Can I Pay My Huntington Car Loan Online

can i pay my huntington car loan online is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on .

Note: Copyright of all images in can i pay my huntington car loan online content depends on the source site. We hope you do not use it for commercial purposes.

Learning Curve Not Too Bad

Now that its been nearly a week with multiple uses daily, Im over the initial shock, and I really am enjoying the format of the new app. It was difficult at first, because Im always in a hurry, it seems, when I do online banking. I was a surprised by the changes at first, so had to login a few times before I became familiar with the formats. I have several accounts with children and grandchildren, which means Im checking balances and moving small amounts of money frequently, in addition to our larger accounts. I do appreciate the new app now. I did notice today, however, because my grandson was with me and reading his message from you aloud, that I did not receive an important message that allBanking must be done at drive through. That would have been good to let me know. I looked all through app to locate said message in my accounts, but its not there. You may want to fix that one! Thank you for your continuing efforts to improve banking with Huntington. I live mostly in FL now, but still bank with Huntington.

Huntington National Bank Premier Savings Account

APY

0.02%

With $0.01 minimum balance

The Premier Savings account has a $4 monthly fee, but it is easy to avoid. It can be waived with a linked Asterisk-Free Checking account or $300 average daily balance. Youâll need $50 to open a Premier Savings account, and it earns interest even if the balance drops lower than that amount. But with a low rate, you probably won’t see your money grow much.

Also Check: Mortgage Commitment Fee

Additional Huntington Bank Features:

Of course, Huntington has some great features that are standard for all its banking customers. Huntington is here to provide the protection you need and to make your life easier. You can download the Huntington Mobile app via IOS or Android, for easy to access service at all times. Check balances, pay bills, review your account, whether youre at home or on the go. Mitigaterisk and protect everything you hold dear with Huntington Commercial Business Security Management.

Learn different types of payment methods your customers can choose from with Huntington Bank Small Business Receivables Management. Huntington will find solutions that optimize your business, allowing it to bloom and expand. Some notable features are Huntingtons Billing service, Lockbox service, Merchant service, vault deposit service, and more!

We are in awe at just the number of services Huntington offers. Check out Huntington Bank Employee Relocation Services if you want to reduce the hassle of relocation. Notable features include Direct Bill which allow advance funds for employees closing cost, Flexible Private Mortgage Insurance that cut PMI down to 10% from normal 20%, and Recast options adjust monthly payments based on mortgage amount.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Things To Consider Before Refinancing

Huntington Bank Auto Loans

Are you thinking about buying a new or used car, truck, or motorcycle and need an auto loan to finance your purchase? An auto loan from Huntington Bank is a great option with its highly competitive rates, flexible payment options, and online account management tool. Huntington also provides you with great resources to help you manage the car buying process. These resources will provide you with tips to help you be well prepared and get the most out of the car buying process. Keep reading for an in depth look at the features and services from Huntington Banks auto loan.

| TOP HUNTINGTON BANK PROMOTIONS |

Don’t Miss: Usaa Car Financing Calculator

Some Customers See Hope

Jeremy Bond, 42, of Mount Pleasant, says he’s now happy his situation has finally been resolved.

He even bought cookies at the local Meijer and took them into his branch for the people who work there once things got on track.

He understood how stressful everything was for them. And he was thankful that the branch employees did their part to fix the problem.

At one point, though, he seriously considered moving his money to another bank.

The deal between Huntington and TCF, first announced in December 2020, officially closed in June and set off the efforts to re-brand TCF as Huntington Bancshares.

In June, it was announced that TCF customer accounts would be converted to Huntington’s systems in the fourth quarter.

The new Huntington is to have dual headquarters: its main headquarters in Columbus, Ohio, and a commercial banking headquarters in Detroit, inside the new 20-story downtown tower that is under construction.

Downsides To Huntington Bank Personal Loans

- Limited Availability: The biggest downside to Huntington Bank is that they are only available in seven states. These states include Ohio, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia. If youre not located within these states, LightStream is an online lender that can be a good option for those with excellent credit.

- Rates Not Listed on Site: Because they offer little information on their website, youll have to contact Huntington Bank to find out what kind of interest rate you could qualify for. This could make it harder to comparison shop with other lenders.

You May Like: Best Fha Refinance Lenders

Other Ways To Make Your Huntington Loan Payment

You have other options for making your Huntington Loan payment.

