How Do I Find My Student Loan Account Number To Verify My Identity For The Irs

Check with the lender from whom you have the student loan. Wouldn’t it be on the information you use when you make your payments? Look on the loan website.

If you are trying to enter student loan interest you paid you need your 1098E.

STUDENT LOAN INTEREST

Only the person whose name is on the student loan and who is legally obligated to pay the loan can deduct the student loan interest. If you co-signed then you are legally obligated to pay if the primary borrower defaults or does not pay. If you did not sign or co-sign for the loan you cannot deduct the interest.

You cannot deduct student loan interest if you are being claimed as someone elses dependent, or if you are filing as married filing separately.

The student loan interest deduction can reduce your taxable income by up to $2500

There is a phaseout for the Student loan interest deduction, which means the amount you can deduct gets reduced when your modified adjusted gross income hits certain income levels and is even eliminated at certain income levels –

If your filing status is single, head of household, or qualifying widow, then the phaseout begins at $65,000 until $80,000, after which the deduction is eliminated entirely.

If your filing status is married filing joint, then the phaseout beings at $130,000 until $160,000, after which the deduction is eliminated entirely.

Enter the interest you paid for your student loan by going to Federal> Deductions and Credits> Education> Student Loan Interest Paid in 2020

I Am A Member Of The Us Military Am I Eligible For Any Special Federal Student Loan Benefits

Nelnet is grateful to those who serve or have served our country, and we recognize the sacrifices you have made. As a member of the U.S. military, youre entitled to special benefits provided by the U.S. Department of Education and the U.S. Department of Defense. To learn more about these benefits, see Resources for Servicemembers.

Why Do You Store Social Security Numbers On Credit Reports

Your personal information, such as name, address, date of birth, and Social Security Number, is reported to TransUnion by your creditors. TransUnion maintains a separate credit file for each individual. Without your Social Security Number, the quality and accuracy of your credit history could be compromised. The federal Fair Credit Reporting Act permits TransUnion to maintain personal and credit information in our records.

Recommended Reading: Apply For Avant Loan

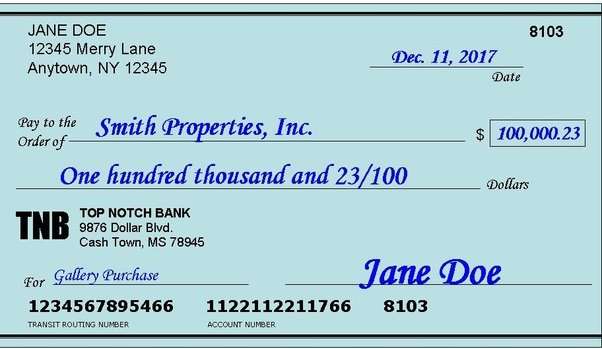

How Do I Make A Payment

Great Lakes offers many free payment methods, including one-time electronic payments , automatic monthly electronic payments , payments by phone, and check or money order payments by mail.

To make a payment or find out more about each payment method, log in to mygreatlakes.org, if you haven’t already, and select the option that works best for you.

Why Can’t You Delete My Credit File At Transunion

TransUnion is a credit reporting company that operates under the Fair Credit Reporting Act. Your credit file is maintained as allowed by federal and state laws. The Fair Credit Reporting Act does not require credit reporting companies to maintain a file on every person, or require credit reporting companies to delete files at a consumers request. The Act does require the companies to use reasonable procedures to assure accuracy. Creditors may access your credit report only if they have a permissible purpose under the Fair Credit Reporting Act.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What If My Loans Are Past Due

You can enroll in Auto Pay even if your account is past due. However, Auto Pay does not resolve any past due amounts. You can take care of your past due amounts by making a payment using one of our alternative options. You can make a payment online, , or . This is a great way to pay your loan off more quickly.

