How To Look For Public Mortgage Records

Knowing how large a mortgage an owner took out on a home can give you a tactical advantage during the bidding process. Unfortunately, a real estate listing rarely will tell you that. Multiple listing services, such as Zillow,Trulia and Redfin, pull some information from public property records, but normally don’t show existing mortgage details. If you want more information, obtain a copy of the mortgage record from the county office where the property is located.

Understand What Information You’ll Receive

It’s a good idea to know what information you can expect to walk away with when conducting a public mortgage records search. Depending on the specific county, you’ll most likely discover the borrower’s name, the property address, maps or surveys of the property, the square footage of any dwellings and the property’s assessed value. You’ll also be able to see previous sales listings and the property’s tax assessment history.

List Of Bank Institution Numbers In Canada

Caitlin Wood

Caitlin is a graduate of Dawson College and Concordia University and has been working in the personal finance industry for over eight years. She believes that education and knowledge are the two most important factors in the creation of healthy financial habits. She also believes that openly discussing money and credit, and the responsibilities that come with them can lead to better decisions and a greater sense of financial security.One of the main ways shes built good financial habits is by budgeting and tracking her spending through the YNAB budgeting app. She also automates her savings so she never forgets to put aside a portion of her income into her TFSA. She believes investing and passive income is key to earning financial freedom. She also uses her Aeroplan TD credit card to collect Aeroplan points so that she can save money when she travels.

Don’t Miss: Is Carmax Pre Approval A Hard Inquiry

What Happens If I Had A Recurring Payment Set Up With My Bank Or Prior Servicer

If you make your payments via your bank’s online bill pay service and wish to continue using this service, please update the payee and payment address to Freedom Mortgage as shown below. Be sure to include your new loan number.

| If you live in: |

|---|

| P.O. Box 7230Pasadena CA 91109-7230 |

If you had automatic payments set up with your prior mortgage servicer, the ‘Goodbye Letter’ you received should contain information on how your previously established automatic payments are treated following the effective date of your transfer to Freedom Mortgage.

Once you receive your new Freedom Mortgage loan number , you can register for access to your loan information online at FreedomMortgage.com. Once registered, please log on and select Manage Recurring Payments to create a new automatic payment.

How Do I Set Up An Account For Payments

-

Your account setup will vary depending on your loan subservicerbut well make sure you have all the information you need to get started. Typically, all you need is your loan number, which you can find with your loan documents or in an email from Better.

Related questions

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate, LLC dba BRE, Better Home Services, BRE Services, LLC and Better Real Estate is a licensed real estate brokerage and maintains its corporate headquarters at 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. A full listing of Better Real Estate, LLCs license numbers may be foundhere. Equal Housing Opportunity. All rights reserved.

Better Real Estate employs real estate agents and also maintains a nationwide network of partner brokerages and real estate agents . Better Real Estate Partner Agents work with Better Real Estate to provide high quality service outside the service area covered by Better Real Estate Agents or when Better Real Estate Agents experience excessive demand.

Better Settlement Services, LLC. 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007

Also Check: How To Get A Car Loan When Self Employed

What Is Merss Role In Mortgage Transactions

When you close on your mortgage loan, youll sign plenty of papers. Two of the most important, though, are the mortgage or deed of trust and the promissory note.

The mortgage or deed of trust is an agreement between you and your lender. It states that you will repay your mortgage and that your lender will hold the legal title to the property until you finish paying off your loan. The deed of trust also states what will happen if you don’t repay your loan. Usually, the deed of trust states that your lender can foreclose on your property and take ownership of your home if you don’t pay back what you owe.

A promissory note is a document that you sign stating how much money you are borrowing, the interest rate your lender is charging, your monthly payment amount, the number of payments you must make to repay your loan and your promise that you will repay the loan in full. This sounds similar to the deed of trust. The big difference? The deed of trust states what will happen if you stop making your loan payments. A promissory note does not include this information.

In some mortgage transactions, a mortgage will state that MERS is the mortgagee, or the lender. If you sign a deed of trust instead of a mortgage, MERS could be named as the beneficiary of your loan.

