How Do You Calculate Monthly Payments On Student Loans

Your monthly payments depend on several factors, including the interest rate on your loans, your loan term, and your principal loan balance.

Some repayment plans also have fixed monthly payments for example, the minimum payment for most federal student loans on the standard repayment plan is typically $50 per month.

Keep in mind that if you sign up for an income-driven repayment plan, your monthly payments will also be based on your discretionary income.

Tip:

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

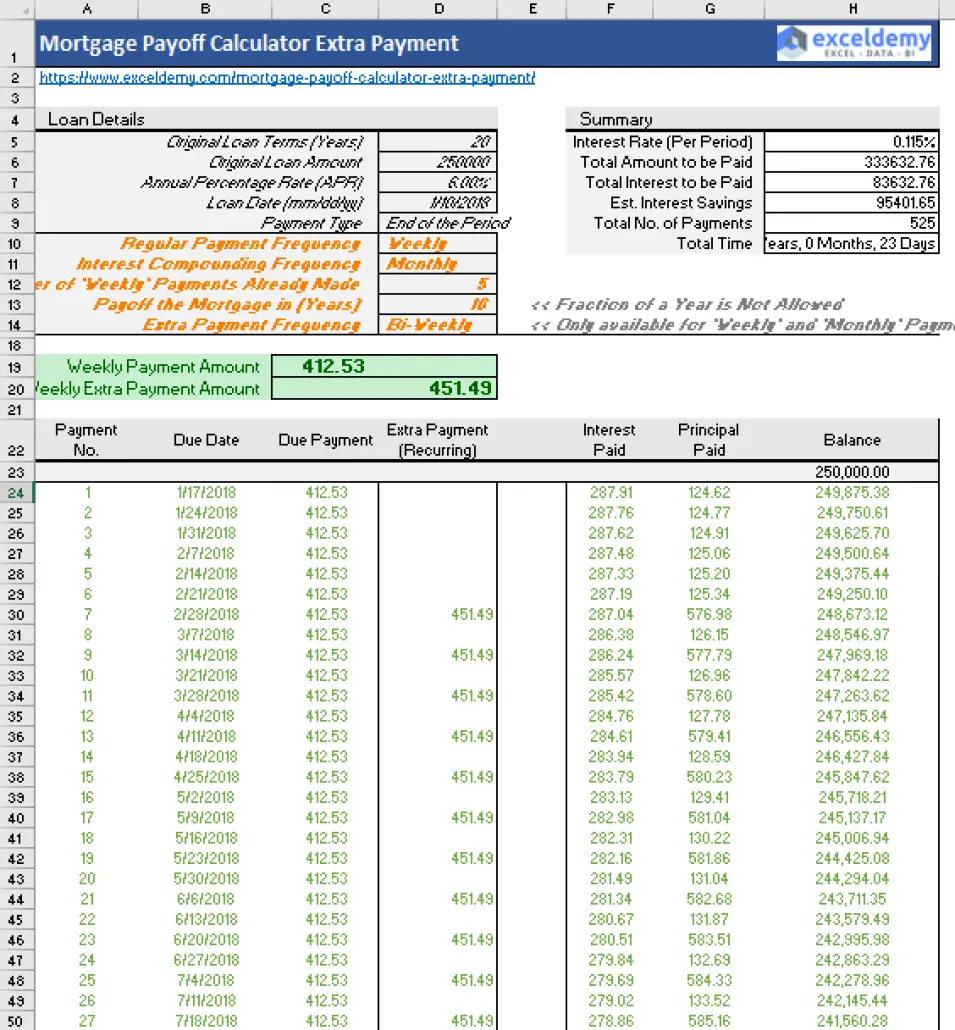

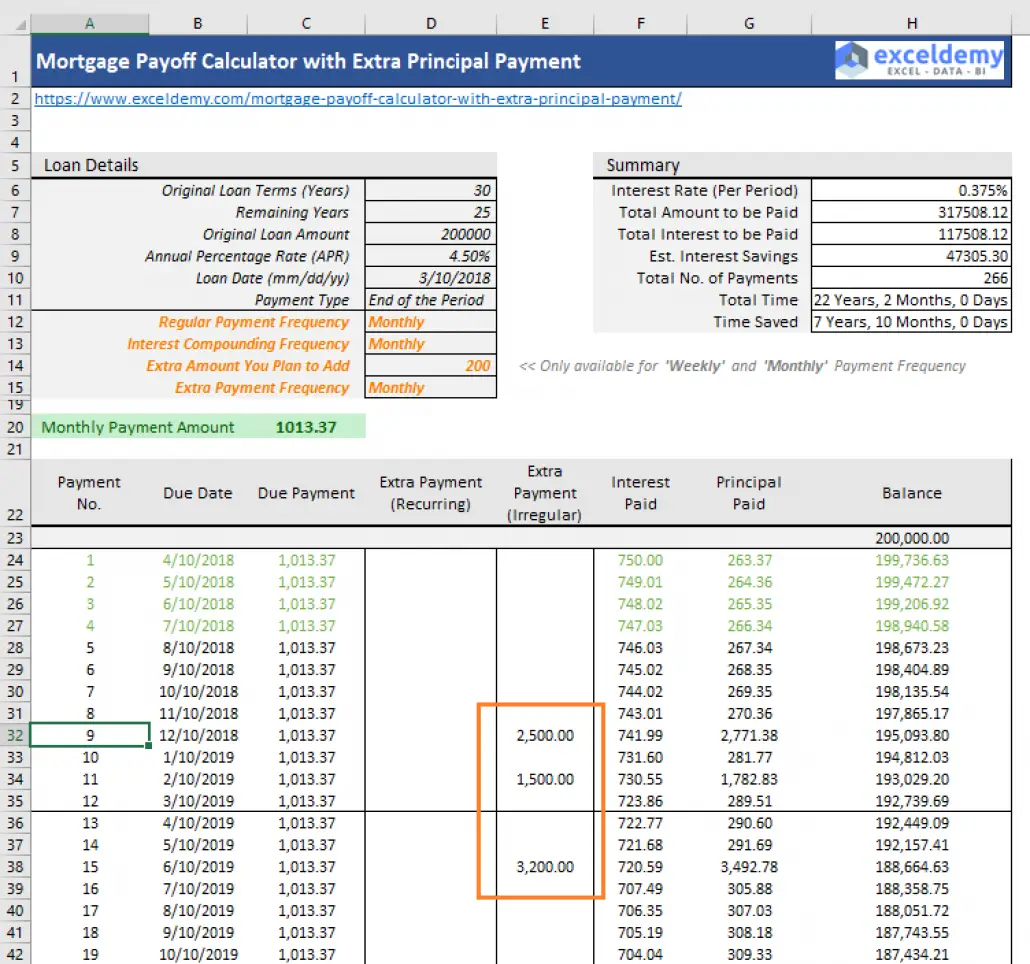

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Factors To Consider When Paying Off The Mortgage Early

Living without any debt is an exciting goal, but paying off your mortgage needs to be done right. Here are some important considerations:

- Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or other loan terms designed to prevent you from prepaying. Make sure to contact your lender and read the fine print in your mortgage contract to determine if this applies to you.

- Do you have credit card or any other debts? Many other types of debt, like credit card debt, have higher interest rates. It’s usually more advantageous to pay off any consumer debt before you pay off the mortgage.

- Have you set aside a sufficient emergency fund? It’s generally a good idea to set aside money in an emergency fund to cover expenses that are not included in your budget or to protect from a rainy day. Build a solid financial foundation first!

- Is your debt oppressing you? Some people feel debt rules their lives. If debt is stressing you out, use the Mortgage Payoff Calculator to calculate how much extra money you need to put toward your mortgage every month to get out of debt sooner.

Once you’ve determined that you’re ready to pay off your mortgage, it’s time to start reaping the benefits!

Related: 5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Don’t Miss: Car Loan Lowest Interest Rate

What Is An Amortization Schedule

An amortization schedule is a calculated table of periodic payments and is used by lenders to represent a schedule of repayments on a loan or mortgage over a period of time.

The term ‘amortization’ refers to the action of paying off a debt with regular set payments, with the debt reducing over time. As more of the principal loan balance is repaid over time, less interest becomes due on the remaining principal balance. Hence, over time the split of interest vs principal changes over the life of the loan, with interest reducing and more of the principal being paid off.

Note that in British English, amortization is spelled as ‘amortisation’.

