Do Loan Companies Check Your Bank Account

In some cases, a lender might ask for your bank account number to know where to send the loan funds after your application has been approved. Some online lenders may ask you to connect a business bank account to analyze and verify your revenues to see whether you qualify for an online loan. In those cases, make sure you are dealing with a legitimate lender and a secure website.

Watch out for scammers looking to get access to your account to make a withdrawal or transfer to their own account.

Report Suspicious Activity Scams Or Fraud

Washington State residents only: If you suspect illegal or fraudulent activity involving a financial product or service, please contact the Department at 1-877-RING-DFI , or online at www.dfi.wa.gov.

If you feel you have been the victim of a scam, please contact the Federal Trade Commission at 1-877-FTC-HELP or online at www.ftc.gov or contact the Consumer Financial Protection Bureau 411-CFPB or online at www.consumerfinance.gov. You may also wish to contact the Office of the Attorney general at www.atg.wa.gov.

If you feel you have been the victim of a scam involving the internet please contact the Internet Crime Complaint Center online at www.ic3.gov.

If you live in another state, go to this webpage to find the regulator in your home state.

Forged Letters/emails And Impersonator Phone Calls:

The perpetrators of this fraud will make unsolicited phone calls or send letters or emails that look like they originated from Cash Factory USA and inform you that you have been approved for a loan. If you have received a communication from us and you are not sure if it is legitimate, please contact us at 374-5626.

Read Also: What Car Loan Can I Afford Calculator

Pull Back The Curtain On Your Business Credit To Find Better Financing

Ready to see your credit data and build stronger business credit to help your business get financing? Check your personal and business credit for free.

Have at it! We’d love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Payday Loans And Credit Ratings

Payday loans are an attractive proposition to people with very bad credit or perhaps no credit rating at all. Most payday loan companies do not check the credit history of the customer, so simply applying for or taking out a payday loan will not usually affect an individuals credit rating.

Some payday loan companies have schemes where if a customer makes on-time payments, they report this to the credit rating companies so customers can slowly build up better credit . The downside of course is that if there are missed payments or a customer defaults on a loan, this information also gets reported.

Also Check: Does Va Loan Work For Manufactured Homes

Consequences Of Applying For Not Legit Loans

We really dont want to see people doing this, but still, many people end up registering with fraud lenders or legit but non-recommended. Below we will list some consequences of doing this.

- You reveal your personal information to lenders who reserve their rights to sell it to third parties.

- You register with an unsafe, unsecured website with your personal details, and your information can get intercepted by hackers.

- You receive a contract with many hidden fees.

- You cant pay the money on time, and the lender requires you to rollover, which puts you in a debt cycle.

- You pay much higher interest fees than with a personal loan.

- Based on your financial situation, you cannot get better loan terms from other legit companies.

- You are made to sign a contract in an office where you dont have enough time to read it carefully.

There can be more consequences, but we reserve our right not to provide legal advice on our site since we are not legal experts. We are financial experts. For more legal consequences, you can turn to a lawyer.

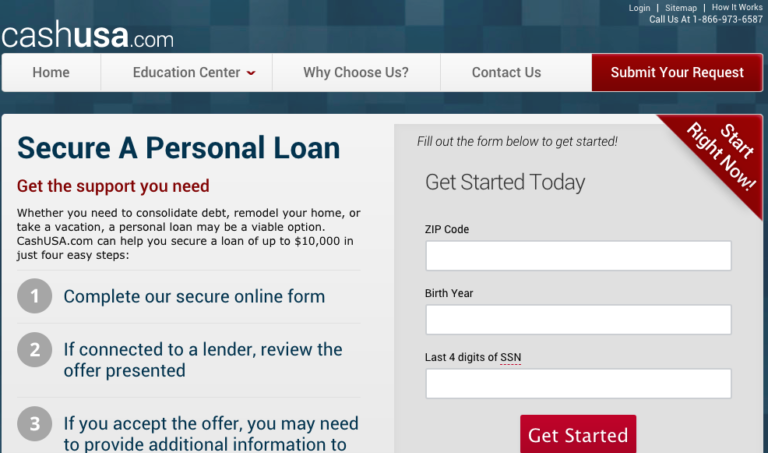

Cashusacom Secure A Personal Loan In 4 Easy Steps Even With A Bad Credit Score

Putting together a thorough CashUSA.com review took substantial time sifting through online reviews, researching the companys history, and developing an understanding of the role the network plays in helping consumers with bad credit find the personal loans they need.

Thousands of consumers who have bad credit submit personal loan requests of between $500 and $10,000 to CashUSA.com. The lending network then forwards those requests to a large group of partner lenders that make prequalification decisions in a matter of seconds.

If youre prequalified, you can complete your loan application and have your funds deposited into a linked bank account within one business day. It doesnt get much easier than that.

