Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

When Is Home Equity Loan Interest Deductible In California

While you can use a home equity loan for many purposes, youll generally only be able to deduct interest on it if you use it for home improvement-related expenses2. These types of expenses may include remodeling your kitchen or bathroom, replacing your roof or siding, adding an addition, or finishing your basement3. Unfortunately, furniture and home decor are not eligible for this mortgage interest credit in California3.

According to the Tax Cuts and Jobs Act of 2017, taxpayers may deduct up to $750,000 in home loan interest for homes purchased as of December 16th, 2017. If you purchased your home before that date, you are eligible to deduct up to $1 million in principal mortgage interest1.

Although its common for homeowners to use home equity loans to improve their homes, its just as common for them to use them for other purposes

Its important to note that the $750,000 limit applies to your total debt on all the properties you own3. So, if you owe $400,000 on your primary home in San Francisco and owe $350,000 on a vacation home in Los Angeles, you may get a property tax deduction in California on the entire amount.

However, if your primary home is $750,000 and your vacation home is $350,000, the tax break will only be applicable on $750,000. In this example, you wouldnt be able to get a California property tax deduction on your vacation home.

What Youll Need To Claim The Home Equity Loan Interest Deduction

- Copy of the 1098 form. You should receive a form 1098 from your current loan servicer at the end of the year. The amount listed in Box 1 shows the amount of interest you paid.

- Copy of your closing disclosure. Youll receive a closing disclosure three business days prior to closing, which provides a breakdown of all the costs paid when your home was purchased.

- Copy of your loan application. Also called a uniform residential loan application, have a copy handy as added proof that the home you purchased was a primary residence or second home.

- Copies of home improvement expenses. Keep your invoice, receipts and work orders to prove you used your home equity loan funds for home improvements.

Don’t Miss: Who Do I Talk To About An Fha Loan

Rules On Deducting Home Equity Loan Heloc Or Second Mortgage Interest

The home mortgage interest deduction allows you to deduct interest paid on your home equity loan in a given year. Under the current guidelines, taxpayers who took out a home equity loan after Dec. 15, 2017, can deduct:

- The interest paid on up to $750,000 of their mortgage debt for married couples filing jointly if it was used to buy, build or improve their main home or second home

- The interest paid on up to $375,000 of their mortgage debt for married couples filing separately if it was used to buy, build or improve their main home or second home

Under these rules, you could potentially deduct home equity loan interest up to the maximum limits if you:

- Buy a primary residence or second home using a home equity loan

- Build a primary residence or second home using a home equity loan

- Make home improvements to your current primary residence or second home using a home equity loan

THINGS TO KNOW

Homebuyers will typically use a home equity loan to buy a home in one of the following scenarios:

In the first scenario, you can avoid mortgage insurance if you take out the first mortgage to 80% and finance another 10% with a home equity loan. This is also called a piggyback loan. Mortgage insurance protects lenders against losses on mortgages they make to homebuyers with less than a 20% down payment.

