Parent Plus Adjustment Request

To request an increase or decrease to the Parent PLUS loan, the borrowing parent must complete and submit the 2018-2019 Parent PLUS Loan Adjustment Request Form . This form must be hand-signed and submitted to SFS via email, fax, or in-person.

Please note that requests for a Parent PLUS increase can only be completed if the credit check on the original loan is still valid. If the credit check has expired, you will need to complete a new PLUS loan application to receive additional funds.

Endorsed Parent PLUS loans cannot be increased by Temple. If your Parent PLUS loan is endorsed and you need additional funds, you must complete a new application at www.studentloans.gov.

Can A Parent Plus Loan Be Transferred To A Student

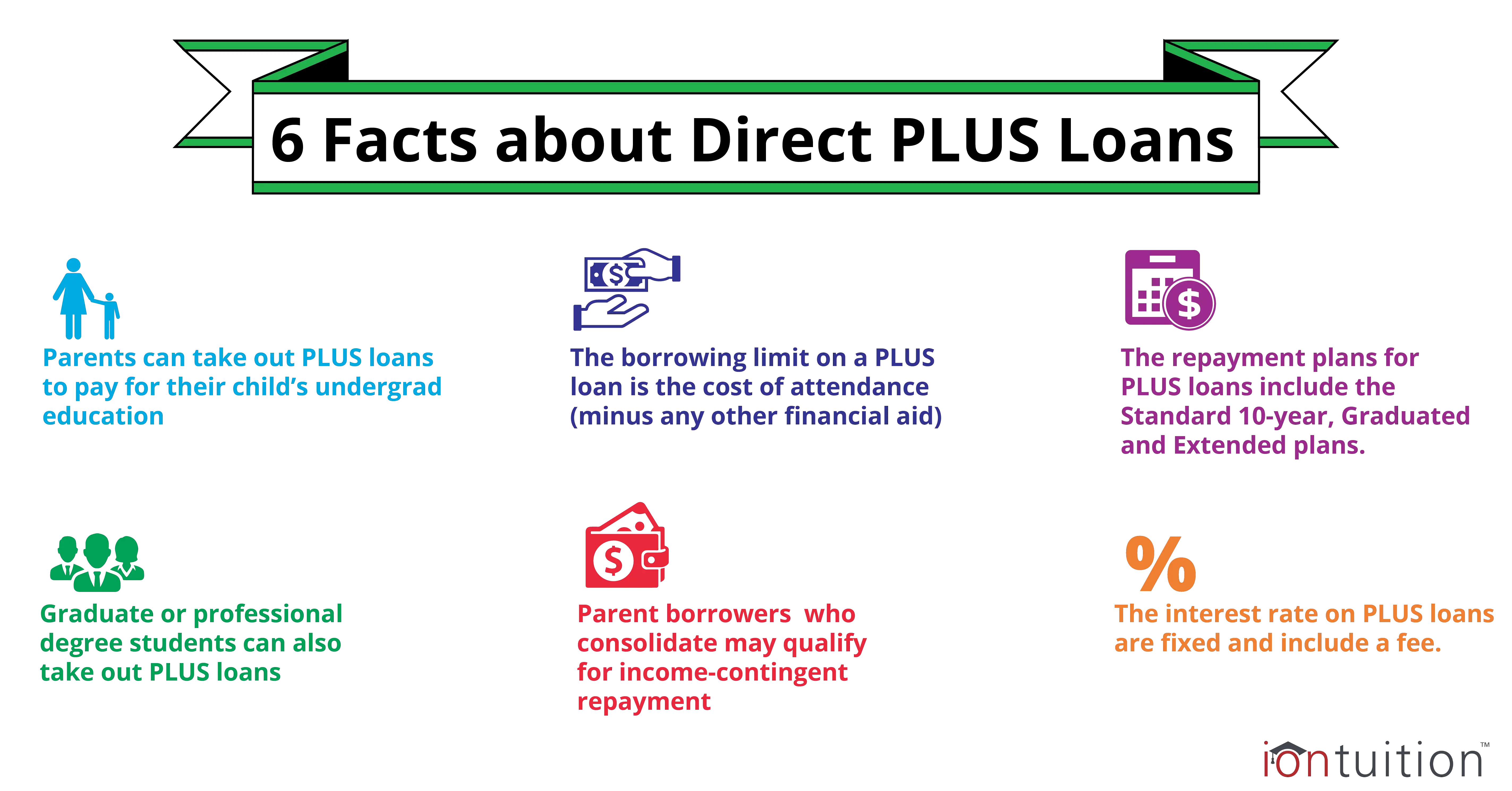

Some families will opt for a Parent PLUS loan since there are more options for repayment.

