How To Save Money

In conversations with lending-industry experts, CR found that there are a number of ways to save money, even if you have a suboptimal credit score.

Know your credit score. Experian recommends checking your credit score at least once per year as a matter of course. That way, youll know where you stand so that you can manage expectations regarding loan eligibility, and be aware of what you have to do to bring up your score. You should also look for errors in your credit report, which can affect your score, Bell says.

Luckily there is no shortageof sites you can visit online to get a free credit score,” says Nana-Sinkam. All the major credit bureaus offer one free credit report annually.

If theres time, improve your score. A credit score can be improved in a number of ways, mostly by paying bills on time. Always pay credit card and other bills when theyre due, even if its only the minimum payment. This is good advice for any loanthe more you pay up front, the less youll pay in the long run.

Bring a bigger down payment. Having a bigger down payment reduces the amount of loan you need, and a smaller loan means less interest, says Amy Wang, associate director of Credit Karma Auto. A down payment can be in the form of cash, a trade-in vehicle, or a combination of the two.

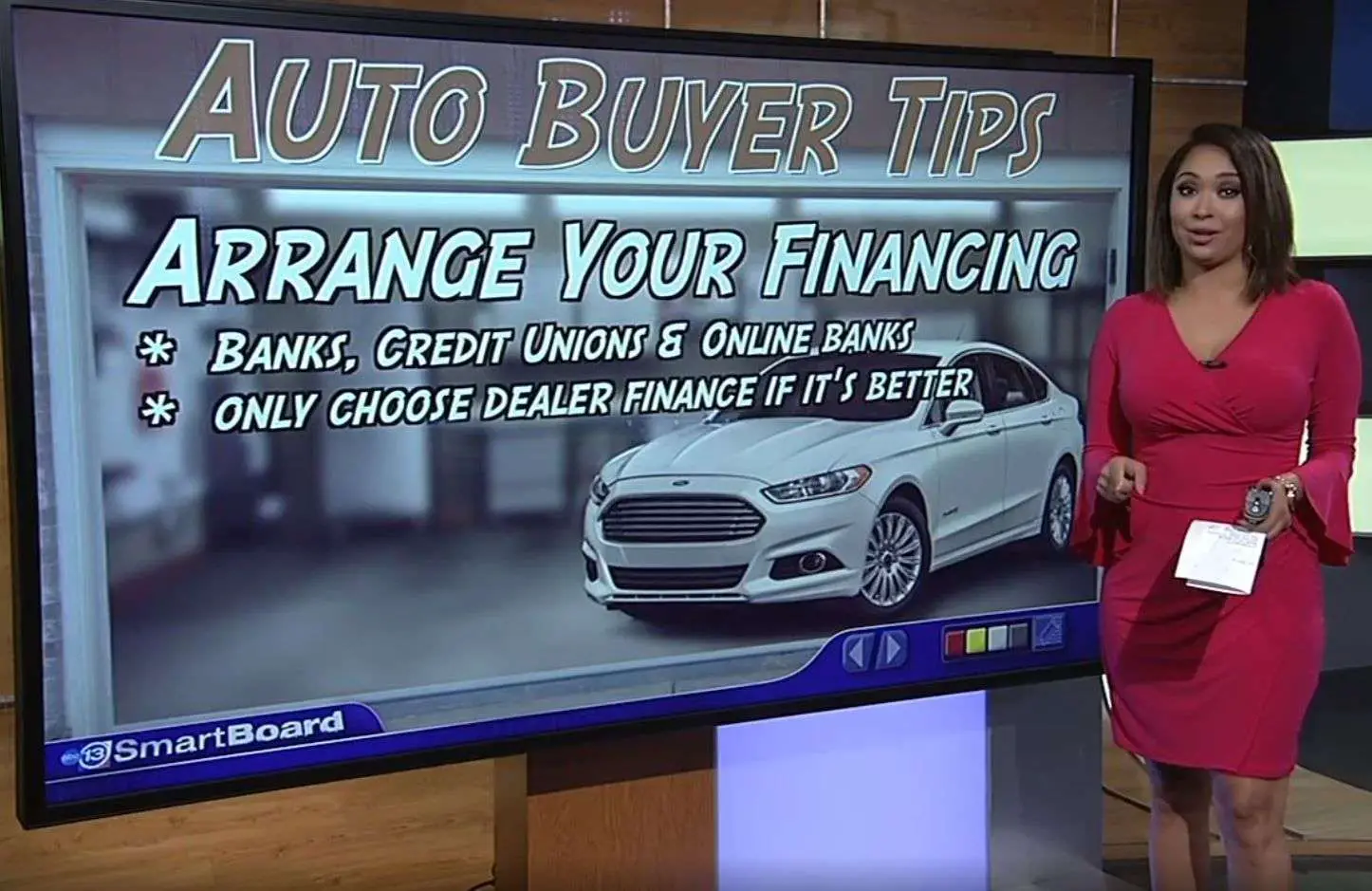

Get prequalified. Much like knowing your credit score, getting prequalified for a loan from your bank helps manage expectations about whats possible.

Benjamin Preston

Review The Dealers Loan Offer

Once youve taken a test drive and have found a car that meets your needs, you may still have a shot at an even better interest rate from the dealer.

Carmakers set up their own banks exclusively for auto purchases through dealerships, and they sometimes offer below-market interest rates. Once the finance manager finds out youre preapproved for a set rate, hell likely try to beat that rate to get your business. Theres no harm in applying to see how low your interest rate can go.

And if you dont want to play that game, still be sure to tell the salesperson youre already preapproved. Tell the salesperson you are a cash buyer, so you can haggle on just the price of the car, not the monthly payment.

Auto Approve: Best For Refinance Car Loans

on LendingTrees secure website