How Do You Claim A Home Equity Loan Tax Deduction

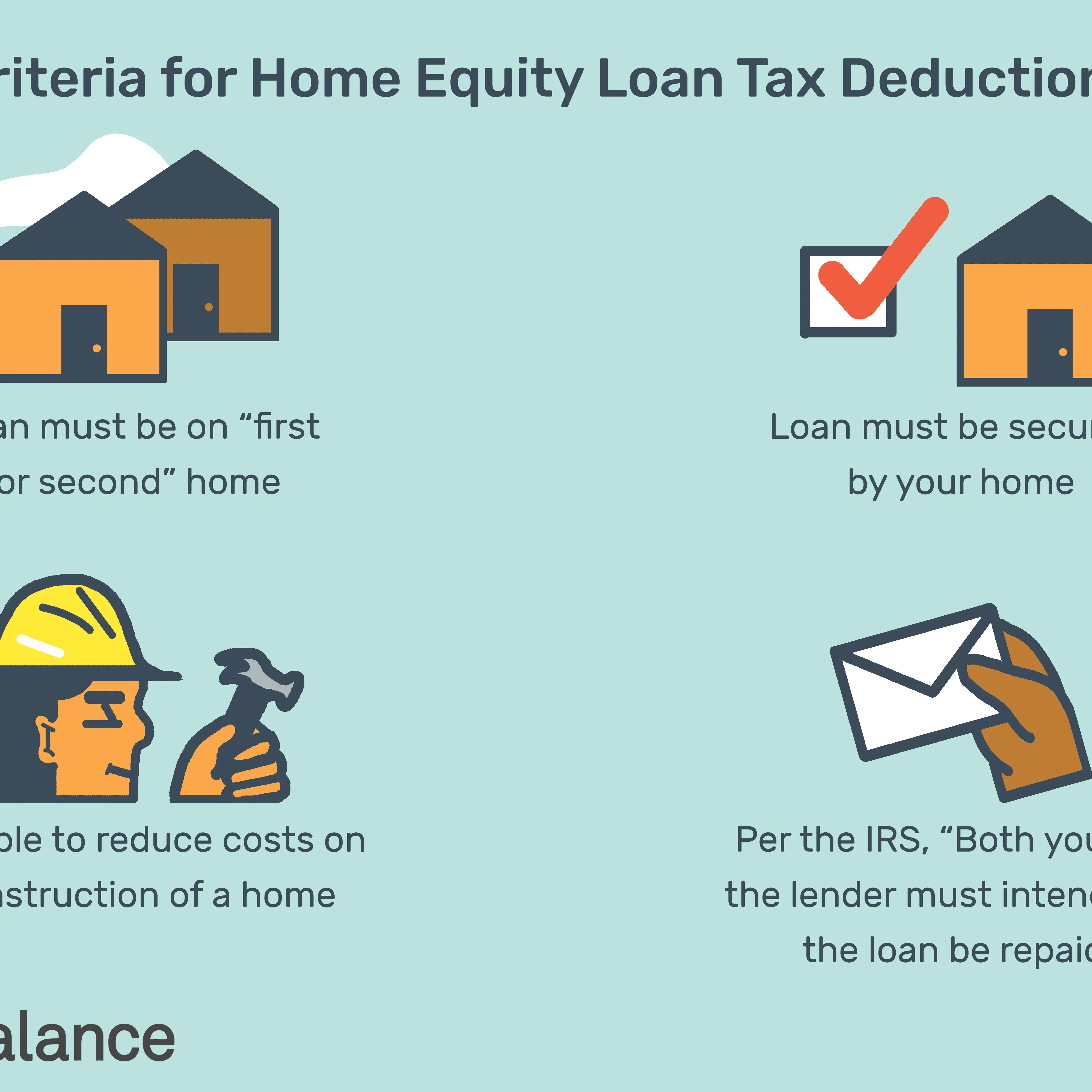

You must keep careful records to claim the home equity loan tax deduction. First, determine if your loans meet the IRS requirements, including:

- Both loans must not exceed the $750,000 limit

- The loans must be for your primary or secondary home

- The loans must be less than your homes value

- You must use the funds to buy, build, or improve a home

Read Also: Do Va Loans Have Pmi

Collect Your Mortgage Statements And Other Documents

You must prove how you used the funds to claim the interest deduction. Youll first need your mortgage statements to prove how much you borrowed. This is necessary to ensure youre within the limits imposed by the TCJA.

Next, you must have receipts, contracts, and any other documentation proving how you used the funds. For example, did you buy your house with them? Finally, show your Closing Disclosure and mortgage deed, and you can prove how you used the funds.

If you used the funds to renovate your home, youd need all receipts for materials, labor and any other costs incurred to renovate the property.