Don’t Miss: What Is An Rv Loan

Ways To Use A Cashusa Loan

One of the advantages of getting a personal loan is there are generally no restrictions on how you can use the money. Here are 10 common reasons why people need personal loans.

- Consolidate debt

- Down payment on a new house

- Medical bills

- College tuition

- Launch a new business

While the loan request form asks your reason for submitting a request for a loan, CashUSA says this won’t have any impact on whether lenders decide to approve you.

How Does Cashusa Work

As noted earlier, CashUSA is not a direct lender. On the contrary, they operate more like a comparison website, insofar that they simply match you with a lender like Elastic based on the details you enter. Nevertheless, the process is very simple. Once you head over to the homepage, you will need to enter the amount that you want to borrow, alongside some personal information such as your full name, address and date of birth.

After that, youll need to advise what you need to loan for, and what your current FICO score range is . Take note, the reason that you state for obtaining the loan does not impact your chances of approval. Its merely so that CashUSA can tailor their products to the relevant audience. As such, whether its for home improvements, or a small business loan, the purpose is effectively irrelevant.

Before you are able to submit your application, you will also need to provide further information regarding your financial background. This covers the usual factors, such as your employment status , your monthly income, and your current debt levels.

Once all of the above has been filled in, the CashUSA platform will work its magic. Much like any other comparison website, youll be presented with a list of suitable lenders, alongside their proposed financing costs. If you then decide to proceed, youll be taken directly to the lender in questions website to complete your application.

Don’t Miss: Usaa Auto Loan Interest Rates

Fast Loans For Bad Credit

Some lenders offer fast loans for borrowers with bad credit . If you have bad credit, a low debt-to-income ratio and proof of stable income will help you qualify.

Your credit score doesn’t affect how long it takes for a lender to fund your loan, but your loan is likely to have a high APR and you may not be approved for a large loan amount.

Though many online lenders can fund loans quickly, take the time to compare bad-credit loans before borrowing and make a plan to repay the loan.

Types Of Loans To Avoid

Here are some loans that are financial traps:

Car Title Loan By using your car title as collateral, you can receive a loan amount worth up to 50% of the cars value. But the interest rate on a car title loan is usually 25% per month and must be paid back in 30 days. On a $500 loan, that means you must repay $625 in 30 days or your car gets repossessed.

On some occasions, the loan might be rolled over into another month meaning an even larger cash outlay somewhere close to $800 to pay off interest and fees.

Because these loans are especially popular among military members, the Military Lending Act of 2006 protects service members and their families against predatory lending.

The law caps interest rates at 36% on loans with a term of 181 days or less to repay. It also requires lenders to alert service members of their rights and prohibits lenders from requiring borrowers to submit to arbitration in a dispute.

Two reasons to bypass this loan: a) You might lose your car b) Washington enacted a law that limited this loan. As members of law enforcement would say, Theres your clue.

Overdraft Protection Loan Most banks offer overdraft protection on checking accounts. That allows you to draw money from the bank even if your account balance is zero. The average bank fee for overdraft protection is $30-$35 each time it occurs. Lets think about this: If you are out of money already, how are you helping your future self by adding a $30 service fee?

You May Like: Loan Without Income Proof

How To Find Legit Loan Companies And Avoid Scams

- Payday loans are illegal in many states

ElitePersonalFinance created a table where we extracted all payday loan regulations by state. You can see that there are states where payday loans are absolutely illegal. In other states, they are legal but not regulated by the law. And in some states, they are legit and regulated by the law. State laws regulate:

- The highest amount allowed, which is $500 in most cases.

- The APR.

- The loan terms.

There are still many lenders that are illegal in their states but operate with no problems.

- Upfront fees

Every lender that requires you to pay upfront fees to qualify for a loan is a fraud. Many free-application loan companies are allowing you to compare offers with no upfront fees. Asking for an upfront fee is not legal.

- Hidden fees

When you accept an offer, make sure that the loan company has listed all of the fees. They have to be carefully explained and included in the contract. Legitimate lenders must disclose all contract fees and even explain them to you if you ask them for clarification. When you accept the offer, be sure that you understand these fees:

Like with payday loans, many states put legal restrictions on auto title loans.

- Personal information

- Avoid lenders that wont check your credit score

- Avoid unsecured and unsafe sites

Every legitimate loan company should have an SSL certificate on your application form where you reveal your personal details if you apply online.

- Avoid sites that look like a scam and relatively new sites

Research The Business Location

Look under the website contact information for a physical address, then look that address up on google maps. You may be surprised how many of these searches result in a residential home address or a business that has nothing to do with lending! If the only address is a P.O Box, make sure you do additional research to verify the company is legitimate. You can also do a reverse search on the phone number calling you.

