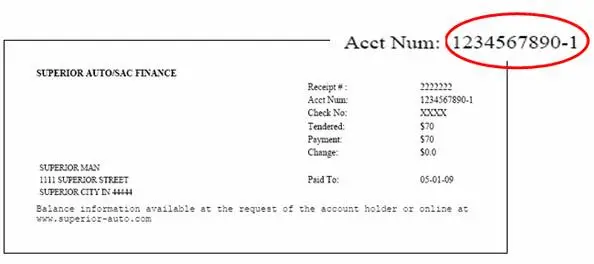

Where Do I Find My Account Number

Your 10-digit auto loan account number can be found in the following places:

Welcome Letter

Your account number is provided with the loan details in the welcome letter that you receive in the mail after your new loan is funded.

Account Statement

Your account number is at the top of your monthly statement and on the payment coupon at the bottom of the statement.

Online

To view your complete account number, sign on, select your auto loan from Account Summary, and then select the account number on the Auto Loan page.

Phone

If you are unable to find your auto loan account number, please call us at 1-800-289-8004.

My Car Was Totaled And My Insurance Did Not Cover The Full Loan Amount What Should I Do

You are responsible for making your regular monthly payments until the loan is paid off. If you had Guaranteed Asset Protection insurance on your loan, some or all of the remaining balance may be covered. If there is a remaining balance on the loan after the GAP payout is determined, you are responsible for making regular monthly payments until the loan is paid off. You can also make a lump sum payment, if you prefer.

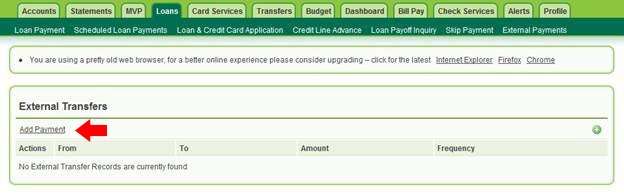

How Do I Make Payments On My Auto Loan Account

Set up automatic payments

You decide which savings or checking account you would like the money to come from each month. There is no charge for enrollment, and you can easily change or cancel the automatic payments online.

To set up automatic payments, download and complete the automatic payment form , and return by mail.

Pay online

Sign on to your account to make a payment. Not enrolled in Wells Fargo Online®? Enroll now

Pay by phone

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Insurance Funding Cancellation: What Is The Process For Insurance Funding Cancellation

Within 11 months from the date of insurance funding, a customer can call the ICICI Bank Customer Care or visit the nearest ICICI Bank Loan Servicing Branch and submit a request for the insurance loan cancellation.

Wherever an insurance funding is done for the Parent Loan , the insurance cancellation amount will be adjusted against the Mortgage loan, as a part payment and the effect of the part payment will be given on tenure.

Does Refinancing My Loan Affect The Aftermarket Product I Purchased

Refinancing your loan may affect aftermarket products, but it depends on the product you purchased. Review the terms in the contract to understand whether refinancing your vehicle will affect coverage. While most products are generally not affected, Guaranteed Asset Protection coverage typically ends when the loan is refinanced or paid off.

Read Also: How Do Mortgage Loan Officers Make Money

How Much Of My Monthly Payment Is Interest

With a simple interest loan, there is a daily interest charge and you will pay interest on the number of days between your payments.

ExampleIf the daily interest charge is $2.50, and it has been 30 days since your last payment was made, the interest due will be $75.00 . Lets use the same daily interest charge, but now say it has been 40 days since your last payment was made, the interest due will be $100.00 .

If you defer a monthly payment, this will extend the term of your loan, and the interest will continue to accrue until the next payment is made. The outstanding loan balance will continue to accrue interest until the loan is paid off.

The total interest paid over the term of your loan may be different from what is shown on your loan agreement. If you pay your loan early, the amount of interest will be less, and if you pay your loan late, the amount of interest will be more.

Cibc Personal Car Loan

With up to 8 years to pay off the loan and the possibility of no down payment, this loan makes it easy to purchase a new or used vehicle.

