Apply For An Unsecured Loan

Before you apply for a loan, pre-qualify to see what rates and terms lenders can offer you. You can pre-qualify with NerdWallet to see offers from multiple online lenders. Pre-qualifying should never impact your credit score.

You can take those offers and compare them with loans that other lenders, like banks, may offer.

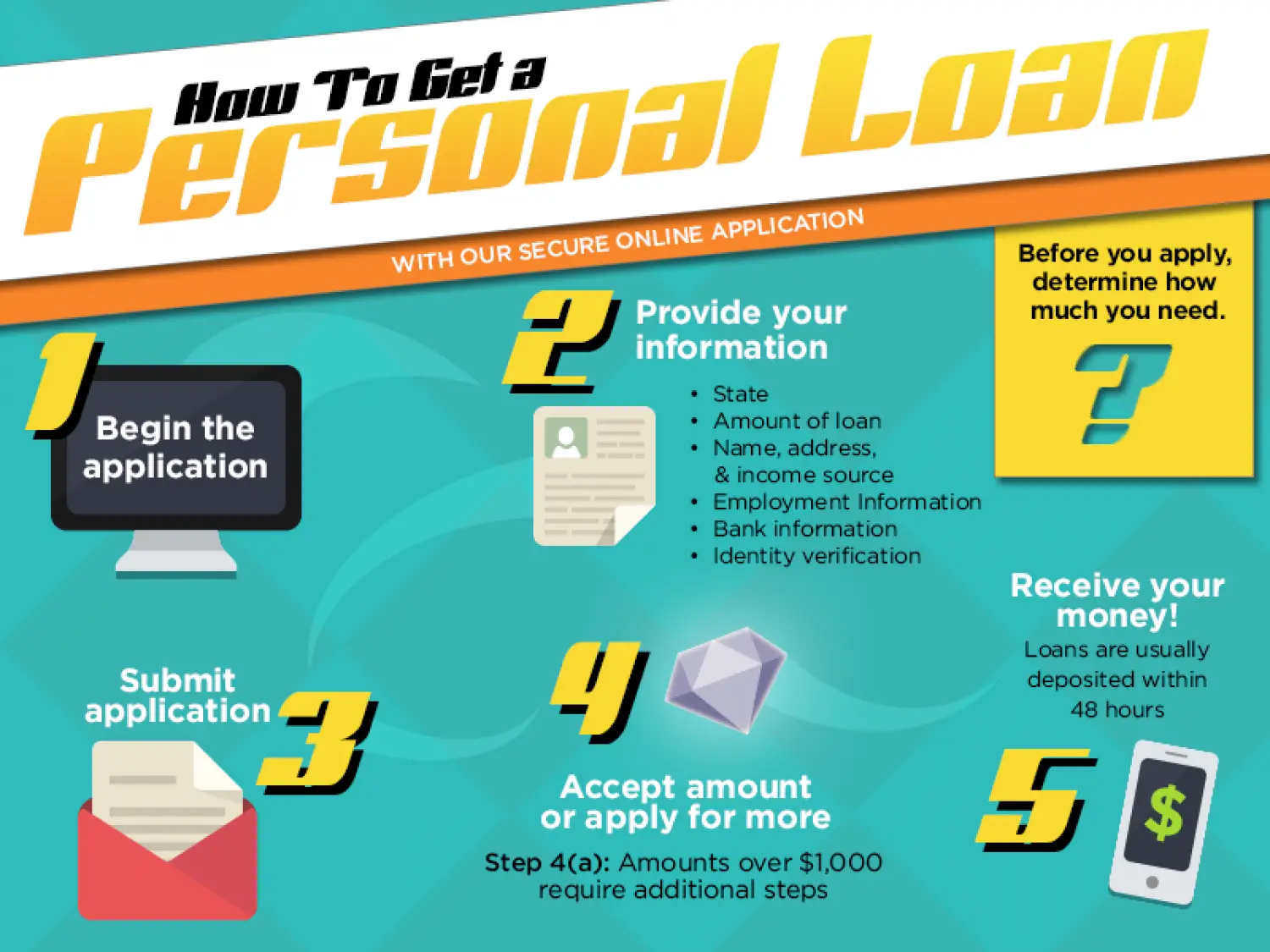

Once youre ready to apply, you’ll need to gather documentation, such as W-2s and bank statements, and begin the online or in-person application with the lender youve chosen.

What Is The Maximum Loan Amount I Can Get

Personal loan amounts vary depending on the lender. With Credibles partner lenders, you can take out a $600 personal loan up to a$100,000 personal loan.

