What Do Loan Processors Do In Short Everything To Close Your Loan

Ive already covered the mortgage underwriters role, so lets take a look at what loan processors do seeing that theyre also key to getting your loan closed in a timely fashion.

Once a loan is originated by the mortgage broker or loan officer, the corresponding paperwork is sent along to a loan processor.

The loan processor is responsible for prepping and organizing the file and getting it over to the bank or mortgage lender for approval.

Key Responsibilities Of A Mortgage Loan Processor

A mortgage processors primary duty is to ensure the proper documentation is included in a loan file and that the borrower meets the requirements for the loan program they want. Most loan processors will perform some or all of the following seven functions:

Occupational Employment And Wage Statistics

The Occupational Employment and Wage Statistics program produces employment and wage estimates annually for over 800 occupations. These estimates are available for the nation as a whole, for individual states, and for metropolitan and nonmetropolitan areas. The link below go to OEWS data maps for employment and wages by state and area.

Recommended Reading: Do You Pay Taxes On Home Equity Loan

The Bottom Line: Mortgage Loan Processors Help You Reach Closing Day

Just like underwriters and loan officers, mortgage processors are a crucial part of the mortgage process. Working with a mortgage processor can help you get everything in order for underwriting and keep your application on course for closing.

Ready to get your financing in order? Get approved now to start the process.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Provide Suggestions For Improving Qualifications

Though a loan officer cant make any issues in your credit history disappear, they can offer suggestions for how you can improve your credit and other qualifications for loan approval. Advice a loan officer gives you could potentially be the difference between getting approved or denied for a loan.

Even if you arent approved for the loan you applied for, following a loan officers suggestions can improve your odds of being approved when you apply for a mortgage again. A loan officer knows the ins and outs of loans and what makes an applicant get approved or denied, so take their suggestions seriously and implement them to increase your odds of getting approved for a loan.

You May Like: How Much Auto Loan Will I Qualify For

Loan Processors Confirm Your Information

Once the loan processor has your documentation, they verify everything. This may include:

- Sending your employer a written Verification of Employment if there are any questions about your income, dates of employment, or any other employment detail

- Sending a written Verification of Deposit to your bank to verify your bank account details

If the underwriter has any question about your qualifying factors, he/she may ask the processor to get a Letter of Explanation from you.

An LOX is written documentation about a situation, such as a gap in employment, decreasing income, or a large deposit.

The LOX is an official statement from you explaining the situation and why it happened. You should include any documentation with it that proves your side of the story.

You May Spend More Time Working With The Processor

- Its common to talk more with the processor than with the loan officer or broker

- Once you submit your loan application they may be your main point of contact

- Since LOs/brokers have to spend more time selling and finding new prospects

- The good news is processors are often very knowledgeable and hardworking

While the loan officer or broker may be the person who got you the loan to begin with, its the processor that will likely take over once youve been sold.

That sold part is pretty important because loan processors arent supposed to offer or negotiate mortgage rates or loan terms. Their role is to assist the originator, whose job it is to sell the rate/product, and organize the loan file.

However, some processors are actually more knowledgeable than the more sales-oriented loan officers because they handle more volume and may have more years of mortgage experience under their belt.

If the loan is originated via the wholesale channel , there are essentially two loan processors working together on the file.

One who works on behalf of the mortgage broker and one that works at the bank, typically referred to as an Account Manager .

The loan processor who works with the broker will essentially send conditions to the AM that works at the bank so they can be signed off.

If the loan is originated via the retail channel, the AM will work with the loan officer at the bank to get the conditions cleared.

Read Also: What’s The Home Loan Interest Rate

Loan Originator Vs Processor

Financing the purchase of a home is often a complex and confusing task. Fortunately, there are professionals whose sole job is to help you through the lending process, such as loan originators and loan processors. Working with mortgage experts can ensure you dont make any mistakes while finding the most suitable mortgage for your needs and wallet. While loan originators help borrowers get mortgages, loan processors administrate paperwork for a loan. Heres a breakdown of what each one does in the loan process.

For help with figuring out how to make sense of your own loans, consider working with a financial advisor.

Mortgage Processor Defined Plus How To Become One

A mortgage processor, or loan processor, is responsible for assembling, administering and processing your loan application paperwork before it gets approved by the loan underwriter. They play a key role in getting your mortgage loan request to the final close.

Home buying statistics show that about 26% of home buyers cite paying down debt as the largest struggle when it comes to affording their first home. If youre currently planning on buying a home or youre in the process of doing so, its important to know what the responsibilities of a mortgage processor are and what they will provide during these crucial steps.

