Where To Find Your Certificate Of Eligibility

You have two options for requesting your COE:1. Request it through the VA ebenefits website.

2. Ask your lender to look it up when you apply for your mortgage .

The second option will likely be the easiest for you, though you may need to provide additional documentation before the loan is approved.

If possible, have all of your service-related documents on hand so theres no delay in processing.

Why You Need A Va Certificate Of Eligibility

Over 60 years ago, the VA Loan Guaranty Program began offering affordable loans to veterans as a way of thanking them for their service and giving them an opportunity to purchase homes that some might find difficult to fund otherwise.

VA Loans are unbeatable, offering veterans a guarantee that the government will pay close to a quarter of their mortgage in case of default.

While theyre distributed by private lenders, these loans are backed by the VA, adding a layer of certainty to their commitment.

Even more beneficial, VA loans come with no required downpayment, letting vets and active duty miltary personnel purchase, build, or refinance a home no matter the state of their savings account.

These loans also come without the requirement of monthly PMIs, saving you money on premiums.

In order to qualify for a low-interest VA loan with no down payment, you must have a VA Certificate of Eligibility, which is available to those people who serve or have served in one of the branches of the armed forces.

In order to obtain a certificate, you must meet certain eligibility requirements as listed on the Department of Veterans Affairs website.

Without the certificate, there is no way to obtain a loan through the VA Home Loan Program.

Former National Guard Or Reserve Members

Because the different branches of service have different forms and documents, the specific ones youll need may vary. But in general, if you were a member of the National Guard but were never activated, youll need:

- Your Report of Separation and Record of Service form for each period of service

- Your Retirement Points Statement and proof of the character of service

If you were in the Reserves and never activated, youll need:

- A copy of your latest retirement points

- Proof of honorable service

Credible lets you compare mortgage rates from multiple lenders, all in one place.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Can I Get A Coe With Other Than An Honorable Discharge

The Certificate of Eligibility process is tricky for Veterans with a separation status other than honorable. In this case, the VA must investigate the discharge. Discharges labeled as dishonorable are not eligible.

People who fall into this category should seek help from their local VA office, especially if you need to file an appeal to the results of your request for eligibility.

Diy Or Do It Yourself

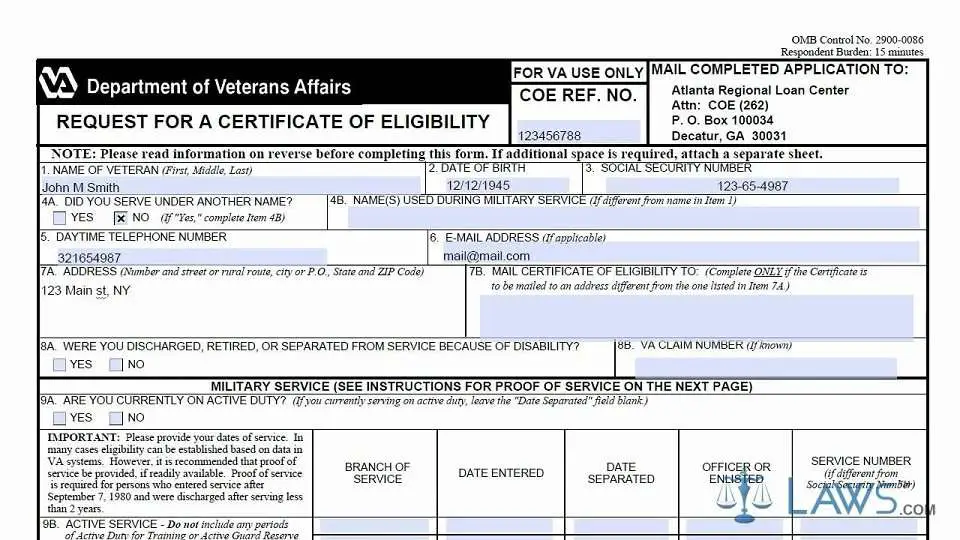

You as the applicant can also fill up and give the form by mail or submit it online. Veterans and service members, whose names do not exist in the system, need to furnish proof of service in the military along with the completed application.

