Will The Total Amount I Have To Repay Stay The Same If I Change Repayment Plans

In most cases, choosing a different repayment plan will change the amount of your monthly payment. The amount you repay each month determines how quickly you pay down your principal balance. Interest accrues based on the principal balance of your loan. Lowering your monthly payment by choosing a repayment plan that offers a longer term will increase the amount of interest you accrue, costing you more money in the long run. For more information, see How Is Student Loan Interest Calculated?.

What If I’m Behind On My Payment Or Anticipate Having Some Difficulty Making My Payment

If youre having trouble making payments or worried that making your payments could become difficult, contact Nelnet right away. We can help you take advantage of options that may be available to help you lower payments or postpone your payments . Log in to your Nelnet.com account and click Repayment Options.

Why Do I Receive Phone Calls From Nelnet And A Guaranty Agency

If you have a FFELP Loan and we have an incorrect address or phone number on file for you or your account is delinquent , we are required by regulations to communicate with you to resolve the delinquency or get updated demographic information. Your guaranty agency is also notified of the delinquency and will also attempt to reach you by telephone and/or mail.

You can conveniently update your address and phone information by logging in to your Nelnet.com account. Click My Info and Preferences, update your information on the Personal tab, and then click Save Changes.

You May Like: Usaa Rv Rates

When Am I Considered Delinquent On My Loan

You are considered delinquent the day after your payment is due. For example, if your payment is due on May 15 and we don’t receive your payment, you are considered delinquent as of May 16.

If you are having trouble making your monthly payments, we have options that can help. Log in to your Nelnet.com account and click Repayment Options.

Student Loan Account Number Loans Taxuni

Preview

1 hours in the pastThe student loan account quantity is a 10-digit quantity. You can discover your student loan account quantity in your billing assertion. Also, it may be discovered in your month-to-month assertion. All the opposite details about your student loan together with the student loan account quantity may be discovered on StudentAid.gov. Student Loan Account Number on StudentAid. 1.

See Also: Student Courses Show particulars

Don’t Miss: Usaa Car Loan Pre Approval

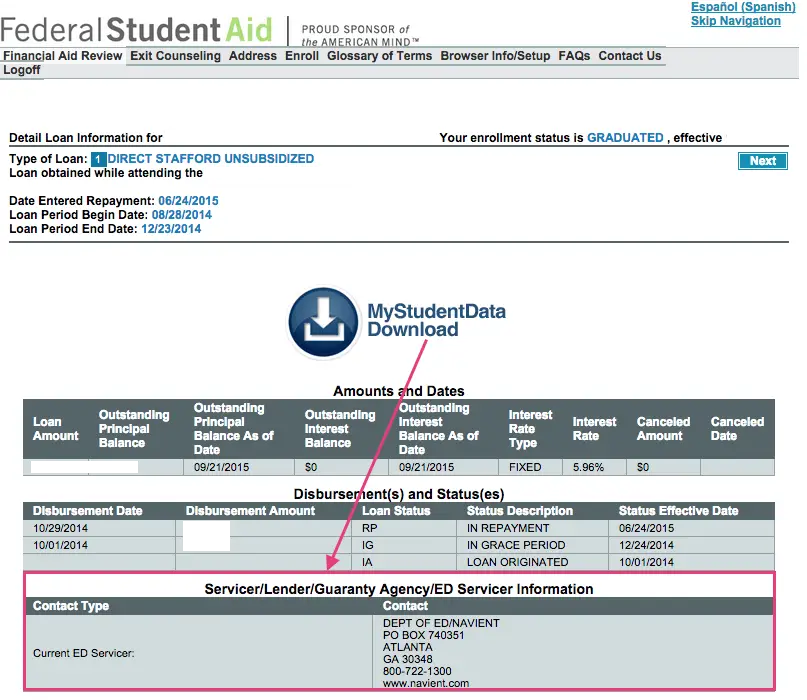

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

How Can I Change My Repayment Plan

To explore options or make changes to your repayment plan, contact us, log in to your Nelnet.com account, or see Repayment Plans. You can also visit the office of Federal Student Aid’s website at StudentAid.gov to review other options like consolidation.

You may prepay your loan at any time without penalty, regardless of repayment plan.

