Save Up For A Down Payment

The amount of your down payment can make a big difference in your auto loans rate. So the more money you can put down, the better. If you cant put much down right now, do your best to sock away some savings quickly.

You might take on a second temporary job, sell some stuff, or put in extra hours at work. Another option is to just make your current vehicle last until you can save a significant down payment for your next car loan. Trust me, waiting a few extra months will be worth it when you save a ton on your car loan!

How Does A Personal Contract Purchase Work

To get a personal contract purchase youll need to pass a credit check.

The personal contract purchase agreement may limit how many miles you can drive, so if you go over the mileage limit youll be charged extra.

At the end of the agreement, you can hand the car back without paying a penny more. If you want to keep the car, you will have to make what is called a balloon payment to buy it outright at the end of the agreement. The balloon payment is usually based on the value of the car at the end of the personal contract purchase agreement and is likely to be much higher than the monthly payment.

You could also choose to get a new car by paying off the remaining cost of the old car and give the car dealership a new 10% deposit on a different new car.

How Msrp Helps Buyers

The MSRP is a good tool to use to compare vehicles and to apply for your loan. It gives you a ballpark for what the vehicle will cost, and allows you to compare the cost of similar vehicles to each other. While it may not be your out-the-door price, it is a good benchmark to use as you shop.The MSRP also gives you a starting point as you negotiate. If the dealer is highly motivated to sell, they will negotiate below this benchmark. However, you may actually pay more than this price. If you’re shopping for a vehicle that’s in high demand, the dealership can put an asking price on it that’s higher than the MSRP. Remember, MSRP is nothing more than a suggestion.

For more information on how the recommended selling price impacts your car loan application, review our blog on the MSRP meaning and how you can prepare for negotiations at the dealership.

Don’t Miss: Is First Loan Com Legit

How Can I Get A Car Loan With Bad Credit And No Co

Applying for a car loan with both bad credit and without a co-signer limits ones financing options. Lenders use credit history to evaluate if a lender will pay back a loan. Borrowers with no or poor credit history benefit from having a co-signer. That person helps reassure the lender that someone will pay back the loan. Without one, alternative lenders, particularly online lenders, are the best option. Unfortunately, they too will consider a borrower with bad credit and no co-signer as a risk. Expect higher interests rate and less favourable terms.

What Are The Pros And Cons Of Car Loans

There are both pros and cons to car loans. While a car loan might enable you to purchase a more expensive vehicle, and to balance repaying costs over a longer timeframe, youll usually need to pay interest, and there can be associated fees to consider. There are also the risks of repossession. Your credit score may also be impacted by you taking out a car loan.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Shop Around With Different Lenders

Many lenders will show you your preapproved rates and terms online after you fill out and they generate a soft credit pull. Taking the time to get quotes from different lenders, both national and local, will give you more leverage in negotiations because you’ll understand the going rates with your particular credit score for the car you’re interested in.

Don’t just take into account the listed interest rate calculate the total interest you’ll pay over the life of the loan based on your overall loan amount and term length.

While this may sound simple, a lower overall price will reduce the amount of interest you’ll pay on the loan.

You can reduce the sales price by declining add-ons like seat warmers and rear seat entertainment systems. You may also get a lower interest rate on a new car than on a used car, as used cars often have more mileage, expired warranties, and increased wear and tear. Lenders bake the increased risk of mechanical breakdown into the interest rate.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Avoid Paving Your Financial Opportunities On Car Deals

Sometimes, it can feel like youve hit the jackpot when you find a great car deal. But, thinking about buying a car means also thinking about the interest rates that youll be paying on your loan. And sometimes, high-interest rates can make a good deal seem not so good.

Auto dealers and car loans are a natural partnership, but it can be very difficult to find the best deals online. Many consumers often end up paying far more for their car than they need to because of the dealers commission or the financing rate. There are several ways to ensure you get a good deal on your vehicle purchase, including shopping around and seeking out out-of-state dealer that offers better rates.

Can I Refinance A Car Loan

It may be possible to refinance your car loan. When you refinance, a new lender buys your remaining debt. Then they offer a new contract under more favourable terms. Favourable could mean extending the length of the loan to lower your payments, decreasing the interest rate or removing a co-signer.

This option can make sense if some time has passed since you bought your car and your credit score has since increased.

