When To Prioritize Paying Down Your Student Loan

Other than when the interest rate is higher than the rate of return you can reasonably expect to make investing the money, it may make sense to pay down your loan when:

- You get a bonus, a raise in pay, or a tax refund

- You want to ease the stress of having student debt

- You have no other more important financial priorities

If You’re On An Income

Because you have lower than normal payments, more, or all, of the payment will be used to pay accrued interest.

You can make recurring student loan payments through Auto Pay, or make a one-time payment using Pay Online. Both options are easily available after you log in to your account. Other ways to pay include our mobile app, .

Who Are Loans Best Suited For

Loans are best suited for those who have expenses they cannot afford to cover on their own immediately. Some reasons for taking out a loan are a necessity, such as credit card debt, costly medical bills, funds for college or to cover rent.

Others may take out a loan for more personal reasons, such as to cover wedding costs or remodel their home. In either case, loans can be beneficial to ones current needs or personal finance goals if they are managed properly.

Remember that you should only take out a loan if you have a guaranteed payoff plan, only borrowing what you know you can pay back without much difficulty.

You May Like: How Much Land Can You Buy With A Va Loan

Education Loan Repayment Tips

-

Planning crucial for Education loan repayment

Make a 4-5 years plan for the education loan repayment. Consider each EMI paid as an unloading exercise, the more you pay the lesser burden you bear. Create targets for your savings so that you can meet the payments schedule for study loan. Foreign education aspirants generally plan their finances 1-3 years before their study abroad exam applications.

-

Pay a bit extra money with every installment

Put in a bit extra money along with every installment towards student loan repayment. Doing this regularly will help you save on interest through the entire period of your student loan. You could save considerably on interest in the long run if you adopt this practice. education loan repayment is all about how soon you set of the principal amount.

-

Get a part-time job while studying

While pursuing an education at the university or college, it is wise to find a part-time job as per your schedule. Saving some amount from the part-time job will help in a great way to ease up the whole process of loan repayment. This tactic especially applies to students studying abroad or pursuing post-graduation in India.

-

Better to automate your payments

-

Wise to pay variable rate loans first

Read more about education loan types and special categories for course-based and institution-based loans.

-

Take help from the employer

-

Better to buy an insurance: Insurance set-off education loan repayment

Bank Of Baroda Education Loans

Bank of Baroda offers you education loans at attractive interest rates. You can choose from a range of tenures up to 15 years for easy and comfortable repayment. We offer you options of secured and unsecured education loans. Bank of Baroda makes borrowing easy. We understand that you have a lot to deal with when it comes to preparing for entrance exams and admissions and we want to simplify the process of funding for you.

You can make use of our student loan EMI calculator tool to understand the EMIs you can expect to pay each month. If you need any specific help in planning or understanding your education loan, our staff will be more than happy to assist you. Choose a Bank of Baroda education loan today and let your dreams soar to the skies. Get in touch to know more.

All the best!

You May Like: Usaa Auto Refinance Phone Number

Federal Student Loan Repayment Options

There are multiple repayment plans you may be eligible for if you have federal student loans. Here’s how they compare.

One quick note: So far, the Public Service Loan Forgiveness program rejected the majority of applicants , so be forewarned that choosing a repayment plan that is a good option for the program doesn’t guarantee that your loans will be forgiven.

Is It Better To Pay Off A Student Loan Or Save And Invest

It depends on your situation. Generally, if the interest rate on your student loan is greater than the rate of return you can reasonably expect from investing, then paying off the loan as quickly as you can, will save you money.

If you can make a better rate of return on your investment than the interest rate youre paying on your student loan, then based on your situation it may make sense to pay the minimum amount on your student loans and invest the rest.

Based on your situation, it may also make sense to do both invest in your future, and pay down your debt. Its a good idea to get the advice of a financial advisor.

Investing involves risk and possible loss of principal capital. Past performance is no guarantee of future returns.

You May Like: Usaa Mortgage Credit Score

What Are The Chances That My Student Loan Debt Will Be Forgiven Completely

Not great, unless you owe $10,000 or less in federal loans. Biden campaigned on forgiving $10,000 of student loan debt, and recent reports indicate that student loan forgiveness would include an income cap.