For current and former members of the National Guard or the Reserves, activated on the federal level, there is an additional requirement to attach a filled DD 214. While filling up this form , do pay attention to items 24 and 28, which are for the character or type of service and the reason for separation respectively.

For those service members who are at duty while they apply for the VA loans COE, submission of a written statement including their name as it should be there on the certificate, along with their DoB and Social Security number, along with the dates of active duty and those lost during their service. Any such written statements should be on a military letterhead, accompanied by signatures of the adjutant and the personnel or commanding officer of the unit to which the applicant belongs.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Best Va Loan Companies

With a plethora of lenders to choose from, weve compiled our top picks for the best VA loan companies, highlighting their best features, the types of rates and loan amounts they offer, and how they can benefit you.

Weve also provided you with a rate tool that can give you quick estimates of the loan rates you can expect with the company.

Each of the providers on the list has demonstrated a commitment to giving back to the military and seeing veterans succeed in their lives. The top three are dedicated solely to military servicemen and women.

Once you have your COE in hand, you can start shopping for rates from these providers.

Va Coe Application Requirements

In order to successfully receive your VA COE, youll need to meet the application requirements.

You will qualify for the VA Certificate of Eligibility if:

- You have served 90 consecutive days of service during wartime, you will qualify.

- You have served 181 days of service during peacetime.

- You are a National Guard or Reserve member, you can qualify if you have served more than 6 years.

Beyond service in the four branches of the military, you may qualify for a COE if you served as a Public Health Service officer, a midshipman at the U.S. Naval Academy, an officer of the National Oceanic & Atmospheric Administration, a merchant seaman during World War II, or a Cadet in the U.S. Military, Air Force, or Coast Guard Academy.

In some cases, you can be eligible if you have not served. For instance, if you are an unmarried spouse of a veteran who died from a service-connected injury or disability. Surviving spouses may also claim eligibility for POW/MIA service members.

Here are some documents you should start putting together now to be ready for your application.

Want to find out more about the specifics of eligibility for the VA loan? Take advantage of our full guide today.

You might want to start putting the required information together now and putting it into a file so that you have it available when you are ready.

Read Also: Drb Refinance Reviews

Can A Military Spouse Obtain A Certificate Of Eligibility

Yes, military spouses that qualify for VA loan benefits can obtain a COE. To get a COE as a military spouse, you need to receive Dependency & Indemnity Compensation and complete VA Form 26-1817. After completing the form, please mail it to your regional loan office. The VA regional loan office address is listed at the bottom of the form.

If you are not receiving Dependency & Indemnity Compensation benefits, you’ll need to apply through VA Form 21P-534EZ, then follow the steps above.

How To Get Your Va Home Loan Certificate Of Eligibility

May 27, 2018VA Loans

You can obtain a copy of your Certificate of Eligibility in one of three ways:

Apply Online You can access your COE on your eBenefits portal. Visit the eBenefits Gateway to learn more.

Apply Through Your Lender The easiest way to get your VA Home Loan Certificate of Eligibility is to have your VA lender request a copy for you. Approved VA Lenders, like HomeVantage, have access to a web-based program and can establish eligibility and issue an online COE with a few clicks of the mouse. Apply for a VA loan to get started. .

Apply by Mail You can obtain your COE by making a written request directly to the Department of Veterans Affairs Regional Loan Center servicing your area. For a full list of Regional Loan Centers, you can visit the U.S. Department of Veterans Affairs.

Applying for your Certificate of Eligibility is only one step in applying for a VA home loan. Youll still need to complete an online application and work directly with your Mortgage Banker to meet the income, credit, debt and residual income requirements for your loan.

Don’t Miss: Can I Refinance My Car Loan With The Same Lender

Servicemembers Veterans And National Guard And Reserve Members

Apply online

To get your Certificate of Eligibility online, please go to the eBenefits portal. If you already have login credentials, click the Login box, and if you need login credentials, please click the Register box and follow the directions on the screen. If you need any assistance please call the eBenefits Help Desk at 1-800-983-0937. Their hours are Monday-Friday, 8am to 8pm EST.

