What About The Interest When I Have Good Credit And Low Income

Another item to consider when thinking about a loan is the interest. This is actually a big factor. It is probably bigger than you think. When you want to borrow money, you have a set amount in mind that you need. The lender adds interest to that amount as a fee for allowing you to borrow the money. The more risk you pose to the lender than the higher the percentage of interest. A lender makes the decision on how much interest to charge you based on your credit score. The main amount that you would like to borrow is called the principal. When you obtain;personal loans with good credit, the interest rate is lower.

If you have great credit, you can expect an interest rate from 3 percent to 6 percent, but if you have just ok credit, you can expect interest rates from 5 percent to 36 percent. That is correct, your interest rate can go up to 36 percent. Now, let me show you what that looks like with numbers.

If you have great credit and you want a loan for $20,000. The lender charges you 5 percent.

5 percent of $20,000 is $1,000.

The principal amount is $20,000 + $1,000 = $21,000.

If you have a loan for 36 months, that means your monthly payment will be $583.33.

If your credit is just ok, your interest rate might be 30 percent.

30 percent of $20,000 is $6,000.

The principal amount is $20,000 + $6,000 = $26,000.

If you have a loan for 36 months, that means your monthly payment will be $722.22.

If you have just average credit, your monthly payment goes up about $138 per month.

How Is My Personal Loan Rate Decided

As you shop for a low-interest loan or credit card, remember that banks are looking for reliable borrowers who make timely payments. Financial institutions will look at your credit score, income, payment history and, in some cases, cash reserves when deciding what APR to give you.

To get approved for any kind of credit product , you’ll first submit an application and agree to let the lender pull your;. This helps lenders understand how much debt you owe, what your current monthly payments are and how much additional debt you have the capacity to take on.

Once you submit your application, you may be approved for a variety of loan options. Each will have a different length of time to pay the loan back and a different interest rate. Your interest rate will be decided based on your credit score, credit history and income, as well as other factors like the loan’s size and term. Generally, loans with longer terms have higher interest rates than loans you bay back over a shorter period of time.

Select now has a widget where you can put in your personal information and get matched with personal loan offers without damaging your credit score.

Reasons To Get A Personal Loan

There are a few reasons why getting a personal loan could be a smart idea. For example, if you have credit card debt, a personal loan could allow you to pay off your debt and consolidate several smaller balances into one fixed monthly payment. Or, if you want to do some home remodeling, pay for medical expenses, or cover pretty much any other expenses you may have, a personal loan can allow you to finance these things without having to max out credit cards.

For many borrowers, personal loan interest rates are significantly lower than they could hope to get from a credit card. Plus, its also important to realize that the interest on a personal loan is usually fixed so if market rates rise significantly, your personal loan interest rate will stay the same. On the other hand, credit card interest rates are variable and can increase over time.

Read Also: How Much House Can I Afford Physician Loan

What Is A Low Interest Personal Loan

Whats considered a low interest rate? An unsecured personal loan with low interest will usually have a rate that sits between 6% and 12% for fixed rates, while variable rates will fluctuate in line with the prime rate. If you have a great credit score and youre willing to secure your loan, you could score a rate as low as around 2%, according to some lenders. But please keep in mind that very few people can qualify for the absolute lowest rate.

Getting a rate that falls under 12% allows you to put more money down on your principal over the course of your term.

Why cant I qualify for the lowest rate with a lender?

Its very difficult to get the lowest advertised rate with any lender because this rate is usually reserved for ideal borrowers. This includes those that have very high incomes, own many assets and have very little debt. While it still pays to apply for an advertised rate that interests you, be prepared for rate adjustments once all of your personal variables have been factored in.

Be Selective About Your Lender

In other words, make sure that the lender that you are working with is a legitimate organization, such as a bank or finance firm. There is not one best bank to get a personal loan from, it all depends on your financial situation. When you go through their website, try to find a street address and a proper phone number. Dont go to just anyone because online personal loan lenders run a higher chance of being a scam. The first thing you always need to establish when you take or give money to any organization is their credentials. Not only should you be selective about the lender, but be selective about the loan itself. Make sure to ask about the details of each loan option that the lender has to offer. If there is anything that doesnt satisfy you, move on to the next lender. If you are interested in other lender options like private money lenders, personal loans can be found there as well!

