Why Do Repos Happen

A car repossession typically occurs when you stop making payments on an auto loan.

When you get an auto loan, the bank you have the loan through technically owns the car until the loan is paid off in full. If you do not pay the loan in full and stop making payments, then the bank can essentially take their car back from you.

Your lender can seize your vehicle at any time once your loan is in default. In most states, they dont even need to notify you that they will do this. Lenders will typically then sell the vehicle to try and recoup the money they loaned for its purchase.

What To Do If Your Loan Doesn’t Appear On Your Report

If your auto loan doesn’t show up on your credit report after 30 to 60 days, reach out to your lender. Ask them if it’s their policy to report loan activity to the credit bureaus and, if so, whether they can follow up to make sure your loan information has been reported accurately.

Short of refinancing with another lender, you have limited recourse if your lender simply doesn’t report to any of the credit bureaus. In the future, you may want to find out what your lender’s policies on credit reporting are before you submit a loan application.

In the meantime, it can still be beneficial to monitor your credit score and report periodically to check your creditand to make sure the information in your is as accurate and up to date as possible. The information in your credit report will likely be instrumental in getting your next auto loan or credit card, whether or not your current loan information is being reported.

If The Dealership Runs My Credit Will My Fico Score Drop

The first “inquiry” has a minor impact on the credit score, but subsequent inquiries do not, says Melinda Zabritski, senior director of automotive credit for Experian.

“It’s well known that consumers shop around when they are car buying,” she says. So Experian, for example, groups multiple inquires occurring within a two-week period and they have no further effect on a consumer’s credit score.

According to the Experian Web site: “10% of your credit score is based on inquiries or ‘credit checks.’ Every time you apply for credit, a ‘hard inquiry’ is placed on your credit report. Having too many hard inquiries could indicate to lenders that you’re trying to overspend.”

Read Also: Can I Refinance My Sofi Personal Loan

Consider A Variety Of Lenders

Don’t forget to check with the dealership in addition to whatever banks, credit unions, or online lenders you consider. Sometimes the dealer will be willing to match or beat whatever financing offer you walk in with. This is tricky territory, though. Car dealerships are notorious for adding unwanted costs to your contract, like prepaid maintenance or extra insurance coverage.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

You May Like: How Do You Find Your Student Loan Account Number

Can A Collection Agency Report An Old Debt As New

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date. They should also all be discharged on the same date seven years after the original open date.

How Credit Scores Are Calculated

Because we can’t see inside these algorithms, the way they respond to certain changes can be unpredictable. A major change to your credit, like, say, paying off a long-running auto loan, can create an instability in your score, said Rod Griffin, senior director of consumer education and advocacy at Experian, a competitor to Credit Karma.

This change shouldn’t be permanent, Griffin said.

“What we typically see is it’s not usually huge and it’s usually short-lived, so if you give it a payment cycle or two, it bounces back to what it was,” he said.

A change to my credit mix: Having a variety of credit, including credit cards, mortgages and auto loans, is generally good for your credit score. Removing a loan your portfolio of credit can have a negative impact.

Shortening the length of my credit history: That auto loan was one of my oldest credit accounts. Closing it could have shortened the overall age of my accounts, leading to a drop in my score.

Hereâs our explainer on building credit and what makes it change.

Don’t Miss: How Do I Find My Student Loan Account Number

Cosigners Are Only Responsible For The Loan

In a cosigner situation, one borrow is the primary borrower. Thats usually the person whos going to use the car, and who has the primary responsibility in paying it off. For example, if a parent cosigns on a loan for their daughters 18th birthday, its the daughter who will drive the car and be primarily responsible for payments.

But if she falters and falls behind, then the parents are on the hook to make the payments. The lender will come after mom and dad for the money, in that case. Even worse, the late payments will be listed on both the daughters and the parents credit report, potentially ruining both of their credit scores.

Thats a scary thing to think about if youre on a cosigned loan, but at least the damage is limited to just your credit history. Thats not necessarily the case if youre a co-borrower, however.

