Final Thoughts On Auto Loan Refinancing

Any of the lenders on our list are a good place to look for auto loan refinancing. But they arent the only lenders to consider. Be sure to visit local banks and credit unions to discuss your auto refinancing options. It can be more of a hassle to visit banks in person, but you have the advantage of being able to speak face-to-face with an expert who can walk you through your options.

If youd prefer to see multiple refinance auto loan offers at once, you can do so by clicking below or visiting AutoCreditExpress.com.

Your Credit Score Has Improved

Your credit score is very important in car finance, as auto lenders sort applications by credit tiers. The APR you get, as well as whether you even receive an offer, are both largely determined by the credit tier youre in. If your credit score has improved since you initially purchased the vehicle and youve moved up a tier, then its likely youll qualify for a better financing deal. Heres how you could improve your credit score.

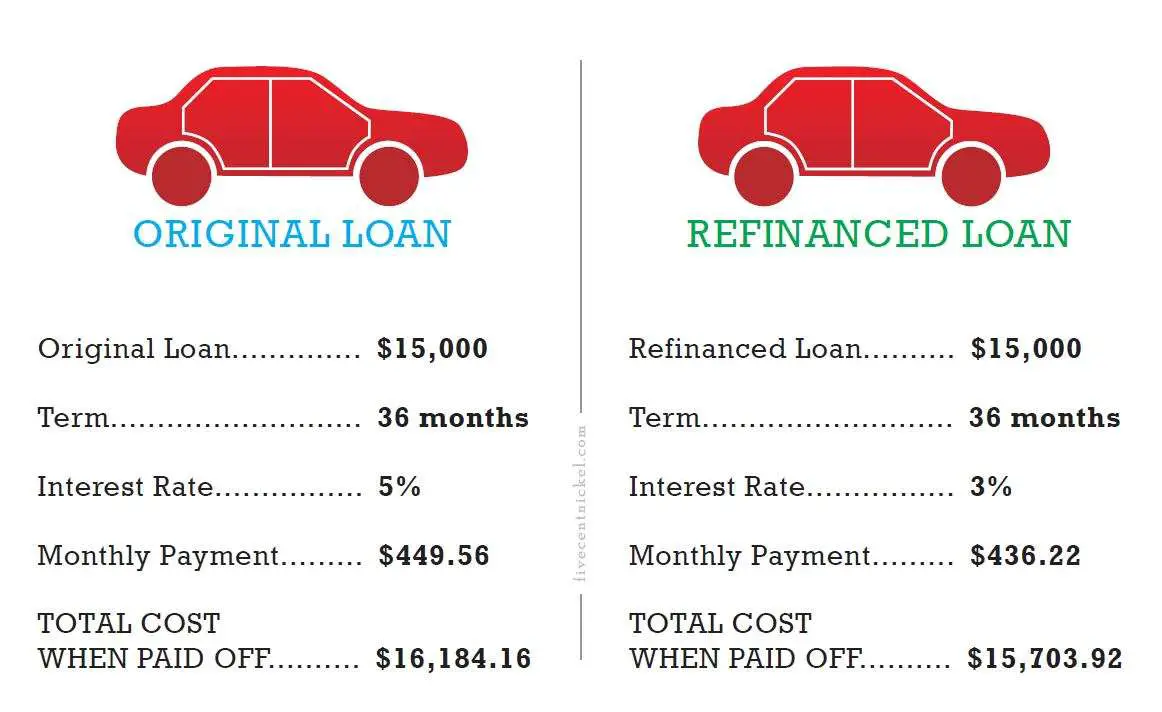

Getting a better APR could save you quite a bit in interest over the life of your loan. For example, refinancing $15,000 from a 7% rate to 5% when making a monthly payment of a couple of hundred dollars would save you around $800 in interest.