A Parent PLUS loan can fill in the gap for funding when college students have maxed out direct subsidized and subsidized loans.

These loans, provided by the Department of Education, are federal student loans and require that borrowers have adequate credit scores.

Parent PLUS loans do offer more options for repayment plans, but the interest rates tend to be higher and could take longer to pay off. Refinancing and forbearance are two options for changing the repayment terms.

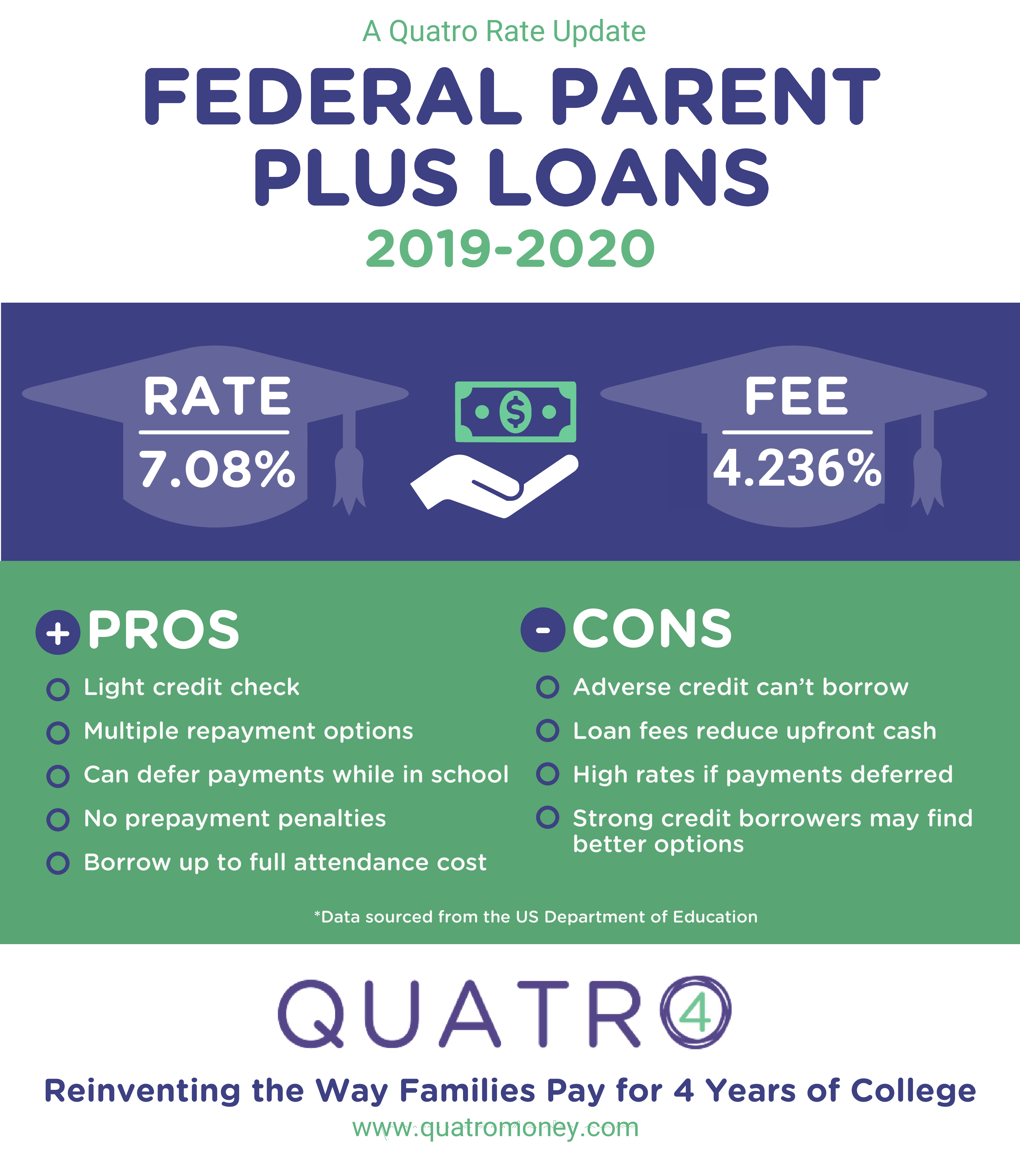

In addition to the higher interest rates, Parent PLUS loans require borrowers to also pay an origination fee. The current Parent PLUS loan interest rate is 7.08 percent and there’s a 4.236 percent origination fee. Although these interest rates are fixed, they are higher than private student loans that often do not have an origination fee.