Term: 1 year – 8 years

Special offer: Get up to 10% cash back with a new CIBC Dividend Platinum® Visa* Card. Plus, save up to 10 cents per litre3,4 on gas at participating Chevron, Pioneer and Ultramar gas stations4 when you link and use your CIBC card with Journie Rewards. Learn more about Journie Rewards.

This personal car loan is for you if you want:

- Help with financing a new or used vehicle

- Lower monthly payments by taking up to 8 years to pay off your loan, giving you maximum flexibility

- The choice of weekly, bi-weekly, semi-monthly or monthly payments to coincide with your pay periods

- To apply online for a faster approval

Other loan details:

- Borrow a minimum of $5,000

- Once youve been approved for a CIBC Personal Car Loan, your information only needs to be updated for future credit applications

- To make scheduled payments from your CIBC account at no charge with an Electronic Fund Transfer

- Pay off all or part of the loan at any time without penalty

- You can also skip up to two payments yearly2

You may also want to consider:

- Using a personal loan to buy a used car

- Applying for a Home Power® line of credit for a lower interest rate and a higher credit limit

Tools and advice

Recommended Reading: Va Mobile Home Loans

What Is A Simple Interest Loan

Simple interest is a method of allocating monthly loan payments between interest and principal. The amount of your payment allocated to interest is calculated based on your unpaid principal balance, the interest rate on your loan, and the number of days since your last payment.

ExampleIf we receive a payment and it has been 29 days since your last payment, then you will be charged 29 days of interest on the unpaid principal balance of your loan. The remainder of your payment is credited to principal and reduces the unpaid principal balance on your loan.

I Need To Change A Name On My Vehicle Title And My Loan Account Has An Outstanding Balance What Should I Do

Begin by checking with your motor vehicle department to find out what title documentation youll need. When we receive the request, well send the title documentation in the appropriate format.

- If the motor vehicle department asks for a copy of the title, an electronic screen-print, or an authorization letter, you or the motor vehicle department can request that from us.

- If the motor vehicle department needs the original paper title, they will need to request the title from us.

Youll then go to the motor vehicle department to formally request the title change. The motor vehicle department will either send the information to us directly or will provide you with the required document. If you receive the document from the motor vehicle department, you can submit it to Wells Fargo Auto, along with one of the following documents:

- Articles of amendment

Fax

1-844-497-8670

Please allow three to five business days for processing from the date that we receive the required documentation.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

When Will I Receive My Title After I Pay Off My Loan

After we receive your final payment and the account balance is satisfied, we will release your title depending on the payoff method, state law requirements, and state motor vehicle department procedures. The title release process can vary in length and depends on if you have a paper, electronic, or customer-holding paper title. If you are unsure of which category applies to you, please contact your local motor vehicle department. If you have additional title-related questions, please call us at 1-888-329-4856.

Paper title maintained by Wells Fargo AutoWe start the title release process in approximately 3 10 calendar days after the payoff posts to your account, to allow enough processing time for your payment to clear through your financial institution, or as otherwise required by state law. To shorten the title release process, payment by guaranteed funds will begin the process within 3 calendar days.

Please note this does not include mail time.

If the payoff amount received does not satisfy the amount owed, the title will not be sent until the balance is settled. If you have additional title-related questions, please call us at 1-888-329-4856.

Electronic title maintained by your stateFor electronic titles, you will not receive a paper title from Wells Fargo Auto. At the time of release, we will electronically cancel our lien with your state. After the lien is released, your state will mail your title in approximately 4 8 weeks.

Why Didnt My Auto Loan Payment Decrease After A Refund Was Applied To My Account

The monthly loan payment is calculated from the terms in the original loan agreement. Your loan agreement is not rewritten because of the refund, so your payment does not change. The refund is applied to your current principal balance which means you have less money to pay back. This may reduce the amount of interest you pay, and it may help you pay off your loan more quickly than the original term.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Is Interest Calculated On My Auto Loan

With a simple interest loan, interest accrues daily. As you pay off the principal balance, the daily interest charge will decrease.