Keep in mind that your credit will also likely affect how much you can borrow. Youll typically need good to excellent credit to qualify for the highest loan amounts. If you have poor credit, you might need a cosigner to get approved for a larger loan.

How Secured Loans Work

Secured loans let borrowers access a lump sum of cash to cover everything from home improvement projects to the purchase of a car or home. You can typically get these loans from traditional banks, credit unions, online lenders, auto dealerships and mortgage lenders.

Even though secured loans are less risky for lenders, the application process generally requires a hard credit checkthough some lenders offer the ability to prequalify with just a soft credit inquiry. And, while secured loan balances accrue interest like other loans, borrowers may access lower annual percentage rates than are available with unsecured options.

Once a borrower qualifies for a secured loan, the lender places a lien on the borrowers collateral. This gives the lender the right to seize the collateral if the borrower defaults on the loan. The value of the collateral should be greater than or equal to the outstanding loan balance to improve the lenders chances of recovering its funds.

Recommended Reading: Usaa Rv Interest Rates

Lets Get Personal: Understanding How To Get A Personal Loan

The rise of personal loans

Sue is driving her daughter to a follow-up doctorâs visit for a broken leg, thinking about paying her recent medical bills. She asks Siri, “How do I get a personal loan?”

Jack has recently started a small food truck business that sells tacos. Sales are booming, but so are his credit card balances. He wants to take out a personal loan to pay off those looming bills and consolidate his debt but isnât sure where to start.

If you, like Sue and Jack, have heard of personal loans but find yourself Googling “how to get a personal loan from a bank,” youâre not alone. Many Americans have researched and taken out personal loans recently.1 The number of personal loans rose from 16.9 million to 19.2 million from 2017 to 2018.1 If you think thatâs a lot of dollars floating around, youâre right. The total balance for all personal loans grew from $102 billion at the beginning of 2017 to $120 billion at the beginning of 2018.1

What is an installment loan?

Sometimes personal loans are referred to as an installment loan, but the two terms really mean the same thing. Personal loans can be used for a lot of different thingsâthatâs part of the beauty.

To get a personal loan, youâll first need to apply for one from a bank or online financial company. Not everyone who applies will qualify, but if you do, the institution may lend you a certain amount, such as $10,000. Then you pay it back during a set amount of time.

Collateral and personal loans

Home Equity Or Homeowner Loans Borrowing More From Your Mortgage Lender

You may be able to get a further advance on your mortgage you borrow an additional amount of money against your home from your current mortgage lender.

This might be a useful option if youre looking to pay for some major home improvements or to raise a deposit to buy a second home.

Read our guide Increasing your mortgage getting a further advance

Recommended Reading: Usaa Auto Loans

Need Someone To Talk To About Your Finances

If youre struggling with money, you can talk to a specialist today, online or by phone, who will be able to help you start sorting out your financial problems.

There are several names for secured loans, including:

- home equity or homeowner loans

- second mortgages or second charge mortgages

- first charge mortgages

- debt consolidation loans .

How Do Installment Loans Work

The three types of loans you are most likely to encounter are:

- Installment Loans: You borrow a set amount and repay it in equal monthly installments over a fixed period. Examples include personal loans, auto loans, and mortgages.

- Revolving credit: You can use revolving credit to borrow money whenever you want, as long as you dont exceed your credit limits. You determine your payment amounts and timing, but you must repay at least a specified minimum each month. Examples include credit cards and home equity lines of credit.

- Lump-sum repayment: You borrow a fixed amount and repay by the due date. Examples include payday and pawnshop loans.

Installment loans possess several characteristics, including:

- The loan amount

- Fees, such as origination fees and prepayment penalties

- Collateral for secured loans

Most installment loans require the same payment each month until your pay off the entire amount. The longer the loan term , the less youll pay each month. But the total loan interest rises directly with the number of installments.

Many installment loans allow you to repay early, but some charge a prepayment penalty.

Also Check: Stilt Loan Calculator

How To Qualify For An Unsecured Loan

While it is challenging to qualify for an unsecured loan, if you know what is expected of you, it can be easier to prepare. Creditworthiness is the main thing lenders consider, however, there are other considerations too. Below are common items that lenders consider for unsecured financing approval.

- . To qualify for an unsecured loan, a credit score of 650 or higher is often required. If your credit score is below 650, do your best to boost it before you apply to better your odds of approval.

- . Credit is important, but lenders will also want to know that you have cash flow available to make payments. Often, this means regular and steady income.

- Payment History. Lenders will definitely consider your previous payment history. How an individual has managed debt in the past is one of the best ways to determine how they will handle debt in the future.