Also Check: Can Parent Claim Student Loan Interest For Non Dependent

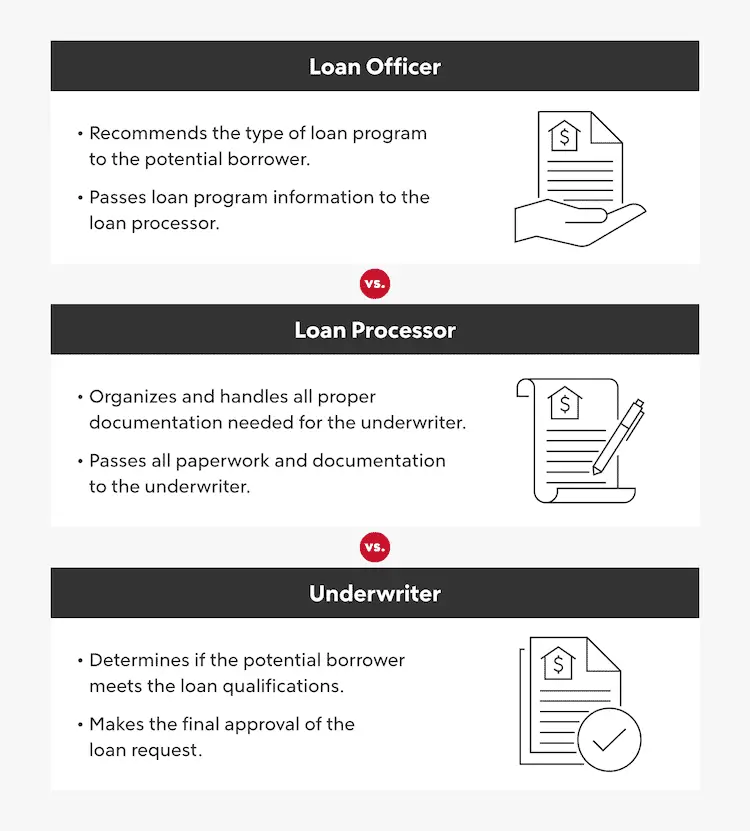

Loan Officer Vs Loan Processor

Here are the main differences between a loan officer and a loan processor.

Job Duties

A loan processor may have more varied duties than a loan officer. While a loan officers primary responsibility is to evaluate applications and determine whether or not to approve them, a processor may also help an applicant complete their application. This can include tasks like checking documentation or contacting third parties for additional information.

A loan officers job duties are more focused on the actual evaluation of an application. They use their expertise in lending practices to determine whether or not an applicant is likely to repay their loan. A loan officer may also be responsible for training other employees who work with applicants.

Job Requirements

Loan officers and loan processors typically need at least a bachelors degree to enter the field. However, some employers may prefer candidates with a masters degree in business administration or another related field. Additionally, loan officers must be licensed by the state they plan to work in. To obtain a license, loan officers must pass an exam that tests their knowledge of banking regulations and financial laws. Some states also require loan officers to complete continuing education courses to renew their licenses.

Work Environment

Skills

Salary

Loan Originators Vs Loan Processor

Essentially, a loan originator shepherds your loan from the application to the closing table. They work directly with loan underwriters to complete your loan approval. Whereas the loan processors assist the loan originator with the paperwork involved in the lending process. They organize and handle all of the documents the underwriters require.

Once the loan originator helps the borrower determine the best type of mortgage for their situation and pinpoints loans terms, type and size, all of the documents and information will go to the loan processor to manage the paperwork for the underwriter. In other words, the mortgage processor acts as the middleman for the loan originator and the loan underwriter.

You May Like: How To Get Loan Officer License In California

What Are The Licensing Requirements For Mortgage Loan Originators

Becoming a mortgage loan originator requires either obtaining a state license or being federally registered as an MLO.

In order to obtain federal registration, the individual has to be an employee of a depository institution , or an employee of an institution overseen by the Farm Credit Administration. MLO federal registrations are recorded in the Nationwide Mortgage Licensing System and Registry . You can visit the NMLS consumer database to confirm your MLOs registration.

State licensing requirements vary slightly, but typically involve providing fingerprints for an FBI criminal history background check, undergoing a credit report check, taking NMLS pre-licensure education courses and then passing an exam.

How To Become A Loan Processor

The key to becoming a loan processor is developing a skill set that is diversified and works well in the financial industry. Gaining as much experience as possible through on-the-job training sessions and online financial courses will set you up to be more of an appealing hire. Lets review the steps you should take to become a loan processor:

Step 1:Earn a high school diploma. This is usually a minimum educational requirement at many loan companies.

Step 2:Earn a higher-level degree. Its highly recommended to graduate with at least an associate degree in a related subject, like finance, banking or business. This allows you to have the basic concepts of financial management and banking practices down.

Step 3: Receive your mortgage license. Youll need to take the NMLS Mortgage Education pre-training and pass the Mortgage License National Test to receive your mortgage license. This process will depend on the state that you reside in.

Step 4: Obtain employment. A loan processor works at places like credit unions, mortgage lenders and banks. From there, youll want to receive on-the-job training. Its recommended to obtain computer software, communication and information processing skills.

Step 5:Work your way up. The longer you stay in the field, the easier it will be to advance in financial positions.

The salaries listed below do not represent salary estimates from Rocket Mortgage® and were pulled from the Bureau of Labor Statistics for educational purposes only.

Also Check: Can Student Loan Interest Be Deducted In 2020

How To Become A Loan Processor With Our Loan Processor Training Courses

What Is A Loan Processor? What Does A Loan Processor Do?

