Where And How Do I Get A Job That Pays Cash Under The Table

With so many people being precariously employed in this new gig economy, and many of the best paying full-time jobs seemingly being gone, it is no surprise that more people are turning to self-employment and creating their own jobs.

The idea can very well be turning a hobby into a side hustle!

All that you really need to get a job that pays cash is:

Different Income Streams Require Different Documents:

-

Salaried or part-time employees

A pay-stub from the last 30 days that includes your year-to-date earnings will usually do the trick if you are a full-time salaried employee. A pay-stub will also suffice if youre employed part-time, but make sure you bring in stubs from each workplace if you have more than one part-time job.

-

Self-employed

Contractors, freelancers and other self-employed folks dont get a bi-weekly pay-stub for the work they do. If you fall into this category, youll need to bring in copies of your recent tax return as proof of income. You can also get a proof of income statement directly from the Canada Revenue Agency through your online CRA account.

-

Seasonal workers

If your job only lasts part of the year, as is the case for construction workers and farmers, employment insurance will make up the bulk of your income. Tax returns from the last two years will usually be enough to verify income and employment.

-

Fixed income

If you receive any form of government assistance and are living on a fixed income youll need to bring in all the relevant documents that show your monthly benefits. Be aware that your income might not be high enough to qualify you for a bad credit car loan. If this is the case, getting a co-signer with good credit can go a long way in strengthening your loan application.

Car Loans For Under The Table Workers

Since this person gets paid “under the table, we’re also going to assume that they don’t receive a W-2 wage and tax statement from the people whose houses they’re cleaning.

This means that with no W-2 to prove this income, the only other proof that’s typically acceptable to subprime lenders is one to three years of professionally prepared income tax returns. These must show a net income that meets both a lender’s minimum income requirements as well as a favorable debt to income ratio .

Chances are, this person doesn’t show all of their income on a tax return, so getting a loan from a subprime lender is probably not in the cards.

Read Also: Can You Use A Va Loan To Buy Land And A Manufactured Home

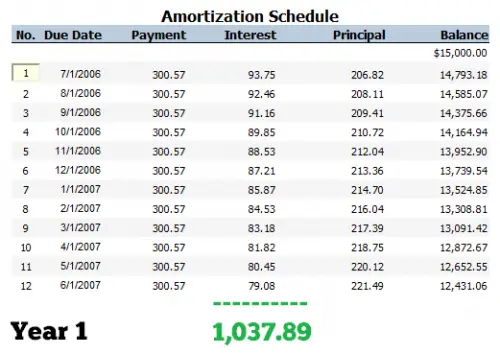

How To Calculate Amortization With An Extra Payment

If you make an extra payment on your loan, your lender could handle it in a few ways. It may apply some of that payment to any fees or interest that are outstanding on the loan, much like when it tallies your interest day by day and you pay mid-month. Or your lender could also just apply any extra payments straight to the remaining balance.

In any case, check with your lender to learn its policies. If it applies extra payments straight to the balance, your job is easy: Simply subtract the extra payment from the remaining balance for that month and use the new number going forward.

Dont Be Afraid To Ask

If youre still not sure what to use as proof of income just ask the dealership or financial institution youre working with. Different lenders might have different income and employment verification requirements. Having the right documents will streamline the approval process and get you into a new vehicle faster.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Can You Finance A Used Car With No Job

If you are looking to get yourself into a vehicle you may be wondering whether used cars would be a good option for you, in many cases used cars are more affordable than new cars and can be just as reliable. You may even choose to purchase an extended warranty on your new to you vehicle to have peace of mind that the costs of repairs will be covered or less expensive. Used cars are a great way to save money while still having a great car that you love. At Autorama we want our customers to love their car. Thats why we offer a wide selection of affordable used cars within our inventory. See our selection of used cars under $10K and used cars under $15K for an idea of what fantastic vehicles you can get in less expensive price ranges. Choosing a used car is a great option for anyone.

