How To Buy A House With No Money Down

Many hopeful home buyers ask Can you buy a house with no money down? The answer is yes.

And Ill show you how.

The first step is to use a program that requires no down payment.

As stated below, there are many options, like the USDA home loan and VA loan. Even FHA can be a zero-down loan if you get gift funds to cover the 3.5% down payment .

Not sure which loan is right for you? It all depends on eligibility.

While FHA loans are available to just about everyone who meet the criteria, you need military service history to qualify for a VA loan and you need to be buying in a rural or suburban area for USDA. More on eligibility factors below.

Once you have the loan, you need to figure out how to cover closing costs.

Closing costs average anywhere from 1% to 5% of the homes purchase price and include things like origination fees, title costs, and even property taxes and insurance that you must prepay.

Complete Guide To Fha Mortgage Loans

FHA home loans are one of the most popular types of mortgages in the United States. With low down payments and lenient credit requirements, they’re often a good choice for first-time homebuyers and others with modest financial resources.

FHA mortgage guidelines allow down payments of as little as 3.5 percent, so you don’t need a big pile of cash to successfully apply for a loan. Credit requirements are less strict than for conventional mortgages, putting these government home loans in reach of borrowers with short credit histories or flawed credit. And FHA mortgage rates are very competitive.

You can use an FHA mortgage to buy a home, refinance an existing mortgage or get funds for repairs or improvements as part of your home purchase loan. If you already have an FHA home loan, there’s a streamline refinance option that speeds qualifying and makes it easier to get approved.

There’s also an FHA reverse mortgage that allows senior citizens to borrow against their home equity but not have to repay the loan as long as they remain in the home.

This guide is broken down into sections to make it easy to find the information you’re most interested in. At certain points, you’ll also find links to further information or indications where you can scroll down for additional details.

Applying For An Fha Loan With Poor Credit

If want to apply for an FHA home loan but are concerned about your credit score, here are things you can do to prepare for the application.

Check your credit report and credit score

Your credit report includes how much debt you have from things like auto loans and credit cards. Before you apply for an FHA loan, check your credit report as well as the balances on your other debts. Try to pay these debts down if you can.

Payment history is another important part of your credit score. Making regular, on time payments for loans and credit card bills can help lenders look more favorably on your mortgage application.

Put together a budget

When you are buying a house, it’s important to make a budget to help you decide how much home you can afford. You’ll want to be confident you can afford your monthly mortgage payment as well as the other bills you need to pay.

Your monthly mortgage payments include interest, principal, homeowner’s insurance, property taxes, and mortgage insurance premiums when you have an FHA loan. Use our mortgage affordability calculator to help you estimate how much home you can afford.

Plan for a down payment

One FHA loan benefit is the low down payment requirement. You can increase your chances of having your loan application approved by making a larger down payment on your FHA loan, however. Plus, making a larger down payment will save on interest payments, because you will borrow less money to buy your home.

Recommended Reading: Can You Use A Va Loan For A Manufactured Home

What Is An Fha Streamline Refinance

An FHA streamline refinance is available to homeowners who already have FHA-insured mortgages. At least 210 days must have passed since you closed on your original mortgage, you cant have a history of late payments, and the refinance must give you a net tangible benefit, such as reducing your monthly mortgage payment or shortening the term of the loan.

Benefits And Disadvantages Of Fha Loans

There are several benefits to FHA loans. They have lower credit score requirements, lower down payment requirements, and their overall qualifications and standards are easier for more individuals to meet. Conventional loan terms are set by private mortgage lenders. That means they tend to be harder to achieve.

However, FHA loans do require mortgage insurance. This is an added cost to your loan purchase and should factor into your monthly payment.

Youll likely benefit from an FHA loan if:

- You can afford the FHA minimum down payment requirement

- You have a credit score under 680

- You have little experience with mortgage loans

An FHA loan may not be right for everyone, especially those with a high credit score and a sizable down payment.

Read Also: Drb Loan Consolidation Reviews

Alternatives To Fha Home Loans

There are several governmentbacked and nongovernment options that also offer low down payments and flexible underwriting. They include:

FHA mortgage eligibility is not restricted to firsttime or lowincome buyers. Alternatives like VA mortgages are limited to eligible military and veteran applicants, and USDA loans have income restrictions and are available in less densely populated areas.

Conforming and conventional loans often require higher credit scores.

No single mortgage program is best for all home buyers, so its smart to compare.

Types Of Bankruptcies And Qualifying For Fha Loan During And After Chapter 13 Bankruptcy

Home Buyers can qualify for FHA Loans after Chapter 7 and Chapter 13 Bankruptcies. However, there are FHA Requirements that borrowers need to qualify for qualification for FHA Loans after Chapter 7 and Chapter 13 Bankruptcy.