- Organizing the loan application’s documentation and makes sure it is in order

- Reviewing the loan package as given by the lender for completeness and accuracy

- Verifying the borrower’s credit history in terms of debts and payments

- Checking appraisal and property issues requiring further justifications

- Determining if the application and ensuring requirements and paperwork comply with the lender’s standards

- Contacting the borrower if information is missing or if additional information or documentation is required

How Are Mortgage Brokers Paid

Mortgage Brokers are paid through commissions and fees, often charging around 1-2% of the loan amount. This commission will be added to the loan amount or paid upfront by the borrower or the lender, and it is negotiable. Mortgage Brokers are required to disclose all fees upfront, and theyre only able to charge the amount disclosed. Unless they are paid upfront, Mortgage Brokers are often paid after the deal is closed.

For example, a Broker sells a $500,000 loan. With their 1-2% fee, they stand to earn $5,000-$10,000 on that loan.

In July of 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was put in place to overhaul financial regulation in response to the Great Recession. This Act restructured how Mortgage Brokers are paid and put laws in place to protect clients, who previously had very little protection. Within the Dodd-Frank Act you can find Title XIV, the Mortgage Reform and Anti-Predatory Lending Act, which states that Mortgage Brokers cannot:

- Charge hidden fees

- Tie their pay to the loans interest rate

- Be paid by both the borrower and the lender

- Receive compensation for directing clients toward an affiliated business

Don’t Miss: What Is The Current Average Auto Loan Interest Rate

Loan Officer/loan Processor Responsibilities

Here are examples of responsibilities from real loan officer/loan processor resumes representing typical tasks they are likely to perform in their roles.

- Develop marketing materials, maintain database and website, create and manage company spreadsheets and pipelines.

- Comply with all of RESPA’s requirements and guidelines.

- Prepare all RESPA documents and make sure loans are in compliance.

- Originate conventional, FHA, and VA loans as a correspondent lender for loans to be sell on the secondary market.

- Administer thorough review and research and enable validation of mortgage documents ensuring accuracy for the execution of foreclosure affidavits.

- Register FHA/VA and conventional loans on the automated origination system.

- Process GNMA, FHA, FNMA/FHLMC.

- Establish positive communication skills necessary to draw interest from industry affiliates thus providing continuous lender recognition for employer.

What Is A Mortgage Loan Originator

A mortgage loan originator, or MLO sometimes just known as a loan originator is an individual or entity integral to the mortgage loan origination process, or the initiation of a loan. From making first contact with the originator, to getting preapproved, to applying for a loan and on through to closing, the loan originator will help you move through the process as smoothly as possible.

Mortgage loan originators can work for a big bank, a credit union or other lending institution, large or small. It depends on where they work, but many are compensated based on commission.

Don’t Miss: How To Estimate Pre Approval For Home Loan

Loan Processors Are Very Important

- Loan processors assist mortgage brokers and loan officers

- And looking out for any red flags along the way

- Before submitting the loan file to the underwriter

Loan processors dont just grab the loan file and submit it they double-check everything like debt-to-income ratios and employment information to ensure the file will actually be approved.

For this reason, they play a critical role in the loan approval process, as mistakes made by the loan originator could be caught and corrected before the file lands in the unforgiving hands of an underwriter.

After all, once it gets to the underwriter theres no going back. Sure, you can fix some things, but not without a lot of red tape.

Assuming the loan is approved, the processor will receive a list of prior-to-document conditions that must be met before loan documents are released by the bank.

It is the processors job to work with the loan originator, title and escrow companies, and various others to get all the necessary paperwork to fulfill those conditions and things can get very complicated in no time at all.

What Training Is Required For A Loan Processor

Loan processing, fraud detection, and policy training may be required. Overall, most of a loan processors training will be done on the job. If an employer does require certifications or education beyond a high school diploma, they may allow a new loan processor to complete the additional requirements over time.

Recommended Reading: How To Figure Student Loan Payments

How Many Hours Do You Need To Be A Loan Processor

Loan Processors are now the only professionals in this industry that are needed to be licensed, as per the BLS. The job applicants must pass twenty hours of training and background checks while undertaking a written exam to obtain the license. Loan Processors should also maintain their license by obtaining continuous education credits regularly.

What Is A Mortgage Broker

A Mortgage Broker acts as a middleman between the homebuyer and lender, and they must sell all originated loans on behalf of individuals or businesses. They sell mortgages through several investors or banks, operating on a commission and fee basis only. A Mortgage Broker will take a loan application and send it out to several possible financial institutions or mortgage companies before choosing the best offer. Traditionally, banks and other mortgage lending institutions have sold their own products, but as the market for mortgages has become more competitive, the role of the Mortgage Broker has become more popular. Mortgage Brokers are always employed by a brokerage and not a bank, making them unable to approve or deny a loan.

Don’t Miss: How To Get Approved For Commercial Loan

How Can I Become A Loan Officer

You can become a loan officer with no experience.You can go to a mortgage broker school and get a license and learn the business on the job. I can tell you that i have been doing this for about 20 years and it is a constant learning process as things change in the industry almost daily. There is tremendous opportunity in this business to make a good living and what is more important is helping people with the biggest purchase that they will ever make.