- Co-Signer. Using a co-signer is not the regular process used by unsecured financing lenders, but it can help to have someone back the loan. A co-signer agrees to repay the debt if the primary borrower defaults, this can make the lender feel more comfortable about extending debt.

In addition to the above, you will also need to be the age of majority in your province or territory. When you apply, youll need to provide government-issued identification and documents showing your proof of income.

Have you ever thought about the true ?

Can I Rebuild Credit With An Installment Loan

Most installment loans report your payments to one or more of the three major credit bureaus. Any lender that does a hard credit pull is likely to report your payments. If those reports show you consistently pay your bills on time, youll build credit.

Installment loans give you a chance to demonstrate creditworthy behavior through timely payments each month. For example, if you take a two-year personal loan, youll have 24 opportunities to demonstrate responsible behavior.

Get your payments in on time, without fail, and your credit score should begin to recover within a year.

Also Check: Usaa Auto Refi Rates

Other Types Of Unsecured Financing And How They Compare

There are many kinds of financing, but Marcus personal loans have advantages. With a Marcus unsecured personal loan, there are no fees. Youll always know exactly how much you owe each month for the term of your loan, and you wont be charged any fees on top of what you already owe only interest.

Lets take a look at how personal loans compare to other types of financing.

Unsecured Loans Vs Secured Loans

Secured loans differ from unsecured loans in that secured loans always require collateral. If a borrower wont agree to provide an asset as insurance, the lender wont approve a secured loan.

This loan type exists for a variety of financing options, including mortgages, car loans, home equity lines of credit and some types of personal loans. Borrowers will likely not encounter unsecured mortgages or car loans since the home or vehicle is always used as collateral for those loan types.

Getting approved for a secured loan can be easier than getting an unsecured loan because secured loans pose less financial risk for lenders. Since they require collateral, they typically have more competitive interest rates than unsecured loans.

Recommended Reading: Usaa Rv Loan Calculator

Deal With Mounting Credit Card Debt

Having trouble getting a loan from a bank because of your credit card debt? Have you been Googling search terms like loans with bad credit or bad credit loans? If you find yourself unable to deal with an unmanageable amount of credit card debt, Lend for All can help.

A personal loan can help pay off credit card debt, which in turn can improve your credit score. Using our AI-powered application process, quickly find out how you can borrow money to mitigate your existing debt and prevent your credit history from being negatively affected.

Ready to apply for a personal loan online? and apply in six easy steps.

Still have questions about unsecured personal loans in Canada? Contact a Lend for Allrepresentative for more information.

Need Cash Fast An Emergency Personal Loan Can Help

Finding the best urgent loan for your needs isnt easy when youre faced with an untimely repair, medical crisis, or costly event. Still, knowledge is power, especially when it comes to your financial future.

Getting familiar with the different types of emergency personal loans and learning how each one works can help you avoid illegitimate loans, save money, and manage your current situation. At the same time, youll be better prepared for the futureand better able to plan for the unexpected.

¹If you accept your loan by 5pm EST , your funds will be sent on the next business day. Loans used to fund education related expenses are subject to a 3 business day wait period between loan acceptance and funding in accordance with federal law.

²Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

Also Check: How Long Does Sba Loan Take

How Are Unsecured Loans Different From Secured Loans

The main difference between secured and unsecured loans comes down to how you apply for them and what happens if you default on your payments.

- Unsecured personal loans. These loans rely heavily on your credit score to determine your eligibility for financing. If you default on your payments, your credit score will be negatively affected. They typically come with higher interest rates and its more difficult to apply with bad credit. These loans are for borrowers with good to excellent credit, or those who dont own any assets.

- Secured personal loans. Secured loans require you to use an item of value to secure the money you want to borrow. Your lender can repossess this item to cover its losses if you default on your payments. These loans tend to come with lower interest rates and theyre easier to qualify for if you have bad credit. They are best for people who own assets or have credit scores under 650.

Why is the interest rate higher on an unsecured loan?

Interest rates on unsecured loans are usually higher than for secured loans since your lender needs to take on more risk. Charging higher interest rates provides them with a financial cushion since they wont be able to reclaim your assets to repay your loan if you default. Youll typically pay the highest rates for unsecured personal loans for bad credit with instant decision in Canada.

Personal Loan Features And Benefits

Axis Bank Personal Loan Features

One needs to be of a minimum age of 21 years and should have a valid set of documents like ID, income and residence proof, among other documents, to avail a Personal Loan from Axis Bank.

To ease the burden of paying off the Personal Loan immediately, you may opt for the EMI facility. The repayment tenure can range from anywhere between 12 to 60 months. If youre an Axis Bank customer, you can avail the best rates for Personal Loans!

