Considering Student Loan Refinancing

If youre looking for another way to tackle your Parent PLUS loan, consider refinancing your parent plus loans with a private lender. This involves taking out a new loan and using it to repay your old one.

The benefit of student loan refinancing is that you may qualify for a lower interest rate or a lower monthly payment, especially if you have a solid credit and employment history. However, when you refinance federal loans with a private lender, you will lose eligibility for any federal repayment plans or loan forgiveness programs.

You can get a preliminary quote online in just a few minutes to see whether refinancing makes sense for you.

Is A Parent Plus Loan A Good Option

Absolutely not! Hopefully youve seen for yourself that debt doesnt pay. Instead, you and your child should be pouring all your effort into finding ways to cash flow college with scholarships, grants and your own savings. Want an amazing resource from an expert on making college affordable? Of course you do. Its called Debt-Free Degreeand its packed with tips and solutions to all of your questions about covering college without loans.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Whom Are Parent Plus Loans Best For

Youre probably suited for one if youre a parent who:

- Has a student whos borrowed up to the maximum undergrad loan limits and is able and willing to help

- Wants to be responsible for this student debt rather than having it burden their child

- Has compared parent PLUS loans with private student loans, and has found that the federal option offers lower interest rates and total costs

- Cant qualify for private student loans

- Wants access to federal student loan benefits, such as deferment and forbearance, federal repayment plans, or even forgiveness.

Recommended Reading: Usaa Car Loan Credit Score

Your Credit Check & Your Master Promissory Note

Parent PLUS Loan eligibility is contingent upon approved credit. The result of your credit check will determine your next steps.

If your credit is approved:

- Your Federal Student Aid PIN is required.

If your credit is denied:

- Direct Loans will send you information on how to repair your credit or obtain an endorser.

- If your credit is repaired or you obtain and endorser, you can complete an electronic Master Promissory Note

- Your Federal Student Aid PIN is required.

If your credit is denied and you are not able to obtain an endorser or repair your credit:

Enrolling In An Income

Although Parent PLUS loans are not initially eligible for an income-driven repayment plan, federal direct consolidation can fix that issue.

When a borrower consolidates a Parent PLUS loan through the Department of Education, it becomes a Federal Direct Loan. All borrowers are eligible for federal direct consolidation regardless of loan status, credit score, or income. The Department of Education estimates that completing the application for consolidation takes less than 30 minutes.

A Word of Caution: There is a risk to taking the federal consolidation approach.One of the most common mistakes is to consolidate Parent PLUS loans with other federal student loans. If a borrower combines a Parent PLUS loan with other federal direct loans, the resulting consolidated loan has limited repayment and forgiveness options.Due to the possibility of making an ill-advised consolidation, borrowers should carefully consider the implications of consolidating before starting the process.

Once federal consolidation is complete, borrowers can enroll in the Income-Contingent Repayment plan.

Read Also: Transfer Auto Loan To Another Bank

Tap Into Your Home Equity

If you have a mortgage, some lenders will let you use your existing home equity to pay off student loans. This is called a student loan cash out refinance.

Increasing your mortgage can put your home at risk if you can’t afford your new payments. That’s why you should typically avoid this option especially if you can’t pay parent PLUS loans are due to larger financial issues.

But this option may make sense if you’re otherwise in good financial shape and simply want to save money on high-interest parent loans.

The Woes Of The Federal Parent Plus Loan

A Federal Parent PLUS Loan can be an enormous burden. Technically, my parents were responsible for the repayment of the loans after all, they were the borrowers.

But I didnt think it made the slightest bit sense for me to have a full-time and them be repaying my loans. Truthfully, I dont know how that situation is typically handled. But I didnt have to be voluntold to repay them nope, I volunteered of my own accord.

If you recall the summary of Federal Parent PLUS Loan from the beginning of this post, a 7.6% interest rate is cited. I want to say my Parent PLUS Loan interest rate was 7.8%. I didnt write it down, but either way, that is quite frankly ridiculous.

Not only that but the minimum payments for a Federal Parent PLUS Loan is based on the parents income, not that of the student. In my case, the minimum payment was $975 if I recall correctly. Again, crazy!

I ended up refinancing my student loans, which helped. But there is also another option for repayment, and that is what I want to call out here.

Read Also: Refinance Usaa Car Loan

How To Refinance A Parent Plus Loan

The first thing you will need to do if you want to refinance is locate all of your relevant loan information. To locate your loan servicer, log in to your student aid account with your FSA ID. There you will be able to view all of your government student loans, including Parent PLUS Loans and any federal student loans you may have for yourself.