There are two types of bankruptcies for individuals who are drowning in debt and need relief from creditors and collections agencies.

You May Like: Is Loan Lease Payoff Worth It

What Are Fha Loan Requirements In Nc And Sc

FHA loans in Charlotte, NC or other areas in the Carolinas are available to buyers as long as they meet FHA loan requirements. North and South Carolina FHA loan requirements include:

- A credit score of at least 580. However, if your score is between 500 and 579, you may still be eligible for an FHA loan if you make a down payment of at least 10% of the homes purchase price.

- Borrowing no more than 96.5% of the homes value through the loan, meaning you need to have at least 3.5 percent of the sale price of the home as a down payment.

- Choosing a home loan with a 15-year or 30-year term.

- Purchasing mortgage insurance, paying 1.75% upfront and 0.45% to 1.05% annually in premiums. This can be rolled into the loan rather than paying out of pocket.

- A debt-to-income ratio less than 57% in some circumstances.

- A housing ratio of 31% or less.

FHA lenders in NC and SC will provide you with all the information you need and can help determine if you qualify for an FHA loan.

Income Requirements for FHA Loans

Theres a common misconception that FHA loan requirements include income restrictions. While FHA income guidelines can be confusing, FHA loans are available to those who have any type of income. There are no minimum or maximum income requirements.

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

Recommended Reading: California Mortgage Loan Originator License

Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.

No Down Payment First Time Home Buyer

As a first-time home buyer, you probably dont have much to put down on a home. Maybe nothing at all. But thousands of buyers per month are able to close on a home purchase and these buyers are not that much different than you.

The key is to find the right loan program or combination of programs.

If youre buying outside a major metro area, check into the USDA loan. Its a no down payment program. You dont have to be a first-time home buyer to get one, but this is who usually uses it.

If you have a military background, you could be eligible for a loan from the Department of Veterans Affairs. It requires nothing down and rates are typically lower than for FHA.

If you choose a loan program that requires a down payment, look around for secondary programs. Your city, state, or county may provide grants and down payment assistance to help first-time home buyers break into the housing market. Learn more about down payment assistance programs here.

Dont think you can buy a home with no down payment? It might not be as hard as you think.

Read Also: How To Get Mlo License California

How Does The 203k Loan Program Work

The process for an FHA 203k loan is like that of regular home buying, with some modifications:

Receiving a final approval involves lining up contractors and receiving bids, and some additional hoops to jump through.

Dont get stressed at this process, though. The 203k lender will drive the process and guide you through. Youre not on your own!

Choose your projects

The first step is deciding which home improvements you want to do .

The lender will require any safety or health hazards to be addressed first things like mold, broken windows, leadbased paint, and missing handrails.

From there, choose which cosmetic items you want to take care of.

For instance, say you want to replace appliances, add granite in the kitchen, and gut the bathroom. Those are all acceptable projects for the loan.

Choose your contractors

Once youve got your project list together, find contractors.

The contractors must be licensed and insured, and typically have to be in fulltime business. You cant use buddies who do construction on the side, and you typically cant do the work yourself unless youre a contractor by profession.

Best results will come from superexperienced and professional remodeling firms that have done at least one 203k renovation in the past.

Remember: your entire project can be held up by one contractor that is unwilling to complete the necessary forms.

Get your bids

Can I Get A Mortgage With No Money Down

In a word, yes. There are mortgages available where the required down payment is zero. These are often referred to as 100% loans loans in which the money lent comprises 100% of a particular homes market value.

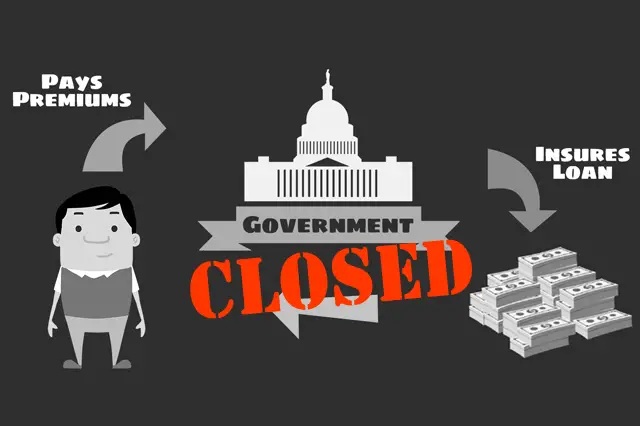

Mortgages with no down payment are usually available only through certain government-sponsored programs.

To help people become homeowners, the government insures lenders if the borrower defaults on the loan. This enables banks and mortgage companies to issue favorable loans, even for first-time buyers with little credit and no money down.

Following are three governmental programs that are known to insure 100% loans.

USDA A USDA loan is a no-down-payment loan backed by the United States Department of Agriculture. These loans are often provided to low-to-moderate income borrowers who cant afford a traditional mortgage and want to live in a rural or suburban setting.