Read Also: How To Get Car Loan When Self Employed

What Is A Good Credit Score

When you want to obtain;personal loans with good credit, it is important to understand the definition of credit. In general, credit is the ability for you to obtain something today with the promise to pay for it at a later date. There are a lender and a borrower involved when it comes to credit. Unless you are incredibly rich and do not need money, you will most likely always be the borrower. The lender is typically a bank or some other financial entity. The lender allows you to take ownership of something despite not having paid for it, or not having paid the full amount.

There are different types of credit. An example that may quickly come to mind is a credit card. That is the most prominent type of credit that we usually consider. However, other great examples are mortgages and car loans. These are instances where a lender is giving you money to buy a house or car and you promise to repay the lender over time. This type of credit allows you to make large purchases, even though you do not have the money for them today. Local businesses may also extend credit to you. Consider the neighborhood plumber or heating technician. They may allow you to pay for a percentage of the work today and pay the rest once the work is completed.

Applying For An Online Personal Loan

The best online lenders usually have an easier loan application process than banks:;

- Stage 1: This generally consists of an online questionnaire where you are asked to provide information including the amount of the loan, the purpose of the loan, and your personal information. You will also probably be asked to provide your income level and housing status.;

- Stage 2: This involves a soft credit pull, which wont affect your credit rating like a hard credit pull. Based on the credit score and other details you provided the lender, they will determine how much to loan you and under what terms and interest rate.;

- Stage 3: Once your application has been pre-approved, you will then complete your application and a hard pull will occur that may impact your credit score. You should have all relevant paperwork on hand and ready to send, including your drivers license or passport, proof of residence , and pay stubs from your place of work.;

Also Check: What Does Jumbo Loan Mean

What Would The Interest Rate Be For A $1000 Personal Loan With Bad Credit

Depending on your exact credit score, if you are looking for a personal loan for $1,000 and you have bad credit, you could potentially be required to pay an interest rate anywhere from 23.4% to 35.99%. Keep in mind that most lenders will consider a variety of factors before extending a loan offer. While we can speculate what rates could be, its usually best to check offers and find out exactly what you qualify for.

Best For Large Projects: Lightstream

LightStream;

With LightStream, you can borrow between $5,000 and $100,000 for a variety of needs. LightStream is one of the best choices for large loans because of the low interest ratewith autopay, you can get a rate as low as 2.49% APR. However, you need to have excellent credit to get the best rate, and rates are based on loan amounts and terms, which can range from 24 to 144 months.

According to LightStream, if you complete your application early enough in the day and its a business day, you might be able to get funding the same day. And there are no origination fees.

| As soon as same day |

| Recommended Credit Score |

Don’t Miss: Is Jumbo Loan Rates Higher

Know Your Rights Under Regulation Z

In 1968 the Federal Reserve Board implemented Regulation Z which, in turn, created the Truth in Lending Act , designed to protect consumers when making financial transactions. Personal loans are part of that protection. This regulation is now under the auspices of the Consumer Financial Protection Bureau .

Subpart C Sections 1026.17 and 1026.18 of the TILA require lenders to disclose the APR, finance charge, amount financed, and total of payments when it comes to closed-end personal loans. Other required disclosures include number of payments, monthly payment amount, late fees, and whether there is a penalty for paying the loan off early.

Rcbc Mycash Personal Loan

- Monthly Add-On Interest Rate: 1.3%

- Loan amount: PHP 50,000 to PHP 1 million

- Loan terms: Six to 36 months

- Processing duration: Seven to 21 days

- Loan fees:

- Processing fee of PHP 1,500 or 1% of the loan amount, whichever is higher

- Late payment fee of 5% per annum on any outstanding balance

Another loan with the lowest interest rate is from RCBC. It allows you to borrow up to PHP 1 million with flexible terms of up to 36 months. The monthly add-on interest rate is 1.3%, and approval may take up to 21 days.

Also Check: Should I Refinance My Truck Loan

How Much Can I Get Approved For

There isnt a clear right or wrong answer to this question – it all depends on your needs, your income and your abilities. If youre trying to consolidate debt, your loan should be the same or larger than the outstanding loans youre covering, and if you need to cover an expense like medical bills or home renovations, then it should meet your needs, so you dont have to go through the hassle or expense of securing another loan.

