How Can I Spot A Personal Loan Scam

Unfortunately, there are plenty of scam artists willing to take advantage of borrowers desperate for a personal loan. Here are a few warning signs of personal loan scams to watch out for:

- Demanding money upfront: You should never have to pay money before getting your loan funds. A scammer might demand that you pay strange fees or require unusual payment methods that cant be tracked, such as a prepaid credit card.

- Using high-pressure sales tactics: Scammers will often pressure borrowers to make an instant decision for example, they might use language like limited-time offer or act now.

- Not requiring a credit check: Personal loan lenders usually perform a credit check to determine your creditworthiness. While there are some no-credit-check personal loans , other companies promising not to check your credit are likely a scam.

- Approaching you about the loan: Some lenders advertise through the mail with preapproved loan offers. But if a loan company approaches you out of the blue with an offer, it could be a scam.

- Not having a physical address: A legitimate loan company should have a physical address that you can verify. If you cant find location information for the lender, it could be a front for a scam.

- Not feeling comfortable with the company: Trust your instincts if something feels off, it probably is.

Learn More: Auto Loans for All Credit Types

What Is The Average Interest Rate On A Personal Loan

The average personal loan interest rates received by borrowers with credit scores of at least 720 who used Credible to take out a loan during the week of Aug. 30, 2021, were:

- 11.72% for a 3-year loan

- 16.51% for a 5-year loan

Keep in mind that personal loan interest rates can vary based on your credit score and other factors. In general, the better your credit, the lower the rate youll get. Heres a breakdown of the interest rates you can generally expect based on your credit score:

| How’s your credit? |

|---|

Learn More: Best Personal Loans for Fair Credit

Pros And Cons Of Personal Loans

- No security or collateral required.

- Fixed monthly repayments.

- Quicker to arrange than a secured loan.

- Can access much larger amounts than a personal loan.

- Can come with restrictions for part or early payment of the loan.

- The item you are using the money to buy or your home will be at risk if you fail to keep up with repayments.

- Often repaid on a variable rate so monthly payment may go up and down.

- Interest rates tend to be higher than for secured loans.

Recommended Reading: Is It Easy To Get Loan From Credit Union

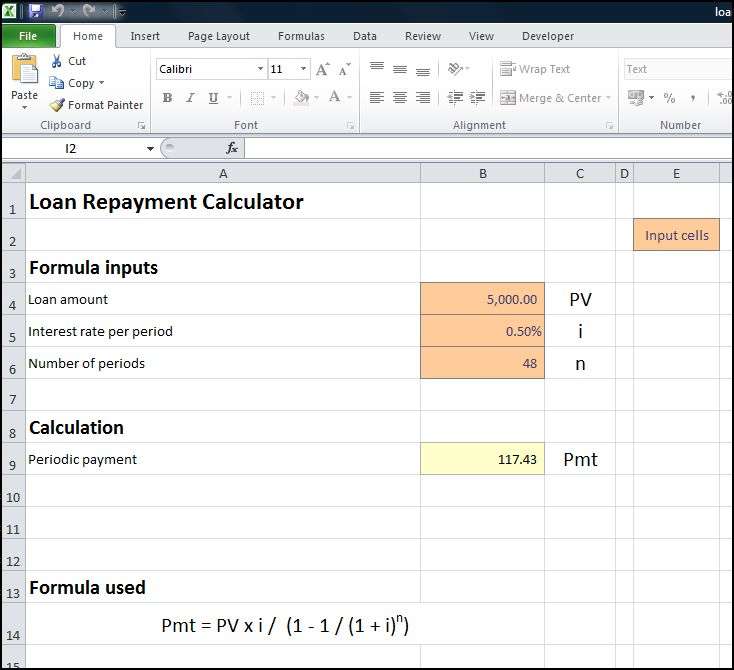

Alternative Loan Payment Formula

The payment on a loan can also be calculated by dividing the original loan amount by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

How Much Can I Borrow

Personal loans generally range from $600 to $100,000 or more, depending on the lender. However, the amount youll actually be approved for will depend on your credit as well as your income and existing debt. Keep in mind that lenders might have more stringent requirements for large loan amounts.

With Credible, you can compare your prequalified rates as well as loan amounts from multiple lenders in just two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

Check Out: Low-Income Loans: Personal Loans for a Tight Budget

Recommended Reading: Is There Any Loan For Buying Land

Financed Upfront Funding Fees

Once youve financed your Upfront MIP multiply the result you got by . In this particular case it would be 1 + 0.0225 = 1.0225. Get your monthly MIP by dividing this result by 12 to get how much each installment would cost you.

Heres a scenario for clarity. Assume for instance that you have an average outstanding mortgage loan balance amounting to $200,000. You get the annual MIP for the coming year by calculating: $200,000 * 0.5% = $1,000.

To get the annual MIP plus your portion of the Upfront Funding Fees get: $1,000 * = $1,022.50. To get the monthly instalment payable, divide this result by 12 to get: $1.022.50 / 12 = $85.21. To get your total payment due, add this result to your monthly mortgage payment.

