Does Your Credit Score Help Determine Interest Rates

The current car loan interest rate is 4.4%. This number can change depending on the credit score. Low credit scores result in higher interest rates than those with high credit scores.

Once you know your credit score, use this knowledge to find the best rate for your auto loan. Find an auto loan calculator that takes into account your credit score, like NerdWallets free car loan calculator. It will show you how much interest youll pay and what your monthly payments will be.

How Does A Low Apr Save Me Money

A shorter loan term with a low APR is the best option for a financially beneficial car loan. The less time is spent paying off the loan, the less time there is for interest to accrue so a two to five year loan is ideal. Lenders also offer lower APR with shorter terms because the borrowers will take less time to repay the loan. A high APR paid even over a short loan term will quickly add up. Longer loans can provide lower monthly payments, but cost most in the long run.

A five-year loan at $28,800 with a 4.96 percent APR will accrue $3778 over the life of the loan. The same loan amount and term with an 11.93 percent APR will accrue $9577. For borrowers in the deep subprime credit ranking, that same loan amount and term with an APR of 23.81 percent will cost them $20,721 in interest over the life of the loan. Therefore, a low APR can save over $15,000 throughout the term of a car loan.

Surrender The Car To The Lender

If youre in financial trouble and you cant keep up your car payments, one option is to give up your car. You can drive your car to the lender, or wait for them to come and get it. Either of these options should only be a last resort.

The problem with turning in your car is that it is a voluntary repossession. If you owe more on the car than the car is worth and you cant pay the excess amount , it may harm your credit history and score. You should also be prepared to keep making your car payments until the lender sells the car. Even then, you may be on the hook for the creditors expense of selling the car.

Whether you turn in your car voluntarily, or you miss payments and they tow it out of your driveway, the repossession will be reported on your credit report. This means any car loan you get in the near future will likely carry a high-interest rate.

Also Check: Does Va Loan Work For Manufactured Homes

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

What Is A Good Apr

A good APR for a credit card is one below the current average interest rate, although the lowest interest rates will only be available to applicants with excellent credit. According to the Federal Reserve, the average interest rate for U.S. credit cards has been approximately 14% to 15% APR since early 2018.

Also Check: Becu Autosmart

Renegotiate A Car Loan

If you just need help getting back on track, or need to make your payments more affordable, try talking to your current lender. It may offer a way to defer a payment or two, giving you some much-needed time to catch up.

Another way it may help is by extending the terms of your loan so your payments are lower. Remember, just like refinancing, when you delay or lengthen your loan, interest charges still accrue. The longer the term, the more total interest you will pay.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

You May Like: Transferring An Auto Loan

Just Like Businesses That Render High Interest Auto Loans

Just like businesses that render high interest auto loans

I dont have an excellent solution a demonstrably, BIG authorities dictating everything we all can or cannot carry out isnt really the answer, but alternatively, people merely are not accountable sufficient to have all of these freedom and preference which ultimately ends up getting shouldered by taxation payers in the future at a heightened cost. Its a predicament for sure!

It actually was caused by some poor preparation whenever some charges are used on my profile, plus a couple of automatic money that I experienced completely overlooked about, together with final result was going to feel 6 overdraft costs at almost $40 a pop. Therefore, I got the mortgage to cover the $400 a put it during the accounts avoiding the $240 in overdraft fees a and settled the loan straight back several days later at $420 roughly, with a processing charge and little interest. The $20 spared myself from the $240 in additional fees a not a practice I would personally advise you to get into regularly, and I also think about me lucky to own squeaked through it without a much bigger monetary mark. That has been a short while ago a and then with better preparing and budgeting, it fortunately hasnt occurred once more.

What Is A Car Loan

A car loan is a type of personal loan used for buying a motor vehicle such as a car, ute, 4WD, motorbike or other road vehicle. If you need a vehicle but do not have enough savings to purchase one upfront, a car loan can be a helpful form of finance, as long as you can afford the repayments.

You can take out a car loan to purchase a new or used vehicle. The lender may specify a maximum age that the vehicle can be to qualify for the loan.

There are two main types of car loans, secured car loans and unsecured car loans.

You May Like: Usaa Refinance Car Loan

How Can I Pay Less Interest On My Car Loan

Interest charges can add thousands of dollars to the amount you have to repay. But there are ways you may be able to minimize the impact on your wallet if you need to finance your car purchase.

- 0% APR financing If you have excellent credit and the auto manufacturers finance division offers special financing, you may be able to take advantage of 0% APR financing for a certain amount of time.

- Early repayment If you have a simple interest loan, you can reduce your interest charges by paying more than the minimum due each month or paying off the balance early.

- Shorter loan term Choosing a shorter repayment term will lower the total amount of interest you pay in the long run. But itll increase your monthly payments, so be sure you can afford it.

- Refinance down the road If interest rates drop or your credit improves after you get your car loan, you may be able to get a lower rate by refinancing.

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |

How Do I Refinance A Car Loan

Refinancing your auto loan is a great and easy way to save money on your car payments and to lower the interest rate on your auto loan.

In order to refinance your auto loan, youll need to gather the right information and documents. All the necessary information would be the car mileage, VIN number, current car loan numbers, drivers license, and income verification. After gathering this information, you can refinance your loan with the same lender or with a different financial institution.