According to Federal Student Aid Data, borrowers have an average of $37,014 in student loan debt, and 2.1 million borrowers owe more than $100,000 as of the first quarter of 2022.

Get the CNET Personal Finance newsletter

Shop Around And Compare Student Lenders

Unlike federal student loan rates, which are the same for all borrowers, rates can vary widely from one private lender to another.

Since your goal of refinancing is to save as much money as possible, youâll want to shop around to find the lender that offers you the best loan terms. You can visit Credible to compare rates from multiple lenders at once to see which offers you the most competitive rate.

STUDENT LOAN REFINANCING RATES ARE DECLINING â HEREâS WHY

Recommended Reading: Usaa Car Buying Rates

You Can Take Out Educational Loans For A Variety Of Courses Including Specialized Courses

It is important to remember that educational loans can be taken out for a variety of reasons, depending on the bank and lending institution you approach. While mostly all banks offer educational loans for undergraduate, postgraduate degrees and diplomas as well as for PhDs and Doctoral programs, some banks also offer educational loans for specialized courses. These could include, IT courses, nursing or teaching certificates, degrees or diplomas for aeronautics, pilot training, job-oriented diploma or certificate courses, amongst several others.

Will The Freeze On Student Loan Payments Be Extended Again

The deadline for ending the moratorium on federal student loan payments has been extended six times so far. The CARES act in March 2020 established the original forbearance in March 2020. President Donald Trump and the Department of Education extended the deadline twice.

Biden has pushed the end of the payment freeze back fourtimes since taking office. Many Democrats want the president to postpone the deadline until at least the end of 2022, but further extensions may depend on any plans from the White House to offer some form of widespread student loan forgiveness before September.

Don’t Miss: Used Car Loan Rates Usaa

Private Student Loan Interest Rates

Private student loans are funded by banks, credit unions and online lenders, so interest rates vary from lender to lender. Many private student loan lenders offer both fixed and variable rates, so your interest rate could fluctuate over the life of the loan if you choose a variable-rate option.

Most student loan lenders set rates based on the Libor or the prime rate. However, while rates are tied to this benchmark, private lenders also typically evaluate your credit score, income and financial history to determine your interest rate. Generally, the better your financial health and credit score, the lower your interest rates will be. In order to access this information, many lenders will run a hard credit inquiry, which can knock your credit score down a few points although you can usually get a preview of your rates and terms with only a soft credit check.

Make Extra Payments Towards Your Loan

Did you receive a bonus at work? Or perhaps, you got some money as a gift from family. If you receive some extra cash, you might want to consider making larger payments towards your student loan. This is a great way to ease the burden of repayment overall. In fact, making larger payments towards your student loan can even help you close your loan early. This is one of the best tips that will help you manage education loans successfully. However, do be sure to check whether your lender charges you any pre-payment penalty. You can ask your lender whether they have any penalties or find out from the fine print before you go ahead with your loan application process.

Don’t Miss: Mortgage Loan Originator License California

Payments Made Within 120 Days

You make a payment within 120 days of your disbursement on your Direct, Grad PLUS, or Parent PLUS loan.

Auto Pay or Pay Online

When you make the payment on mygreatlakes.org you’re given the option to:

- Apply it as a refund.Refund payments reduce what you originally borrowed. Any interest charged on the amount you pay will be reduced, and a portion of the disbursement fees may also be reduced.

– OR –

- If you want it applied to a different loan or loans within the account, please define your Excess Payment Preference.*

U.S. Mail or Bill Payment Service

It will automatically be applied as a refund to your unpaid balance unless you contact us in writing to ask that it be applied as a paymentfirst to accrued interest, then to principal.**

You make a payment within 120 days of your disbursement on your federal consolidation loan.

Auto Pay, Pay Online, U.S. Mail, or Bill Payment Service

Your payment will be applied in this order:

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan.

