The Government Cancelled The Perkins Loan Program

The federal government canceled the program because of budgetary issues. The purpose of the Perkins loan program was to provide an outstanding financial need for students. Even though the Perkins loans program was available for about one percent of all students who borrowed, it helped thousands of students to get out of debt.

Now, according to the National Association of Student Financial Administrators, 528,000 benefited from the program in the 2014-15 academic year. The average amount was $2,198.

In 2015, the purpose of the Federal Perkins Loan Program Extension Act was to eliminate the Perkins loan in two years. The idea was that Congress would overhaul the whole student loan system before they ended it. But somehow, they allowed the Perkins Loan program to expire in 2017. Currently, lawmakers are working to make a replacement.

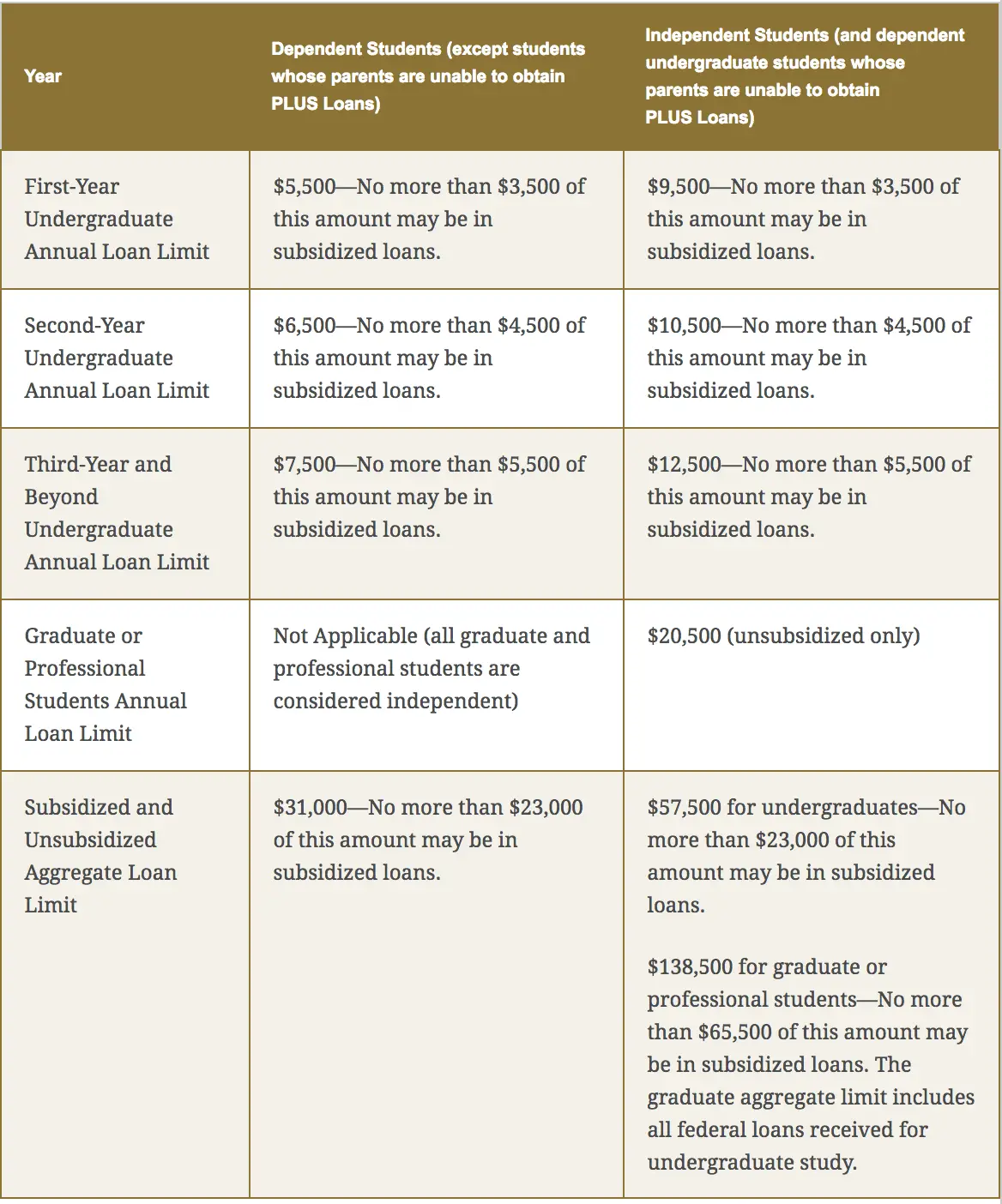

How Much Can I Borrow

You can borrow up to:

- $5,500 for each year of undergraduate study. The total amount allowed for undergraduates is $27,500.

- $8,500 for each year of graduate/professional studies. The total amount allowed for graduate/professional students is $60,000, including Federal Perkins Loans you borrowed as an undergraduate.

Everything You Need To Know About The Perkins Loan

Jimmy KarnezisUpdated February 21, 2020

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

The federal government used to offer the Perkins Loan to students with exceptional financial need. The loan guaranteed low-interest rates for both undergraduate and graduate students.

Although Perkins loans accounted for only about 1 percent of student borrowing, they were an important source of funding for thousands of students. An analysis by the National Association of Student Financial Aid Administrators, estimated that 528,000 students took out Perkins loans in the 2014-15 academic year, with an average award of $2,198.

The Federal Perkins Loan Program Extension Act of 2015 was intended to phase Perkins loans out over two years, with the expectation that the entire student loan system would be overhauled by Congress before it ended. But the Perkins loan program was allowed to expire in 2017, and lawmakers are still working on a replacement.

Don’t Miss: How To Get Loan Without Proof Of Income

How Much Can I Qualify For

You can have up to 100% of your Perkins Loans forgiven, depending on your profession and how long you work.

Teacher forgiveness amounts

