Estimating Rates For Private Mortgage Insurance

Many companies offer mortgage insurance. Their rates may differ slightly, and your lendernot youwill select the insurer. Nevertheless, you can get an idea of what rate you will pay by studying the mortgage insurance rate card. MGIC, Radian, Essent, National MI, United Guaranty, and Genworth are major private mortgage insurance providers.

Mortgage insurance rate cards can be confusing at first glance. Heres how to use them.

Refinance Your Home To Remove Pmi

With interest rates at historical lows, theres never been a better time to refinance your mortgage than now. Since many FHA loan borrowers are first-time homebuyers, they find that in the years since they first purchased their home, their incomes have increased. If this sounds like you, then refinancing from an FHA loan to a conventional loan will automatically drop PMI. And since youre used to sending the bank PMI every month, you may find that the slightly higher principal payment your making doesnt change your monthly mortgage obligation much, if at all.

Next Steps To Cancelling Your Pmi

If youve run the numbers and discovered that you may be eligible for PMI removal, contact your loan servicer about its specific removal process.

The requirements will vary by lender, but youll typically need to make the request in writing, have a good payment history, no other liens on the property and agree on how you will get a professional estimate on your home value.

As you fixate on the numbers that show an increase in your homes value and equity, consider what it might cost if you try to remove your PMI costs. While a new appraisal or valuation might end up being worth the cost, more expensive actionssuch as refinancingmight make you lose money in the long run.

Recommended Reading: Can You Use A Va Loan For A Manufactured Home

Making A Plan To Get Rid Of Fha Mortgage Insurance Is A Great Financial Decision

When youre youre making a home purchase, youre mainly focused on getting into a place where you can set down roots and build a solid future. The down payment can be a big hurdle so high FHA PMI costs can be a worthwhile trade-off.

But now youre settled in, its time to think about getting rid of FHA mortgage insurance. These high monthly PMI payment costs could and should be going into savings, a childs college fund, or toward loan principal.

Dont delay. Even if youre not able to cancel your mortgage insurance now, make a plan for how youre going to do it.

Ten or twenty years down the road, youll be glad you did.

How To Get Rid Of Pmi

7-minute read

You probably had to add private mortgage insurance if you bought a home with less than 20% down. PMI can add hundreds of dollars to your monthly payment but you dont need to pay for it forever.

Well go over the basics of PMI and what it covers, and well also show you how and when you can stop paying it.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

If Your Mortgage Is From A Minnesota

Minnesota law, unlike federal law, allows homeowners to benefit from market appreciation. Under Minnesota law, the value of your home is based on what it would be worth if you sold it today. For instance, if you bought your home for $100,000 with 5 percent down and your house is now worth $130,000, you probably are eligible to cancel PMI under Minnesota law because you owe less than 80 percent of the market-value of your home.

You will need to hire an appraiser to establish the market value of your home to prove that you owe less than 80 percent of its current value. You should feel confident in the market value of your house before you obtain an appraisal. If the appraisal value falls short, you will have paid for the appraisal and must still continue to pay PMI, as well. Minnesota law gives you the right to shop for and pick an appraiser, as long as he or she is reasonably acceptable to your lender. A Minnesota-chartered lender cannot reject your appraiser without reason and cannot require you to pick only from a short list approved by the lender. Nonetheless, before you pay for the appraisal, contact your lender and make sure that the appraiser is acceptable.

How To Use An Fha Mortgage To Your Advantage

Over the last several years, the housing market has been strong. Equity is building faster than ever. Many first-time homebuyers or buyers getting back into the market take advantage of the ability to get an FHA mortgage.

Then as their equity is building, they work on their credit. Once their score is 700 and above and they have 20% equity, they refinance into a conventional loan without MIP.

You May Like: How To Find My Loan Servicer

Automatic Pmi Removal: Know Your Rights

The HPA rule of 1998 also grants homeowners the right to have their PMI removed automatically on the date when your principal balance is scheduled to reach 78 percent of the original value of your home, explains the CFPB. However, a homeowner must be current on their payments for this automatic removal to occur.

Other than staying current with your payments, this automatic removal requires no action on the homeowners part. However, you will end up paying PMI longer than you would have if youd successfully requested to cancel at 80%.