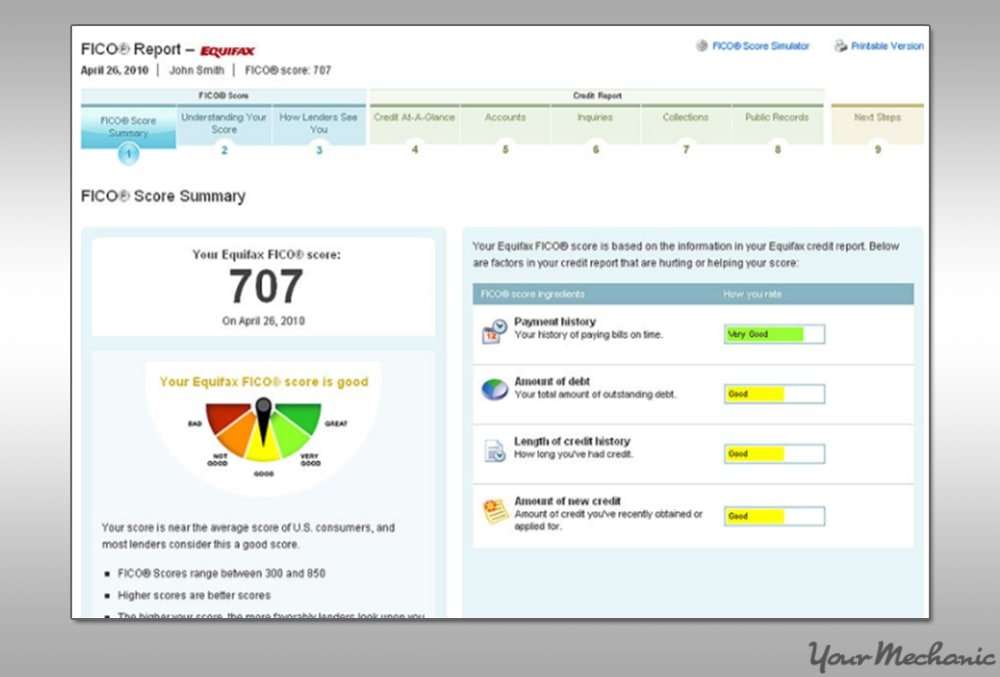

What Is A Good Credit Score For An Auto Loan

While lenders can set their own standards when assessing an individual’s FICO score, generally accepted standards across the board for multiple lenders. According to Experian, “higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed.”

So what’s a “good” credit score? Anything above 700 will at least allow borrowers to be in a good position to obtain auto loans. Once you build your score over 800, you can pretty much be assured of your excellent credit and an ace up your sleeve when negotiating your annual percentage rate and your loan terms. However, if you credit score is higher than 600 and lower than 750, you’re in line with most borrowers. The average credit score in America is 657.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Do You Calculate Interest On A Car Loan

Lenders charge monthly interest on the car loan. The interest amount is the result of multiplying the monthly interest rate by the loan balance. The monthly interest rate is the basis for calculating the annual interest rate, which takes into account the lender’s fees, which are added to the balance and charged over the life of the loan.

Will Paying Off Car Improve Credit

A car payment can be a substantial financial stressor in your life, especially if you have other types of debt at the same time. Between student loans, credit card payments, and other bills, such as your auto insurance, it’s easy to start to feel the stress. For this reason alone, many people aim to pay off their debts to free up money for their savings and other life goals.

However, while paying off your debt is an admirable goal, it can lead to some concerns when it comes to your credit score. Since your credit score depends on the types of debt you have and your payment history, many people may be surprised to see a sudden change in their numbers after paying off a substantial debt like their car. So, will paying off a vehicle improve your credit?

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Faqs On Cibil Score For Car Loan

What is the CIBIL score required to secure a car loan?

The minimum CIBIL score required for being eligible for a quick and streamlined car loan approval process is 750. Besides, lenders may also evaluate other parameters like monthly income, number of existing loans, income to debt liability ratio, etc. to assess car loan eligibility.

Can I get a car loan without a CIBIL score?

Yes, you can secure a car loan without a CIBIL score, though the approval process will be more time-consuming and hassled. Besides, the terms and conditions you will be offered may not be as favourable as offered to those with a high CIBIL score. For instance, your loan amount may be lower or interest rate may be higher or may have a lesser tenure. You stand a higher chance of securing a car loan with a low CIBIL score, as compared to other types of loans, as your car serves as collateral till you have repaid the entire car loan.

I have a low CIBIL score. Will my taking a guarantor improve my chances of getting a car loan?

Getting a guarantor is one of the options you can explore if you have a low CIBIL score. The guarantor may be anyone from your friends or family with a good CIBIL score. In such car loan applications, your guarantors CIBIL score will be evaluated during the car loan approval process.

Does paying only the minimum amount due against my credit card bill affect my CIBIL score?

How Do Late Payments Affect Your Credit Score

Having just one delinquent account on your credit report can be devastating to your credit scores.

Whether its a late car payment, credit card payment, or mortgage payment, a recent late payment can cause as much as a 90-110 point drop in your FICO score.

As time goes on, the late payment will hurt your credit score less and less until it drops off. However, potential creditors can still see that history as long as its listed on your report.