Heres how much you would pay in interest over the life of a 5-year loan if you borrowed $25,000, based on the APRs for closed auto loans by credit score on the LendingTree platform in the first half of 2021.

| Lifetime Interest Charges on a $25,000 Loan |

| $11,733 |

Pros Of Refinancing An Auto Loan

- Lower interest rate: One of the best reasons to refinance a car loan is to lower your interest rate. A lower interest rate can help you save money on the cost of the loan over time. If you previously had bad credit or even no credit and your credit has since improved, it can be worth looking into refinancing your auto loan to see if you may now qualify for a better interest rate. Or, rates in general may be lower than when you originally purchased the vehicle. If the rate you could qualify for is 1% or more lower than the rate you are currently paying, consider refinancing. A significantly lower interest rate will help you pay your loan off faster.

- Lower monthly payments: If you need to free up more room in your monthly budget, refinancing your auto loan can help you reduce your monthly expenses by extending the loan. Lengthening the life of the loan by 1-2 years can significantly lower your monthly payment. Even though it will take longer to pay off the loan in the long run, and you will pay more interest over the life of the loan, it will give you the needed wiggle room in your monthly finances in the short term.

Also Check: Is Jumbo Loan Rates Higher

When Can You Refinance

You do not need to wait any minimum amount of time before refinancing your car loan. You just have to meet all the requirements for the new loan to refinance. Refinancing is possible immediately after buyingeven before you make your first monthly payment. Just be sure that you actually end up with a better deal, and that refinancing doesnt cause you to pay more for your vehicle.

In some cases, you may be unable to refinance until you have documentation from your states Division of Motor Vehicles . Gathering registration details may slow you down somewhat.

Refinance Rates Are Down Across The Board

The lower the interest rate on your mortgage, the lower your monthly payment will be. If refinance rates have dropped due to market conditions, it could pay to apply for a new mortgage.

Say you’re able to refinance from a $100,000, 30-year fixed mortgage at 3.75% to the same loan with an interest rate of 2.75%. By refinancing, your mortgage payment will go down by $54.64 a month. You’ll also save $19,670 in interest over the life of your loan.

To see how much refinancing might save you, use our mortgage calculator to run the numbers based on your specific loan balance and term.

You May Like: When Do Student Loan Payments Start After Graduation

You Want To Shorten Your Loan Term To Pay Off Your Home Sooner

Refinancing will often lower your monthly mortgage payment, but not always. If you refinance from a 30-year loan to a 15-year mortgage, you’re likely to find that your monthly payment goes up, because you’re now paying off your home in half the time. However, you could still reap major savings on interest throughout the life of your repayment period.

Usually, you’ll get a lower interest rate on a 15-year mortgage than you will for a 30-year loan. Going back to our example above, refinancing that $100,000 mortgage to a 15-year loan at 2.35% will raise your monthly payment by $197.06 rather than lower it. But you’ll also enjoy $47,825 in interest savings by repaying your mortgage loan in 15 years instead of 30. And, you’ll be clear of your mortgage debt sooner. That’s important if you’re aiming to have your home paid off in time for a specific milestone, like retirement.

For more on refinancing to a 15-year mortgage, check out our guide on the topic.

What Happens When You Refinance A Car Loan

Refinancing a car loan involves taking on a new loan to pay off the balance of your existing car loan. People generally refinance their auto loans to save money, as refinancing could score you a lower interest rate. As a result, it could decrease your monthly payments and free up cash for other financial obligations.

Recommended Reading: How Long Does It Take To Get Student Loan Money

You Want To Change The Loan Term

It also makes sense to refinance your car loan when you need a lower monthly payment. You could extend the length of the loan on your car refinance to get a lower payment. Still, its important to note that extending the length of your loan, which is known as the loan term, reduces your payment but also increases the amount of interest youll pay over time. And it works the other way, too: Reduce the term, and your monthly payment will increase while the amount of interest you pay overall will fall.

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

Read Also: What Is The Lowest Car Loan Rate

Getting Your Credit In Shape For Auto Refinancing

When seeking auto refinancing or applying for any credit or loan, it’s wise to review your credit reports and check your credit score to know where you stand as an applicant. You can get a free credit report from all three consumer credit bureaus by visiting AnnualCreditReport.com. You can also get a free copy of your Experian credit report every 30 days.