You May Like: Transfer Car Loan To Someone Else

Is The Lenders Website Secure And Safe

Some sites are knock-offs of real lending websites. The first step in identifying a phishing website is checking the URL. If the site encrypts communications to the server, it will have a secured padlock next to the website address. However, some dubious sites now use HTTPS, so its not a foolproof way of identifying a fake site.

Thats why its important to also check the site for errors, for instance, in spelling or grammar. You can also perform a WHOIS check to see who owns the URL. Next, check reviews for that particular lender. And finally, see if they have trusted badges on their site issued by payment processors, security providers, or associations like the Online Lenders Alliance .

What Can I Use A Cashusa Loan For

You can use a personal loan from CashUSA for any purpose. This is different from other loan types that limit how you use the funds you borrow. You cant use the proceeds of an auto loan, for example, to fund home repairs.

But with a personal loan, sometimes referred to as a cash loan or a signature loan, you have complete control over how you spend your borrowed money.

There are two main types of personal loan products a secured loan and an unsecured loan. CashUSA connects borrowers with unsecured loans, which means you dont need to provide collateral to secure your loan.

A personal loan is also commonly referred to as an installment loan because it gives you the option to repay your debt through a series of monthly payments also known as installments. Each monthly payment will include a portion of your loans principal as well as incremental interest charges that provide the lender with the profit needed to make the loan worthwhile.

And even though CashUSA makes qualifying for an unsecured installment loan easy, you may still be charged a high interest rate, an origination fee, and other charges that may make the loan expensive. Thats, unfortunately, the cost of having bad credit.

The loan duration will typically range from six to 84 months and your repayment term will vary by lender. While these loans may sometimes come with a high interest rate, the lack of collateral makes them a better deal for any consumer who has credit issues.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How To Check If A Loan Company Is Legitimate

There are several ways to check if a loan company is legitimate. First, check out the loan company on the Better Business Bureau website. Do a quick online search and look up customer reviews. Finally, check with your states attorney general to make sure that the lender is registered with the proper state government agencies.

Before you apply with a lender, think about these steps to make sure you dont get caught up in a scam.

Lendup: Best Payday Loans Online For Small Loans

If you’re looking for a smaller loan, either for a single payment or with installments, then LendUp is the best option here. It specializes in these smaller loans to cover things like household bills, food, or other everyday expenses the average American will come up against. Founded in 2011, it’s a modern company with some attractive rates and excellent additional benefits, and it will help you improve your credit rating and manage any debt you have, which is a neat little extra.

If you borrow payday loans regularly, LendUp does incentivize repeat business by offering regular customers lower rates. Not only does this bring in repeat business, but it also helps out those who need to borrow the most and are struggling to make ends meet on a regular basis. If you are a regular customer and make repayments on time, you’ll be rewarded by free admission to LendUp’s financial management and education courses, that will help you get better with money.

What’s more, LendUp will not trap customers with ‘rollover loans’, meaning that you’re less likely to get into the debt cycle that less ethical lenders may encourage. Customer services are good here too, and you should be able to have all questions about your loan answered promptly.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Customer Service At Cashusa

Once again, CashUSA is not a direct lender. As such, it is unlikely that you will have any reason to make contact with them, insofar that you will need to speak with the lender directly regarding your loan. Nevertheless, CashUSA are happy to take queries regarding the information listed on its platform including that of the loans displayed within its search results.

Heres how you can make contact:

Phone: 866-973-6587

In Writing: 3315 E Russel Rd Ste A-4 Box #105, Las Vegas, NV 89120

It remains to be seen what hours the customer care team works, although it is assumed that standard business hours apply.

Does Cashusa Check Credit

According to the CashUSA website, neither CashUSA nor the lenders in its network check credit scores. The company states: “CashUSA.com lenders do not require credit scores and do not ask applicants to provide details. Your credit score will not affect the fees and terms of your loan in any way.”

If you choose to move forward with a loan, however, it’s a good idea to ask the lender directly if it performs a soft or hard inquiry of your credit report.

Don’t Miss: Becu Used Car Loan

What Is Cashusas Criteria

The eligibility criteria that a potential borrower must satisfy so that they are able to request personal loans are as follows:

- Be at least 18 years old

- Be a U.S. citizen or permanent resident

- Minimum income threshold of $1,000 after taxes

- Have a checking account in your name

- Be able to provide work and home phone numbers and an email address

The company might perform a soft credit check to verify your bank information.

Cnu Of Washington Is Licensed

CNU of Washington, LLC d/b/a CashNetUSA is licensed by DFI. However, this licensed company is not associated with the above scams. According to CashNetUSAs website, it has been targeted by unidentified and illegal organizations that are falsely claiming to represent the company. To learn more, you may visit the companys website at: www.cashnetusa.com/consumer-notices.

Recommended Reading: Does Va Loan On Mobile Homes