Note: If you have your own federal student loans as well as Parent PLUS Loans, you may choose to refinance these federal loans together into one new loan.

Note: If you have private parent student loans as well as Parent PLUS Loans, you may choose to refinance those loans together into one new loan.

Once youve gathered the contact information and balances for your existing loans you will want to compare lenders to find the right fit for you. Compare features such as:

Once youve chosen a lender its time to apply as a loan borrower. Most lenders offer an easy online application to get you started. If you are transferring a Parent PLUS Loan to your child, your child will need to apply for the refinance loan.

Parent Plus Loan Repayment Options

You cant put off payments forever. Depending on the plan you choose, you will have between 10 and 25 years to pay off the loan in full. But Parent PLUS loan repayment doesnt have to be daunting here are a few of the Parent PLUS Loan repayment options you have:

Standard Repayment Plan: One of the most straightforward options is the Standard Repayment Plan . In this scenario, you will pay the same fixed amount each month and pay the loan in full within a decade. The benefit is that you always know how much you owe and youll accrue less interest than with most other plans, since youll be repaying the loan in a faster time frame.

The difficulty is that this results in monthly payments that are too high for some people. Its a good option if you can afford the payments and you dont expect your situation to change in the next ten years.

Graduated Repayment Plan: Another option is the Graduated Repayment Plan . You will also pay off your loan within a decade, but the payments will start out smaller and then increase, usually every two years. Youll pay more overall than under the previous plan because youll accrue more interest, but less than if you were to sign on for a longer repayment term. This plan is a good option if you expect to earn more in the relatively near future.

Also Check: How To Get Loan Officer License In California

Double Consolidation: The Most Powerful Parent Plus Loophole

Parents living mostly off Social Security income in retirement would likely have an extremely low AGI. Thats why paying 20% of your AGI minus 100% of the federal poverty line with the income-contingent repayment plan can make sense.

However, what if there was a way to pay 10% of your income instead of 20%? Middle and upper middle income parents who were formerly not good candidates for forgiveness could suddenly have a huge amount of debt forgiven.

Weve written an entire article on the Parent PLUS double consolidation loophole.

Its not for the faint of heart, but if youre willing to put in the time following our guide how to use it, you could cut your payments by more than half. You could also book a consult with us and well walk you through the process.

Thats because other income driven repayment plans not only take a lower percent of your income, they also give you a larger deduction before you have to pay anything .

What Are Federal Parent Plus

Federal Parent PLUS Loans are loans taken out by parents of dependent undergraduate students, enrolled at least half-time, to help pay for their childs college expenses. Parents are responsible for repaying Parent PLUS loans.

PLUS loans are in addition to the loans taken out by your child, and your PLUS loan will cover the entire cost of tuition, room and board, and other school-related expenses that your childs financial aid doesnt cover. These PLUS loans also have a fixed interest rate .

Note: Parents cannot borrow more than the cost of the childs education minus other financial aid receivedyour childs school will determine the actual amount parents can borrow.

Also Check: Defaulting On Sba Loan

Strategically Pay Off Parent Plus Loans Or Plan On Expensive Mistakes

Parent Plus is the red-headed orphan stepchild of the Department of Education student loan portfolio. There are about 3.6 million Parent PLUS loan borrowers as of the last quarter of 2020, and many owe a loan balance of six figures. If thats you and youre looking to learn everything you need to know about Parent PLUS loans, youre not alone.