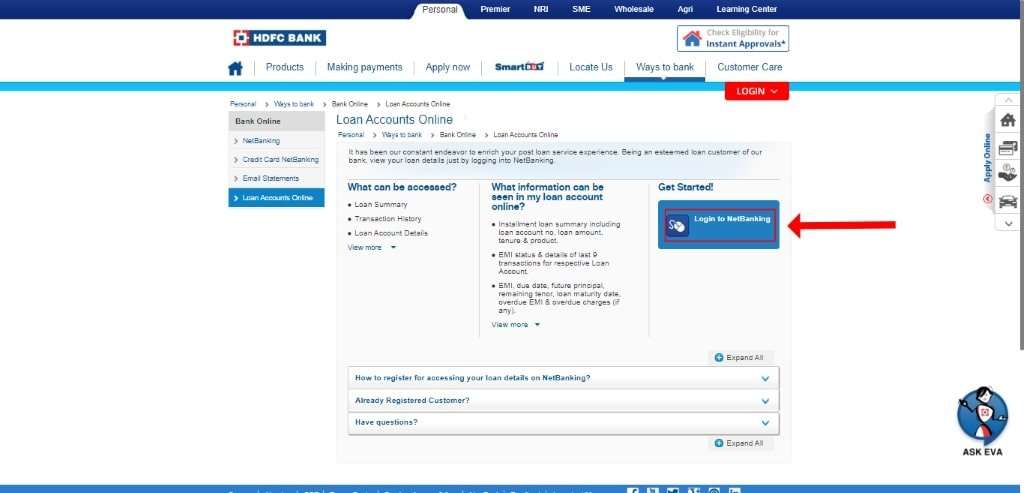

How To Check Your Personal Loan Status Online

The online mode is the easiest way to keep track of your personal loan application status. All the top lenders in the market provide ways for customers to track the status of their loan applications online. You can simply visit the website of the lender and track your loan status with the following details:

- Application reference number

- Date of birth

- Name

You might be asked to provide any of the above details for verification. Once you have provided the details, you can easily get the status of your loan application online.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Importance Of Bajaj Finance Loan Account Number

Bajaj loan account number proves useful for these purposes:

- Tracking loan transactions

- Accessing loan interest repayment details

- Summarizing applicable charges

- Assigning a unique identity to each borrower

Besides these, borrowers must provide their LAN to Bajaj Finance customer care to access loan details. You can find out your Bajaj Finance loan account number by simply logging in to the customer care portal Experia. Other than that, you can check the information through SMS, customer care number, or raising a request on our website. Individuals who prefer in-person assistance can visit the nearest branch of Bajaj Finance to request their LAN.

How Can I Postpone Or Lower My Payments

To review your repayment options for suspending or lowering your monthly payments, select Repayment Options from the My Repayment Plan menu, and then select the scenario that best fits your situation. You’ll be guided through your available options and prompted on how to move forward.

If you are still unsure about your options, contact us.

Also Check: How Can I Refinance My Car Loan With Bad Credit

How Do I Make A Payment Online

Just follow these steps:

Get The Status Of A Recent Payment

Also Check: Sofi Vs Laurel Road

When Will My Loan Be Disbursed

A federal student loan must generally be paid out in multiple disbursements. You will likely receive a portion just before or at the beginning of each term . If your school doesn’t use terms, you’ll usually get half at the beginning of and half at the midpoint of the academic year. Contact your school’s financial aid office for dates and details.

What Do I Do If I Can’t Get My Federal Student Aid Id To Work

There may be several reasons why your Federal Student Aid ID isn’t working.

You may be entering something incorrectly. To use your FSA ID, you must enter your user name and password exactly as you entered them when you created your ID.

The U.S. Department of Education may not have completed their match with the Social Security Administration . Your FSA ID is considered to be conditional until your information is verified with the SSA. You may use your FSA ID to:

Sign an initial Free Application for Federal Student Aid , and

Participate in the Internal Revenue Service data retrieval and transfer process.

Once they complete verification with the SSA , you’ll be able to use your FSA ID to access your personal information on Federal Student Aid websites.

Their records show that the SSN, name, and date of birth you provided on your FSA ID application do not match the information on file with the SSA.

Apply for an FSA ID again if you believe you entered incorrect information when you applied the first time.

Contact the SSA if you believe their information is incorrect.

You haven’t created your FSA ID yet. If you previously used your FSA Personal Identification Number to access information on FSA websites, you’ll need to create an FSA ID. To create an FSA ID, select Create Account

Learn more about IDR recertification requirements and what happens if you don’t recertify.

Don’t Miss: Where To Refinance Auto Loan

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Will The Total Amount I Have To Repay Stay The Same If I Change Repayment Plans

In most cases, choosing a different repayment plan will change the amount of your monthly payment. The amount you repay each month determines how quickly you pay down your principal balance. Interest accrues based on the principal balance of your loan. Lowering your monthly payment by choosing a repayment plan that offers a longer term will increase the amount of interest you accrue, costing you more money in the long run. For more information, see How Is Student Loan Interest Calculated?.