New Rules For Home Equity Tax Deductions

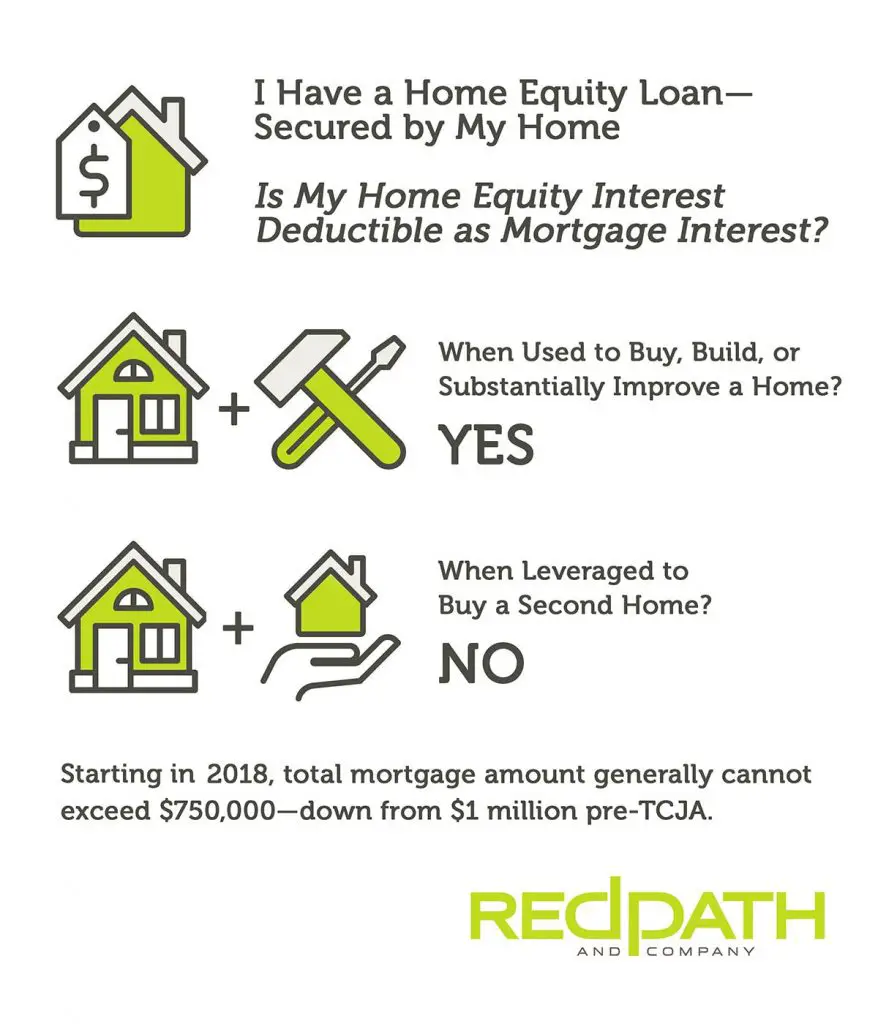

Since the tax law changed in 2017, the tax deductibility of interest on a HELOC or a home equity loan depends on how you are spending the loan funds. That applies to interest on loans that existed before the new tax legislation as well as on new loans. Heres how it works.

Interest on home equity debt is tax deductible if you use the funds for renovations to your homethe phrase is buy, build, or substantially improve. Whats more, you must spend the money on the property in which the equity is the source of the loan. If you meet the conditions, then interest is deductible on a loan of up to $750,000 .

Note that $750,000 is the total new limit for deductions on all residential debt. If you have a mortgage and home equity debt, what you owe on the mortgage will also come under the $750,000 limitif its a new mortgage. Older mortgages may be covered under the previous $1 million limit .

That gives people borrowing for renovations more benefits than before. Previously, interest was deductible on up to only $100,000 of home equity debt. However, you got that deduction no matter how you used the loanto pay off credit card debt or cover college costs, for example.

Currently, interest on home equity money that you borrow after 2017 is only tax deductible for buying, building, or improving properties. This law applies from 2018 until 2026. At that time, Congress may opt to change the rule once again.