You might qualify to have 100% of your Perkins Loans canceled if you teach full time at either a public or nonprofit elementary or secondary school for five consecutive years. However, your debt is canceled bit by bit at higher percentages over five academic years:

- First and second years. The government cancels 15% of your debt each year.

- Third and fourth years. The government cancels 20% of your debt each year.

- Fifth year. The government cancels 30% of your debt the final year.

Other employment or volunteer forgiveness amounts

You could cancel all or part of your Federal Perkins Loan debt if you work in specific professions.

| Position | |

|---|---|

|

4 years of eligible volunteer work |

Perkins Loan Cancellation For Teachers

If you were a full-time teacher in a public or nonprofit elementary or secondary school system working as a:

- Teacher in a school serving low-income families

- Special education teacher for infants, toddlers, children or youth with disabilities

- Teacher in math, science, foreign languages, bilingual education or other fields of expertise determined to be in a shortage for qualified teachers in that state

You may be eligible for Perkins Loan Cancellation. Your eligibility is based on what duties were described in the job description rather than in the job title. You must be directly employed by the school system and theres no provision for canceling Federal Perkins Loans for teaching in postsecondary schools.

Perkins Loan Deferment

While teaching in a school that qualifies you for cancellation, you also qualify for a deferment. Contact your Perkins Loan servicer directly to find out how you can apply for deferment.

Get Help With Your Student Loan Debt Today!

Read Also: How Do I Get My Student Loan Number

Other Factors To Consider

Most students end up needing to finance some portion of their education. Always maximize your use of funds you do not have to repay such as federal financial aid, institutional grants, scholarships, 529 plans, tuition remission, prepaid tuition plans, etc. Even if you or your family have very high income, you can still receive low cost federal student loan including an Unsubsidized Direct Student Loan and the Direct PLUS Loan for Parents. Graduate students can receive both the Unsubsidized Student Loan and Direct PLUS Loan for Graduate and Professional Students. To see all the ways you can use to pay for college, review our Financial Aid Flowchart

Of course, if you still need funding to pay for college beyond what you receive in free money and federal student loans, you can always pursue a private student loan.