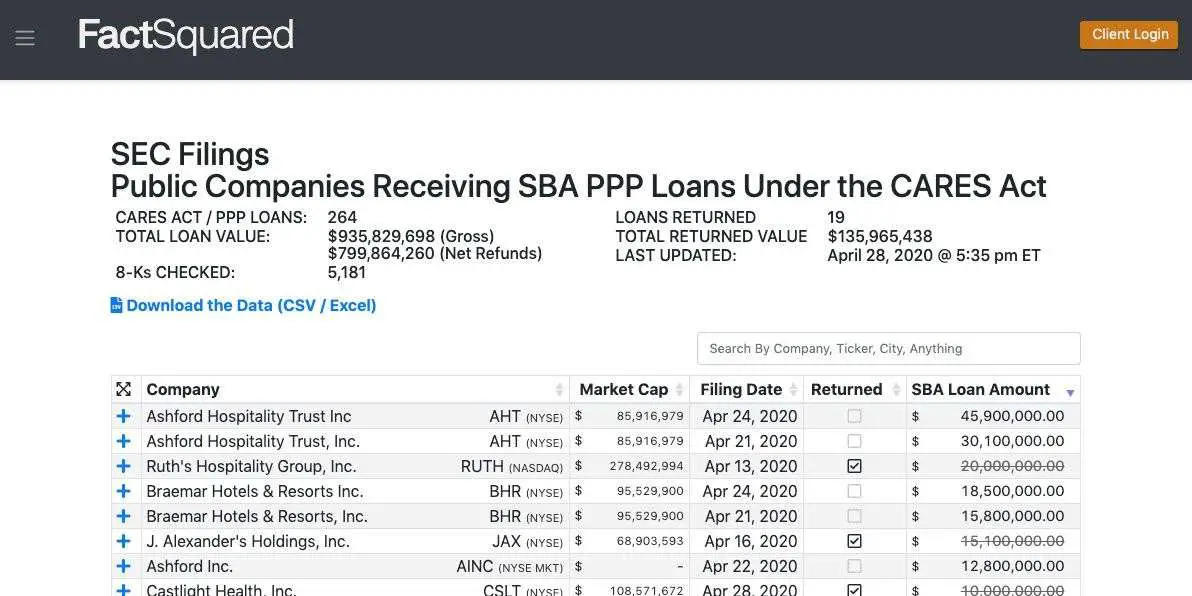

Commercial Real Estate Databases For Finding Mortgage Data

As we mentioned to start, one of the challenges with commercial mortgage data is that it is notoriously difficult to find.

Mortgage data associated with private bank loans tend to be the most elusive, as banks are not required to report loan-level detail in the same manner as public entities.

Instead, private banks tend to report categories of data, like total loan volume, rather than report the data associated with individual loans.

Often times, youll need some basic information, like the owner or borrowers name and/or the property address.

Then you can search the countys registry of deeds to pull the public records associated with that property.

That can be a laborious process, however.

There are a few easily accessible commercial real estate databases that can help expedite your efforts of finding commercial mortgage data.

Reonomy

With Reonomy, commercial lenders and banks can quickly analyze the portfolios of owners and lenders with data spanning everything from transaction data, to current debt, to full ownership details.

Reonomy technology connects all of this data to show the interconnectivity of people, companies, and property.

CoreLogic

CoreLogic offers a few different tools that can be helpful for finding mortgage data.

One of those tools, called RealQuest, includes property-specific data for 149 million parcels, including transaction histories, MLS data, valuations and more.

HUD

Recommended Reading: Refinance Through Usaa

What Are The Benefits Of A Refinance

If you refinance with an FHA or VA loan, the process is simple as some FHA and VA products require less documentation than conventional loans and do not require an appraisal, if you qualify. That allows closing to be quicker than a home purchase.

Learn more about your home refinancing options with Freedom Mortgage today.