Auto Approve offers refinancing and lease buyouts for cars, trucks, SUVs, motorcycles, boats, RVs and ATVs. When you apply, youll see potential car refinance offers from multiple lenders without impacting your credit. Once you choose, the lender will do a hard credit pull and give you an official offer for you to accept or reject.

Don’t Miss: How To Apply For Fha Loan In Illinois

Save Up For A Down Payment

The amount of your down payment can make a big difference in your auto loans rate. So the more money you can put down, the better. If you cant put much down right now, do your best to sock away some savings quickly.

You might take on a second temporary job, sell some stuff, or put in extra hours at work. Another option is to just make your current vehicle last until you can save a significant down payment for your next car loan. Trust me, waiting a few extra months will be worth it when you save a ton on your car loan!

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Summary Of Auto Loans For Good And Bad Credit

| Lender |

|---|

|

20.58% |

Loan terms: Some lenders offer loans for up to 84 months. However, its best to pay off a car loan quickly since cars depreciate rapidly. Owing more on the loan than the car is worth is called being underwater or upside down, which is a risky financial situation. Also, the best interest rates are available for shorter loan terms. NerdWallet recommends 60 months for new cars and 36 months for used cars.

Soft vs. hard credit pull: Some lenders do a soft pull of your credit to pre-qualify you for a loan. This doesnt damage your credit score, but it also doesnt guarantee youll be approved for a loan or get the exact rate youre quoted. Other providers run a full credit check, which temporarily lowers your credit score by a few points. But again, your final rate could differ slightly from your preapproval quote. A hard pull will be required in all cases before a loan is finalized.

Rate shopping: Applying to several lenders helps you find the most competitive interest rate. However, it can lead to your being contacted by multiple lenders, or even dealers when you apply for a purchase loan, especially if you use a service that compares offers for you .

Restrictions: Some lenders only work with a network of dealerships. Others wont lend money to buy cars from private sellers. Lenders may also exclude some makes of cars, certain models and types of vehicles, such as electric cars.