To learn more about the various repayment plans you may be eligible for, log in to your Nelnet.com account and click Repayment Options.

Read Also: Usaa Rv Buying Service

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Student Loan Account Number Fafsa Application 202122

Preview

3 hours in the pastThe student loan account quantity is supplied by the student loan supplier. There are some ways you may discover your student loan quantity. Surely, you obtained a couple of billing statements out of your student loan supplier. The billing statements present the student loan account quantity alongside together with your student loan supplier data. Your student loan account

Estimated Reading Time: 2 minutes

Show extra

Read Also: What Do Mortgage Loan Officers Do

You May Like: Can You Use Fha Loan If You Already Own House

What Are The Advantages Of Making Automatic Monthly Payments Through Auto Debit

Auto debit is a convenient, simple payment option offering you the peace of mind that comes with knowing your student loan payments are being made accurately and on time.

Nelnet does not charge a service fee for using auto debit. In addition, you don’t need to use stamps, envelopes, or a check, which saves you time and money.

Additionally, when you sign up for auto debit, you may be eligible for a 0.25% interest rate reduction * while your account is in an active repayment status.

*Your lender may modify or terminate its borrower benefit program at its discretion and without prior notice. Your failure to satisfy benefit eligibility requirements may result in the loss of benefit. Some lenders do not offer this benefit. back

Use The National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System , a database run by the Department of Education.

When you enroll into a college or university, the schools administration will send your loan information to the NSLDS. The database also pulls information from loan servicers and government agencies, so its a comprehensive outline of all federal student aid youve received.

To find your federal student loan balance on NSLDS:

While the NSLDS is useful, there are some limitations:

- Not always up to date: Information on the NSLDS can be as much as 120 days old, so it may not be the most up to date view of your loans.

- Not all loans are listed: The NSLDS only contains information about Title-IV eligible loans and grants, so if you took out other federal loans such as loans for medical or nursing school programs they wont show up on the NSLDS. Private student loans also wont be listed.

You May Like: Is First Loan Com Legit

How Would A Deferment Or Forbearance Impact Auto Debit And Incentives

Automatic monthly payments are not debited during deferment or forbearance. If the 0.25% auto debit interest rate reduction incentive or an on-time payment incentive is active on the account, it may become inactive during the deferment or forbearance period, and may return to an active status once your deferment or forbearance ends, depending on your lenders guidelines *. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will resume.

*Certain lenders, including the U.S. Department of Education, suspend the .25% interest rate reduction when your loan is not in an active repayment status. back

Paying Back Student Loan Debt

With federal student loans, there are multiple payment plans available:

Standard repayment plan: This is a ten-year repayment plan and students who choose this will typically pay less back, over time, than in other plans. This isnt a good choice if the student is interested in obtaining Public Service Loan Forgiveness . Graduated repayment plan: With this plan, payments increase every two years. This can help students who expect their income to increase, but they would pay more interest over time than if on the standard repayment plan. Extended repayment plan: Payments can be made during a period of up to 25 years. This can help with monthly payment amounts, but students will pay back more over the life of the loan than those who use the standard or graduated repayment plans. Income-based repayment plan : There are four different plans where student loan payments factor in the borrowers income this can be a good choice for those who plan to use PSLF, but borrowers will typically pay back more than under the standard plan.

PSLF is a forgiveness program that borrowers employed by a governmental or non-profit organization might qualify for. If a student has been denied for PSLF in the past, there is currently a Temporary Expanded Public Service Loan Forgiveness program to explore.

Recommended: How Much Do I Owe in Student Loans?

Recommended Reading: Is An Fha Loan Assumable

How Do I Find My Federal Student Loan Balance

Use the National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System , a database run by the Department of Education. When you enroll into a college or university, the schools administration will send your loan information to the NSLDS.

What If I’m Behind On Payments Is Delinquent At The Time Im Requesting A New Repayment Plan

To bring your account up to date, you have the option to make a payment anytime, anywhere. See How to Make a Payment If you cant make the payment to bring your account up to date, Nelnet may be able to grant you a loan forbearance to cover the delinquency. Interest may continue to accrue during a forbearance, and may be capitalized at the end of the forbearance period. Log in to your Nelnet.com account and select Repayment Options to explore your options.