How To Calculate Finance Charges On A Car Loan

Subtract the car loan principal from the total amount ; the difference is the finance charge for your loan. in our example, the finance charge is;

Basically, youre dividing the total number of payments into the amount youve borrowed plus interest. Each month a portion of the loan payment you make will go;

12 steps1.Determine how much you will borrow. Typically, buyers will make a cash down payment on their new car and borrow from a lender to cover the remaining cost 2.Figure out the annual percentage rate and duration of your loan. The APR reflects how much additional money you will have to pay beyond your principal 3.Find out how many payments you will make each year. The majority of car loan payments are made on a monthly basis. When calculating your monthly payments

Recommended Reading: How To Pay Down Student Loan Debt

The Four Values You’ll Need To Set:

- Loan Amount – the principal amount borrowed. It does not include interest.

- Number of Payments – the “Payment Frequency” setting impacts the loan’s term. For a loan term of five years, if the payment frequency is monthly, you need to enter 60 for the number of payments.

- Annual Interest Rate – the nominal interest rate. This the quoted interest rate for the loan.

- Payment Amount – the amount that is due on each payment due date.

Set one of the above to 0 if unknown.

How much can I borrow?

How long will it take to pay a loan off?

What interest rate allows me to pay $350 a month?

Always Enter A 0 For The Unknown Value

Note – You must enter a zero if you want a value calculated.

Why not design the calculator to recalculate the last unknown?

Because we want the calculator to be able to create a payment schedule using the loan terms you need. This behavior is a feature! After all, there is no such thing as a “correct” loan payment. The payment amount is correct as long as both the lender and debtor agree to it!

Also Check: Who Can Loan Me Money

Can I Get A Personal Loan

While it is still possible to get an unsecured loan if you have a poor credit score it can impact the amount a bank or loan company is willing to lend you as well as the APR. This means that before you decide on a personal loan, for whatever purpose, its always a good idea to check your;.

Another factor that will impact your ability to get a loan is your income and you may need to prove that you have the money each month to meet the minimum repayments of the loan. The number of debts/amount of debt you already have will likely be taken into account by a loan provider when reviewing your application. You should also be prepared to answer questions about why you want to take the loan, especially if it is a large amount you want to borrow.

How Long Can I Take An Unsecured Loan Out For

Normally personal loans tend to be taken out from between one and eight years . Longer terms might be available but will very likely require you to take out a secured loan instead.

As with the amount you will be able to borrow, the length of time you borrow funds over is subject to the lenders agreement.

You May Like: How Much To Loan Officers Make

Can A Student Get A Personal Loan

Students can indeed apply for an unsecured loan, however, the maximum amount you can borrow, and the interest rates charged will be heavily influenced by your current personal and financial circumstances, as well as your credit history. As a student, it is likely that your only income is from part-time employment so your loan will be judged on this. It is highly unlikely that any lender will consider a loan if your only income is a grant or a regular allowance from your family.

Use Of Loan Payment Formula

The loan payment formula can be used to calculate any type of conventional loan including mortgage, consumer, and business loans. The formula does not differ based on what the money is spent on, but only when the terms of repayment deviate from a standard fixed amortization.

Simple interest and amortized loans will generally have the same payment. The terms amortized and simple interest relate to how much of the payment is applied to principal and how much is applied to interest for each payment.

Simple interest loans rely on the date of payment to determine the amount of interest paid with the remaining amount going to principal. If a payment is made early, the interest portion of the payment will be less than if paid later. Less interest accrues when the amount is paid early because the loan balance will be less due to the extra principal payments.

On the other hand, an amortized loan has a predetermined amount of interest paid per payment so an earlier payment has no affect on lowering the principal balance sooner. Different companies and their loans will have different policies on how they are amortized. An example of how a company may amortize their loan, is by re-amortizing every year so that extra principal payments to the loan will only go in effect after a year to lower the monthly interest portions of the payment.

Recommended Reading: How To Get Low Interest On Car Loan

Is It A Good Idea To Get A Personal Loan

Whether or not a loan is a good idea for you will depend on your personal circumstances and why you are looking to borrow several thousand pounds. If youre not sure you can afford to make the same repayment every month and you only need a thousand pounds, you could consider a;;instead.

For sudden costs that youll be able to pay off after a month or two, a credit card or even an arranged overdraft on your bank account may be more suitable than a personal loan, as it generally doesnt matter when you pay these debts off, as long as you make a minimum monthly repayment. At the other end of the spectrum, large amounts of money may require a;secured loan also known as a homeowner loan.

An unsecured loan really shines in the middle ground. Its for an amount that is not too little but also not too large. Youll be tied to it for several years, but youll also be sure that you clear your debt by the end of the term, provided you keep up with your repayments.

Loans have the added advantage of not tempting you to spend more, with a credit card typically allowing you to keep using it until you hit your credit limit. A loan will therefore make it hard for you to get into any additional debt, as long as you put all your debt on it and cut up and cancel all your cards.