Parent Plus Loan Forgiveness With Public Service Loan Forgiveness

While ICR is a good fit for some, the 25-year timeline can be hard to swallow. Another option through the federal government is the PSLF program. Parents who work full-time for certain government entities or nonprofits for 10 years are then eligible for loan forgiveness.

Borrowers need to be on an income-driven repayment plan to qualify for PSLF, so parents will still need to first apply for a Direct Consolidation Loan, and then apply for ICR. Once approved for the ICR Plan, submit the PSLF Employment Certification form.

This repayment strategy is an excellent fit for parents who already have made a career in a PSLF qualifying position or industry.

You May Like: How Can I Refinance My Car Loan With Bad Credit

Benefits Of Transferring Parent Loans To A Student

There are some big advantages if you make the decision to transfer private student loans to a student or to transfer a Parent PLUS loan to the student. Some of the benefits include the following:

- You can often reduce the interest rate if the student qualifies for a more affordable loan

- Parents can free up money for other financial goals, such as saving for retirement

- The debt will no longer show up on the parent’s credit report, so it will not continue affecting their debt-to-income ratio

- Students will become legally responsible for the debt and thus eligible for the student loan tax deduction

Sign The Documents And Start Saving

Once your application has been submitted, the lender will run a hard credit check on the applicant and also you as the cosigner, if applicable to determine whether to approve the application and what the terms will look like.

If your child decides to accept the offer, theyll sign the loan agreement, which they can do online, and the lender will pay off your loan directly.

That said, make sure you continue to make payments until you get confirmation that the loans have been paid in full. If you overpay, you should receive a refund check in the mail. Encourage your child to set up automatic payments to avoid missing a payment. Also, many lenders offer interest rate discounts for autopay, so thats another reason to make it a priority.

Also Check: What To Do If Lender Rejects Your Loan Application

Student Loan Repayment Assistance Programs

If you dont find any federal options that can help you with your parent PLUS loans, look elsewhere. Many state agencies offer repayment programs for student loans. You usually have to work in certain careers, like a teacher, nurse, doctor or lawyer. Additional requirements often apply, such as working in a rural or high-need area for a specific number of years. While this isnt the same as forgiveness, you can earn free money to pay off your student loans faster.

Student loan repayment is becoming more popular among the private sector as well. Companies are increasingly offering loan repayment as a benefit for employees. If youre in the market for a new job, research employers that offer loan repayment as a perk.

Some Of The Key Considerations Include:

- Federal Parent PLUS loans generally have lower fixed interest rates than private student loans. However, if you have very good credit, you might be able to qualify for a lower fixed interest rate on a private student loan.

- Some private student loan lenders offer variable interest rates that are initially lower than the interest rates on federal loans, providing you with an opportunity to save money if you expect to pay off the private loan before interest rates rise too much.

- Private student loans do not offer income-driven repayment plans.

- Federal Parent PLUS loans offer more flexible repayment options, such as extended and graduated repayment. Some private student loans may not allow the borrower to change repayment terms.

- Federal Parent PLUS loans offer longer deferments and forbearances than private student loans, such as the economic hardship deferment.

- Private student loans do not offer loan forgiveness programs such as teacher loan forgiveness or public service loan forgiveness.

- Federal Parent PLUS loans offer other opportunities for loan cancellation, such as the death and disability discharges, and closed school discharges. Only about half of private student loans offer a death and disability discharge.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Can Parent Plus Loans Be Transferred To The Student

Parent PLUS loans can never be transferred to the student. Taking out this loan could instead impact a parents credit score if payments are not paid on time.

Another issue is that parents must consolidate their loans with the Department of Education first before they can qualify for income-based repayment or public service loan forgiveness . By extending the repayment period, parents face paying more for the loan since interest continues to accrue. Use a student loan calculator to determine how much the interest costs.

Compare Your Actual Prequalified Rates In 2 Minutes

**************

At Purefy, we do our best to keep all information, including rates, as up to date as possible. Keep in mind that each private student loan refinancing lender has different eligibility criteria. Your actual rate, payment and savings may be different based on credit history, actual interest rate, loan amount, and term, including your co-signer . If applying with a co-signer, lenders typically use the higher credit score between the borrower and the co-signer for approval purposes. All loans are subject to credit approval by the lender.