Apply through your lender

Most lenders have access to the Web LGY system. This Internet-based application can establish eligibility and issue an online COE in a matter of seconds. Not all cases can be processed through Web LGY – only those for which VA has sufficient data in our records. However, Veterans are encouraged to ask their lenders about this method of obtaining a certificate.

Apply by mail

Use VA Form 26-1880, Request for Certificate of Eligibility.

How To Apply For A Va Home Loan With A Certificate Of Eligibility

In recognition of your service, the Department of Veterans Affairs financially backs home loans for Veterans, Active Duty Service Members, National Guard, Reserves and some surviving spouses. VA home loans can be used to buy a single-family home or condo, purchase and renovate a house, or build a new home, often with no down payment required in many circumstances.

One of the stipulations to apply for a VA home loan is that you must show your mortgage lender a Certificate of Eligibility which verifies that your length of service and character make you eligible for a VA home loan benefit. While the COE is not usually need to pre-qualify for a home loan, the certificate will be one of the documents you will be required to submit for your VA home loan application, so its a good idea to obtain your COE when you first decide to buy a home.

Don’t Miss: Usaa Auto Loan Reviews

Eligibility Requirements For Va Home Loan Programs

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to apply for a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status. Keep in mind that for a VA-backed home loan, youll also need to meet your lenders credit and income loan requirements to receive financing.

Can I Use A Coe I Used Before

You may be able to restore an entitlement you used in the past to buy another home with a VA direct or VA-backed loan if you meet at least one of the requirements listed below.

At least one of these must be true:

- Youve sold the home you bought with the prior loan and have paid that loan in full, or

- A qualified Veteran-transferee agrees to assume your loan and substitute their entitlement for the same amount of entitlement you used originally, or

- Youve repaid your prior loan in full, but havent sold the home you bought with that loan

To request an entitlement restoration, fill out a Request for a Certificate of Eligibility and send it to the VA regional loan center for your state.

Read Also: What Is A Student Loan Account Number

How To Get Your Coe As A Surviving Spouse Who Receives Dic

To qualify for Veterans Home Loan Benefits, the surviving spouse must have a copy of the veterans discharge papers .

For survivors who were not married, you will need to fill out and submit a Request for Determination of Loan Guaranty Eligibility-Unmarried Survivor Spouses if you receive Dependency and Indemnity Compensation .

How to Get Your COE as a Surviving Spouse Who Does Not Currently Receive DIC

If you are not receiving DIC benefits, you will need to provide the following information:

- A completed Application for DIC, Death Pension, and Accrued Benefits .

- A copy of your marriage license.

- A copy of the Veterans death certificate.

Compare Top Va Purchase Lenders

Take the guesswork out of finding a VA Loan provider. Veterans United Home Loans created this site to educate and empower military homebuyers. Regardless of what lender you pick, it’s always a good idea to compare and know your options.

- NMLS # Loading Reviewsâ¦

- ranks No. 1 in Customer Ratings for VA purchase lenders, according to ratings and reviews collected by TrustPilot.

- In , closed 0 VA Purchase Loans, which was 9% of all VA Purchase Loans closed nationwide last year.

Read Also: Va Home Loan For Manufactured Home

How To Obtain Your Va Loan Certificate Of Eligibility

Many people talk about all of the conditions that must be met for VA loan eligibility.

There are multiple conditions that an active service member or veteran must meet.

But, the first step is obtaining your VA loan certificate of eligibility, aka COE.

We know that this can be intimidating. There are a lot of moving parts but in this article, we will simplify it and make this process as simple as possible.

We will walk you through how to obtain your VA loan certificate of eligibility and what forms the VA requires you to provide to prove you served or are serving in the military, how to get a copy of form 26-1880 , and where your certificate of eligibility must be sent.

Why Is Having A Certificate Of Eligibility Important

Without a COE, lenders are unable to approve you for a VA loan and the benefits that come along with it. Providing an up-to-date COE allows lenders to determine your entitlement and to help you get the right loan for your needs.

