to input into the car loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, plus the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

Also Check: How Much To Loan Officers Make

Calculate Auto Loan Interest For Your First Payment

If you want to learn how to calculate auto loan interest for the initial payment, you can use this fast calculation:

This is the amount you will be paying in interest for the first month.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

Read Also: What Is The Commitment Fee On Mortgage Loan

Calculate Your Total Interest Paid

Once you have the interest rate, it is time to calculate the total interest. Luckily, you can find free calculators online. Look for a vehicle interest calculator, as these take into account amortization, which means the principal and interest are reduced at different rates, with the interest being paid off more at the beginning of a loan and then gradually switching over to paying off more of the principal toward the end of the loan.

Step 1: Use an online amortization calculator. This calculator takes the information you provide and figures how much interest is paid each month and for the life of the loan. You can find auto loan calculators online at such sites as Bankrate, Auto Loan Calculator, and Amortization Schedule Calculator.

Input your data, such as the principal loan amount, loan term, and interest rate. Some calculators allow you to look at the amortization schedule and add extra payments to see how they affect your overall payment schedule.

- Warning: Check with your lender before making any extra payments. Some put provisions in the loan paperwork stating that you will be penalized for paying off the loan early.

Step 2: Print or save the calculations you receive. Find the area that gives you the total amount of interest paid and highlight it.

How To Figure Interest On A Car Loan For The Future

After you begin to pay down your initial principal, you will then be required to determine your new balance to see what you will be paying going forward. Here is how you can calculate these payments:

Errors in the calculation and the fact that the numbers are rounded will cause you to not have an exact calculation each time, but it does give you a good idea on how to calculate the interest rate on a car loan.

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

What Is A Good Loan To Value Ratio For A Car

In general, you want a low LTV. When refinancing a home, you want at least 20% equity in the home, so an 80% LTV or lower. Vehicles are a little trickier, since they depreciate in value over time.

While an LTV less than 80% is ideal, its not uncommon to have an LTV around 100% on your existing loan when it comes to car loans. When getting a new loan through refinancing, a high LTV wont necessarily disqualify you, but depending on the lender, you may be asked to put down a down payment to lower your LTV .

All that said, the lower the LTV, the better the interest rate youre likely to get. So a lower LTV is always better for you as the consumer.

Need Help With Your Car Loan Consult With Metro Honda

Whether you live in or near the Bayonne area, Metro Honda can assist you with your car loan. If you have any questions on trading-in a financed car, contact our Finance Department. Feel free to use our online car payment calculator! If you are looking to upgrade your Honda, we have new Honda vehicles for you to find your best match!

Also Check: How Do I Refinance My Car With Bad Credit

Find Out How Much Is Being Financed And For How Long

The first step of the loan process is determining which loan you want to pursue. This requires you to figure out how much you can expect to pay in principal, annual percentage rate , and other fees.

Step 1: Find out the principal. Discover the amount you are financing in your loan, which is called the principal.

It will be the purchase price minus any cash rebates and your down payment and trade-in. When you subtract these amounts from the total purchase price, which will also include charges and the sales tax, it gives you the principal.

For example, if your cars sticker price was $20,000 and you traded in your old car for $5,000 and gave $2,000 as a down payment, your principal is $13,000.

Step 2: Find out the length of the loan term. Many car loans for new or slightly used vehicles carry a term up to five or even six years. Some may go as long as seven years, but keep in mind that you pay more interest for longer-term loans.