So, it pays to keep track of where you are in your mortgage payments and when youll hit an 80% LTV ratio. Washington DC Marketing Consultant Regine Smith says she discovered this the hard way. Her mortgage balance was far below the 78% figure, and her lender still hadnt removed PMI.

It was an uphill battle, says Smith. I did a rant on Twitter that went viral. It led to someone in customer care taking another look at my case.

Knowing your rights when it comes to PMI can help you avoid paying the insurance long after its due to be removed.

How Do You Calculate If Pmi Can Be Removed

Removing PMI the “traditional” way just involves some simple math. Homeowners can take the purchase price of their residence and multiply it by 80%. The result is essentially the magic number when it comes to removing your PMI.

For example, perhaps you bought your home for $300,000. Once your loan balance drops to $240,000 , you’re free to do away with PMI, for good.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Looking To Remove Pmi On Your Fha Loan

Need more advice on how to eliminate mortgage insurance from your monthly budget for good? Were on standby. Learn more about how you may be able to replace your existing FHA loan with a new loan from Union Home Mortgage that aligns with your specific goals or contact us today.

Get a mortgage you can rave about.

How To Get Rid Of Fha Mortgage Insurance

The fastest way to get rid of a MIP on an FHA loan might be to refinance into a conventional loan. If you have 20% equity, you can avoid paying PMI on the new loan.

Amy FontinelleUpdated December 4, 2020

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

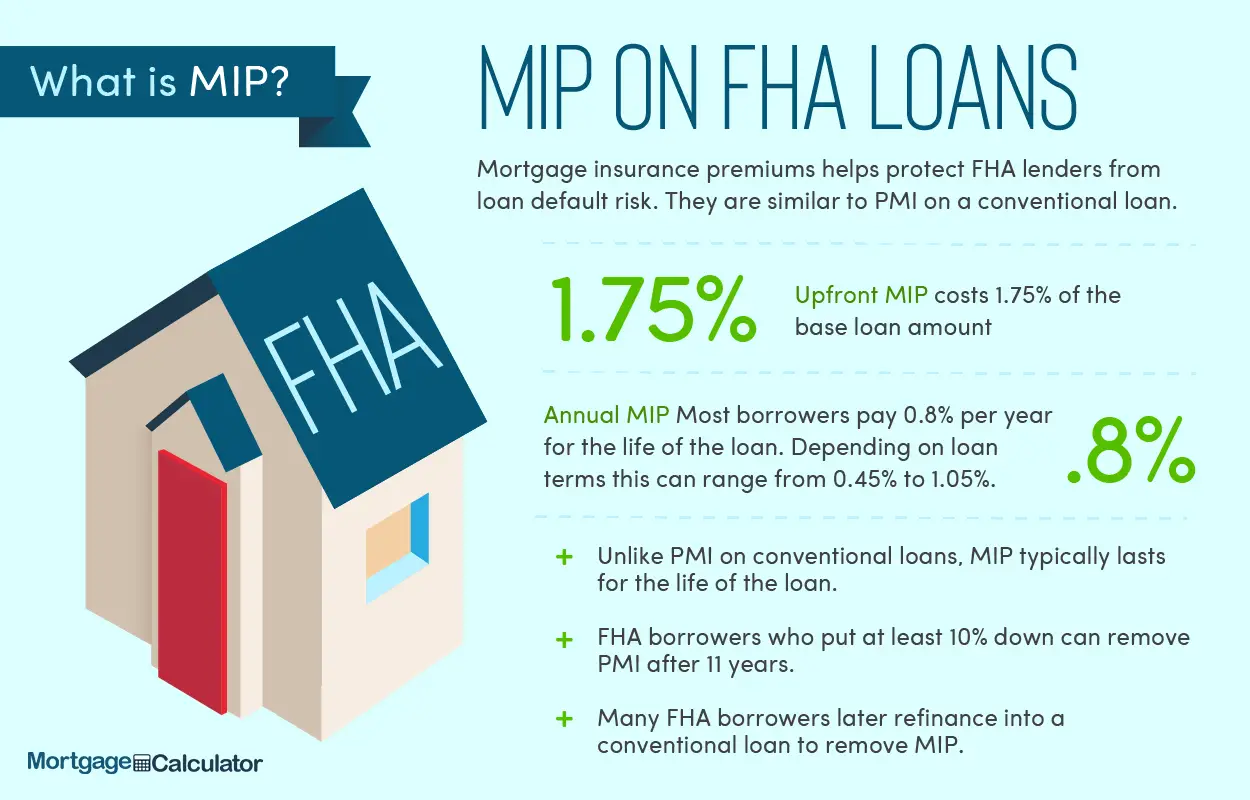

Mortgage insurance protects lenders from losing money on higher-risk borrowers who might default on their mortgages. This protection helps make home financing available to borrowers who otherwise might not qualify.