Understanding Mortgage Holders And Guarantors

A mortgage holder, more accurately called a “note holder” or simply the “holder,” is the owner of your loan. The holder has the right to enforce the loan agreement. The loan agreement consists of:

- a mortgage .

The holder of the note is the only party that has the legal right to collect the debtand foreclose on the propertyif you don’t make payments.

A guarantor, or mortgage backer, is an entity, like the Federal Housing Administration or Veterans Administration , that guarantees the holder will get paid if the borrower defaults.

Recommended Reading: Reinstate Va Loan Eligibility

What To Do When Mortgage Loan Records Are Lost

A: The issues of what happens when records are lost is an important one. Letâs start with the questions on keeping old records. Weâve frequently told our readers that they can toss out their financial records after seven years. Even so, there are some records you should keep forever, including certain financial documents, deeds to property, stock certificates, and others.

So, donât just toss all boxes dated from the year 2011 or before. Instead, go through the box and see if thereâs anything important in there. Given todayâs technology, you can easily scan any documents and keep an electronic copy. Again, original stock certificates, original title documents to cars and boats and items like that should be kept forever.

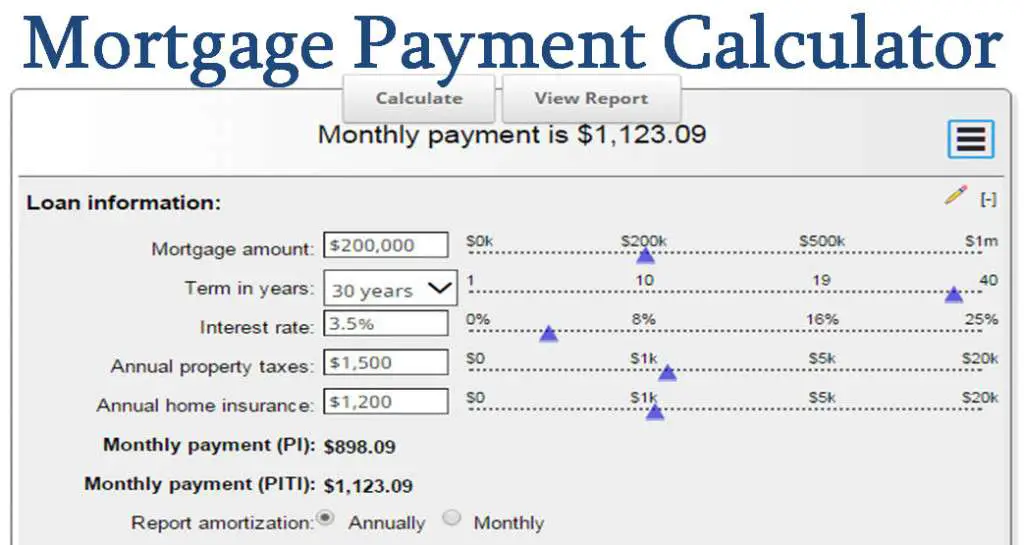

How A Mortgage Calculator Can Help

- The loan length thats right for you. If your budget is fixed, a 30-year fixed-rate mortgage is probably the right call. These loans come with lower monthly payments, although youll pay more interest during the course of the loan. If you have some room in your budget, a 15-year fixed-rate mortgage reduces the total interest you’ll pay, but your monthly payment will be higher.

- If an ARM is a good option. With fixed rates at record lows, adjustable-rate mortgages have largely disappeared. But as rates rise, an ARM might be a good option for some. A 5/6 ARM which carries a fixed rate for five years, then adjusts every six months might be the right choice if you plan to stay in your home for just a few years. However, pay close attention to how much your monthly mortgage payment can change when the introductory rate expires.

- If youre spending more than you can afford. The Mortgage Calculator provides an overview of how much you can expect to pay each month, including taxes and insurance.

- How much to put down. While 20 percent is thought of as the standard down payment, its not required. Many borrowers put down as little as 3 percent.