As you research your loan options, you can also take steps to increase your credit score quickly, with the best tactics for fast improvement being:

- Paying down high credit card balances, ideally getting all balances down to 30% or less of the cards’ borrowing limits.

- Consider enrolling in Experian Boost, which applies your record of cellphone, cable and other utility payments to your Experian credit report and can help increase FICO® Scores based on Experian data.

- Continuing to make all your debt payments on time.

Refinancing a car can save you money over the long term, reduce your monthly payments to ease your household budget. Experian partner RateGenius can help you better understand your auto loan refinance options. Shop around for lenders and do your best to put forward the best credit scores you can get, and you could drive home a great deal.

Who Does Car Financing Suit

Financing a car can be worth it for people in certain situations. Generally, there are many people who can afford to have a car but wont buy it outright.

If you are looking to own a car that you can use on a daily basis and you have a full-time job with a regular salary and a good credit history, choosing car financing will be right for you. Car financing is the best way to get you on the road but you dont have thousands of dollars to spare right now to pay for the car outright.

You May Like: How To Lower Car Loan Payments

Why Refinancing A Car Could Be A Bad Idea

- You may not save that much:;

As mentioned above, car loan rates have remained low over the last five years with minimal movement. So, you may not end up shaving off that much by refinancing, like you would with a mortgage, as terms are shorter, between one to 10 years. This means that the period of time to save is a lot less. So overall it may end up only being a few hundred dollars – which could be the cost of applying for a new loan anyway.;Take this for example: say you have three years left on your six-year car loan with $30,000 remaining. Your original car loan rate was 7.82%, if you kept this rate, you would pay $938 per month and $3,754 in interest overall. If you refinanced from a loan with a 6.68% rate, youâd pay $922 and $3,189 in interest. Thatâs a savings of $16 per month and $565 in interest.;Currently on the Mozo database, application or establishment costs for car loans range between $0 and $995. So the saving may be even less if you need to front up a fee.;

- Refinancing new to used:;

If you are planning on refinancing a new car loan, itâs likely that youâd have to refinance to a used car loan – as your car is no longer new. Generally, used car loans come with higher interest rates than new car loans, so you may not be able to find a lower rate.;For example, the average variable new car loan rate sits at 6.33% on the Mozo database. On the other hand, the average for used vehicles is 6.83%.

When Is It A Bad Idea To Refinance A Car Loan

An auto loan refinance can be a smart way to save money, but there are several circumstances in which it may not make sense:

- If interest rates have increased since you took out your original car loan, it may be impossible to get a better financing rate, even if your credit scores have also improved in the interim.

- If you’ve paid off the majority of your car loan, the benefits of refinancing may be negligible, as origination fees on the new loan could offset the savings you’d get by refinancing just 12 to 18 months of payments.

- If you purchased your car new or near new and have since logged exceptionally high mileage, or if it’s been damaged in a crash, flood or other mishap that’ll significantly reduce its resale value, you may not be able to get a loan that covers what you owe on the original loan.

Finally, a strategic consideration: If you’re planning to seek a mortgage or other large loan in the next six to 12 months, it’s wise to refrain from applying for any credit, including auto refinancing, that could cause a dip in your credit score. Avoiding new credit applications can help you present your best possible credit score when you submit your mortgage application.

You May Like: What To Do If Lender Rejects Your Loan Application

Your Credit Score Increased

The interest rate you qualify for is directly impacted by your credit score. Your credit score could range from 300-850, 850 being the goal.

Heres how lenders interpret your score.

300-629: Bad credit

630-689: Fair or average credit

690-719: Good credit

720-850: Excellent credit

The higher your score, the lower auto loan interest rate youll qualify for. The lower the rate, the less money youll pay. The average Americans score is currently 695.

Your credit score can change for the better over a relatively short period of time. Perhaps opening an installment loan, like the auto loan, raised the score. Or maybe a longer history of on-time payments caused the rise. Or maybe you read our article, Use these 7 Hacks to Repair and Raise Your Credit Score and are now seeing the benefits.

If your credit score is higher than when you originally applied for an auto loan, it could be beneficial to refinance if you qualify for a significantly lower interest rate!