Auto loan rate data courtesy Experian updated 9/2/2021.

Mission Fed Car Financing & Auto Loan Guide

Key Information You Need to Know About Auto Finance Loans in San Diego

- Understand important loan terminology

Your success is our bottom line, and that includes helping you navigate the car buying process by finding you a great used car loan. We look forward to helping you through the loan process and getting you into your new-to-you car today!

1. Loans subject to credit approval terms and conditions apply. No branded titles or commercial use vehicles will be financed. A valid driver license and current insurance are required at the time of financing. Financing up to 120% based on Retail Kelley Blue Book for used vehicles. Programs, rates, terms, conditions, and services are subject to change without notice.2. Interest will accrue during the deferment period.

Read Also: How To Transfer Car Loan To Another Person

What Is An Auto Loan

Auto loans are used as a source of credit to finance the purchase, maintenance, and/or repair of motor vehicles, with repayment scheduled using either an installment loan or a lease.

An auto loan is a loan for the purchase of an automobile. The money does not need to be paid back until the car is sold. They are typically used during periods when it would be impractical to use either a credit card or bank loan for the amount needed to purchase a new car.

When Is The Best Time To Buy A Used Car

The best time to buy a used car is the beginning of the month. Interestingly, this is the opposite of new cars where it’s best to wait until the end of the month to catch salesmen when they are trying to hit their sales goals.

The reason used cars are different is because dealers update their inventory on used car websites and search engines like the one below at the beginning of the month. As the month goes on, there is less selection to choose from and demand for the remaining vehicles goes up.

You can still find bargains from both dealerships and private sellers throughout the month, but you’ll have more options if you start your search early.

Recommended Reading: How Much Commission Does A Mortgage Loan Officer Make

Alternatives To Getting An Auto Loan Including Car Rentals

There are other ways that you can get a vehicle if you do not want to go through the process of getting an auto loan. Rentals are a great alternative because they can be done for short periods of time and will help give you the car experience without spending any money.

There are many alternatives to getting an auto loan. You can rent a car and finance it through the rental company, use a term-life insurance policy, or even get a car as a gift. There are also some good rates available for those who have good credit.

Lenders With The Best Auto Loan Rates

- PenFed Credit Union tops the list with annual percentage ratings starting at 1.04%.

- Shorter financing terms of 24 to 36 months generally come with the lowest interest rates.

- Shop around and get quotes from multiple lenders to find the best auto loan rates for you.

Affiliate disclosure: Automoblog and its partners may be compensated when you purchase the products below.

Lenders compete with one another by offering low interest rates to what they consider dependable borrowers. Currently, the best auto loan rates for new vehicles are about 2.5% and under. Many providers offer rates like this, including credit unions, banks, and online lenders.

In this article, well talk about the five best providers for low auto loan rates and go over how you can find good financing terms. When shopping around for auto loans, its a good idea to compare pre-qualification offers from several top lenders.

Don’t Miss: How Can I Refinance My Car Loan With Bad Credit

Used Car Loans From A Bank Or Credit Union

Before you start shopping for a used car, it’s a good idea to get preapproved for an auto loan from a bank or credit union. If you know what kind of car you want, use online resources such as Edmunds or Kelley Blue Book to research average costs. With a price range in mind, you can tell the lender how much you want to borrow.

After the lender reviews your preliminary application, they’ll tell you how much you can borrow and the interest rate they’re likely to offer. This isn’t a firm guarantee, but it gives you a good idea of how much a loan will cost you and makes it easier to negotiate with the dealer. A loan preapproval results in a soft inquiry on your credit report, which does not affect credit scores.

Banks may be the first place you think of for getting a used car loan. But if you belong to a credit union, are new to credit or have fair to poor credit, there could be advantages to applying for a loan at a instead.