Benefits Of Paying Extra On A Mortgage

The main benefit of paying extra on a home mortgage or personal loan is saving money. When a borrower consistently makes additional payments, he could save thousands of dollars on his loan.Let’s take a look at an example of how much extra payments can save on a loan of $150,000 with an interest rate of 5.5% and a 10-year term.Loan Amount: $150,000Interest Rate: 5.5%Term: = 10 yearFollowing are the payment details for this loan.Monthly Payment: $1,627.89Total Interest: $45,347.30Total Payment: $195,347.30Pay Off: 10 YearsOn this loan, the borrower would pay $45,347.30 in interest payment after 10 years of payment. Let’s see how much he can save if he makes an additional payment of $300 each month which is about 18% more than the original monthly payment of $1,627.89.Extra Payment: $300New Monthly Payment: $1,927.89Total Interest: $35,923.95Total Payment: $185,923.95Pay Off: 8 YearsAs we can see by making an extra payment of $300 each month, the borrower saves about $9,423.35 in interest payment, and he pays off his loan in 8 years instead of 10.

Don’t Miss: How To Pay My Student Loans

What Repayment Plan Qualifies For Student Loan Forgiveness

Some federal student loan forgiveness programs require you to make payments under an eligible repayment plan.

For example, to potentially qualify for Public Service Loan Forgiveness, youll need to work for 10 years at a government or nonprofit agency while making qualifying payments under an IDR plan.

You could also qualify for loan forgiveness under an IDR plan itself. Depending on the plan, your loans could be forgiven after 20 to 25 years of payments. There are four plans to choose from:

Keep in mind:

Is There A Disadvantage To Paying Off A Mortgage

A: Paying your mortgage off early and closing out an account could impact your credit score. Mortgages are considered “good debt,” and paying it off extremely early could negatively affect your score. But, remember, you can alwaysrefinance to a shorter-termif you are determined to pay it off sooner. In addition, you could possibly get a lower interest rate in the process and be able to pay your loan off sooner.

Related Articles

Recommended Reading: Pnc Bank Auto Loan Phone Number

How Can You Pay Off Student Loans Faster

Here are a few ways that might help you pay off your loans faster:

- Pay extra on your loans. If you can afford it, make extra payments toward your loans. This could save you money on interest and cut down your repayment time.

- Refinance your loans. This could get you a lower interest rate. If you also choose to shorten your loan term, you could pay off your loans more quickly with fewer interest charges.

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage The remaining number of years until you want your mortgage paid off.

- Principal The amount of money you borrowed to buy your home.

- Annual Interest Rate The percentage your lender charges on borrowed money.

- Mortgage Loan Term The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings How much you’ll save on interest by prepaying your mortgage.