Purefys comparison platform is not offered or endorsed by any college or university. Purefy is not affiliated with and does not endorse any college or university listed on this website.

You should review the benefits of your federal student loan it may offer specific benefits that a private refinance/consolidation loan may not offer. If you work in the private sector, are in the military or taking advantage of a federal department of relief program, such as income based repayment or public service forgiveness, you may not want to refinance, as these benefits do not transfer to private refinance/consolidation loans.

Purefy reserves the right to modify or discontinue products and benefits at any time without notice.

Recommended Reading: Can You Use A Va Loan To Buy Land And A Manufactured Home

Wait For Loan Forgiveness

Like other federal student loans, Parent PLUS Loans can qualify for different types of forgiveness programs. The two most common forgiveness programs for parents are the Public Service Loan Forgiveness Program and Income-Driven Repayment Forgiveness.

Under the PSLF Program, parents who work in public service can have their loans forgiveness after 10 years of making qualifying payments. If you’re interested in this option, be sure to read up on the PSLF eligibility requirements.

For those who don’t work for the government or a nonprofit, you can get your student loan debt forgiven after 25 years of payments. The income-contingent repayment plan offers parents that have Direct Consolidation Loans forgiveness after they make 300 monthly payments. The drawback with this option is that you’ll have to pay taxes on the amount forgiven.

How Do I Transfer My Parent Plus Loan To My Child

Have your child fill out the application as if they were refinancing their own loan. Even though the Parent PLUS loan is in your name, they should fill out the refinance application with their information including income, school, and degree. Later on in the application, we’ll ask for a copy of the current loan statement. At that point your child can indicate that the current loan is in your name and they will be taking it over.

Read Also: Drb Student Loan Refinance Reviews

Pros Of Parent Plus Loan Consolidation With A Direct Consolidation Loan

Combine multiple loans into one

If you have several federal student loans with different loan servicers consolidating your loans will simplify your payments by combining multiple loans into one with a singular loan servicer.

Parent PLUS Loan may become eligible for Public Service Loan Forgiveness

When you consolidate your loans through the federal program your Parent PLUS loan may be eligible for Public Service Loan Forgiveness . You would need to repay the Direct Consolidation Loan under an income-contingent repayment plan and meet all other eligibility criteria for Public Service Loan Forgiveness.

Retain deferment and forbearance

The federal student loan program comes with generous periods of deferment and forbearance to help borrowers who have encountered hardship or inability to pay.

Loans will be discharged if you or your child dies

With the federal student loan program if you or the child you borrowed the loan for passes away, loan forgiveness also applies.

Adjust your repayment term

When you consolidate Parent PLUS Loans, you may choose a new repayment term . This will lower your monthly payments by extending the amount of time you have to repay the loan. You will continue to be charged interest over the life of the loan, meaning if you extend your repayment term, your parent or student loan debt will cost you more over time.

Pro: You Can Get A Lower Interest Rate

Depending on when you took out your federal loans and the type of loans you have, you could have a relatively high interest rate. By refinancing your loans, you may qualify for a lower rate and save money over the life of your loans.

You can typically choose between a variable and fixed-rate loan when you refinance your debt. Right now, refinancing lenders offer rates starting around 2% for borrowers with excellent credit and a reliable income.

Recommended Reading: Conventional 97 Loan Vs Fha

Cons Of Refinancing Parent Plus Loans

Now its time to look at some of the drawbacks of refinancing Parent PLUS Loans with a private lender. Note that the cons to refinancing Parent PLUS Loans are primarily related to taking your loans out of the federal program.

Lose eligibility for federal repayment options

When you refinance student loans with a private lender you will lose eligibility for the federal repayment programs, such as, income-contingent repayment.

Lose eligibility for federal deferment and forbearance

Perhaps the most important federal loan benefits you need to weigh losing are the generous periods of deferment and forbearance offered with federal loans. Some private loan lenders may offer some sort of hardship forbearance, but these periods arent as lengthy as those offered by the federal program and are not a feature of all lenders.

Transferring A Parent Plus Loan To A Student

Can a parent PLUS loan be transferred to a student? Absolutely.

Many parents take out loans to help put their children through school. But as a parent, you may find yourself dealing with additional financial burdenssuch as a mortgage, retirement savings, or medical billsthat make the student loan difficult to deal with.

In those situations, if your child is financially settled, it might make sense to transfer the balance to them.