Don’t Miss: Which Fico Score Is Used For Rv Loans

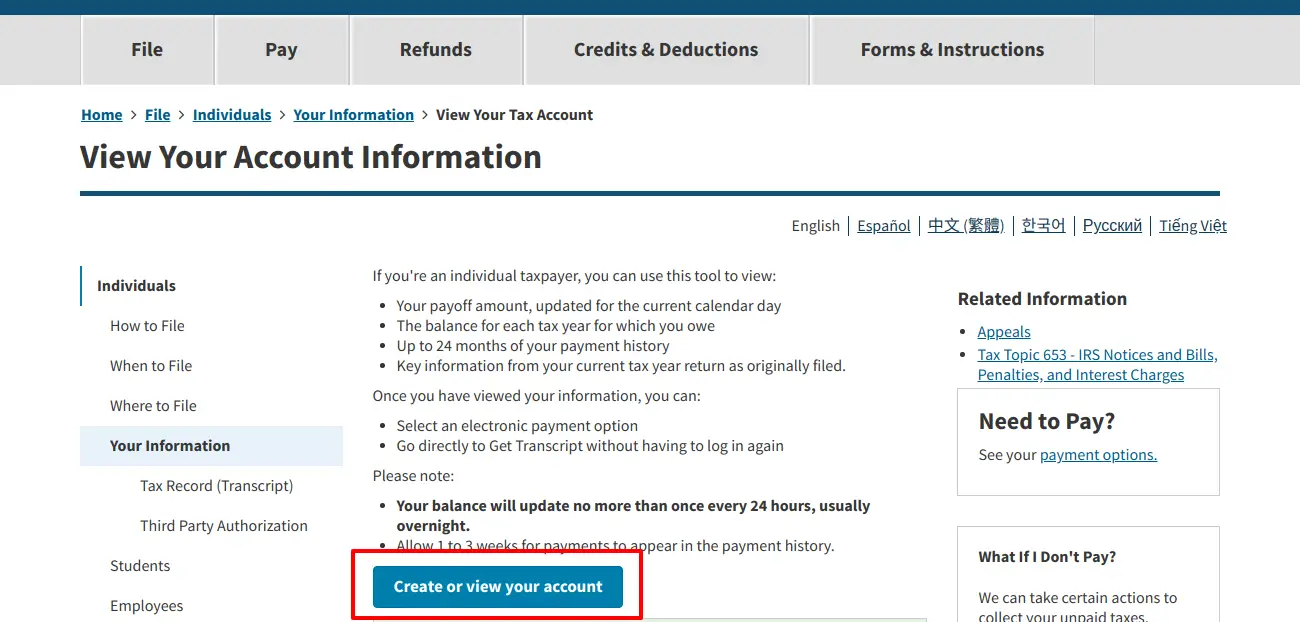

More About The Fsa Id

The FSA ID replaced the Federal Student PIN in 2015, so students who havent taken out new student loans or havent logged into the Federal Student Aid website since 2015 might not have an FSA ID yet.

Students who dont have an FSA ID can create one on studentaid.ed.gov.. Once you sign up for an FSA ID, the federal government will verify your information with the Social Security Administration. Once your information is verified, you will be able to use your FSA ID to obtain information about your federal student loans.

The site, managed by the U.S. Department of Education, can provide a convenient way to get a full picture of all your federal loans, including:

How many federal student loans you have Their loan types The original balance on each loan Current loan balances Whether any loans are in default Loan service providers names Contact information of the loan service providers

My Parent Or Another Third Party Is Making Payments On My Account How Can Third Parties Continue Making Payments On My Account If They Dont Receive A Statement

Your parent, co-signer, endorser, or other third parties can quickly and easily make payments by logging in to a free online authorized payer account at Nelnet.com. First, you need to set up the third party as an authorized payer. Remember that authorized payers have access to your account details, including account number, due date, amount due , payment amount, payoff amount, accrued interest, account balance, interest rate, loan type, and payment history.

Follow these easy steps one time to set up an authorized payer:

If you would like to give copies of your Nelnet statements and correspondence to a third party, print or save the documents from your Nelnet.com account inbox and send them by email or post office mail.