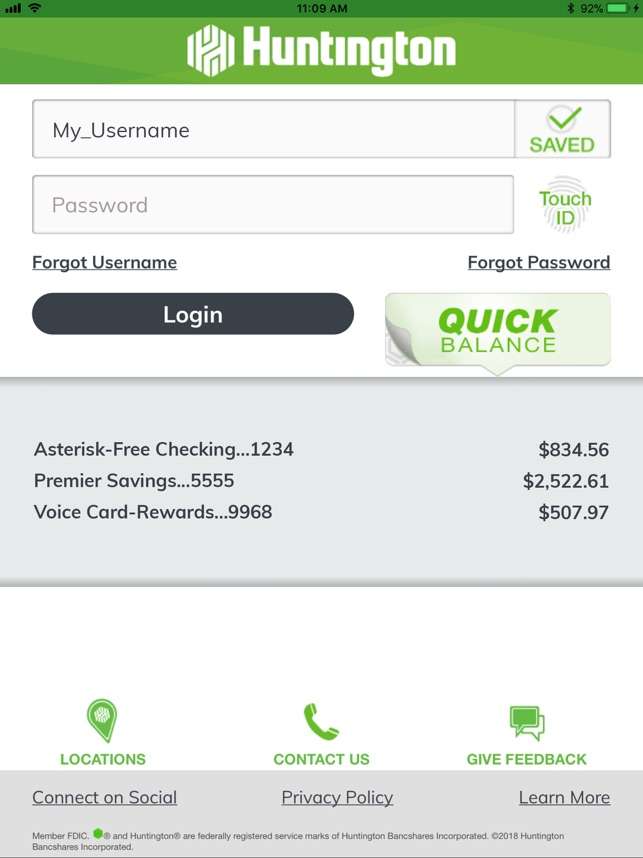

- Pay by app: You can make a payment by downloading the Huntington app on App Store or . Log into the app to make your payment.

- Pay in person: You can visit any Huntington branch location to make a payment in person. You can find the closest branch by visiting their website.

- Pay by mail: You can mail a check or money order toHuntington Installment LoansColumbus, OH, 43218.

How To Apply For Financing

Applying for a Huntington auto loan is as easy as filling out its self-described five-minute form. That number does jump to 10 minutes if you have a co-applicant.

Its application has three sections: loan information, personal information and financial information.

The loan section covers whether youre looking to insure a specific car or whether youre going to shop for a new one and would like a pre-approval. Youll need to provide an estimate of how much you expect to borrow. There is an option for Huntington to contact you if you qualify for more financing than you estimated.

The personal section asks for a variety of contact information, including your phone number, email and address. Itll ask for a previous address if youve lived in your current home for less than two years. You also have to provide your Social Security number and the name and phone number for a contact person.

The financial section is a run-down of your income. Youre asked to provide the name and contact info for your employer, plus a summary of your occupation and wages. Theres also a place to report additional sources of income like a side hustle, or any money you receive in child support.

Read Also: Does Va Loan Work For Manufactured Homes

How Do I Pay My Huntington Auto Loan

4.7/5

Send payments straight from your phone or computer.

Additionally, does Huntington do car loans? Buy your next car, truck or motorcycle with a simple auto loan from Huntington. We offer competitive rates, no application fees and a fast approval process. So you’ll be on the road in no time.

Also know, how do I pay my Huntington Bank auto loan?

What is Huntington pass a payment?

Highlights of Huntington auto loan financingIt offers flexible payment options, such as the ability to choose your payment schedule or to skip payments and make them up later. There’s no prepayment fee if you decide to pay off the loan early.

Auto Loan Features And Benefits:

An auto loan from Huntington Bank offers numerous features and benefits. These features and benefits help you manage your auto loan and provide you with exceptional service.

Competitive Rates: The interest rates from Huntington Bank are extremely competitive and offer good value. Once you lock in a fixed rate, it doesnt change for the life of the loan.

Auto Buying Resources: Huntington Bank provides you with several tools that will provide you helpful tips and advice on auto dealers, average vehicle prices and more. These resources include Kelly Blue Book, which has the definitive new and used car pricing resource. Kelley Blue Book includes car values from 1977 to today, a nationwide used car dealer database, auto manufacturer site links and other helpful information. Another resource are auto calculators that will help provide you with answers to basic car buying questions such as which vehicle can I afford, buy or lease, finance or pay cash, etc.

Flexible Payment Options: Make fixed monthly payments on a day that fits your needs best. This flexibility is important to help manage your monthly budget as not everyone gets paid at the beginning or end of the month. Perhaps you get paid mid month or the third week of the month, this flexibility allows you to fit the payment to your schedule.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Check Out Our New Improved Customer Portal

Managing your account online is easy with MyWater. You can view and pay your bill, sign up for Auto Pay and Paperless Billing, track your water usage and compare it to your neighborhood average, and more! Weve improved our customer portal, so if you havent logged on recently, view the video below, or log on/enroll and see if for yourself! Visit MyWater today!