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Don’t Miss: Refinance Auto Usaa

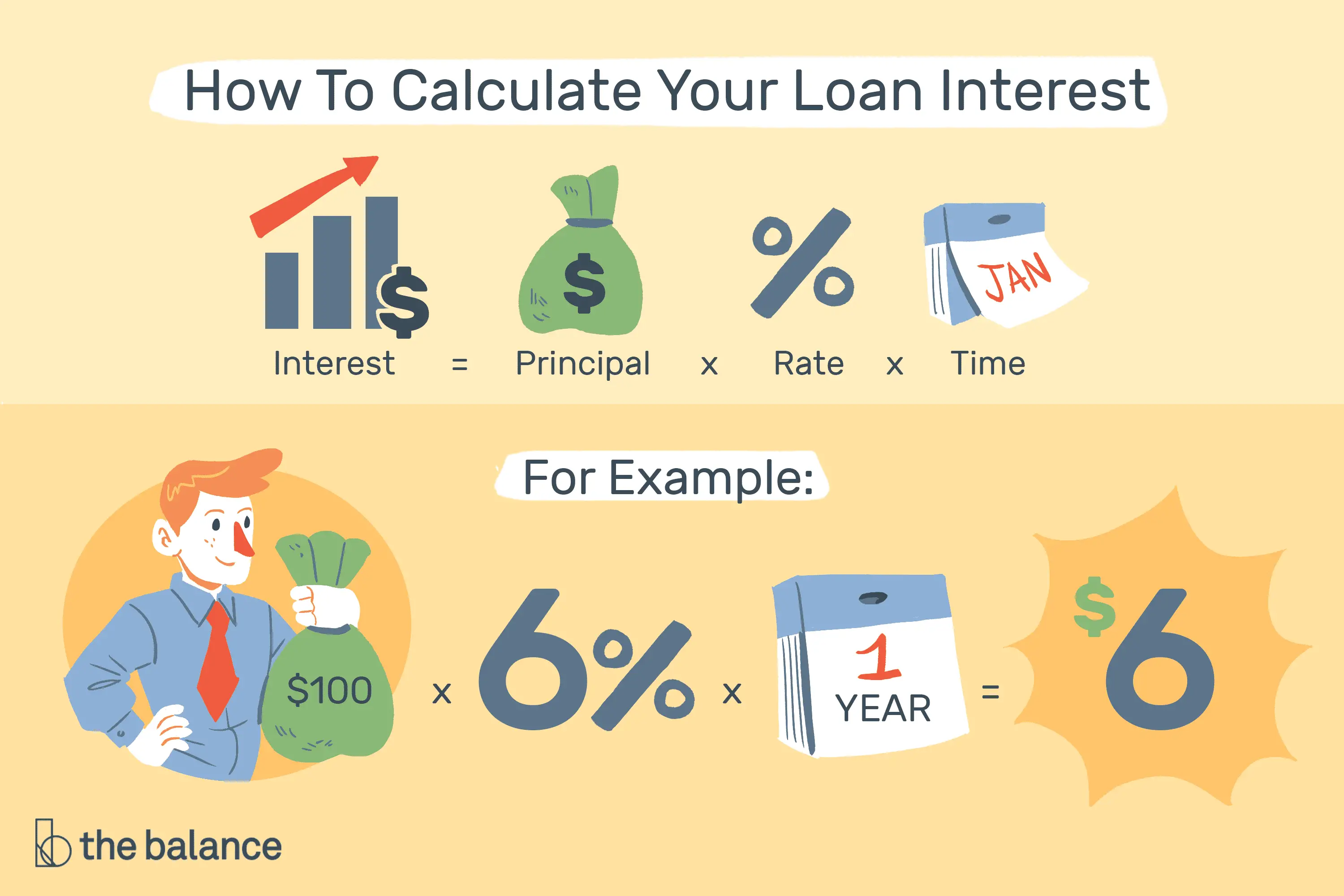

Student Loan Interest Accrues On The Principal Differently Depending On Your Loan

Ultimately, any payment plan you use on your loan should pay off the principal. The principal of your loan is the amount of money you borrowed to pay for your education. For example, if you borrow $10,000 for a year of school, the principal on your loan will be $10,000. Depending on the type of loan you take out, you may have a fixed interest rate, which is set at the time you accept the loan and never changes, or a variable interest rate, which is based on stock market fluctuations. There are four basic types of loans you can accept as a college student.