Employee Parking Reimbursement & Taxable Income

When your boss pays you under the table, the law doesnt recognize you as an employee, which means you lose out on a number of benefits and legal protections. Being paid off-the-books doesnt get you in trouble provided you satisfy all of your tax responsibilities. Your employer, however, may be in trouble with various government agencies if theyre ever caught.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

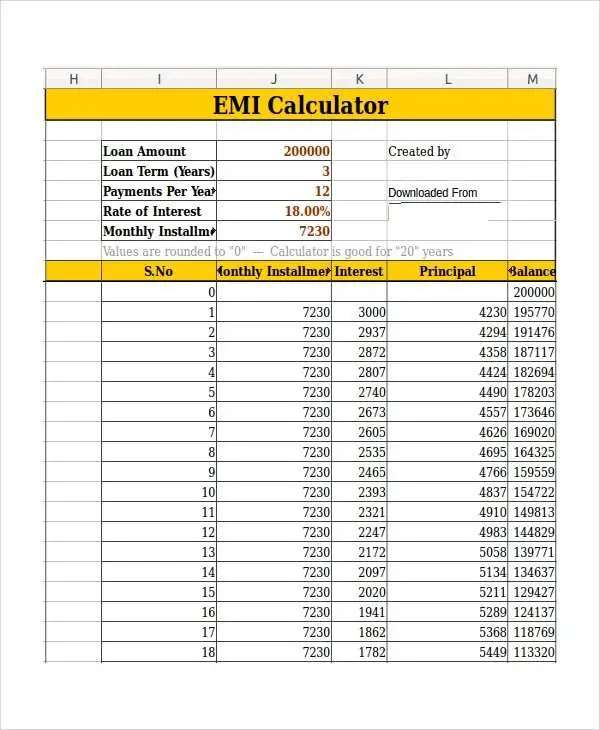

How To Calculate Amortization

This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant in Ohio with over 20 years of accounting experience. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.There are 8 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 12 testimonials and 87% of readers who voted found it helpful, earning it our reader-approved status. This article has been viewed 641,481 times.

Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. With amortization, the payment amount consists of both principal repayment and interest on the debt. Principal is the loan balance that is still outstanding. As more principal is repaid, less interest is due on the principal balance. Over time, the interest portion of each monthly payment declines and the principal repayment portion increases. Amortization is most commonly encountered by the general public when dealing with either mortgage or car loans but it can also refer to the periodic reduction in value of any intangible asset over time.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What You Should Know About Auto Loans Before You Sign On The Dotted Line

With few exceptions, buying a car consists of two major activities: finding the car and taking out a loan to pay for it.

Understanding how car loans work, how they differ from other types of borrowing, and what you need to know to avoid getting taken for a “ride” is the business of consumer affairs expert Kathryn J. Morrison of South Dakota State University.

Dr. Morrison spoke with Investopedia recently to try to help would-be car buyers understand the sometimes confusing world of automobile loans. Our edited conversation follows:

Consequences Of Falsely Reporting Income

When you create a fake pay stub and submit it to a dealer or lender, youre committing fraud. Fraud is the wrongful or criminal deception intended to result in financial or personal gain, according to dictionary.com. According to FreeAdvice Legal, there are three main types of fraud:

Depending on the severity of the fraud committed, it can be considered both a criminal and a civil offense. As for the penalties, FreeAdvice Legal states:

Criminal penalties vary widely depending on several factors including the type of fraud and the amount of money involved, but can range from suspended sentences, and probation and fines to prison sentences of up to fifteen years. Generally, however, fraud is a felony charge with a potential sentence of six months to five years.

Recommended Reading: How To Apply Loan In Sss

Three Big Factors About Car Loans

The average price of a new car is $33,652 as of June 2016, up 2% from June 2015, so its no surprise that consumers increasingly finance their purchases with longer-term loans. The average auto loan term is at a record 68 months as of Q1 2016.

But here are the three big factors to consider before taking out your own auto loan:

- Auto loan interest rates change daily, and vary widely. Before you enter a showroom, check the current auto loan rates. You might consider getting pre-approval from a bank or credit union before shopping for a car. Consumer advocates say that an auto salesman might give you either a good price on the car, or a good deal on the financing, but not both. In any case, you want to be informed about what a “good deal” on a loan currently is.

- Auto loans include simple interest costs, not compound interest. This is good. The borrower agrees to pay the money back, plus a flat percentage of the amount borrowed.