Don’t Miss: Loan Officer License Ca

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Read Also: Does Va Finance Manufactured Homes

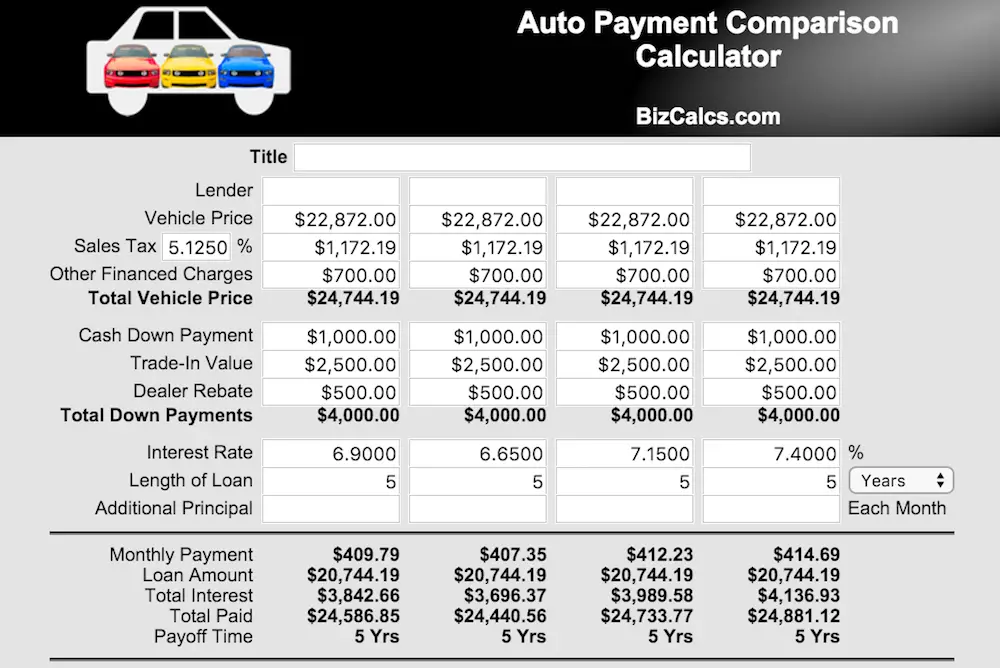

Calculate Your Monthly Payment

The best thing to do with a car loan calculator is to calculate your monthly payment. If you know the interest rate on your loan and your estimated car purchase price, you can plug that information in to the calculator to see the amount of your monthly payment. Change the loan’s term to see how that changes your monthly payment amount.

How Can I Improve My Chances Of Getting Approved For A Good Car Loan

Applying for an auto loan is much easier in the digital age but that doesnt mean you should immediately dive into the process. You should have an idea of your creditworthiness, so check your credit report first .

If youre concerned about qualifying, here are a few routes you can take to improve your chances of getting approved.

Recommended Reading: Do Loan Officers Get Commission

Finding The Best Auto Loan Rates

The best beginning for finding good rates is to speak with a credit union manager or financial advisor. Most credit unions offer financial advice such as auto loan needs for free and can help you through the process of nailing down your budget for a vehicle purchase and what you can expect as an interest rate. Some may even have low APR loans available.

Auto loan brokers are another good source of finding a loan. Brokers charge a fee, usually lumped into the loan itself, but only do one credit check to look at rates from a long list of potential lenders. This could save your credit score from dropping due to multiple credit checks and saves you the legwork of going lender-by-lender to find the best rate. Many brokers, such as Auto Approve, myautoloan.com, and Auto Credit Express are up-front about their fee structure and can find loans even for those with little or no credit.

Compare Loan Rates and Save

Don’t settle for dealer financing, get loan quotes from multiple providers

What Are The Pros And Cons Of Buying A Car With A Loan

There are many benefits to buying a car with a loan.

Pros

- There may be restrictions and conditions on the age and type of vehicle you can buy

- Variable-rate car loans may fluctuate, making budgeting less predictable

- Cars out of warranty could suffer a catastrophic failure, leaving you with a broken vehicle and an outstanding loan

- You have to pay for the loan, through interest

- The car will depreciate

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Make Loan Payments On Time

Credit scoring models take into account how reliably you pay all your bills, including auto loans. In fact, payment history is the most important factor in determining credit scores. By paying your car loan on time every month, you can help build positive credit history.

What’s more, when you finish repaying the loan, the lender will report the account as closed and paid in full to credit bureaus, and that will remain on your credit report and benefit your credit for 10 years from the closed date. That paid-up loan tells future lenders you know how to manage credit and repay your debts.

However, paying late or missing payments altogether can hurt your credit scores and make it harder to get credit in the future. Late or missed payments appear as negative information on credit reports, and remain for seven years. On the positive side, as the late payment ages over time, the less impact it will have on your credit score.

Missing too many payments may cause the lender to turn your debt over to collections or even repossess your vehicle. Both collections and repossessions remain on credit reports for seven years from the initial date of delinquency, and can negatively affect credit scores throughout that time.

Can You Negotiate Auto Loan Rates

Just like the price of a car, auto loan rates often can be negotiated. Sometimes you can negotiate the rate with the dealer or directly with the lender. The better your overall financial picture, the more success you will have negotiating your rate. You also can negotiate loan terms. For example, maybe you dont want to make a payment for the first 90 days or you want to finance the vehicle for 60 months instead of 48.

You May Like: Loan Officer License California

How To Get The Best Car Interest Rates

If you are like many prospective car buyers, you will need to take out a car loan in order to make the purchase of a new car. There are many considerations to think about when youre figuring out how much car you can afford and how much your loan will cost you in the short and long term.

