Make One Large Payment Per Year

If you like the idea of rounding your payments up to the nearest $50, you might also like this strategy. With making one large payment per year, you are essentially rounding up one months payment. It doesnt matter what time of the year or payment you choose, but consider adding an extra sum on top of what you already pay. For example, commit to paying an extra $500 per year. This is another great way to save big on interest.

Make Payments On Your Extra Pay Periods

If you want to make additional payments but feel like you cant commit to a biweekly payment, think about making additional payments on your extra pay periods. You might already use your extra paychecks to buy new clothes or treat yourself to a spa day, but consider giving them a new use and pay off your car loan debt. You will be able to make plenty of fun purchases without worry once your loan is paid off!

How Does The Car Loan Payoff Calculator Work

Our calculator helps you work out the costs associated with purchasing a car on credit. Once you have entered the amount, the interest rate and the period of the loan, the calculator will return the total repayment amount, the total interest and the monthly payment figure, as well as full amortization.

Read Also: Usaa 84 Month Auto Loan

Auto Loan: Accelerated Payoff

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

You May Like: How Do Mortgage Loan Officers Make Money

Refinance For A Lower Interest Rate

If your credit score, income and/or other financial circumstances improved since you took out a vehicle loan, you may want to consider refinancing for a lower interest rate. Aim for a shorter loan term while youre at it so you can pay off the loan faster, especially if you plan to pay extra on principal every month.

Apply Tax Refunds And Bonuses

Its tempting to spend a big tax refund or work bonus on a vacation, new electronic devices or other fun stuff. But if you apply hundreds or, if youre lucky, thousands of dollars from a tax refund or bonus at your job to the loan principal, you can knock down your car loan balance significantly.

Recommended Reading: One Main Financial Approval Odds

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

Pay Less For Insurance

Theres also the matter of insurance costs. Borrowers who finance a vehicle are often required to buy more insurance coverage as part of the loan terms. Specifically, they have to buy full coverage which includes comprehensive and collision.

You may even be required to have a lower deductible , making your premiums even more expensive. Once the car is paid off, you can choose whatever level of insurance coverage you want.

Borrowers who pay off a car can switch to liability only insurance can save hundreds each year. The average annual cost of comprehensive and collision coverage insurance is $1,427 a year while the minimum is only $606. This represents a $821 difference.

Recommended Reading: Usaa Car Loan Refinance

Determine Your Current Balance And Payoff Penalties

The first step when planning on how to pay off your car loan faster is to look at the details of your loan. Some lenders make it difficult to pay off car loans early because theyll receive less payment in interest. In the best-case scenario, your loan was calculated using simple interest, which means your interest payment is based on your loans outstanding balance. If you pay off the loan early, youll make fewer interest payments.

Prepayment penalty

If your lender does allow early payoff, ask whether theres a prepayment penalty. Some lenders will impose a fee for early payoff, which could reduce any interest savings youd gain by paying the loan early.

Then, check your balance and make sure that any extra payments go toward the principal of the loan. Some financial institutions will automatically apply additional payments toward interest or other fees rather than toward reducing the principal. You may have to specify that a transfer or a check is a principal-only payment, so run it with your lender first.

Calculate how much youll save

After youve figured out how much you owe and whether your lender imposes prepayment penalties, use an auto loan calculator to determine how much youll save if you pay off the car loan early. If there are prepayment penalties, they can negate any savings.

How To Pay Off Debts Early

Once borrowers decide to pay off debts early, they may struggle to act. Achieving such a goal often takes firm financial discipline. Finding extra funds to pay off the debts usually involves actions such as creating a budget, cutting unnecessary spending, selling unwanted items, and changing one’s lifestyle.

Borrowers should also use the right strategies to pay off their debts. Listed below are some of the most common techniques:

Debt Avalanche

This debt repayment method results in the lowest total interest cost. It prioritizes the repayment of debts with the highest interest rates while paying the minimum required amount for each other debt. This continues like an avalanche, where the highest interest rate debt tumbles down to the next highest interest rate debt until the borrower pays off every debt and the avalanche ends.