Your COE also provides the entitlement code for lenders to use to determine your loan eligibility. That entitlement code informs the lender about your military service and allows lenders to determine if youre required to pay the VA funding fee, which goes directly to the Department of Veterans Affairs.

Recommended Reading: Does Collateral Have To Equal Loan Amount

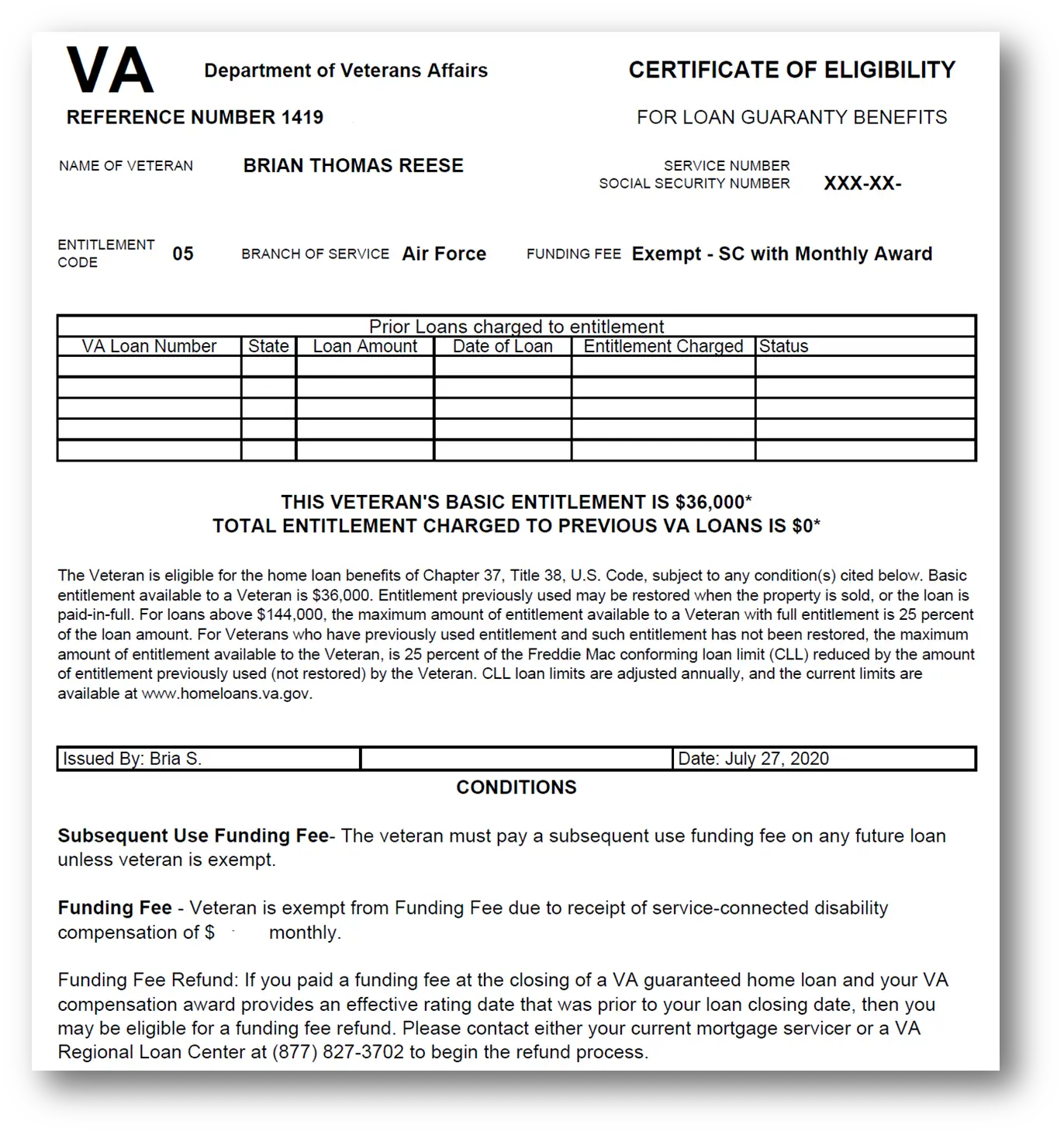

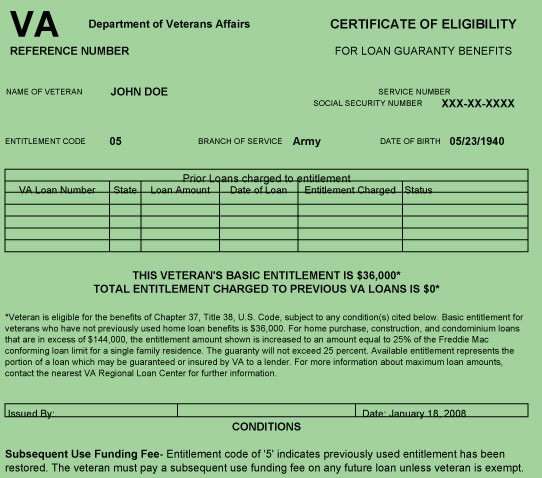

What Does A Certificate Of Eligibility Look Like

See the image below. A Certificate of Eligibility is a relatively simple document that displays basic information like:

- The VA reference number for the certificate.

- The Veteran or service member’s name.

- The last four digits of your Social Security Number.

- Your branch of service.

- Your entitlement code

Do Familiarize Yourself With The Three Ways To Get It

There are three ways to get your COE.

- VA eBenefits Portal via the Internet

- Atlanta Regional Loan Center by U.S. mail

- VA Online Portal through your VA-approved lender

No matter how you get it, your COE is a vital part of the VA loan process. With some methods above it can take just a few minutes to obtain! And the good news is that unless you originally applied for your COE while on active duty, it never expires. If your COE was obtained while on active duty, youll need to get another one after discharge. Surviving spouses may only use option #2.

Also Check: Can I Refinance My Sofi Personal Loan

What Documents Do I Need To Get A Va Loan Coe

The documentation required to receive a VA Loan COE varies based on the service-members status.

Service members still on active duty need to provide a statement of service signed by their commander or personnel officer.

Veterans and current or former activated National Guard/Reserve members must submit a copy of their DD Form 214.

National Guard/Reserve personnel that have never been activated need to provide a statement of service signed by their commander or personnel officer, as well.