Most student loans require interest payments on top of paying the principal, although they typically do not expect you to pay down the principal of the loan while you are in school. If youre wondering whether it is better to pay off the interest or the principal on student loans while you are still in college, you should focus on making interest payments as often as possible. Most students need loans to help them pay for tuition, associated fees, and living expenses while they are in school. Even if they can get a job, this work is likely to be part-time, so they can remain at least a half-time student. If you are able to pay down the interest on your loans while you are in school, you will end up paying less on your loan over time. This helps you pay off the interest faster after you graduate.

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

You don’t need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

Don’t Miss: Refinance Options For Fha Loans

How Can I Decide If I Should Keep Making Loan Payments

Whether or not continuing to make loan payments is the right decision for you will depend on your personal financial situation and whether or not you’re working towards loan forgiveness. The big question you need to answer: “How much can I afford to put towards my student loans each month?”

You shouldn’t pay more than you can afford each month. Going into another form of debt to pay off your student loans doesn’t make much sense.

The Federal Student Aid Loan Simulator can help you determine exactly how much you should pay each month based on your goals, loan amount and other info. Once you log in to the Federal Student Aid site, the simulator will have all of your student loan details preloaded.

Managing Your Debt Repayment Assistance Plan

As a borrower, you are required to repay your loan. Missing payments could damage your credit rating. Your student loan could go into default. Contact the National Student Loans Service Centre at 1-888-815-4514 before you miss a payment. There are options available to help you manage your payments and avoid defaulting.

The Repayment Assistance Plan makes it easier to manage your debt. You pay back what you can reasonably afford, based on your family income and size. Monthly payments are limited to no more than 20 per cent of your gross family income. No borrower on RAP will have a repayment period lasting more than 15 years. If you have a permanent disability, your RAP repayment period will not last longer than 10 years. If you earn very little income, you might not be required to make loan payments until your income increases. Contact the National Student Loans Service Centre to apply.

Also Check: Rv Loan Calculator Usaa

Paying Down The Principal On Your Student Loans Is Crucial

No matter which payment plan you choose for your student loans, you must start paying the principal down so you can repay the whole loan making minimum payments on accrued interest will not get rid of your student loan debt.

While you can work with your loan servicer to ease your financial burden by temporarily making only monthly interest payments, you will benefit more in the long term by finding ways to pay down the principal faster.