Find Student Loans

Perkins Assignment And Liquidation Guide

The Federal Perkins Loan Assignment and Liquidation Guide is available on the Campus-Based Processing Information Page in the Knowledge Center. See the EA of May 3, 2019 on the Updated Federal Perkins Loan Assignment and Liquidation Guide for more detail.

The Assignment and Liquidation Guide includes information about the assignment process and information about the required processes for the liquidation of a schools Federal Perkins Loan portfolio and Perkins Loan Revolving Fund . The following two processes can assist a school with the assignment and liquidation of its loans:

Perkins Loan Assignment System allows schools to submit Perkins Loan assignments electronically. The system is found at efpls.ed.gov. There is a chart that summarizes supporting documentation that schools must provide when assigning Perkins Loan to the Department in Chapter 5.

The determination of the Federal and Institutional shares of the remaining cash in the Fund is now calculated as part of the Perkins Liquidation Module. Schools are given the opportunity to update the cash on hand amount prior to the calculation. The calculation may include a liability for any amount of loans a school must purchase.

The Campus-Based section of the COD System will post the Federal share amount owed to a schools selfservice page in the eCampus-Based section of the COD System with instructions for remitting payment to the Department.

You May Like: Typical Origination Fee

What Is A Federal Perkins Loan How Do You Get One

There are a lot of great federal aid options out there, for every type of student. The Perkins loan may just be one of many types of federal loans, but it comes with a lot of perks that make it worth an in-depth look. I’ll go through all the information you need about this loan program, before telling you how to get your own Perkins loan.

Federal Perkins Loan Program Updated Guidance On Mandatory Assignment Of Federal Perkins Loans In Default For More Than Two Years

Section 463 of the Higher Education Act of 1965, as amended, states that if an institution knowingly failed to maintain an acceptable collection record for a defaulted Federal Perkins Loan , the Secretary may require the institution to assign the loan to the Department of Education without recompense.

As part of the wind down of the Perkins Loan Program, the Secretary requires all institutions to assign to the Department all Perkins Loans that have been in default for more than two years. Unless the institution has documentation that these borrowers are making payments toward their Perkins loan debt, you are required to assign all Perkins Loans that have been in default for more than two years to the Department.

Institutions will have through June 30, 2022 to either assign or purchase loans that have been in default for more than two years. If an institution determines that borrowers who have defaulted Perkins Loans are making payments, the institution may notify the Department that documentation showing an acceptable collection record is available upon request. If the documentation is requested and reviewed by the Department, the institution will be notified whether these loans are required to be assigned, purchased, or if the institution may continue collecting on these loans.

Don’t Miss: Rv Loan Calculator Usaa

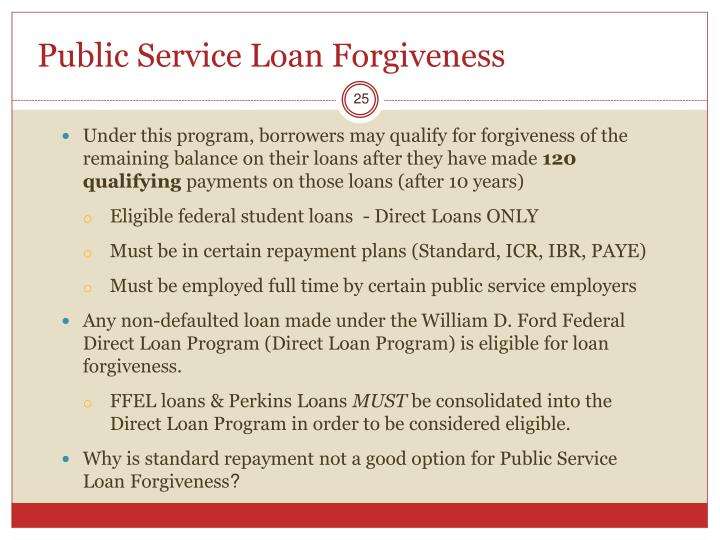

Information On Consolidating Perkins Loans

Consolidation offers a Perkins borrower options the borrower does not have under the Perkins regulations alone. During exit counseling, a school must also include information on the consequences of consolidating a Perkins Loan, including:

-

the effects of the consolidation on total interest to be paid, fees, and length of repayment

-

the effect on a borrowers underlying loan benefits, which includes grace periods, loan forgiveness, cancellation, and deferment and

-

the option the borrower has to prepay the loan or to select a different repayment plan.