FHA FHA loans are insured by the Federal Housing Administration. These loans are designed for low-to-moderate income buyers and those with less-than-perfect credit. First-time and repeat buyers are eligible, and buyers can receive gift funds to cover the 3.5% down payment requirement.

VA VA loans are zero-down loans that are guaranteed by the U.S Department Of Veterans Affairs. To qualify for a VA loan, you must be a current or past service member. Those with eligible service get ultra-low mortgage rates and dont have to pay monthly mortgage insurance.

Don’t Miss: What Credit Score Does Usaa Use For Mortgage

Are 80 10 10 Loans Available

Most mortgage lenders offer piggyback financing in 2021.

Lenders have always offered the first mortgage the 80% portion of the homes purchase price. In the past, it was challenging to find a lender for the 10% second mortgage.

That is no longer the case. Due to the extreme popularity of the program, most lenders have created their own second mortgage program or have created relationships with external companies to secure second mortgage financing for the home buyer making it one seamless transaction as far as the buyer is concerned.

What Are The Downsides Of An Fha Loan

A major drawback of FHA loans is the high cost of FHA mortgage insurance, which must be paid for the life of the loan if you make the minimum 3.5% down payment. FHA county loan limits also curtail your buying power, since theyre set at 35% below conforming conventional loan limits in most counties in the U.S.

Read Also: How Long Does Sba Loan Take To Get Approved

What Is A Federal Housing Administration Loan Loan

A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by an FHA-approved lender. FHA loans are designed for low- to moderate-income borrowers. They require a lower minimum down payment and lower than many conventional loans do.

Because of their many benefits, FHA loans are popular with first-time homebuyers.

% Financing: The Va Home Loan

Another mortgage loan that allows you to finance 100% of the homes cost is the VA home loan. This loan is available to applicants typically with at least two years of former military experience, or 90 days if still serving.

The Veterans Administration estimates that 23 million people in the U.S. are eligible for the VA home loan. Thats about one in every 13 people, and many dont even know theyre eligible.

Anyone who is eligible should take advantage of this zero-down home loan program. VA loans have very low rates usually even lower than conventional loans. And they dont require a monthly mortgage insurance fee like USDA, FHA, or conventional loans.

When compared to any other low down payment mortgage, VA home loans are the most affordable in upfront as well as monthly costs.

Youll need to pay an upfront VA funding fee but it will almost always be less than the cost of private mortgage insurance or a down payment.

With a VA loan, you can buy a home with zero down and have the seller pay some or all of your closing costs, meaning you could own a home with no money out-of-pocket.

Lenders typically allow lower credit scores on VA loans as well. While most mortgage lenders require just a 640 score, some allow you to have a score as low as 620.

The VA home loan is the easiest 100% home financing option available. If you have served in the military, the VA home loan is worth checking into.

Read Also: Student Loans Average

What Is The Lowest Credit Score For Fha Loans

At Freedom Mortgage, our minimum FHA loan credit scores depend on whether you want to buy a home or refinance a home.

- We can often accept a minimum credit score as low as 600 when you want to buy a house with an FHA loan.

- We can often offer an easy credit score qualification when you want to refinance a house with an FHA loan.

If you have a lower credit score and smaller down payment, FHA loans may be more affordable than conventional loans. Lenders often require a credit score of at least 620 and a minimum down payment of 5% to qualify for a conventional loan.

Keep in mind you will need to meet credit, income, and financial requirements to get approved for an FHA loan. Read more about the requirements for FHA loans.

Thoughts On Fha Loans: Everything You Need To Know

Why does.the FHA not allow you to obtain a loan from a bank for the down payment?

Brandi,

The FHA doesnt allow unsecured loans as borrower funds, but other sources like down payment assistance and loans secured by other assets may be acceptable.

Im in an underwriting and today I received the disclosures from the Lender. I notice they asked for tax transcripts. I owe 2015 taxes just havent gotten a bill yet and havent made payment arrangements. Can this be issue ? Our broker is away and we have this dilemma. I dont want to start a payment plan and make the lender feel that Im trying to be sneaky.

Dre,

If it were a tax lien or delinquent it could be an issue, but the lender may wonder why you havent paid them yetdo you actually need a bill sent to you in order to pay them? Are you delaying payment for some reason? Do you have the necessary funds to pay and still qualify for the mortgage?

Colleen,

Your 2015 tax return is pretty important because the lender needs to know what you most recently earned and also to know if a tax bill is due or not. If you got an extension you can ask if theres a way around it using other documentation but at that point you might feel its easier to file.

Daniel,

You may want to speak with your lender to determine how they qualify you for the assumption to ensure you in fact qualify, and if not, what your other options are.

Got it.thank you Colin

Also Check: Usaa Auto Loan Approval