At the same time, you need to make sure that the payments arent too heavy for you to keep up with. After all, theres no sense taking out a loan to cover another debt, only to find yourself unable to keep up with the payments on the new loan.

Is A Debt Consolidation Loan Worth It

Debt consolidation loans are a great option, if for no other reason that they are easier to manage than credit card debt, especially if you have multiple credit cards. You make one payment to one source, once a month. This will save you money and your credit score should improve.

All good!

The real issue is whether you can combine that with a change in your spending habits so new bills dont pile up while youre paying off the old bills. If you really mean to succeed with this process, you need to give your credit cards some time off while you pay off the debt. They could use the rest.

When you finish paying off the debt, you can decide whether you want to drag out the cards that got you in this situation in the first place.

8 Minute Read

Don’t Miss: How To Get Low Interest On Car Loan

Banks And Credit Unions

Institutions with a banking license or charter are governed by the Federal Reserve, Federal Deposit Insurance Corporation , Office of the Comptroller of the Currency , and the National Credit Union Administration .

Local banks and are the first places many people think of when contemplating a personal loan. If you apply there, you will likely meet face to face with a loan officer, the experience will be personalized, and the officer can guide you through the application process smoothly. Compared to other options, banks tend to have higher loan qualification standards. If you are already a customer, the bank may cut you a break in that area, though.

The credit union qualification process tends to be less rigid than that of banks, and interest rates there are typically lower than at banks. You must, however, be a member in order to do business there. Neither banks nor credit unions typically charge loan origination fees, which is a plus.

How Much Do Personal Loans Cost

Some lenders charge origination, or sign-up, fees, but none of the loans on this list do. All personal loans charge interest, which you pay over the lifetime of the loan. The lenders on our list do not charge borrowers for paying off loans early, so you can save money on interest by making bigger payments and paying your loan off faster.

Don’t Miss: Should I Get An Unsubsidized Student Loan

Personal Loan Essentials To Know

To be clear, while the interest rate is certainly an important piece of the puzzle, its not the only thing you should consider when deciding on a personal loan. Here are a few potential factors to include in your decision-making process:

Average Personal Loan Interest Rates By Credit Rating

Average personal loan interest rates range from 10.3 percent to 12.5 percent for excellent credit scores of 720 to 850, 13.5 percent to 15.5 percent for “good” credit scores of 690 to 719, 17.8 percent to 19.9 percent for “average” credit scores of 630 to 689 and 28.5 percent to 32.0 percent for poor credit scores of 300 to 629.