Some lenders, such as SoFi, Laurel Road, and Lendkey, specialize in programs that help parents shift their Parent PLUS loans to children. While each lenders process is different, the lender will look at the childs credit score and financial standing in determining a new interest rate.

Your child will have to apply to refinance the loans, with the note that the current loans are under your name. Heres an example of how this process works with CommonBond.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

How To Transfer Parent Plus Loans To Your Child

Did you take out a Parent PLUS Loan to help fund your childs education?

If so, you can certainly be forgiven for wanting to transfer the loan from your name to your childs. On average, parents who take out PLUS loans owe about $120 a month for every $10,000 borrowed for their childs education.

While that can be manageable at first, it may be difficult to maintain those payments over timeespecially if retirement is on the horizon. The solution may be to turn the repayment reins over to the graduate, who may be better equipped to manage the loan debt.

So the question is what are you options for turning the loan over to your child?

Parent Plus Loan Origination Fee

The present origination payment on Parent PLUS Loans is 4.228. Fees are deducted from every loan disbursement. Borrowers can ask the faculty monetary assist workplace to extend the quantity borrowed to cowl the charges.

Parents ought to examine the prices and advantages of PLUS Loans and personal student loans. Parents with glorious credit could qualify for personal student loan rates of interest which might be decrease than the present PLUS Loan charge.

Instantly Compare Lenders

Recommended Reading: Does Va Loan Work For Manufactured Homes

Three Annual Student Loan Acknowledgement

-

If you, the parent, are approved for the Direct PLUS Loan, you must complete the Annual Student Loan Acknowledgement at www.studentaid.gov.

*If a parent is denied the credit, the student may be eligible for an additional Direct Unsubsidized Loan. Freshmen and sophomores may receive up to an additional $4,000 for the year juniors and seniors may receive up to an additional $5,000 for the year.

Parent Plus Loan Interest Rate

The rates of interest on Parent PLUS Loans are fastened and dont change over the lifetime of the loan. The rate of interest for the 2020-2021 educational yr is 5.30%.

Every yr on July 1, rates of interest are reset based mostly on present market charges.

The curiosity on a Parent PLUS Loan begins so as to add up from the date the loan is first disbursed. If the borrower doesnt pay the curiosity because it accrues, it is going to be capitalized , growing the dimensions of the loan.

Don’t Miss: Sofi Vs Drb

Your Child Can Afford To Take Over The Debt

When you take out Parent PLUS Loans, you are legally responsible for the loans repayment your child has no legal obligation to repay the loan.

However, there are some cases where your child may be willing and financially able to take over the debt. If thats the case for you, you and your child can refinance the loans and transfer them into their name. By doing so, your child will be responsible for the loans, and you will no longer have to make payments.

Having your child take over the loans can be especially helpful if you are planning on applying for other types of credit, such as a car loan or mortgage. Without the student loans on your credit report, you are more likely to qualify for a loan and secure a lower interest rate.

Refinance Parent Plus Loans

Another way to manage your loans more effectively is through student loan refinancing, sometimes referred to as private student loan consolidation. This is an especially helpful approach if you have other forms of student loan debt, such as private parent loans.

To refinance your parent loans, you apply for a loan for the amount of some or all of your existing student loans. Refinancing lenders are private rather than federal, and offer different loan terms.

Depending on your credit and what terms you select, you could qualify for a lower interest rate or a smaller monthly payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Parent Plus Loan Deferment

Repayment on a Parent PLUS Loan usually begins no later than 60 days after the loan is absolutely disbursed. However, debtors can defer reimbursement of a Parent PLUS Loan whereas the student is in class and through a six-month grace interval after the student graduates or drops beneath half-time enrollment standing. Parent PLUS Loans may also be deferred whereas the mum or dad borrower is enrolled on at the least a half-time foundation in an eligible program. However, curiosity continues to accrue throughout these deferment durations.

Refinance To A Lower Interest Rate

If you want to pay off parent PLUS loans quickly, refinancing to a lower interest rate can help you become debt-free faster and save you money in interest. You can refinance parent PLUS loans in your name, or the child can take over the PLUS loan by refinancing it in his or her own name.

To qualify, you generally need good credit and enough income to comfortably afford all of your expenses and debt payments including housing, student loans and credit cards. Refinancing isn’t a good option for borrowers who are pursuing student loan forgiveness or need to make payments based on their income. You’ll lose these federal benefits by refinancing with a private lender.

Use this calculator to estimate how much you could save by refinancing parent PLUS loans:

Don’t Miss: Usaa Used Car Loan Interest Rates