Typically, youll have to pay for private mortgage insurance on a conventional loan when your down payment is less than 20%. On FHA loans, however, all borrowers must pay mortgage insurance premiums no matter what size their down payment is.

Heres what you should know about removing mortgage insurance from your FHA loan:

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How To Cancel Early

The first step to cancellation is to call your lender. Your lender will probably request that you send a written request for cancellation, and will give you an address to which you can send it. To cancel early, you must be current on your mortgage payments and you must have no recent missed payments.

Danielle Pennington, loan officer with the Wolcott, Connecticut office of BestWay Mortgage Corp., said that it is possible to cancel early, too, hit the 80 percent mark earlier simply by paying additional money toward your mortgage’s principal balance each month.

This will get you to that 80 percent mark in fewer months.

“It’s amazing how quickly even an extra $50 a month can lower the balance of your loan and, therefore, increase the equity you have,” Pennington said.

Now that you know how PMI works, you’ll be in a better position to understand what it takes to lower the monthly PMI payments. The better your credit score and the bigger the downpayment for the mortgage, the better your equity will be.

One Other Option For Avoiding Pmi

There is yet one more way to avoid PMI on a conventional loan, and thats by doing a first/second combination. Thats where you take a new first mortgage equal to 80% of the value of your property, and then cover the remaining balance through the use of a second mortgage or home equity line of credit .

It should be understood however that the first/second combination is generally not an option if you have a low credit score. This is because the credit score requirements for second mortgages and HELOCs are generally higher than for conventional first mortgages.

Typically however, a first/second refinance combination will be limited to an 80% new first mortgage, and a 15% second mortgage or HELOC. That means that your current mortgage cannot exceed 95% of the value of the property otherwise youll have to put up additional cash in order to lower the loan balance to that level.

But if you can use either refinancing strategy to turn your FHA mortgage into a conventional mortgage with no PMI or lower PMI, you can eliminate your FHA mortgage and the PMI that it will charge for the life of the loan.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Accept It As Permanent

As of 2015, the FHA requires mortgage insurance premiums on homes bought with less than a 10 percent down payment for the entire life of the loan. If less than 5 percent is put down on a home of $625,500 or less, your monthly payment will include 0.85 percent annual mortgage insurance premium on a 30-year fixed mortgage for the entire life of the loan. If buying a home that requires the maximum FHA loan amount in San Francisco of $679,650, the mortgage insurance premium will be one percent for the entire 30 years. Loans amortized over 15 years pay a lower mortgage insurance premium of about 0.15 percent for loans of $625,500 or less and 0.05 percent less for those above.

How To Get Rid Of Pmi: My Favorite Methods

After my first PMI payment, I knew I wanted to get rid of it as quickly as possible. It’s actually not that hard to do, but the banks don’t make it easy to do quickly. Here’s what I mean:

When does PMI go away? Most banks will automatically remove PMI when the loan balance has reached 78-80% of the value of the original purchase price. In other words, if someone buys a house for $100,000 and puts $10,000 down , once the mortgage is paid down to $80,000 the bank will automatically remove PMI. For FHA loans, that number is usually 78%, and every bank is different.

You can also get starting removing PMI by proving to your bank that your home has appreciated enough to bring your LTV ratio down to 80%. In the same example as above, if your $100,000 house appreciates to $120,000 then your $90,000 mortgage is less than 80% of the home value. BUT… you have to get an appraisal to prove your homes appreciation.

Maybe this is obvious, but you can also refinance if you have built up enough equity so that your refinance loan will be over a 20% LTV. I wouldn’t necessarily recommend this unless you also want to take cash out for other investments, or you can get a lower interest rate. If you do refinance, LendingTree is a good place to check for rates.