Discharged National Guard members that were never activated should submit NGB Form 22 for each service period and NGB Form 23.

Discharged Reserve members that were activated must submit their most recent retirement points and statement and proof of honorable discharge.

What Do I Do Once I Have My Coe

Once you have your Certificate of Eligibility, your home buying process will look much like anybody elses. If you havent done so already, youll need to find a lender who issues VA loans. Your lender can guide you through the process of applying for a loan, finding a real estate agent and closing on your new home.

When youre ready to find a lender, check out Credible to compare mortgage rates from different lenders.

Don’t Miss: Rv Loan With 670 Credit Score

How To Submit An Application For A Certificate Of Eligibility

Once you have all your required documentation as described above, youre ready to begin the process.

There are three ways to obtain your COE:

Q: I Have Already Obtained One Va Loan Can I Get Another One

A: Yes, your eligibility is reusable depending on the circumstances. Normally, if you have paid off your prior VA loan and disposed of the property, you can have your used eligibility restored for additional use. Also, on a one-time only basis, you may have your eligibility restored if your prior VA loan has been paid in full but you still own the property. In either case, to obtain restoration of eligibility, the veteran must send a completed VA Form 26-1880 to our Atlanta Eligibility Center. To prevent delays in processing, it is also advisable to include evidence that the prior loan has been paid in full and, if applicable, the property disposed of. This evidence can be in the form of a paid-in-full statement from the former lender, or a copy of the HUD-1 settlement statement completed in connection with a sale of the property or refinance of the prior loan.

Also Check: Va Loan Requirements For Mobile Homes