After applying, the bank or credit union will check your credit history and let you know if you qualify for a lower interest rate. After approval, the bank or credit union will work with you to set your new loan term to a lower monthly car payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Pay Off Your Car Loan Early

1. Pay half your monthly payment every two weeks

This may seem like a wash, but if your lender will let you do it, you should. With a payment every twoweeks, youll end up making 26 half-payments per year. That adds up to 13 full payments a year,rather than 12.

If you have a 60-month, $10,000 loan, youll save only about $35 in interest, but youllrepay the loan in 54 months rather than 60. Thats six months of your life back and can be aneasier transition if you get paid every two weeks.

2. Round up

Instead of just paying what is recommended, round your payments up to the nearest $50 to help repayyour car loan more quickly.

Say you borrowed $10,000 at a 10% interest rate for 60 months, then your monthly payment is $212.47.With that payment, youll repay your car loan in 60 months, having paid $2,748.23 in interest.

However, if you decide to round up and pay $250 a month, youll repay your car loan in 47months, having paid only $2,214.69 in interest saving you $533.54!

3. Make one large extra payment per year

This is the one-time version of rounding up. But it doesnt matter when you do it.

Lets say you borrow that same $10,000 over 60 months at 10% interest. If you make an extra payment of$500 a year, you will repay the loan in 49 months, having paid $2,279.35 in interest a savings of$468.88 in interest.

4. Make at least one large payment over the term of the loan

5. Never skip payments

6. Refinance your loan

Dont Forget to Check Your Rate

Compare Best Bank For Auto Refinance Loan

Hey Sunshine,

Compare these Top 10 Best Bank for Auto Refinance loans, get to know minimum credit scores required, loan terms, quotes, interest rates, buy or renew online.

We all know finding the best bank for auto refinance is a time consuming task, so we compared Top 10 banks that will help you in getting the best auto refinance rates. Refinancing your car loan is fast and easy with these Top 10 banks. Let us find out the pros and cons of each individual bank, what they offer, and why you should choose them?

We understand your financial needs and we are always there to help you save money. Whenever a new customer reaches a bank for a loan, there might be chances that you will be charged extremely high annual percentage rates. At Mount Shine, we are here to help you answer these questions to ensure youre making the right decision. Well help you provide every information on refinancing your auto loan that leads to lower interest rates, monthly installments, or duration.

Lets get started by knowing what an auto refinance car loan is?

Don’t Miss: Va Loan For Land And Manufactured Home

How Do You Get The Best Interest Rate

If you are looking to get the best interest rate that you can, it is important to do a little planning before you shop. Learn how to qualify for a car loan before heading to the dealership. Check your credit history and note the score. The higher the credit score, the lower your interest rate. Remember to prepare for negotiations as well.

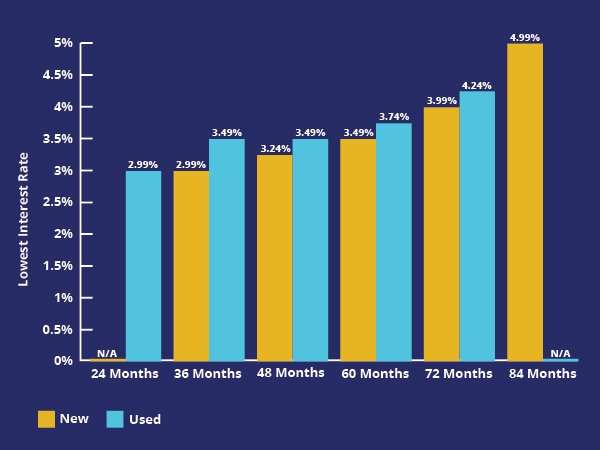

So what is a good car loan rate? According to the chart, this can range between 3.17% and 13.76% based on credit score.

If you are offered a higher interest rate than you were anticipating, you can try to negotiate a better offer. When you receive the offer, look at all of the details, dont just focus on the payment amount.

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make monthly payments on the principal of the car with no interest for a set number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How To Get Out Of A Car Loan

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

We all make mistakes. Maybe youre struggling to pay your bills, especially your car payment, and looking for a way to get out of that car loan. Or perhaps youre doing better financially than when you purchased your car and its time to refinance into a better loan. No matter how you got into a bad car loan or why you want out of it, you always have options. Understanding those options is the first step to improving your financial situation. Heres what you should know:

Is It Safe To Use A Home Equity Loan To Buy A New Car

Interest rates differ between lenders and borrowers, and they also change over time. So, a high interest rate for one person in one situation may not be high for someone else. To get the best interest rate available to you, look at different factors that affect loan interest rates. Contact several different lenders to compare the rates available to you.

TL DR

A high interest rate on a car loan is any rate that rises above the national average at the time of purchase.

Don’t Miss: How To Get Loan Originator License

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. , however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

The Best Ways To Get A Lower Interest Rate

There are several ways to get a lower interest rate on your auto loan. One way you can lower your interest rate is to be employed at a company that offers their employees discounted rates. You can also save money by refinancing your auto loans with the help of an online service such as LendingClub or Zillow Mortgage Marketplace.

The interest rate is the cost of borrowing money. When you borrow money, youre charged with a certain interest rate that goes unpaid over the length of the loan. The current auto loan interest rates vary depending on the lender and the type of car being financed. Additionally, there are other factors that may come into play when determining your final interest rate. For example, if you have a high credit score, your interest rates may be lower than if you are financing a vehicle with poor credit.

Don’t Miss: How Do I Get My Student Loan Number