How To Calculate A Loan Amortization Schedule If You Know Your Monthly Payment

It’s relatively easy to produce a loan amortization schedule if you know what the monthly payment on the loan is. Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal. For month two, do the same thing, except start with the remaining principal balance from month one rather than the original amount of the loan. By the end of the set loan term, your principal should be at zero.

Take a simple example: Say you have a 30-year mortgage for $240,000 at a 5% interest rate that carries a monthly payment of $1,288. In month one, you’d take $240,000 and multiply it by 5% to get $12,000. Divide that by 12, and you’d have $1,000 in interest for your first monthly payment. The remaining $288 goes toward paying down principal.

For month two, your outstanding principal balance is $240,000 minus $288, or $239,712. Multiply that by 5% and divide by 12, and you get a slightly smaller amount — $998.80 — going toward interest. Gradually over the ensuing months, less money will go toward interest, and your principal balance will get whittled down faster and faster. By month 360, you owe just $5 in interest, and the remaining $1,283 pays off the balance in full.

Recommended Reading: Which Student Loan Accrues Interest While In School

How Does This Loan Repayment Calculator Work

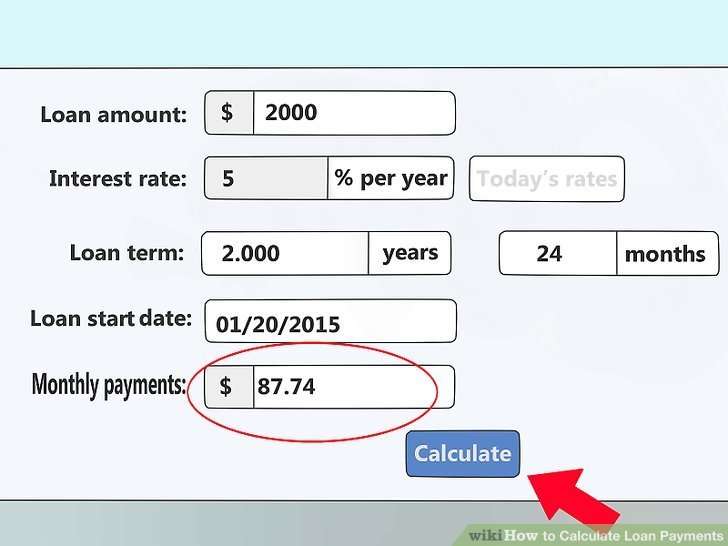

The easy-to-use loan calculator above works based on some pretty mundane math. Don’t worry, this isn’t going to turn into an algebra lesson. Just know that we’ve coded all the appropriate formulas to do the math for you.

So, all you have to do is enter three pieces of information: the amount of the loan, the loan term, and the interest rate.

- Loan amount. This is how much you’re intending to borrow. Remember that this includes the total amount you’re borrowing. Depending on the situation, the lender may include fees and or other expenses in that amount.

- Loan term. This is how long you will take to pay back the loan. For the purpose of this calculator, you need to enter the terms in months. So, if you’re borrowing money for 6 months, you would enter 6. If you’re borrowing for 2 years, you would enter 24. To convert terms of years into months, multiply the number of years by 12.

- Interest rate. Enter a hypothetical interest rate. This is how much the lender is going to charge for letting you borrow the money. The higher this rate, the higher the cost of the loan and the more you may have to pay back each month. Don’t include a percent sign when entering this number.

Once you enter all three pieces of information, click “Calculate” and the tool will return an estimated monthly payment. If you borrowed exactly the amount entered at the terms and interest you entered, that would be your monthly payment for the loan.

How Much Can I Borrow For An Unsecured Loan

Normally, the maximum amount you can borrow on an unsecured loan is £25,000. Beyond this point, you will be unlikely to find a lender who will consider a loan without some form of security.

While £25,000 is normally the most you can borrow for an unsecured loan , this is not a guarantee that you will be approved for a loan of this figure. The lender will take into account your personal and financial details and history to make a decision on the maximum they will be prepared to lend you. This may be less than £25,000.

Read Also: How To Cancel My Student Loan Debt

Computing Amortization For The Entire Loans Term

How Do I Qualify For A Personal Loan

Eligibility criteria for a personal loan can vary by lender. However, there are a few common requirements youll likely come across, including:

- Good credit: Youll typically need good to excellent credit to qualify for a personal loan a good credit score is usually considered to be 700 or higher. There are also several lenders that offer personal loans for bad credit, but these loans tend to have higher interest rates compared to good credit loans.

- Verifiable income: Some lenders have a minimum income requirement while others dont but in either case, youll likely need to show proof of income.

- Low debt-to-income ratio: Your debt-to-income ratio refers to the amount you owe in monthly debt payments compared to your income. Lenders generally prefer a DTI ratio no higher than 40% for a personal loan though some lenders might require a lower ratio than this.

Tip:

A cosigner can be anyone with good credit such as a parent, other relative, or trusted friend who is willing to share responsibility for the loan. Keep in mind that this means theyll be on the hook if you cant make your payments.

Check Out: How to Get a Personal Loan With a 600 Credit Score

Read Also: How Much Business Loan Can I Get