Don’t Miss: Refinance Usaa Auto Loan

Why Is An Nmls Number Important

Before the enactment of the Secure and Fair Enforcement for Mortgage Licencing Act , there were almost no resources to help consumers stay safe from predatory lenders. Consumers can now use an MLOs Unique Identifier to verify their credentials. This can significantly prevent them from making a costly mistake when trying to obtain a mortgage loan. Not only does this provide peace of mind, but it also allows consumers to compare the professional experience and expertise of multiple MLOs.

Without an NMLS number, consumers may be wary of your services and decide to move forward with another MLO.

Can I Pay My Mortgage Online

Yes! Freedom Mortgage offers you the option to make a one-time payment or set up recurring payments through our website. Simply to your account or create a new account if you havent already set up your online access. Select One Time Payment from Account Details.

On your first visit, you can set up your banking information. For subsequent payments, you can simply select that account for payment. Payments made on Saturday or Sunday will not be applied to your account until the next business day. If you have trouble logging on, please contact our Customer Care representatives at . We are available to assist you Monday through Friday from 8 a.m. to 10 p.m., and Saturday from 9 a.m. to 6 p.m. Eastern Time.

Read Also: Carmax Pre Approval Hard Pull

Look At Smaller Lenders

In addition to considering a mortgage from the big banks and online lenders, research smaller, lower-profile players such as credit unions and community banks.

Search online with the name of your home state and terms like community bank mortgage, S& L mortgage, and credit union mortgage.

We found some competitive options this way. Not too far from Consumer Reports Yonkers, N.Y., headquarters, Maspeth Federal Savings in Maspeth, N.Y., was showing an annual percentage rate of 4.008 percent for a conventional 30-year fixed loan. Cleveland-based Third Federal Savings & Loan was showing a 30-year fixed-rate conventional loan with an APR of 4.47 percent.

Gumbinger says these smaller lenders typically have better rates for adjustable-rate mortgages and offer better terms and rates to people with variable income streams, like the self-employed. Thats because they often dont sell those loans in the secondary market as larger banks do, Gumbinger says: Because lenders are putting these loans on their books, they can price them any way they wish.

Applying For Your Mcc

If you decide that a mortgage interest credit certificate is compatible with your financial situation, you will first need to secure the certificate from your state or local government. This can commonly be accomplished with application forms provided by the relevant government agencies where you live. As part of your application, you will be required to meet a number of requirements focused on income levels, credit scores and loan limits.

There are also a variety of property requirements introduced as part of the MCC application which ensure that your home is fully eligible for this tax subsidy. Some of these include limits on sale price, acreage size and others. It is important to note here that these requirements may differ significantly from state to state. With that in mind, it is essential that you do your own research in order to ensure that your property is eligible.