Should You Refinance Your Car

Whether you should refinance your car loan depends on your situation.

Here’s when it’s beneficial to refinance your auto loan:

- If interest rates have dropped. Refinancing into a lower rate can reduce the overall interest costs on your loan.

- If you want to lower your monthly payments. Getting a new loan can help you free up cash for bills and other costs.

- Your credit has improved since you purchased the vehicle. If your credit score has jumped up since you first purchased your vehicle, you might be able to get a better loan.

Here’s when it’s not beneficial to refinance your auto loan:

- If you’re going into negative equity. You don’t want to owe more on the car than it’s worth. If refinancing will put you upside-down on your car loan, consider other options.

- Extending the loan term. Lengthening the term of your car loan typically will cause you to pay more interest over the life of the loan and more for your car. Though longer terms can lower your monthly payment, long-term loans are generally more expensive.

Refinancing your auto loan can help you decrease your payments and the amount of interest you pay over the life of the loan. But whether you should refinance depends on your situation. If you decide that refinancing is the right move for you, seek out a lender and loan terms that meet your needs and help improve your overall financial picture.

Read Also: Who Can Qualify For An Fha Loan

Time Remaining On Your Loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

If your answer to When should I refinance my car loan? is Soon, review our current refinance rates and take a look at our auto loan refinance calculator to get a better understanding of whether refinancing makes sense for you.

You may also like

You Bought The Car Less Than 6 Months Ago

While technically you could refinance your car as soon as you buy it, its best to wait at least six months to a year to give your credit score time to recover after taking out the first car loan, build up a payment history and catch up on any depreciation that occurred when you purchased. Unless there are other reasons to refinance, its unlikely youll get a lower rate than what you currently have.

Its vital to know you can afford a new car before you make the initial purchase. If you have any doubt about your ability to make the payments, youre better off not making the purchase and looking for an alternative.

You May Like: How To Find Student Loan Interest

Reduce Your Interest Rate

One of the best reasons to refinance a car loan is if you have an opportunity to reduce your interest rate. If you previously had no credit or bad credit, it is worth checking into refinancing your car loan after a couple of years to see if you receive better offers. Your credit score may have improved enough to qualify you for a lower interest rate. With a lower interest rate, you will be able to pay off your loan faster or lower your monthly payment while paying it off at the same pace. In either case, you’ll pay less over the life of the loan.

You Want To Lower Monthly Payments

This is an excellent reason to revisit the terms of your finance agreement, especially if your financial situation has changed since you bought your automobile

A booming economy means more jobs, better pay, and higher interest rates all around. But an economic downturn heralds just the opposite

So if you are one of the many still suffering from the Great Recession, why wouldn’t you lower your monthly expenses by speaking with a lender about renegotiating the terms of your auto payments for the remainder of the contract?

Whether you have simply realized how low interest rates have dropped and you want to take advantage or you truly need lower payments in order to live within your means, taking a second look at your contract for repayment would be wise.

Don’t Miss: Which Bank Gives Loan For Land Purchase

After Youve Been Approved

Once youre approved with several different lenders, compare the various offers carefully. The most important factor is the annual percentage rate and total interest paid over the life of the loan. The APR includes the interest rates and any fees, including the lender and title fees. A lower APR means youll pay less in fees and interest.

You may be approved for several different interest rates and loan terms. Loans with longer repayment terms generally have higher interest rates and lower monthly payments. A loan with a shorter term means youll have higher monthly payments and a lower interest rate.

Look at your budget and decide how much you can comfortably afford each month. Remember, you can also make extra payments on the loan if you choose a lender that doesnt charge a prepayment penalty.

After you select the lender, youll have to finalize the car loan. The new lender is responsible for paying off the loan balance from the old lender, but its a good idea to double-check that this goes through correctly. Its also important not to fall behind on your car payments during this transfer process. Once the first lender is paid off by the new lender, they should return any extra payments you made during that window.

Once the loan is paid off, you can start making payments to your new lender. Consider setting up automatic payments so you dont have to worry about remembering your new due date.