Late payments appear on your report as either 30 days late, 60 days late, 90 days late, or 120-plus days late. Each of these degrees of delinquency has a different impact on your credit.

The later you are, the more damage it does to your credit. More recent delinquent accounts also have a greater impact than older ones.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How Credit Reports And Credit Scores Are Affected By Inaccuracies

While it might not seem like a big deal at first, even a single error can cause a lot of problems for your credit report. If left uncorrected, it can even lead to a significant drop in your credit score .

Once your is between 300 600 its considered to be poor. With poor credit, it can be difficult to get approved for large amounts of credit, favourable term conditions and low interest rates, since lenders might think its because you havent paid your debts in the past. Plus, it can take a lot of time and effort to get your score back to the good range .

All this to say, if you do find some kind of inaccuracy on your credit report, its extremely important to resolve the situation as fast as you can. Although there are relatively fast and easy ways of doing this, the longer the error goes uncorrected, the worse your credit and approval chances will be.

The Impact Of Paying Off Debt On Your Credit Score

It can be tricky to calculate your credit score, simply because of how many different factors contribute to it. As mentioned, the more on-time payments you make, the better your score will be, so it would seem like paying off a loan would show that you have excellent money management skills. However, because it matters what types of accounts that you have, it’s not that simple.

When it comes to debt, there are two significant kinds: revolving credit and installment loans. Revolving credit refers to ongoing bills, like your credit card, where even if you pay your account down to zero, it remains open, allowing you to gain more payments in the future, such as when you use your credit card on a new purchase.

Installment loans are debts that you pay off in pieces, usually with monthly payments. Many types of debt, such as student loans, mortgages, and, yes, car payments, fall into this category. With an installment loan, once you pay down the account to zero, it will close up and won’t reopen for any additional payments.

When you have both revolving credit and installment loans in your history, it will help to boost your credit score because it shows that you can handle both types of debtso long as you’re making your payments on time. Usually, paying off an installment loan doesn’t improve your score, often having a neutral effect, leaving your numbers as is. In some cases, though, it can decrease your credit score.

Read Also: Can I Use Fha If I Already Own A Home

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

What To Know About Car Loan Shopping

Your application for auto financing will show up in one more place: credit inquiries. Inquiries made when you apply for credit can cost you points on your credit score. But if you group applications for car financing close together, they should count as just one.

While youre shopping for the lowest auto loan rates, you may allow multiple lenders to run credit checks and end up with several hard inquiries listed on your credit report. Thats OK.

Generally speaking, if youre shopping for an auto loan within a 30-day period, all those hard inquiries that are listed on your credit report will only count as one when your FICO score is calculated. The VantageScore has a 14-day rolling window for shopping. Play it safe and keep your search brief so that your credit score doesnt take an unnecessary hit.

About the authors:Claire Tsosie is an assistant assigning editor for NerdWallet. Her work has been featured by Forbes, USA Today and The Associated Press. Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: Avant Refinance

Dont Fret About The Temporary Drop In Points

As we said, active credit has a better impact on your credit score than past closed accounts. However, while your credit score may go down for a little while after you complete the loan, when you apply for future vehicle financing your past completed auto loan look great on your credit reports if you maintained a good payment history.

Because you paid off your car loan, it tells auto lenders that you were able to fulfill your obligations successfully. This means you probably have a higher chance of qualifying for future credit because youve proven your ability to repay loans.

Most auto lenders dont just consider your creditworthiness from your credit score, but your credit reports as a whole. This applies to subprime lenders as well, and theyre lenders that specialize in assisting borrowers with credit challenges. A past car loan that had a great payment history and was completed may mean more to a lender than your credit score, depending on the lender.

How To Improve Your Credit Score Before Buying A Car

If you dont have a perfect credit score just yet, dont worryyoure not alone. There are plenty of steps you can take to improve your credit score before applying for an auto loan. Here are some things you can do that will increase your score relatively quickly:

- Catch up on paying off any past-due debts.

- Check your credit report and dispute any inaccurate marks on your file.

- Pay down as much revolving debt as possible.

- Avoid any hard credit checks, such as those from applying for new credit or services.

- Avoid closing old credit cards you dont use, as long as they dont carry an annual fee.

- Request credit limit increases on your credit cards (and dont use that extra credit if its not needed.

Here are some things you can do to improve your credit score in the long run:

- Always pay your bills on timeset up autopay so youre worried you might forget.

- Open new types of loans and credit as you need them, such as student loans or credit cards, to diversify the types of credit you have.

Building your credit score to a level that qualifies you for an affordable car loan can take a long time in some cases. But its well worth it because youll be able to get the best car possible at a price that wont drain your bank account.

You May Like: What Credit Score Is Needed For Usaa Auto Loan