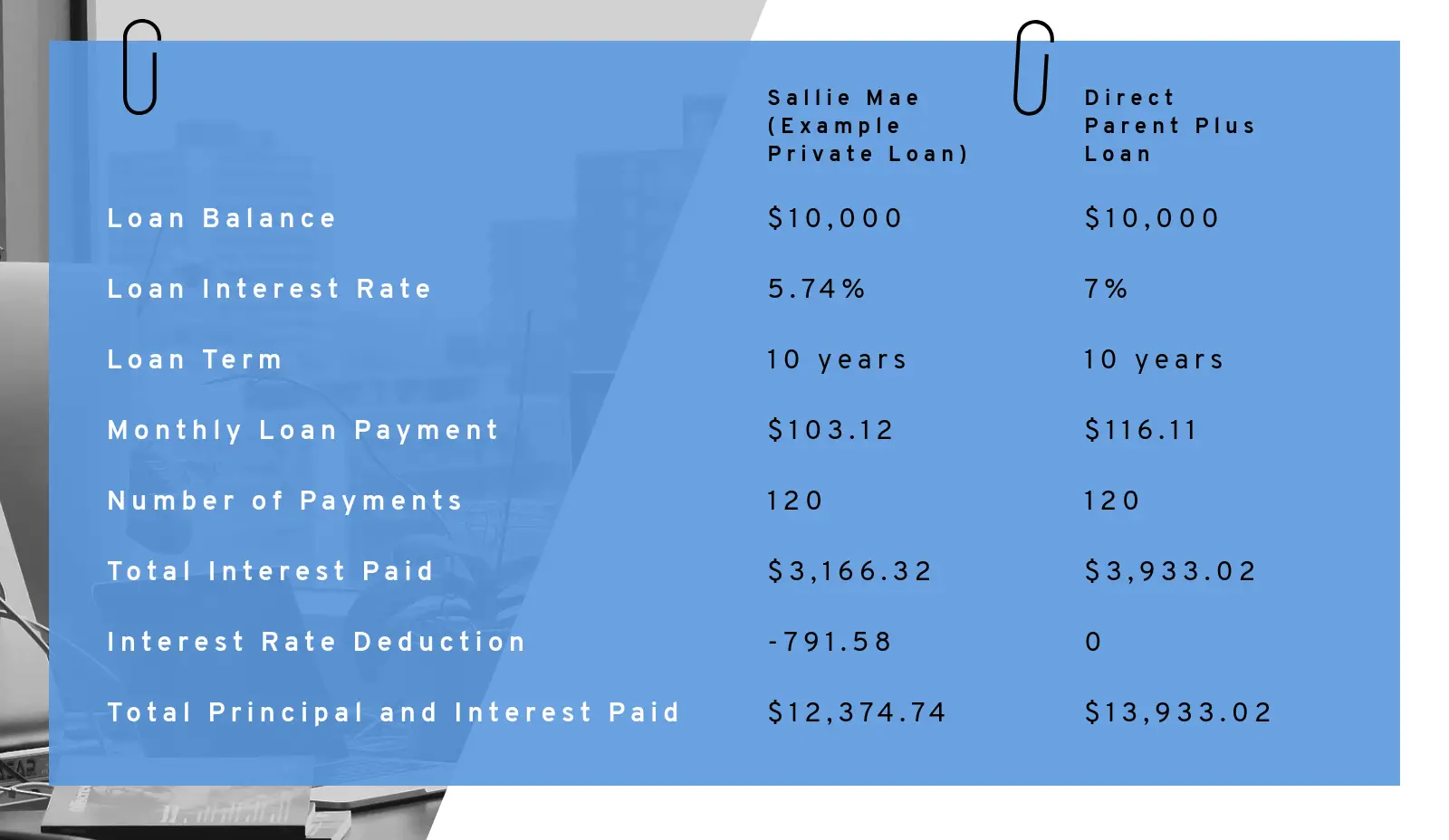

The total interest cost is higher so at first glance it might seem like refinancing is always the answer if you want to make Parent PLUS loans affordable. However, if you look at the math its a lot more complex. If you know you need to refinance, check out some of the cash back bonus links on our site.

If you want a custom plan, thats what we specialize in. Feel free to reach out to us with the contact button.

If youre currently trying to pay off Parent PLUS loans, wed love to hear what youre going through. Just post a comment below and well respond.

Transfer The Loan To Your Child

If you cant pay but your kid can, consider having them refinance the parent PLUS loan in their name through a private lender. Theyll need good credit to qualify and enough income to comfortably afford their expenses, student loan payments and other debts.

Even if your child doesnt qualify to refinance parent PLUS loans, talk to them about taking on some payments. You may be surprised by the answer in a 2019 survey by private student lender Sallie Mae, 74% of students said they expected to bear some responsibility for parent loan payments.

Unless you transfer the parent PLUS loan to your student, youll still be legally liable. But their contribution can make repaying the loan more manageable.

You May Like: Capital One Pre Approved Car Loan

A Guide To Parent Plus Loan Repayment

Repayment options for Parent PLUS loans include income-driven repayment plans, loan forgiveness, and refinancing.

The process of Parent PLUS loan repayment works a bit differently than most other federal student loans.

Unlike nearly all other kinds of student debt, the parent borrows the money rather than the student. This dynamic causes confusion when researching topics, such as federal program eligibility, repayment plan selection, student loan forgiveness options, and when making strategic decisions.