What Happens If Youre Approved For Perkins Loan Cancellation

Your loans are usually forgiven in increasing percentages each year that you work in public service. This means that youll receive 15% during the first two years that you work and then 20% in the third and fourth years. By the fifth year, the remaining balance is canceled. This includes all accrued loan interest during your years of service.

You May Like: Usaa Auto Loans Review

Exactly What Federal Perkins Debts Had Been

Perkins loan resources relied in your economic need therefore the option of resources at the college or university. Are considered for a Perkins Loan, you must have confirmed a fantastic monetary want on your Free program for Federal pupil Aid . This form must figure out the qualifications for any other financial aid software besides and that can getting renewed every year. Together with the FAFSA, youngsters had to fill out a Perkins promissory note to qualify for that loan. ? ?? ? ?

The program was actually at first set-to expire in 2014, nonetheless it is approved two different extensions. It had been sooner or later apply hold in 2017 when Congress couldnt acknowledge new laws to extend funding when it comes down to program. No particular plan enjoys replaced the Perkins loan system subsequently, although university value operate, in mind in Congress in 2020, proposes new financial support for Perkins loans. ? ?? ? ?

How To Repay A Perkins Loan

Because the loan program was only discontinued in 2017, there are still outstanding Perkins loans. These loans make up the $1 trillion student loan debt held by over 43 million borrowers.

Perkins loans must be repaid in a 10-year period but there many ways to pay them off. First, if you hold a Perkins loan, reach out to your school’s loan servicer or your university’s financial aid office to learn how to repay the loan. If you are employed in a public-service-related job, such as a public school teacher or a nurse, you may be eligible to have your loans canceled after specific years of service.

Another option is loan consolidation. If you consolidate all of your student loans, including your Perkins loan, then you will have more repayment options based on your income.

On their own, however, Perkins loans do not qualify for the same repayment options as those who hold direct loans. If you want to pay off your Perkins loans, you must contact your school directly.

Don’t Miss: Usaa Credit Score For Auto Loan

Full Perkins Loan Forgiveness In 5 Steps

Unlike several other federal student loan options, a Perkins Loan is not operated by the U.S. Department of Education. Your loan services or school needs to complete a specific application, which is why not every applicant will have a streamlined loan cancellation process.

Follow the steps below to make sure you have a smooth Perkins Loan cancellation.

Prepare And File Annual Cancellation Requests

As mentioned, you will need to complete the loan forgiveness application form every year, for the four to seven-year cancellation term.

Some loan servicers require that you submit an Anticipation of Cancellation form at the beginning of the year, and a Request for Cancellation at the end of the total loan cancellation period.

This option is available on the vast majority of loan servicer forms.

Make sure you double-check all of your personal and loan details when youre completing the paperwork. Reach out to your school or loan servicer and maintain communication with them throughout the loan forgiveness period.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Am I Eligible For A Federal Perkins Student Loan

Eligibility for a Federal Perkins Loan is somewhat complex, and may vary on a case-by-case basis. Factors that influence your eligibility include:

- Your enrollment in an undergraduate, graduate, or professional school

- Your ability to demonstrate exceptional financial need

- Your enrollment at a school that participates in the Federal Perkins Loan Program

- Other potential criteria

Financial need is determined using the information from your FAFSA. Its based on the difference between the cost of attendance at that school and your expected family contribution. The exceptionality of your need could be impacted by how expensive your school is, your familys income, and how your level of need aligns with other potentially eligible students at your school.