You May Like: Where To Get An Fha Loan With Bad Credit

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

The interest paid on that home equity loan may still be tax deductible, in some cases.

Many taxpayers had feared that the new tax law the Tax Cuts and Jobs Act of 2017, enacted in December was the death knell for deducting interest from home equity loans and lines of credit. The loans are based on the equity in your home, and are secured by the property.

But the Internal Revenue Service, saying it was responding to many questions received from taxpayers and tax professionals, recently issued an advisory. According to the advisory, the new tax law suspends the deduction for home equity interest from 2018 to 2026 unless the loan is used to buy, build or substantially improve the home that secures the loan.

If you take out the loan to pay for things like an addition, a new roof or a kitchen renovation, you can still deduct the interest.

But if you use the money to pay off credit card debt or student loans or take a vacation the interest is no longer deductible.

The I.R.S. also noted that the new law sets a lower dollar limit on mortgages over all that qualify for the interest deduction. Beginning this year, taxpayers may deduct interest on just $750,000 in home loans. The limit applies to the combined total of loans used to buy, build or improve the taxpayers main home and second home.

Are Home Equity Loans Tax

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you borrow on your homes equity, there may be a bonus: The interest you pay each year is tax-deductible up to a government-imposed limit, as long as the borrowed money goes toward improving your home.

Don’t Miss: What Type Of Home Loan Should I Get

Rules For Deducting Home Equity Loan Interest

The changes introduced under the TCJA include a reduction of the cap on the mortgage interest deduction. The deduction can be claimed only for the interest paid on mortgage debt up to $750,000 if the loan was taken out after Dec. 15, 2017. The previous limit was $1 million. This cap also applies to home equity loans, home equity lines of credit , and second mortgages, but only under specific circumstances.

In February 2018, the IRS issued an advisory memo for taxpayers regarding the status of the home equity loan interest deduction under the new set of tax laws. This memo specified that interest on home equity loans, HELOCs, and second mortgages still might be deductible, as long as the loan is for an IRS-approved use. Specifically, these loans must be used to buy, build or substantially improve the taxpayers home that secures the loan for the interest to be deductible. Prior to the TCJA, there were no restrictions on how homeowners could use funds.

While the IRS did not include a list of expenses that would be covered under the laws provisions, their advice did include some examples of allowable home improvement expenses, such as building an addition to your home. Other purposes that qualify for the deduction if youre using a home equity loan or a HELOC include:

- Putting a new roof on the property

- Replacing your HVAC system

- Completing an extensive kitchen or bathroom remodeling project

- Resurfacing your driveway

Know Where You Stand With Your Mortgages

You’ll want to make sure the combined debt from your first mortgage and your home equity loan, which is your second mortgage, meets IRS requirements and doesn’t exceed $750,000 or $1 million for joint filers, or $375,000 or $500,000 for single filers, depending on whether you took out your loan before or after 2018. You also need to make sure that you’re borrowing against a qualified residence, which should be either your primary or second home, and that the funds were used to increase the value of your property through renovations or upgrades such as a new roof.

Read Also: How Much To Mortgage Loan Officers Make

Irs Clarification: Home Equity Loan Interest May Still Be Deductible

PKS CPA

The IRS recently announced that in many cases, taxpayers can continue to deduct interest paid on home equity loans. The tax agency issued the clarification because there were questions and concerns that such expenses were no longer deductible under the Tax Cuts and Jobs Act , which was signed into law on December 22, 2017.

Background Basics

Taxpayers can deduct interest on mortgage debt thats acquisition debt under the tax law. Acquisition debt means debt that is:

1. Secured by the taxpayers principal home and/or a second home, and

2. Incurred in acquiring, constructing, or substantially improving the home. This rule hasnt been changed by the TCJA.

Under prior law, the maximum amount that was treated as acquisition debt for the purpose of deducting interest was $1 million . This meant that a taxpayer could deduct interest on no more than $1 million of acquisition debt. Taxpayers could also deduct interest on home equity debt. Home equity debt, as specially defined for purposes of the mortgage interest deduction, meant debt that:

- Was secured by the taxpayers home, and

- Wasnt acquisition indebtedness.