- Auto loans are “amortized.” As in a mortgage, the interest owed is front-loaded in the early payments. During the housing price collapse, homeowners who owed more than their homes were worth for resale were said to be “underwater.” Similarly, car buyers can be driving “underwater” for a long time, unless they had a hefty down payment or a late-model trade-in because a car depreciates steeply in value as soon as you drive it off the lot.

How Can I Apply For Auto Financing

If you feel that you are ready to get yourself into a new to you vehicle and will require financing, your first step is to apply for the financial support you need. At Autorama, we are proud to offer a variety of financing options to help everyone get into a car they love. Consider contacting us today to learn more about your financing options or fill out our auto loan pre-approval form online. We are the experts at helping you find your dream car. Let us help you find the car of your dreams on our lot today.

Don’t Miss: Lightstream Rv Loans

How To Accelerate The Financing Process:

- Proof of identity: A photo ID with your signature on it. Government identification or a passport are typically acceptable documents. Check with your lender or dealership to see which they prefer.

- Proof of insurance: Dealers may ask you for proof of insurance before you purchase and take out a loan on your new or used vehicle. You can contact insurance companies from the dealership when you buy your car, or get details lined up with the insurance provider before purchasing the vehicle.

- In some cases, you’ll need proof of residence: A driver’s license is typically acceptable.

- If you’re trading in another vehicle as part of your financing, you should probably have your registration papers for your current vehicle.

- In some cases you’ll need to prove that you have a steady source of income, usually through several months of pay stubs or W-2 forms. Some lenders may also call your employer for verification.

Other Things You Might Need For A Car Loan

Once youve provided your and proved that youre capable of making payments, youre almost in the clear for getting your next car loan as a self-employed individual. There are a few other things that a lender may ask you for, though. Be prepared to show the following items in order to secure your self-employed car loan if your potential lender asks for it:

Proof of residence

Don’t Miss: Do Loan Officers Get Commission

What Is An Amortization Table And How Does It Work

An amortization table shows the schedule for paying off a loan, such as a mortgage. Learn how to make and use one to determine your own loan payoff schedule. You could use the amortization table for other types of loans such as student loans or personal loans, but it helps to know how to make one first. If you need more hands-on help understanding your loans and your overall financial picture, considering enlisting the help of a trusted financial advisor.

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Read Also: Va Manufactured Home Requirements

Other Considerations For Lenders

Your line of work

While gauging your auto loan eligibility, the lenders will also look closely at your line of work. This is the particular field youre involved in. Say, for accounting. If youve been an accountant for all your working years, but simply changed employers, lenders will take note of it. They may also ask the reason for switching employers if you had in the past.

Is the income steady and verifiable?

Are you getting paid on a timely basis, and can you prove it by submitting paychecks or payslips? You might have a job, but if youre getting paid irregularly and there are a lot of deductions, then it may negatively influence your loan approval decision-making process. Some lenders will go as far as to look past the newness of the income source, which they may or may not disclose.

Any other source of income?

If youre showing extra income above what youre getting at your current job, then you need to describe the source. This can be from a side hustle or federal benefits like court order payments for child support or an annuity. Depending on the auto loan provider, this income may be considered legit.

Cosigner

While not mandatory, having a cosigner can increase the chances of getting an auto loan, even if you are not employed. Some lenders make it mandatory to have a cosigner while applying for a loan.

Jobs That Pay Under The Table Vs Gig Economy

DoorDash

Postmates

Instacart

Nextdoor

Rover.com

TaskRabbit

Hopefully, this list of good jobs has your creative imagination flowing to create your own under the table jobs. If you have any suggestions or comments, please leave them below!

*Disclaimer: working and intentionally not declaring income is, in most cases, a federal offense. This website in no way endorses tax evasion against the IRS. In any event, I thought it might be useful to post a list of such positions in hope that it might give some ideas on how to get some extra revenue flowing in these extraordinarily difficult times as a stop gap towards legitimate self-employment. It is highly probable that some of these ideas can lead to you establishing your own, legitimate business. If you do manage to come up with a job that pays cash, “under the table”, it allows you access to 100% of your earnings up front, as long as you pay the taxes in the next tax season, when they are due–essentially allowing you some more money up front. This information is for information and entertainment purposes only.

Recommended Reading: Transfer Car Loan To Someone Else