In other words, a credit card with an 18% interest rate will receive priority over a 5% mortgage or 12% personal loan, regardless of the balance due for each. The Debt Payoff Calculator uses this method, and in the results, it orders debts from top to bottom, starting with the highest interest rates first.

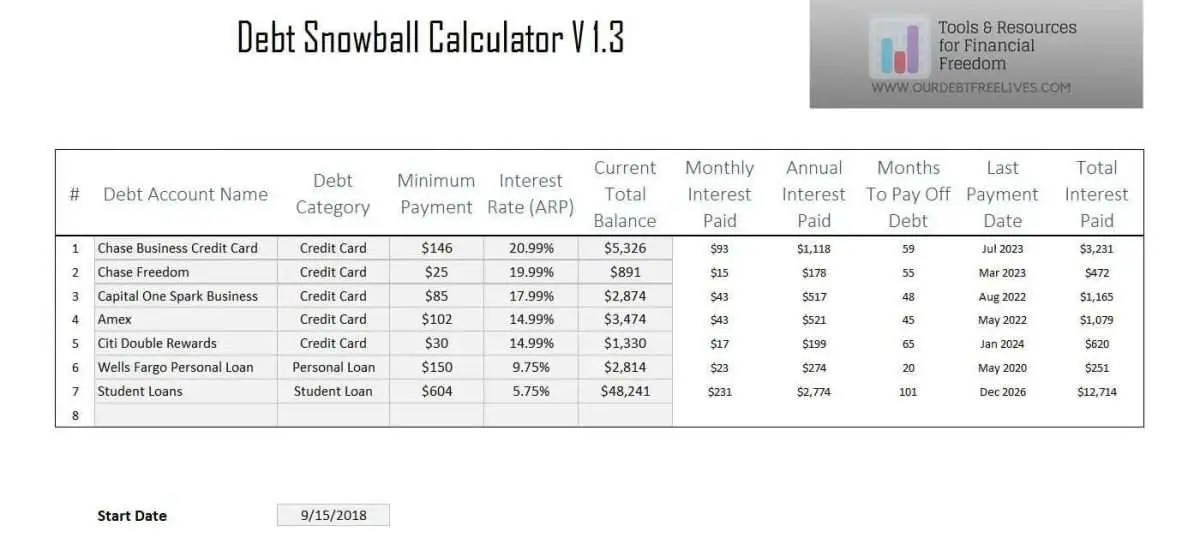

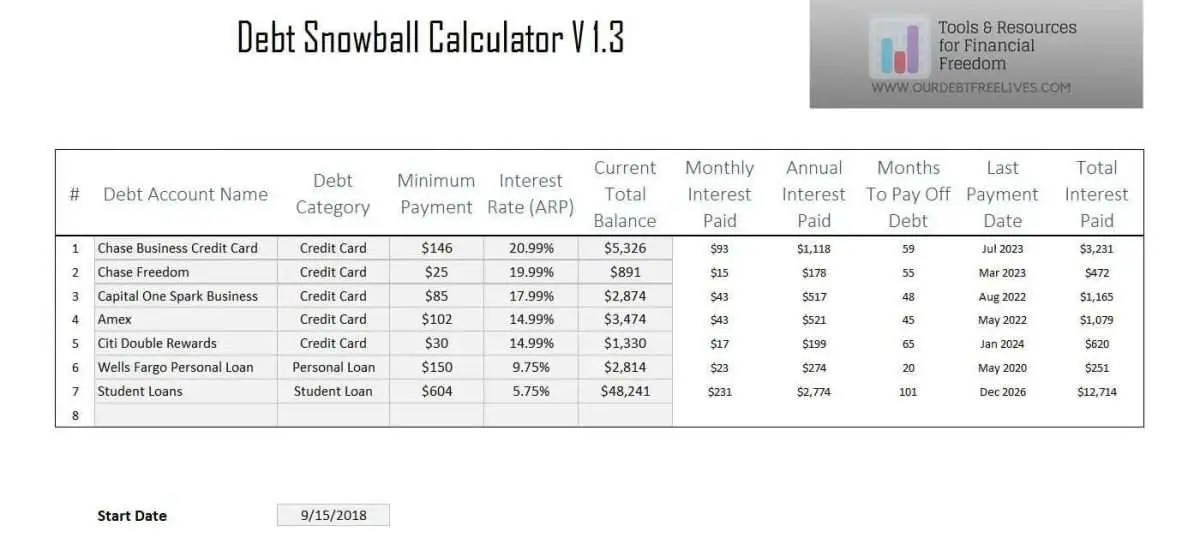

Debt Snowball

In contrast, this debt repayment method starts with the smallest debt first, regardless of the interest rate. As smaller debts get paid off, the borrower then directs payments toward the next smallest debt amount.