Also Check: What Loan Options Are Strongly Recommended For First Time Buyers

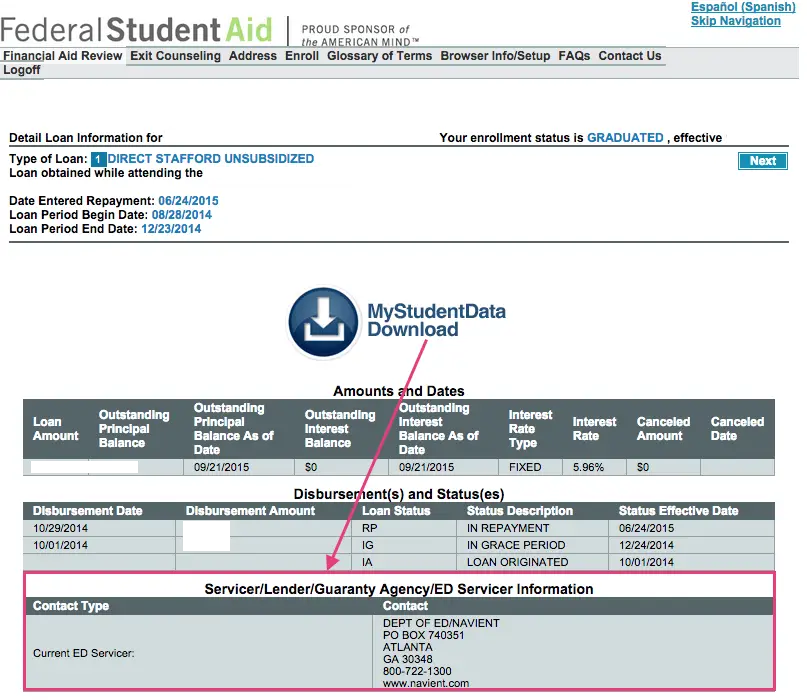

Here’s How To Find Out Who Owns Your Mortgage And Who Services It

By Amy Loftsgordon, Attorney

Finding out what company or entity owns or backs your mortgage loan isn’t always simple. Your loan might have been sold, perhaps several times since you took it out with the original lender. And the company that services the loan might not own the underlying debt.

Here’s how to figure out who holds or guarantees your mortgage.

What Is The Loan Account Number

A loan account number is a unique series of numbers that your bank assigns to your loan account when your loan is approved and the loan account is created. Every loan account has a unique loan account number. If you have taken two or more loans from the same bank, all the loans will have different loan account numbers. Banks keep track of all the loans they have sanctioned using the loan account number, which is unique for every loan account.

Don’t Miss: Usaa Refinance Auto Loan

Confirm All Mortgage Payments Are Credited Before Refinancing Or Modifying Your Loan

If you suspected something was amiss, the time to complain would have been before you refinanced or modified your loan. Without having the records in hand, youâll have a heck of a time trying to calculate the numbers and frankly, canât ever imagine how youâd figure out if you were credited the right amount 15 years ago.

Youâd probably have to spend money to see if your bank has records going back that far and then pay someone to help reconstruct your payment history. And for what? Itâs unlikely that youâll find thousands of dollars werenât applied correctly.

At the end of the day, this feels like a wild goose chase. But, if you decide to continue, please let us know what happens. Good luck!

What Is An Escrow Account

It is an account, established in connection with your mortgage loan, and managed by Freedom Mortgage, to pay your:

-

Real estate taxes

-

Hazard insurance as required

-

Mortgage insurance, if required

The escrow account does not pay for:

-

Supplemental tax bills, interim tax bills, special or added tax assessments, or any other fees that are not included in your property tax bill

-

Homeowners association fees

-

Premiums for non-required insurance policies, such as separate personal property insurance

Part of your total monthly mortgage payment will be used to fund the escrow account. If any of the fees being collected for escrow change, this could affect your monthly mortgage payment. For example, if your taxes go up this will make your monthly mortgage payment go up.

Don’t Miss: Usaa Used Auto Loan

Review And Keep Your Records

Review all letters, emails, and statements when you get them from your mortgage servicer. Be sure their records match yours. Most servicers must give you either a coupon book or a statement every billing cycle . Servicers must send periodic statements to all borrowers who have adjustable rate mortgages, even if they decide to send them coupon books.

Your coupon book or statement will have your servicers contact information. That way, you can learn more about your account, get an explanation of a charge, or confirm that theyre crediting your payments properly and on time.

If your statement is late even by just a few days call the mortgage company to track it down in case theres a problem with your account. If your account shows that youre paying late, you could be in default on your loan. Late payments and a default are reported to a credit bureau and will appear on your credit report. That could affect your ability to get credit in the future. Get an explanation for anything you dont understand.

If you get a notice that your servicer has changed, call your current servicer to confirm the new mortgage servicer before you send in your next payment. This will make sure your payment goes to the right servicer, avoid delays in processing, and can help you avoid a scam.

How Do I Set Up My Online Account For The First Time

To create a new account select Register Now from the Login page. You will need your ten-digit loan number to set up your account the first time, which can be located on your monthly mortgage statement or Welcome Letter. If you have trouble logging on, please contact our Customer Care representatives at 855-690-5900. We are available to assist you Monday through Friday from 8 a.m. to 10 p.m., and Saturday from 9 a.m. to 6 p.m. Eastern Time.

Read Also: Www Nslds Ed Gov Legit