To calculate the daily interest charge, first convert the interest rate percentage into a decimal by dividing the interest rate by 100. Multiply that number by your principal balance, and then divide by the number of days in a year . This will give you the daily interest charge.

ExampleIf the loan has a 9% interest rate and a $10,000 principal balance, you convert the interest rate into a decimal: 9 / 100 = .09, and calculate the daily interest charge: .09 x $10,000 / 365 = $2.47 daily interest.

How Do I Know Who My Auto Loan Lender Or Servicer Is

If you financed your auto loan directly with a bank, credit union, or other lender , that entity is your lender. If you got your financing through the dealer, or your lender transfers servicing rights to a third party, you can generally expect that you will receive a welcome letter from your lender or servicer giving you information about your loan.

The letter should include contact information and information about how and when you make payments. Make sure you keep and pay attention to your paperwork, as it can tell you:

- Who your lender or servicer is

- Where to send your payments

- What counts as an on time payment and whether there is a grace period

- The amount of any late fees

- Whether there is a penalty if you pay off the loan early

- Who to contact if you are having difficulty making payments

Don’t Miss: Can I Buy A Manufactured Home With A Va Loan

Go Electric And Drive Away With Big Savings On Your Auto Loan

Getting a car loan doesn’t have to be a major journey. We create a speedy course for you to take, so that you can get on the open road. Take advantage of competitive rates and flexible terms. The roadmap for a car loan doesn’t get easier. Save an additional 0.25% when you make automatic payments from a Bank of the West checking or savings account. There may even be additional benefits for our Premier and Wealth Management customers.1

Have you recently moved to the U.S. to pursue your career? If so, financing a car without established credit history can be challenging. We’re here to help you get behind the wheel. Learn More

Go green with an Electric Vehicle loan discount and save 0.25% off our standard auto rates when you finance a qualified electric vehicle. Learn More

Checking Icici Bank Car Loan Status By Calling Customer Support

You can also track the status of your ICICI Bank car loan by calling the customer support helpline at 1860-120-7777 . Once you call the number and provide your loan reference number, the customer care representatives will find out the status of your loan application and let you know.

Did you know are three types of car loans in India? ICICI Bank Customer Care

Read Also: How Much Do Loan Officers Make Per Loan

Importance Of Bajaj Finance Loan Account Number

Bajaj loan account number proves useful for these purposes:

- Tracking loan transactions

- Accessing loan interest repayment details

- Summarizing applicable charges

- Assigning a unique identity to each borrower

Besides these, borrowers must provide their LAN to Bajaj Finance customer care to access loan details. You can find out your Bajaj Finance loan account number by simply logging in to the customer care portal Experia. Other than that, you can check the information through SMS, customer care number, or raising a request on our website. Individuals who prefer in-person assistance can visit the nearest branch of Bajaj Finance to request their LAN.

Faqs On Icici Bank Car Loan Status

Answer: Having a credit score lower than 750 is likely to cause the rejection of your ICICI Bank car loan application. This is because a low credit score reflects a poor repayment capacity and hence, banks see it as a risk to lend to anyone with such a score.

Answer: Yes. A processing fee starting from Rs.3,500 will be charged to you upfront, depending on the price band of the vehicle, during the application process of ICICI Bank car loan.

Answer: Yes. A steady income is a mandate for the bank to offer you a car loan, whether you are a salaried or self-employed individual. If you do not have a steady income, you may not be eligible to get a car loan from ICICI Bank and so, your loan application will get rejected.

Answer: The eligibility for ICICI Bank car loan can be checked by using the Car Loan Eligibility Calculator available on the banks official website). Once you calculate your eligibility and find out that you are eligible, you can initiate the loan application process.

You May Like: 20/4/10 Rule Calculator

Will I Get A Refund If I Cancel The Aftermarket Product

The contract may say whether you are entitled to a refund. If it does not, contact your coverage provider, as they will determine whether you are entitled to a refund and what amount, if any, is owed. The coverage providers information is listed on the contract. To request a copy of the contract, contact the dealership or call us.