The good news is that borrowers can avoid the confusion and repay their Parent PLUS loans without too much stress. By taking the proper steps, borrowers of Parent PLUS loans can enroll in an income-driven repayment plan and even qualify for student loan forgiveness. In some circumstances, parents can also transfer the Parent PLUS loan debt to their child.

With the many ways to repay Parent PLUS loans, Parent PLUS loan repayment should never endanger a retirement plan or jeopardize a parent and childs relationship.

Dont Let High Student Loan Payments Reduce Your Retirement Savings

If you plan to refinance Parent Plus student loans into your name alone, you need to plan on working for another 10 years. Your 50s and 60s are prime years for deferring money for retirement. Its very likely that youll be in a lower income tax bracket once you quit working.

Furthermore, you can make $6,500 catch-up contributions to 401k and 403b accounts for 2020 and 2021. This is in addition to your annual contribution limit of $19,500, which means your max retirement contribution to an employer account is increased all the way to $26,000. If youre married, multiply that number by two for the total contribution you could make together.

Parent PLUS loan repayment can make those contributions more difficult. I would suggest that if you do refinance Parent Plus that you get rid of it in a hurry. You want to shoot for a repayment plan with a period of fewer than five years, so you can go into retirement unburdened.

For example, a parent with $30,000 of Parent Plus loans could refinance that amount to a 3.5% interest rate and pay $546 a month to have it all done within five years. That kind of payment is very doable if your childs loan is a low to mid five figure balance.

Youd also save thousands of dollars in interest by refinancing to a lower interest rate. Additionally, you can speed up your repayment plan and save even more by making extra payments.

You May Like: Usaa Auto Loan Bad Credit

Refinancing Parent Plus Loans Into Your Name Only

If you want to know how to pay off Parent PLUS loans quickly, refinancing is worth looking into. Virtually every major lender will agree to refinance Parent Plus loans into your name only. After all, Parent Plus loans are legally your responsibility, not your childs.

Some parents prefer to keep it that way. The most common arrangement Ive seen with clients and readers is, Ill pay for undergrad student loans, but you pay for everything after that!

Of course, some parents take the other side and view this loan as their kids loan that theyll take on once theyre able. Theres no right or wrong answer but choosing between these approaches carries big implications for your lifestyle.

How Plus Loans Work

PLUS is an acronym for Parent Loan for Undergraduate Students.

The parent PLUS program allows parents to borrow money for dependent students to pay any costs not already covered by the student’s financial aid, such as Pell Grants, student loans, and paid work-study jobs.

PLUS loans have fixed interest rates for the life of the loan. They are typically repaid over 10 years, although there is also an extended payment plan that can lengthen the term up to 25 years. Payments and interest on student loans from federal agencies were suspended in 2020, resuming early 2022.

Parent PLUS loans are the financial responsibility of the parent rather than the student. They can’t be transferred to the student, even if the student has the means to pay them.

Don’t Miss: When Does Pmi Fall Off Fha Loan

Using 401 Or Other Retirement Funds

Because the repayment options for Parent PLUS loans are not ideal, many parents consider using 401 funds or other retirement accounts to pay down the debt.

We do not recommend using retirement funds to pay down student debt.

The analysis is straightforward. Once a borrower moves their money from their retirement account and applies it to the debt, there is no turning back. The borrower loses that money forever.

Dealing with Parent PLUS loans may be a hassle, but taking money out of a retirement account turns a student loan issue into a retirement issue. While there are options to deal with a Parent PLUS loan without any income, retirement options without any income are far more limited.

Parent Plus Loans: How The Department Of Education Manages This Program

The parent PLUS loan is a subset of the direct PLUS loan program from the Department of Education . This program is specifically designed for parents to get financial help for their children. You take this loan out in your name and then make monthly payments on the interest while your child is in school. Many financial advisers recommend that you ensure your child pays the monthly installments, but you also have some options for parent PLUS loan forgiveness.

Also Check: How Much To Loan Officers Make

Parent Plus Loan Repayment Options And Ibr Paye And Repaye

While the ICR plan charges borrowers 20% of their monthly discretionary income, other federal repayment plans cost less.

The Income-Based Repayment Plan, Pay As You Earn Plan, and Revised Pay As You Earn Plan all charge 10% to 15% of a borrowers discretionary income. Unfortunately, Parent PLUS loans cannot be eligible for these plans, even with federal direct consolidation.