Don’t Miss: Does Collateral Have To Equal Loan Amount

Michigan Down Payment Assistance Mortgage Programs For Homebuyers

Also, keep in mind there are other home loan programs dedicated to specific demographics, like veterans. If youre a member of a unique demographic, there might be loans dedicated to people like you.

MI Home Loan:

- MI Home Loan is a project through MSHDA.

- It empowers first-time homebuyers across the state.

- Repeat homebuyers are eligible in targeted areas in Michigan.

- MI Home Loans have low, fixed interest rates and low down payment options

- If I were to take out an MI Home Loan, I could choose from an FHA loan, a USDA loan, or a VA loan.

MI Home Loan Flex is a variant of the program that requires buyers to take an education course. Flex lets an individual take out a home loan while living with other adults. Its available for qualified applicants, even when other resident adults dont qualify.

Michigan State Housing Development Authority

- The MSHDA runs all state housing programs in Michigan.

- It offers rental assistance, housing choice vouchers, fixed-rate home loans, and emergency housing programs for homeless people.

DPA loans are zero-interest. The borrower makes no payments until the first mortgage is paid off. Or, the borrower must begin paying back the DPA if the home is sold or refinanced.

Habitat For Humanity in Michigan:

- Habitat for Humanity is a non-profit organization.

- Homebuyers who meet requirements set by the organization can purchase a home with a guaranteed low monthly payment.

Wait For Pmi To Be Automatically Cancelled At 78% Ltv

Under the Homeowners Protection Act, your lender must automatically cancel PMI on the date your LTV will be at 78% based on the original payment schedule. If you make extra payments and your LTV hits 78% earlier than scheduled, youll have to reach out to the lender in order to have PMI removed earlier.

Don’t Miss: Arvest Construction Loans

How Much Is The Fha Mortgage Insurance Premium

Borrowers who put down 10% or less, the PMI is .85%. If a borrower puts down more than 10%, then the MIP goes down slightly to .80%.

For example, if you buy a $200,000 home and put in a 3.5% downpayment.

The LTV is 96.5%, so you have to pay a mortgage insurance premium of .85%, roughly $1700 per year. You can figure the amount you will have to pay for mortgage insurance using the FHA MIP chart below.

Mortgage Insurance: When You Can Get Rid Of It

Because we arent all Warren Buffett sitting on a mountain of money, many of us dont have a 20% down payment when it comes time to buy a house. The good news is you can still put down less than 20% you just have to pay mortgage insurance.

Mortgage insurance gives you a lot more buying power because you dont have to bring as much money to the table in the form of a down payment. The downside is that its an additional item tacked on your mortgage payment every month.

The goal of this post is to give you some clarity around if and when you can get rid of your mortgage insurance. In some cases, it vanishes into thin air of its own accord.

First, well go over some factors affecting whether you can get rid of your mortgage insurance and when you can do it. After that, well look at how these factors together help you determine whether or not you can eliminate your mortgage insurance.

Read Also: Does Va Loan Work For Manufactured Homes

Can A Fha Loan Be Refinanced

You can get an FHA Simple Refinance that replaces your existing FHA insured loan with a new fixed-rate or adjustable-rate loan. Because youre already an FHA borrower, the process should be faster and simpler than when you got your original loan.

The Good News: Lower Pmi On Fha Mortgages

FHA made the announcement in January of 2015 that FHA insured mortgages originated after January 26, 2015 would be assessed lower PMI charges.

Its important to understand that, unlike conventional loans, FHA actually imposes two different PMI charges on mortgages that it insures. .

FHA charges an UFMIP premium equal to 1.75% of the new mortgage balance. That rate did not change with the January 2015, announcement. However, monthly MIP did drop, and substantially at that.

FHA has varying rates on annual MIP, depending on the size of the loan and the amount of the down payment. But on what is by far the most common loan type for FHA borrowersa 30-year mortgage with less than 5% down, and a loan balance of up to $625,500the annual premium rate dropped from 1.35% down to 0.85%.

What this means is that had you taken a $200,000 mortgage prior to January 26, 2015, the annual premium would be $2,700 , or $225 per month. But as of now, it would be just $1,700 , or $141.67 per month.

Resource: Check out FHA rates online at LendingTree

Recommended Reading: When Can I Apply For Grad Plus Loan