Debt Consolidation

Read Also: Usaa Pre Approval Car Loan

What Happens When You Pay Off A Car Loan Early

If your car loan allows for an early payoff, you have the opportunity to save money on interest and improve your credit score.

Depending on your car loans interest rate, the longer the loans terms, the more interest you can rack up. So if you pay your loan off early before the term ends, you can actually save money by not having to pay as much interest. Now, instead of paying off your loans interest, you can have that money to spend on other purchases. To find out how much money you could save in interest, speak with your lender or utilize an auto loan calculator.

If you do choose to pay off the balance for your car loan, keeping the account open for the loans full term will show investors that you made your payments on time, which could potentially boost your credit score.

Paying Off Debt Is A Holistic Decision

Paying off your car loan early isnt just a financial or mathematical decision. Its also an emotional one. Debt can cause anxiety and stress, and unloading your car loan can ease your mind. Once you pay off the car loan, you can put the money toward an emergency fund, retirement savings or childs college education.

You can also put the same amount of money in a savings account to buy your next car in cash and skip the loan completely. This also gives you more leverage at a dealership because you can pay for a car in cash.

Ready to refinance your car loan?

Recommended Reading: Conforming Loan Limits California 2017

Calculate By Monthly Payment

For many consumers, the monthly payment on a new loan is the single most important factor. You can use the Calculate by Monthly Payment option to find what you feel will be the right payment for you.

Just as was the case when I did Calculate by Loan Term, Ill start by entering a loan amount of $10,000 and a loan APR of 7%.

Next, click the Calculate by Monthly Payment option. Then hit the Calculate button.

Youll be asked to enter the Expected monthly payment. For the sake of example, lets enter $155, then hit the Calculate button.

The loan payoff calculator will display three results:

- Months to Payoff 81 months.

- Years to Payoff 6.75 years.

- Interest Paid $2,555.

Now, most lenders wont make a loan for 81 months, since it doesnt represent a specific number of years. Youll likely be asked to choose either 72 months, which will raise the payment somewhat, or 84 months, which will lower the payment slightly.

But notice that the lower monthly payment $155 vs. $198.01 I used in Calculate by Loan Term also results in a much higher amount of interest paid over the life of the loan.

With the term at 60 months, youll pay $1,880.60 over the life of the loan. But at 81 months and the lower monthly payment youll pay $2,555, which will raise the cost of the loan by $675.

Should You Pay Off Your Car Loan Early

Whether you should pay off your car loan early depends on the contract you signed. Since lenders make their money on the amount of interest you pay, its possible there will be a repayment fee if you decide to pay it off early. What youll need to do before deciding to pay it off is calculate the amount of interest youd pay if you were to continue making monthly payments. Once youve done that, compare it to how much youd pay for the repayment fee then ask yourself if its worth the cost difference. If you do decide to pay it off early, remember that your could also drop for multiple reasons. These reasons include a decrease in the age of accountsthe number of months/years youve had the loan foror the number of installment loans also known as a loan where you borrow a certain amount of money at once and pay it off on a month-to-month basis.

Don’t Miss: Credit Score Needed For Usaa Auto Loan

How To Calculate Auto Loan Payoff

The price of your vehicle, down payment you make, length of the loan, and interest rate are all factors that determine how much you’ll pay for your car. Adding a bit more to your payments each month can help you pay off your car loan sooner and, ultimately, save you money. Use this calculator to see the impact of putting a bit more money toward your loan each month.

Enter the price of your vehicle as the Vehicle Price and adjust the sliders to match the details of your loan. Move the Added Monthly Amt slider to see the impact of paying more toward the loan.