But theres one often-overlooked factor that can make a big difference: your auto loans interest rate.

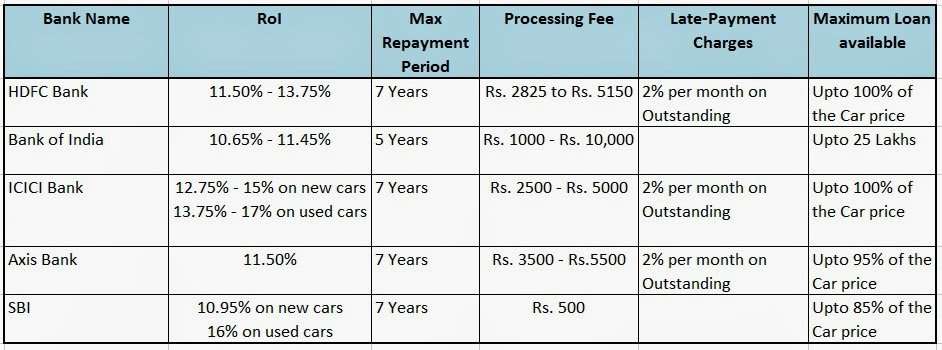

The chart below shows the average 60-month auto loan rates by credit score

Getting the best interest rate possible on a car loan can save you hundredsif not thousandsof dollars on the total cost of your vehicle over the long run. While it may not always be possible to get the interest rates that you see advertised on TV, it is still possible to secure a good interest rate if you put in some preparation ahead of time.

Here, you can learn what it takes to get the best interest rate on your next big car purchase.

Apply For Financing At Sam Leman Automotive Group

If you need assistance with automotive financing, you can trust the experts at the Sam Leman Automotive Group. Apply for financing in advance to expedite the process. We look forward to helping you drive home to Bloomington-Normal, Peoria, or Champaign in the vehicle of your dreams. Contact us today for more information or use our car payment calculator.

You May Like: Usaa Refinance Car

What Determines My Auto Loan Rate

The most important factor that decides your auto loan rates is your credit score. The better your score, the lower your APR will be. The best rates are reserved for those with credit scores above 800, but according to Equifax, any score above 670 makes you a low-risk borrower and opens the door to lower rates.

However, your credit score isnt the only determining factor. Employment status, income, and the type of vehicle you purchase also affect rates. Having a steady income stream and purchasing a newer vehicle will result in better auto loan rate offers.

How To Get The Best Auto Loan Rates

Modified date: Jun. 27, 2021

Editor’s note –

When it comes to buying a car, way too many Americans are likely to just get a loan from a dealer. And thats a very bad idea.

Really, its best if you dont finance your car at all. Paying cash will net you a better deal. And youll skip paying interest on financing.

With that said, sometimes you just have to finance at least part of your car purchase. You need a vehicle to get to work or haul your kids around. But you dont have time to save up to purchase the vehicle in cash.

Its understandable and sometimes unavoidable. But just because you have to finance your car doesnt mean you should go with whatever the dealer offers. As with other types of financing, its a good idea to shop around for a car loan. Luckily, the internet makes that easier than ever!

Here, were going to give you the down and dirty on where to find the best auto loan rates. But before we launch into that, lets talk about how to set yourself up ahead of time to get the best possible rates.

You May Like: How To Refinance An Avant Loan

What Is A Good Interest Rate On An Auto Loan

Interest rates on auto loans depend on your creditworthiness, the vehicle being financed, the details of the loan, and market rates. Creditworthiness is a combination of your , payment history, income, and if youve financed a vehicle before. Whether the car is new or used impacts the rate, as does the loan term, which is the length of the loan.

Current market rates also affect your auto loan rate. Typically, credit unions offer customers lower rates than other lenders. The market constantly fluctuates, but a rate less than 5% generally is considered good.

Simple Rules For Saving Money

1. Get preapproved for a loan before you set foot in a dealer’s lot.

“The single best advice I can give to people is to get preapproved for a car loan from your bank, a credit union or an online lender,” says Philip Reed. He’s an automotive expert who writes a column for the personal finance site NerdWallet. He also worked undercover at an auto dealership to learn the secrets of the business when he worked for the car-buying site Edmunds.com. So Reed is going to pull back the curtain on the car-buying game.

For one thing, he says, getting a loan from a lender outside the car dealership prompts buyers to think about a crucial question: “How much car can I afford? You want to do that before a salesperson has you falling in love with the limited model with the sunroof and leather seats.”

Reed says getting preapproved also reveals any problems with your credit. So before you start car shopping, you might want to build up your credit score or get erroneous information off your credit report.

And shop around for the best interest rate. “People are being charged more for interest rates than they should be based upon their creditworthiness,” says John Van Alst, a lawyer with the National Consumer Law Center.

If you take that bad deal, you could pay thousands of dollars more in interest. Van Alst says the dealership and its finance company, “they’ll split that extra money.”

You May Like: Will Va Loans Cover Manufactured Homes