You are leaving a California American Water regulated operations page and proceeding to a page with information about our parent company, American Water and its affiliates.

Important Notice About External Links

From time to time, we provide links to other websites for the use of our visitors, which have been compiled from internal and external sources. By clicking Continue below, you will be opening a new browser window and leaving our website. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

Information on linked website pages may become dated or change without notice, and we do not represent or warrant that information contained on these linked pages are complete or accurate. We suggest that you always verify information obtained from linked websites before you act upon such information.

The privacy policy of this bank does not apply to the website you visit. We suggest that you always verify information obtained from linked websites before you act upon such information.

Don’t Miss: Usaa Certified Auto Dealers

What To Expect At The Continental Currency Services Payment Location In Huntington Park

Turning in your title loan payment on time is crucial for your financial history. So that you have more opportunities open to you, keep your credit looking good by making title loan payments at the Continental Currency Services payment location in Huntington Park. You can send a quick and secure wire transfer if your payment date is fast approaching and you donât want to risk a late charge.

Once you are done making your title loan payment, you could also take care of any vehicle registration needs at the Continental Currency Services payment location in Huntington Park! But thatâs not all, as you could also use the ATM, exchange foreign currency, cash checks, get a debit card, and more! Expect convenience when you make a title loan payment in person.

Things Didn’t Go As Planned For Some

Bond applauds the early communication that he received about the merger between Huntington and Detroit-based TCF.

The paperwork seemed to spell things out pretty well, he said, such as telling customers that they’d need to temporarily stop making online bill payments as of Oct. 4 as part of the transition period. The accounts would officially go offline Oct. 8.

All that was expected, he said, but he was told he could regain access on Oct. 12.

“I was actually in the system for five minutes but those five minutes were fleeting,” said Bond, who is director of instructional development for Office of Curriculum and Instructional Support at Central Michigan University.

More:Justice Department forces Huntington, TCF to sell 13 bank branches for merger

And then everything went haywire when he saw a message stating “Online Banking — Error.”

The father of three ended up spending the next two days trying to resolve an increasingly maddening banking situation.

Like other upset TCF customers, Bond says he tried to phone the bank for help at a number that was provided. But many of those calls were disconnected after a recording said the bank was experiencing unusually high call volume. At one point, he waited a bit more than an hour on hold.

And when he did finally get through to talk to a live person, twice, nothing was resolved, either.

Melissa, he said, was kind and positive but not the least bit helpful.

Kenya, out of Grand Rapids, was pleasant, too, but didn’t fix anything.

Also Check: Usaa Used Car Interest Rates

Home Equity Line Of Credit

A Home Equity Line of Credit is a line of revolving credit in which your home serves as collateral. Your credit amount is based on the amount of equity you have in your home, your ability to repay and other qualifying factors. You can borrow or draw on the line of credit for a period of time, typically up to ten years. Your home equity credit line can be used for anything. Since your home is likely your most valuable asset, most people use their home equity line of credit for major expenses.

How You Can Use Your Home Equity Loan or Line

- Home Improvements

- Pay off high interest rate credit cards

- Consolidate debt

So, if you have big plans, let Huntington Federal put those plans into action with a Home Equity Line of Credit. Call one of our loan officers today to see if a home equity line of credit is right for you. Reach us at

__________________________________________________________________________________________________

Enroll For Huntington Loan Payment Online

On their www.huntington.com, click the link on the right side of the page reading Enroll Now.

https://www.huntington.com/

You can enroll using either your account number or your Huntington debit card.

To use your personal account number, enter your account number and your Social Security number. If you want to use your debit card, click on the button reading Personal Debit Card and enter your debit card number, your PIN, and your Social Security number.

After entering your information, click the orange button saying Continue.

Follow the prompts to finish enrolling your account. You will need to create a username and password.

Recommended Reading: Usaa Used Car Loan Rate

Best Bank For Refinancing Your Huntington Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

About Huntington Auto Loans

Huntington auto loans are a product of Huntington Bancshares Inc., a regional bank holding company based in Columbus, Ohio. With 954 branches across eight states, the companys largest subsidiary, The Huntington National Bank, and its affiliates, provide consumers with a variety of personal banking, commercial, small business and insurance services.

Through its auto loans, Huntington offers coverage for cars, trucks and motorcycles, regardless of whether youre financing a new or pre-owned vehicle. The company says it prides itself on offering easy financing with flexible terms and competitive rates.

Recommended Reading: How Do I Refinance An Auto Loan