- You may have a better chance of being approved for a loan. Credit unions are community-focused and smaller than many banks, so they take a more personal approach and are typically more understanding than banks if you have less-than-perfect credit or a limited credit history.

- You might find it easier to get a small loan. Banks and car dealerships typically have minimum loan amounts, but many credit unions don’tor if they do, the minimums are quite low.

Navy Federal Credit Union: Best Auto Loan Rates For Those With Military Affiliation

*Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $10,000 loan at 3.49% APR with a term of 3 years would result in 36 monthly payments of $292.98.

LightStream auto loans are unsecured, meaning there are no restrictions based on the vehicles age, mileage, make or model. The 2.49% APR applies to any auto loan: new, used or refinance. This rate could possibly go lower LightStream promises to beat any qualified offer from another lender by 0.10 percentage points.

You May Like: Can I Refinance My Parent Plus Loan

Check And Improve Your Credit

Before you start shopping for an auto loan, take the time to check your credit score. You can do it for free pretty easily. If you have a credit card, your . Or you might check out a site like for a fairly accurate score estimate.

If your score is below the excellent range of 760+, you have room for improvement. Maybe you dont have time to take months for improving your score. But chances are you can take a couple of simple steps to boost your score within a month or two.

The most common ways to quickly boost your credit score include:

Choose The Right Time Of The Month

Dealerships have quotas not only for the year, but also for the month. If they are not close to meeting their goals, they may offer better pricing or incentives if you shop towards the end of the month.

That said, the very last day of the month may not be the best time, but rather a few days before the month’s end. Each dealership has its own time frame for quotas, and they may not sync perfectly with the calendar month.

You May Like: Does Va Loan Work For Manufactured Homes

Best For Tech Junkies: Carvana

Courtesy of Carvana

Carvana offers a completely online shopping experience, from financing to delivery with no minimum loan amounts and is our choice as the best for tech junkies.

-

Prequalify with a soft credit check

-

No minimum credit score requirement

-

End-to-end online shopping experience

-

Financing for Carvanas vehicles only

-

$4,000 minimum annual income required

-

Only used vehicles

It seems like every industry is cutting out go-betweens these days and the car industry is no exception. If you would rather skip the dealership and the bank altogether, Carvana is the site for you. Without ever leaving your home, you can apply for a car loan, choose your car and get it delivered. If you want to trade your old car in, you can do so while youre at it. Carvana will give you an offer and pick it up from your home.

Best of all, these loans aren’t just easy to get they are great deals for all kinds of borrowers. There is no minimum credit score, so anyone who is 18 years old, has no active bankruptcies and makes at least $4,000 per year is eligible.

Tips For Getting The Best Auto Loan Rates

More than 100 million Americans have car loans if you plan on being a part of this number when you purchase your next vehicle, its critical to your budget that you shop for the best interest rate. Get a lower interest rate and youll be able to keep your car payment as low as possible.

Here are six tips on how to get the best car loan rate:

Also Check: Usaa Credit Score For Auto Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

BEST OF

Best Places To Get An Auto Loan

Well get right to it: Truliant Federal Credit Union is the best overall credit union for getting a car loan, while Capital One Auto Loans is the best overall bank for auto loans. In this post, we also go into which financial institution is the best for military members and which is the best for online car buying .

We also explore what is an auto loan, places to get a car loan, the advantages of a dealership loan and more. Read on for more about auto loans and which financial institution is the best for your specific needs.

Read Also: Get A Loan Without Proof Of Income

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Best Online Auto Loan: Lightstream

LightStream

- 2.49% to 9.49%

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. It’s also strong on customer service, receiving the top score in the J.D. Power 2020 U.S. Customer Lending Satisfaction Study for personal loans.

-

Auto payment discount of 0.5%

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is the online lending arm of SunTrust Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 2.49%, which includes a 0.5%-point discount for autopay. The maximum APR on an auto loan is 9.49%.

Also Check: What Credit Score Is Needed For Usaa Auto Loan