Online Way Of Checking Icici Bank Car Loan Status

If you have applied for a car loan from ICICI Bank online on the banks official website, you will receive a reference number. Using this reference number, you can track the status of your loan application by following the below-given steps:

- You will be redirected to a new page where you can track your loan status.

- Enter your reference number or form number in the space provided and hit on the Submit button.

- In case you have forgotten the reference number, you can proceed to the section below that says, Forgot Your Reference Number? and then enter the requested details .

- Once you click on the Submit button, you will be shown the status of your loan application.

Applying for car loan online in a matter of minutes. Check it out here! ICICI Bank Car Loan

Don’t Miss: How Much Do Loan Officers Make In Commission

How Do I Make Payment For My Car Loan

1) By Fund Transfer from your UOB account / GIRO arrangement through UOB Personal Internet Banking or UOB Branch. GIRO application form can also be found in UOB website or UOB branch.

2) By Cash / Cashier’s Order / Cheque – make payable to UOB Ltd for A/C XXXX, where XXXX refers to the vehicle loan account number. The vehicle loan account number and car plate number should also be written on the reverse of the cheque. Customer can also deposit cheque at any UOB Branches or drop into Fast Cheque Deposit box.

3) By Telegraphic Transfer – Please see details required below:

| Beneficiary Bank Name: |

Why Do I Still Have A Loan Balance If I Have Gap

There are limitations and exclusions for GAP, which you can find in the contract. For example, GAP may not cover late payments, late fees, or payment deferments. If you have questions about the coverage, contact the dealership or the coverage provider their contact information is listed on the contract. To request a copy of the contract, contact the dealership or call us.

Recommended Reading: Does Va Loan Work For Manufactured Homes

What Happens If I Make A Payment That Does Not Clear

If a payment is returned unpaid, we may attempt to present the payment to your financial institution one more time. Your financial institution may charge a fee each time the payment is returned. If the payment doesn’t clear, youll need to resubmit the payment once you have sufficient funds in your bank account.

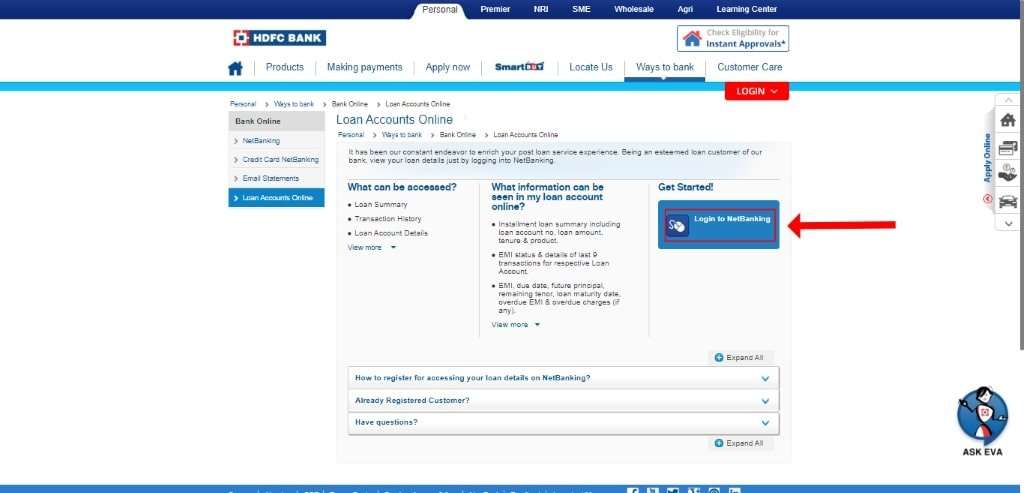

How Do I Enroll In Online Banking

With Wells Fargo Online, you will need to complete a one-time enrollment process. You will need your Social Security number and your 10-digit auto loan account number to get started.

You can access and manage your auto loan account from your desktop or mobile device to conveniently make payments, view your payment and transaction history, sign up for online statements, and more.

If you have questions or need assistance with the enrollment process, please call us at 1-800-956-4442.

Recommended Reading: Does Va Loan Work For Manufactured Homes