Redirect Income Tax Refunds

Your tax refund check may go to fun things, like a new phone or a family vacation. But you can make significant progress if you can forgo those expenses and apply that lump sum to your car loan every year.

Using the $30,000 loan example from above, assume you get a roughly $1,500 income tax refund check every year. If you apply that refund as an extra payment to your car loan each year, youd pay it off about 11 months earlier.

Also Check: Apply For Second Upstart Loan

Early Auto Loan Payoff Calculator

Have an auto loan that you want to pay off sooner? Wondering how much faster you could pay it off by paying a bit more each month? And how much interest you could save in the process?

This Early Auto Loan Payoff Calculator has the answers.

Enter how much extra you want to pay each month, and the calculator will immediately tell you how many months you’ll shave off your loan and your total savings in interest. It can also show how quickly you’re paying down the loan, with the balance remaining for each month until the vehicle is paid off.

This is good information to have if you’re thinking of trading in the vehicle before it’s paid off and wondering how much to knock off the anticipated trade-in value.

Pay Down Higher Interest Debts First

Debts with higher interest rates cost you more money and take the longest to pay off. One strategy is to focus on your debt with the highest interest rates first. Direct your excess income towards this debt while still meeting your minimum payments on all other obligations. Once you pay off your highest interest rate debt first, snowball the funds towards the debt with the next highest rate.

Read Also: Rv Loan Calculator Usaa

Amortization Table And Interest

- Expanding the “Auto Loan Balances and Interest” section below the Auto Loan Payoff Calculator will display a graph illustrating the rate you will pay down your loan with and without any additional payments, plus your accumulated interest charges over time.

For the full amortization schedule, choose whether you want to see monthly or annual amortization then click “View Report” at the top of the page. You’ll then see a page showing how much you’ll shorten your loan by, the graph illustrating your amortization, a summary of the loan and a line-by-line table showing the amortization of the loan over time and comparing regular vs. accelerated payments.

- FAQ: Great tool to make positive decisions on budget planning and goals

If you’re looking to trade in your car at some point in the future, the amortization schedule is useful in that it lets you know exactly how much you’ll still owe on the loan at any point in time. You can then use this information, combined with the vehicle’s depreciation, to estimate what your trade-in value would be.

How Do I Figure Out My Car Loan Payoff Amount

To know how long it will take you to pay off your car loan, you’ll need the following information:

- Remaining principal: How much of the original loan cost is leftnot the total with interest.

- Interest payments: A sum of the interest you pay each month throughout the loan.

- Lender fees: Any added costs placed on the loan by the lender.

- Prepayment penalties: Fees associated with paying off a loan before a lenders designated time period. If youre thinking of paying the loan off earlier than planned, prepayment penalties might be in place.

Also Check: Used Car Loan Usaa

What Are The Options To Pay Off My Car Loan Early

There are a variety of options to pay off your car loan early, which can include:

- Making multiple payments per month

- Making one large extra payment per year

- Making one large payment over the course of the loan

Each persons debt-payment strategy should be tailored to their situation. Theres no one-size-fits-all solution. To learn more about your options, refer to the section above entitled How early can I pay off my auto loan? Or, you can use a car loan payoff calculator.

How Do Car Loans Work

Before learning how to pay them off early, we first need to understand how car loans work. To explain it simply, suppose you wish to buy a car worth $20,000 and give $5000 for the down payment on the car. The remaining balance of $15,000 can be financed through an auto loan. You will have to pay interest on the $15,000 over the term of the loan and make monthly payments which usually comprise of the interest amount as well as a portion of the principal amount. To get a lower car payment and low-interest rates you must have a good credit history. The higher your credit score, the lower your interest rates will be, although you can buy a car with bad credit too.

While many borrowers consider paying off the loan early, many lenders charge a penalty for early payment. Its important that you ask your lender about early repayment beforehand so you dont end up making an extra payment on your loan.

| Did You Know: A survey found that by 2017, over 100 million Americans had car loans. This number increases every year because its now possible to finance a car even with bad credit. |

Read Also: Refinance Usaa Car Loan