You May Like: Does Va Loan Work For Manufactured Homes

Whats The Difference Between The William D Ford Direct Loan Program And The Federal Family Education Loan Program

Generally, loans in these programs have the same terms and conditions. There are a few differences, including available repayment plans, borrower benefits , loan forgiveness programs, and interest rates. The primary difference between the two loan programs is that the U.S. Department of Education funds loans under the Direct Loan Program, and private lending institutions funded loans under the FFELP. There are still many FFELP loans in existence, but since July 2010, no new FFELP loans are being made.

Online Transfers And Payments

You can make a payment by transferring funds from a Wells Fargo deposit account or a non-Wells Fargo account through Wells Fargo Online®.

Sign On to Wells Fargo Online®, select your student loan account then Make a Payment.

It could take 1 2 business days for this payment to reflect on your account. Payments received by Midnight Pacific Time online will be effective as of the date of receipt. If received after Midnight Pacific Time they will be effective the following day.

You May Like: Can I Refinance An Fha Loan

Can I Make Payments While Im In School

Yes. While you arent required to make payments while youre in school, youll save money on interest in the long run if you do. To learn more about how making payments while you are in school helps you pay less interest over the life of your loan, see What Does It Mean That Interest Is Capitalized?.

If you make a payment within 120 days after the date your school disbursed your loan funds , your payment is first applied to the original principal balance of that disbursement. This reduces the amount of your loan. For more information about payments made within 120 days of disbursement, see How Are Payments Allocated? Please note: this excludes loans that are already in repayment status and consolidation loans.

Can I Have My Payment Applied To Interest Or Principal Only

No. For loans in repayment status, once a portion of a payment is allocated to a specific loan group, payments are applied to individual loans proportionally to fees first *, then to interest, and then to principal. If you are on an Income-Based Repayment Plan , payments are applied to interest, then to fees *, and then to principal. For loans not in repayment status, payments are first allocated to outstanding interest and fees . * For more information about how payments are applied to your student loans, see How Payments are Allocated.

*The U.S. Department of Education does not assess late or returned payment fees. back

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Does Nelnet Own My Student Loan

It’s possible Nelnet owns your student loan. However, we also act as a student loan servicer in other words, we provide customer service on behalf of many lenders and the U.S. Department of Education . Get details on all of your federal student loan with Nelnet and other loan holders and servicers online by logging in to StudentAid.gov. If you havent already, you will need to create an FSA ID to access your account with EDs office of Federal Student Aid.

Make A Payment By Phone:

To make a payment over the phone you can call us at 1-800-658-3567.

Have your 10-digit student loan account number as well as your checking account information available. You will need your checking account number and routing number, which you can find on the bottom of your checks.

Payments received by Midnight Central Time over the phone will be effective as of the date of receipt.

Recommended Reading: Usaa Refinance Car

Don’t Miss: Usaa Auto Refinance Phone Number

Completing Your Tax Return

On line 31900 of your return, enter the eligible amount of interest paid on a student loan.

Remember to claim the corresponding provincial or territorial non-refundable tax credit on line 58520 of your provincial or territorial Form 428.

For more information about your student loan and interest paid, visit Student Financial Assistance.

How To Get The Student Loan Interest Deduction

Unlike many other deductions, you dont have to itemize your tax return to take advantage of the student loan interest deduction. Instead, you can claim the deduction as a straight adjustment to your income. As a result, you may be able to take advantage of this write-off even if you take the standard deduction on your tax return.

Keep in mind that only the interest you pay on qualified student loans can be deducted . The amount of money you pay toward your principal loan balance throughout the year is irrelevant to how much you are able to deduct.

When you pay at least $600 in qualified student loan interest, your lender should send you an IRS Form 1098-E . You can use this form to claim the student loan interest deduction when you file your taxes.

Not sure whether you qualify for the deduction? The IRS provides an online interview to help you figure out if youre eligible.

Even if you think you might not qualify for the deduction, its worth the time to find out for sure. The student loan interest deduction could potentially save you hundreds of dollars on your tax obligation lowering your tax bill or boosting your tax refund.

Recommended Reading: Does Va Loan Work For Manufactured Homes