Recommended Reading: Usaa Auto Refinance Rate

Why Doesn’t The Dollar Amount On My Public Record Match The Balance Due

The dollar amount reported on a public record does not reflect the balance due rather, it is the total amount owed prior to any payments. The amount reported on the public record remains the same regardless of whether payments are being made. However, if the item has been paid, it should reflect Paid Civil Judgment if a paid Judgment, or Released if a paid lien.

What Happens To My Auto Pay Withdrawal Amount When Or If My Payment Amount Changes

Your monthly payment amount is set and won’t change unless your repayment terms change, for example, if you change your repayment plan or exit a deferment or forbearance. If it does change and you are enrolled in Auto Pay, you will receive a new payment schedule detailing your new payment amount and date. A few weeks later, you’ll receive an email reminding you of the change.

If you are in school and transitioning to repayment while enrolled in Auto Pay, your payments will also change. When they do, you will receive a payment schedule letting you know your new payment amount and withdrawal date. You will receive an email reminder before your payment is withdrawn.

If you are in school and making payments through Auto Pay, you may change your Auto Pay withdrawal amount and date at any time.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Private Student Loan Refinancing

Refinancing is similar to consolidation in that you bring all your loans into one manageable loan. But refinancing is only done with private lenders the federal government doesnt offer student loan refinancing. That means youll lose federal loan protections when you refinance federal loans into a private one.

You can refinance both private and federal student loans together. Youll complete an application with a lender and detail all the current student loans you want to refinance. When youre approved, youll start making one monthly payment on your new loan to your new lender.

You should refinance if:

- You have good or excellent credit and can secure a lower interest rate than what youre paying now.

- You have multiple loans with many different lenders, especially private loans.

- You can secure a lower monthly payment by stretching out your loan term.

You should avoid refinancing if:

- You dont have strong enough credit to get a lower interest rate.

- Your federal loans are eligible for an IDR plan or youre on track for PSLF.

- You want to keep federal protections and benefits, like deferment and forbearance, in case you experience financial hardship.

What If You Have An Old Paper Cd

Before much of the financial system was made electronic, financial institutions would issue paper certificates for things like stocks or CDs.

If you find an old paper CD, your best bet is to get in touch with the bank that issued it.

The bank will be able to tell you whether the account is still valid or if the money has been escheated.

Do note:

Losing a paper certificate does not mean that you’ve lost your money.

In most scenarios, the best thing you can do is ask the bank for help. Most banks want to work with their customers and make sure that they get their money, so it cant hurt to ask for help.

You May Like: What Are Commercial Loan Rates Now

What Is A 1099

The 1099-C Cancellation of Debt is an IRS tax form that lists the amount of debt that was cancelled on your student loans. The IRS treats debt cancellation as income, and Great Lakes is required to report student loan debt cancellation to the IRS. If applicable, you’ll receive a 1099-C from Great Lakes with the amount of debt cancelled on your Great Lakes-serviced loans. You’ll report the amount listed on your 1099-C statement on your federal tax return.

If you have student loan debt with another servicer that was cancelled, they may send you additional 1099-C statements.

How Long Do I Have Before I Must Completely Repay My Loan

The term of a student loan is based on the type of loan and repayment plan you choose. In some cases, the loan term is based on your outstanding loan amount. Periods when your loan is not in repayment due to school enrollment, a grace period, a deferment, or a forbearance do not count toward your repayment term. Log in to your Nelnet.com account to view your repayment schedule, repayment plan, and other student loan information, or contact us. To explore loan options that may be available to you, see Repayment Plans.

To maintain borrower benefits and repayment incentives, you may be required to continue making monthly payments. For more information about qualifying for borrower benefits, repayment incentives, or loan forgiveness, contact us.

If you plan to pursue Public Service Loan Forgiveness, visit StudentAid.gov for information about periods when your loan is not in repayment, qualifying payments, and how prepayments impact qualifying payments.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Is The Difference Between Auto Debit And Making A One

Auto debit is a convenient, simple payment option that offers you the peace of mind that comes with knowing your student loan payments are being made accurately and on time every month. You only have to sign up once to have all of your monthly payments made automatically.

Your Nelnet.com account allows you to make a one-time online payment even when your student loan payment is not due. Plus, you can direct your payment to specific loan groups. For more information on these and other ways to pay, see How to Make a Payment.