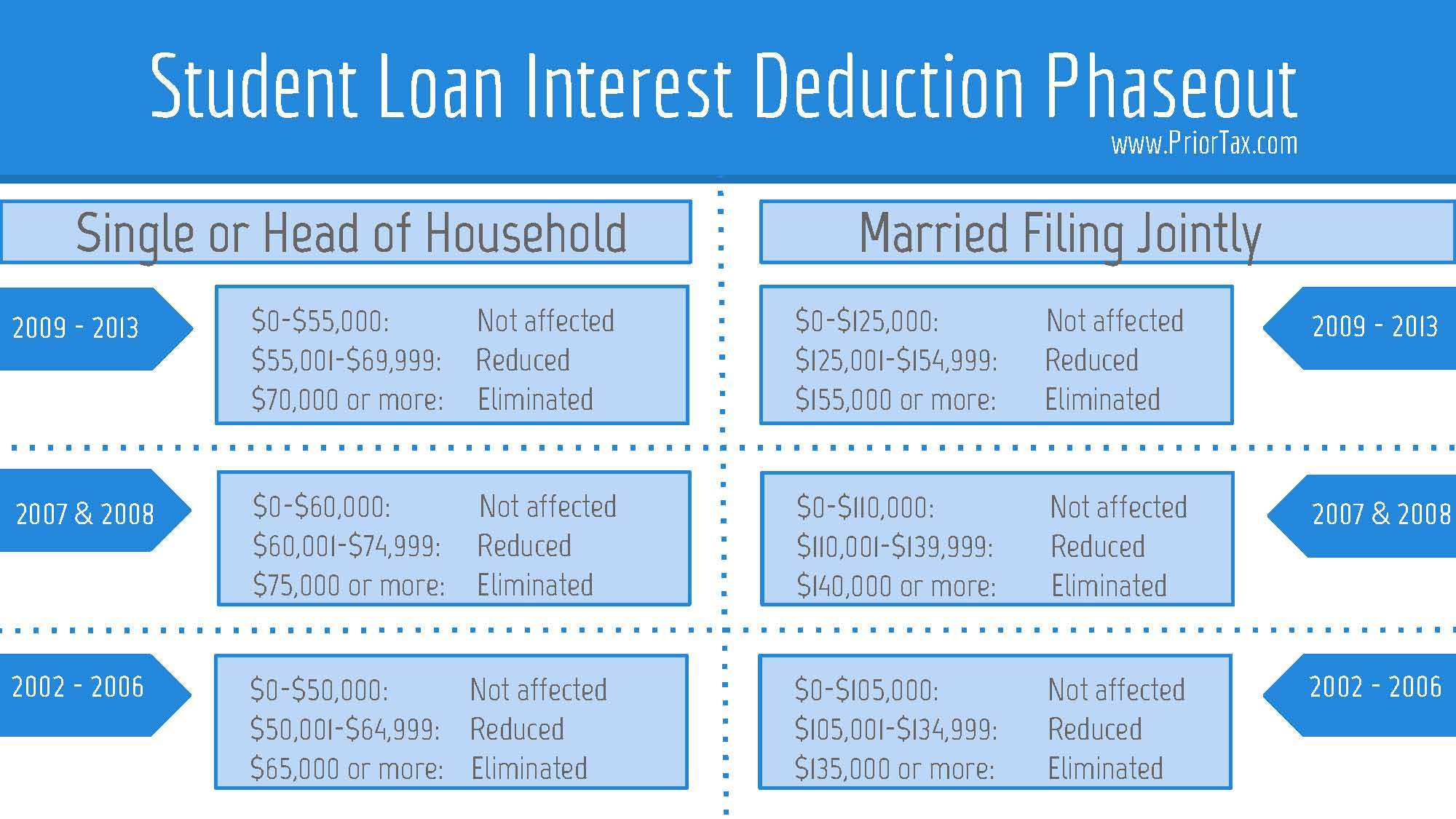

Be sure to claim any student loan interest over $600 on your taxes so you can ease your tax burden. This will help you stay financially solvent so you can continue to pay down the principal on your loan.

Insurance On A Student Line Of Credit

Your lender may offer you optional credit protection insurance on your student line of credit. This is a type of credit and loan insurance.

You dont have to take loan insurance to be approved for a student line of credit. This type of insurance may help cover your loan payments if you cant make them due to serious illness, accident, death or if you lose your job.

Not all illnesses, accidents, deaths or periods of unemployment will be covered by loan insurance on a student line of credit. For example, to be eligible for a job loss benefit, there is typically a requirement that you have been employed with the same employer for a certain amount of months and are eligible for employment insurance. As a student, you may not need job loss insurance coverage on your student line of credit.

Federally regulated lenders, such as banks, cant add optional loan insurance without your permission. If optional loan insurance has been added to your student loan without your permission, contact FCAC to file a complaint. You should ask your lender to remove the optional services and reverse the changes.

Also Check: Auto Calculator Usaa

Additional Factors To Consider When Calculating Student Loan Interest

- Fixed vs. variable rates. Unlike federal student loans, which offer only fixed interest rates, some private lenders offer fixed or variable student loan interest rates. A fixed rate wont change during your loan term, but variable rates can decrease or increase based on market conditions.

- Term length. How short or long your student loan term is dramatically changes how much total interest youll pay. In addition to calculating your total interest paid, the student loan calculator above shows you how much of your monthly payment goes toward interest to see this view, click on show amortization schedule.

- Private student loans require a credit check. The stronger your credit, the more likely youll be offered competitive, low interest rates. Borrowers shopping for bad credit student loans might be approved at a higher interest rate, which means more money spent on interest charges overall.