To know how much you need to pay per month, there is a Personal Loan calculator at your disposal. You can choose your tenure and the amount that you are comfortable repaying each month for the chosen tenure. With the Personal Loan EMI Calculator, you can also calculate the compound interest and know exactly how much you need to finally part with – including the interest.

Axis Bank Personal Loan Benefits

Read Also: How Does Someone Take Over A Car Loan

How To Apply For Unsecured Loans

- Company website: Almost all the top lenders in the market now provide their services through their websites. You can visit the official website of the bank and apply for a loan with your credentials.

- Loan aggregators: There are third-party loan aggregators like Bankbazaar that can help you find the best deals available in the market. Here, you can compare the different loan products and choose the best product that suits your specific needs. In this way, you can check the interest rates and processing fees of different lenders before making a final decision.

- Branch office: You may also visit the lenders branch office and apply for a loan. With the advent of the internet, this is not the most popular choice among todays borrowers. However, if you are not internet savvy, you may use this option to apply for a loan.

How Long Does It Take To Apply For And Receive A Loan

This depends on the lender. For example, with an online lender, you can often fill out an application and receive an approval decision within minutes while a traditional bank might require you to visit a branch to apply.

The time to fund for a personal loan also varies by lender. Here are the funding times you can typically expect:

-

Online lenders:

- 1 to 7 business days

- 1 to 7 business days

There are also some lenders that offerfaster personal loans with shorter funding times. For example, several of Credibles partner lenders provide next- or evensame-day personal loans.

If you want to get your funds as soon as possible while avoiding any delays, be sure to:

- Fill out the application as accurately as you can

- Submit any required documentation in a timely manner

Recommended Reading: Refinance Fha Loan To Conventional Calculator

Pros And Cons Of An Unsecured Loan

As with all financial products, its important to consider the pros and cons before making a final decision to proceed. Lets explore the pros and cons below.

Pros

- Funding Possible Without Valuable Assets. Many people do not have assets with significant value which can make it challenging to find secured financing. Unsecured financing is a good alternative for these individuals.

- Easy Application Process. Your application can be completed online and is much simpler than traditional lending institution application processes. You will also find out if you were approved or not in under a day.

- Personal Assets Are Safe. In the event that the borrower cannot repay the loan on time, they will not need to give up personal assets. The lack of collateral requirements is what allows the borrowers assets to remain safe.

Cons

Types Of Secured Loans

Mortgages and auto loans are perhaps the most well-known secured loans, but there are a number of other financing options that may require collateral. These are the most common types of secured loans:

- Mortgages.Mortgages are a common type of loan used to finance the purchase of a home or other real estate. These loans are secured by the financed property, meaning the lender can foreclose in the case of borrower default.

- Home equity lines of credit. A home equity line of credit is a revolving loan that is secured by the borrowers equity in their home. The borrower can use the funds on an as-needed basis.

- Home equity loans. Like a HELOC, a home equity loan is collateralized by the borrowers home equity. With a home equity loan, however, the borrower receives a lump sum of cash, on which interest begins accruing immediately.

- Auto loans.Auto loans are secured by the vehicle being financed. To protect its interest in the collateral, a lender holds title to the financed vehicle until the loan is repaid in full.

- Secured personal loans. Secured personal loans let borrowers access cash that can be used for personal expenses like home improvements, vacation costs and medical expenses.

- Secured credit cards. With a secured credit card, a borrower gets access to a line of credit equal to the amount of cash she commits as a security deposit. This makes these cards an excellent option for borrowers trying to improve their credit scores.

Recommended Reading: Refinancing Fha Loan

What Is The Minimum Credit Score Needed For A Personal Loan

Lenders dont typically have a minimum required credit score that you need to achieve for loan approval. Thats because your credit score is just one facet of whats considered on your application.

For example, someone may have a good credit score, but a lot of debt that would make it difficult to cover another monthly payment. In that case, the consumer would most likely not receive the loan.

On the other hand, a consumer may have bad credit, but a recent string of good payment history and few debts that require monthly payments. If this consumer can prove that he or she has the monthly income to afford the loan repayment plan, then theres a good chance of approval.

Since an unsecured personal loan comes with no collateral, you have to overcome a bad credit score by proving to the lender that you can afford the monthly payment. After all, obtaining a loan regardless of your credit score is all about gaining the lenders trust.

In addition to your credit score, the lender will look at several factors to determine approval. These include:

You can overcome your poor credit by showing a lender that youre responsible and ready to take on the loan youre applying for.