| 28.5%32.0% |

You May Like: How Do I Get My Student Loan Number

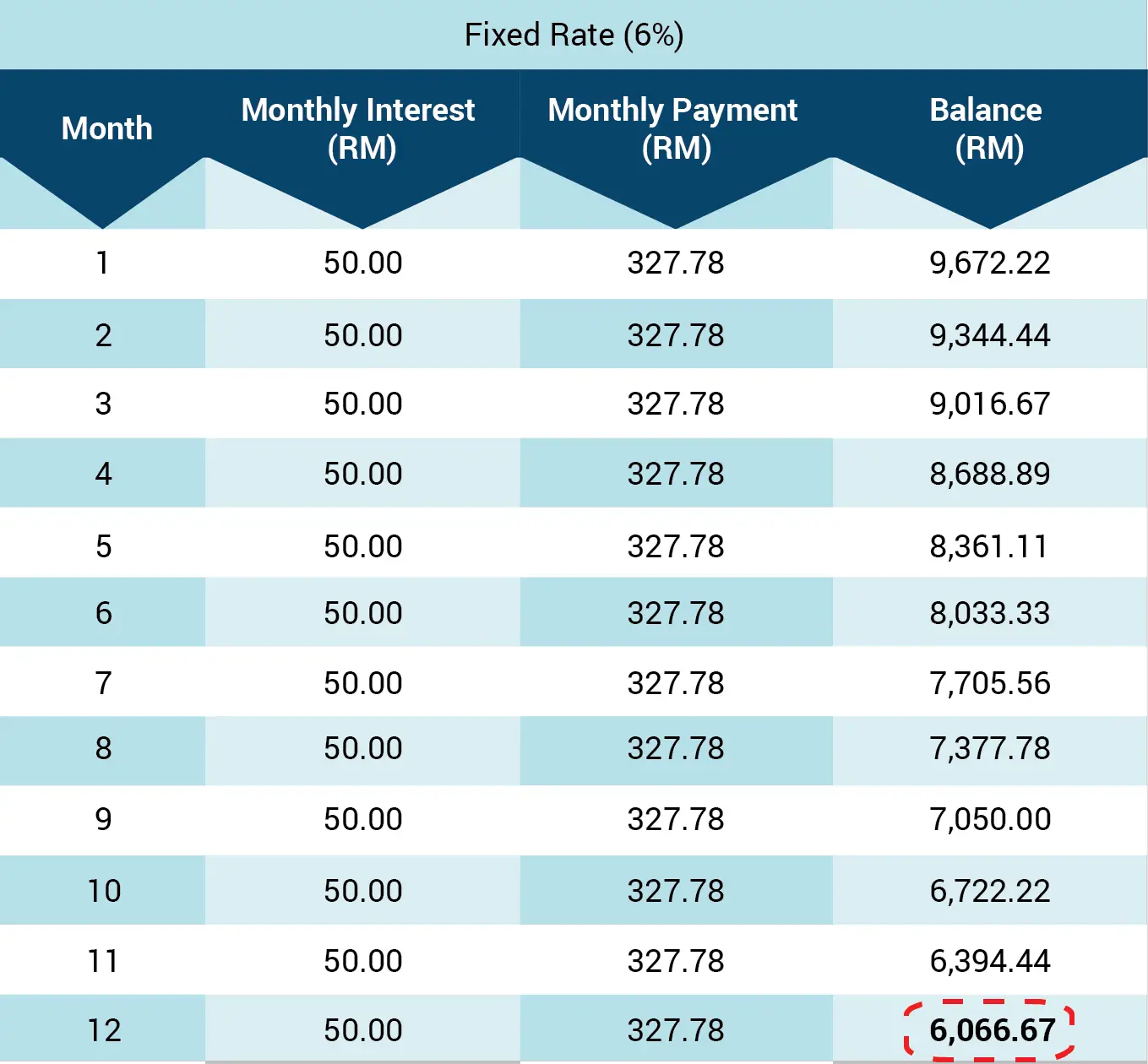

With A Fixed Rate Loan

- You know for the duration of your loan the exact payment amount you will be making each month.

- Your interest rate is locked in for the duration of your termup to 5 years.

- You could choose an amortiztion and payment schedule that meets your budget.

- You could switch to variable rate loan or pre-pay your loan at any time without penalty.

What Is Considered Low Interest For A Personal Loan With Bad Credit

If you are looking for an unsecured personal loan and you have bad credit, depending on your credit score, any loan offer with an interest rate below 23% might be considered a good offer. Bad credit personal loans can sometimes have interest rate APRs in the low to mid 30s. Any loan offer that contains an interest rate in the low 20s or closer to 18% or 19%, may be considered one of the best loan offers you will be able to find. If this happens to you, and you need the money, you may want to snatch up the loan offer quickly as you may not get an offer that good again. However, if you can wait, you may want to rebuild your credit before taking out a loan.

You May Like: How To Get 150k Business Loan

Do I Need A Proof Of Income

You always need to provide some type of documentation any time that you apply for a loan. You always must prove your identity to the lender. They want to make sure that you are who you say you are. In this world of fraud, lenders cannot be too careful when interacting with you. They must protect your identity as well as their data. Lenders may as for some type of photo ID, whether it is a drivers license, passport, or military ID. It is important that your ID is valid and not expired.

Any lender wants to see;proof of your income. They may want recent pay stubs or bank statements showing how much income you receive regularly. If you do not have a standard job and do contract work or some other form of self-employment, the bank may want to see your tax returns. The sooner you have all of these documents prepared and ready for the bank, the faster you can be approved.;Lenders may also ask for some other type of document or may have additional forms for you. You should respond quickly to any and all requests. Failure to do so may result in your loan being delayed and even denied, even for;personal loans with good credit