How Much Money Can You Get

The loan amount depends on the availability of funds at your school, your financial need and the amount of other aid you receive.

- Undergraduate students may borrow up to $5,500 per year and $27,500 in total.

Recommended Reading: Usaa Refinance Auto

Applying For A Perkins Loan

To apply for a Perkins loan, complete a Free Application for Federal Student Aid . By completing this application, youll also find out if youre eligible for other types of federal financial aid such as Stafford loans.

If youre not eligible for these loans or if they dont cover all of your educational costs, you can also apply for PLUS loans or private education loans.

2 Minute Read

Retaining The Electronic Mpn

If the student completed an eMPN, your school must maintain the original electronic promissory note, plus a certification and other supporting information regarding the creation and maintenance of any electronically-signed Perkins Loan promissory note or eMPN. Your school must provide this certification to the Department, upon request, should it be needed to enforce an assigned loan. Schools and lenders are required to maintain the electronic promissory note and supporting documentation for at least three years after all loan obligations evidenced by the note are satisfied.

When using an e-signed MPN, a school must not only meet the Departments Standards for Electronic Signatures in Electronic Stu- dent Loan Transactions as specified in DCL GEN-01-06, but also adhere to the regulatory requirements for retaining information on loans that are e-signed under 34 CFR 674.50. For additional information, please see Assignment under e-Sign or Perkins MPN section in Chapter 5 of this volume.

Read Also: Usaa Minimum Credit Score For Mortgage

Is It Ever Possible To Postpone Repayment Of My Federal Perkins Loan

Yes, under certain conditions, you can receive a “deferment” or “forbearance” on your loan, as long as the loan isnt in . During a deferment, youre allowed to temporarily postpone payments, and no interest accrues . Look under “Perkins Loans” on the Loan Deferment Summary Chart for the list of deferments available. Also, the school that made you your loan must automatically defer your Federal Perkins Loan during any periods where you perform a service that qualifies you for loan cancellation.

Other Perkins Loan Forgiveness Opportunities Available

If youre not a teacher, there are still opportunities for you to qualify for the Perkins loan program. You can be eligible if youre a full-time:

- A medical technician or a nurse

- Peace Corps or Vista volunteer

- Active duty military member in the armed forces in a hostile fire

- Member in child-care program or pre-kindergarten, licensed by the state

- Firefighter for a state, local or federal fire department

- Speech pathologist with a certified masters degree who works in elementary or secondary school

- Librarian or serving in a public library of Title I schools

- An attorney who is working in a community or public defender organization

- An employee at a non-profit or federal family service agency, serving low-income families

You May Like: Loan Originator License California

The Federal Perkins Loan Program

The Federal Perkins Loan Program included Federal Perkins Loans, National Direct Student Loans , and National Defense Student Loans . No new Defense Loans were made after July 1, 1972, but a few are still in repayment. No Perkins disbursements of any type were permitted under any circumstances after June 30, 2018. If you awarded a Perkins Loan after September 30, 2017, or made a disbursement after June 30, 2018, the award or disbursement was made in error and must be corrected. In this case, the school must:

-

notify the borrower

-

reimburse the Perkins Loan Revolving Fund for the amount of the loan

-

update NSLDS accordingly and

-

correct the FISAP.

See the Perkins Loans Awarded or Disbursed after the Expiration of the Perkins Loan Program EA of December 20, 2018 for more in- formation on Perkins Loans awarded or disbursed after the expiration of the authority to award new Perkins Loans. For more information on processing Perkins portfolios, go to: .

What’s The Repayment Process

You begin repaying the loan nine months after you graduate or leave school. If you return to school, you have six months before you start repaying on previous loans. You may be allowed up to 10 years to repay your loan.

The amount of the monthly payment depends on the size of the debt and the length of the repayment period.

Part or all of the loan can be deferred or canceled under certain conditions, such as:

- If you teach children with disabilities.

- If you teach full-time in a designated elementary or secondary school that serves low income students.

You must seek approval for these provisions from your school.

Also Check: Becu Auto Smart