Under the TCJA, for tax years beginning after December 31, 2017 and before January 1, 2026, theres no longer a deduction for interest on home equity debt. The elimination of the deduction for interest on home equity debt applies regardless of when the home equity debt was incurred.

New Release

In its release, the IRS provided the following examples:

How To Claim The Home Equity Interest Deduction

If you own a home and are planning to claim the home equity loan interest deduction, there are a few things to remember:

First, the money must be used for home improvements or renovations. For example, you cannot take the deduction if you are using home equity proceeds to pay for personal expenditures or to consolidate credit card debt. The same goes if you are taking out a loan and letting the money sit in the bank as your emergency fund. Whats more, the renovations have to be made on the property on which you are taking out the home equity loan. You cannot, for example, take out a loan on your primary residence and use the money to renovate your cottage at the lake.

Next, youll want to keep proper records of your expenses. The odds of being audited by the Internal Revenue Service are generally low, but you do not want to take any chances. If you plan to use a home equity loan or a HELOC to pay for home repairs or upgrades, be sure to keep receipts for everything that you spend and bank statements showing where the money went.

Finally, remember that this deduction is not unlimited. You can deduct the interest on up to $750,000 in home loan debts if the loans were made after Dec. 15, 2017. If your total mortgage debt is higher than that, then you wont be able to deduct all of the combined interest paid. The $1 million cap applies for mortgages obtained before that date.

Also Check: When Will I Pay Off My Student Loan Calculator

Not All Home Equity Loan Interest Is Deductible

Depending on when the loan originated, the IRS allows interest deductions on up to $750,000 or $1 million in mortgage debt . That limit applies to the combined amount of all loans secured by a qualifying property whether they are first or second mortgages.

For 2021, you can deduct the interest paid on home equity proceeds used only to buy, build or substantially improve a taxpayers home that secures the loan, the IRS says.

That rule went into effect for the 2018 tax year and was a big change from prior years, when you could deduct the interest regardless of what you used the money for.

Collateral In Your Home

It’s likely that your mortgage lender has a security interest in your home as collateral for repayment of the loan. This security interest generally allows the bank to remain on the title to your home. As long as the mortgage document you sign includes this type of security interest, then you may be eligible to deduct your interest payments.

When checking your mortgage document, it may either expressly state this or will provide that in the event you default on mortgage payments, the bank can foreclose on your home and apply all sale proceeds to the outstanding mortgage balance. However, if you use a credit card to subsidize the purchase of your home, these interest payments are not deductible since the credit card company doesn’t have any security interest in your home.

Recommended Reading: How To Qualify For 500k Home Loan

What Is The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 reformed the individual income and corporate tax codes. Some of the key changes instituted by the Act affecting individual taxpayers include:

- A reduction of the top marginal tax rate from 39.6% to 37%

- Elimination of personal exemptions

- Substantial increases to standard deductions

- Expansion of the Child Tax Credit

- Increases to the estate tax exemption

- Caps on state and local tax deductions

- Caps on mortgage interest deductions, including interest paid on home equity loans

While the Tax Cuts and Jobs Act included some permanent changes to the tax code for businesses, many of the provisions for individual taxpayers are set to expire after 2025.

So, is home equity loan interest tax-deductible in 2021 and beyond? The short answer is, it depends.

Dont Miss: Personal Loans With Lowest Interest Rates

Should I Get A Home Equity Line Of Credit Or A Home Equity Loan For The Tax Deduction

If you need a large amount of cash specifically to fund either an improvement or a repair on your primary residence, and if you are already itemizing your deductions, then a home equity line of credit or a home equity loan is probably an economically sound choice. If you are on the fence about a property remodel, then borrowing against your home just to take advantage of deducting the interest is probably not your best choice.

Recommended Reading: What To Do If Your Home Loan Is Denied