Also Check: Fair Credit Loans Guaranteed Approval

Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

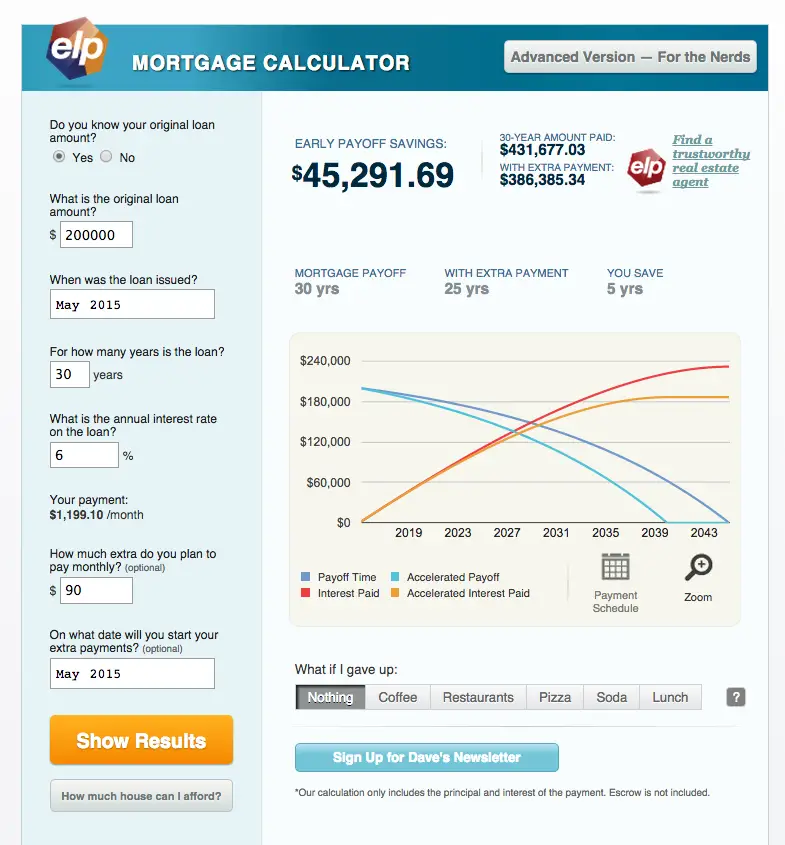

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

Extra Payment Mortgage Calculator

Determine mortgage payments for different types of loans, estimate how much you can afford to borrow, calculate the income required to qualify for the particular loan, and find out how your bi-weekly payments influence the loan term and the interest paid over the life of the loan.

185 Plains Road – 3rd Floor – Milford, CT 06461

You May Like: Loans From Government For Small Business

Loan Early Payoff Calculator Definitions

- Annual interest rate

- Annual interest rate. Maximum interest rate is 20%.

- Number of months remaining

- Total number of months remaining on your original loan.

- Loan term

- Total length, or term, of your original loan in months.

- Loan amount

- The original amount financed with your loan, not to be confused with the remaining balance or principal balance.

- Additional monthly payment

- Your proposed extra payment per month. This payment will be used to reduce your principal balance.

- Current payment

- Monthly principal and interest payment based on your original loan amount, term and interest rate.

- Monthly prepayment amount

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Also Check: What Is The Best Student Loan Servicer

Considerations For Extra Payments

Pay Off Higher Interest Debts First

Paying off your mortgage early isn’t always a no-brainer. Though it can help many people save thousands of dollars, it’s not always the best way for most people to improve their finances.

Compare your potential savings to your other debts. For example, if you have , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate.

Further, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.

Also consider what other investments you can make with the money that might give you a higher return. If you can make significantly more with an investment and have an emergency savings fund set aside, you can make a bigger financial impact investing than paying off your mortgage. It is worth noting volatilility is the price of admission for higher earning asset classes like equities & profits on equites can be taxed with either short-term or long-term capital gains taxes, so the hurdle rate for investments would be the interest rate on your mortgage plus the rate the investments are taxed at.

Are There Any Other Advantages To Making Extra Mortgage Payments

Another advantage to paying down your mortgage more quickly: As you build up home equity, you get the ability to tap that equity in an emergency or if you need to make an expensive repair or addition. You have to use home equity loans carefully, because if you dont repay them, you could lose your house. Nevertheless, its good to know that the money is available if you need it.

Make sure you get credit for an extra mortgage payment. Most loans allow you to prepay principal. Its always wise to mark your extra principal when you make your payment and to check that your bank has credited it to your principal, rather than interest. Be sure to ask your lender for instructions on how to make your extra principal payment.

And dont forget: When you get to 20 percent equity, ask your lender to remove the mortgage insurance payment.

Also of Interest

You May Like: Which Loan Options Are Best For First Time Home Buyers

Is It Worth It To Pay Off A Mortgage Early

A: As long as you aren’t charged a prepayment penalty by your lender and saving money is your goal, then yes, it could be worth it for you to pay it off early. However, consider that everything depends on your financial goals and what is going on in the housing market. It’s always a great idea to talk to a salary-based mortgage consultant when in doubt. Find out more about makingextra mortgage payments.

How Long Does It Take To Pay Off $100000 In Student Loans

How long it will take to pay off $100,000 in student loans will mainly depend on your repayment plan and strategy.

For example, if you have federal student loans, youll have 10 years under the standard repayment plan, while you could have up to 30 years if you consolidate with a Direct Consolidation Loan.

You could also refinance federal or private student loans and opt for a longer or shorter repayment term. Its usually a good idea to choose the shortest term with a payment you can afford to save the most on interest.

Tip:

Don’t Miss: How To Transfer Personal Loan From One Bank To Another

Mortgage Payoff Calculator Help

-

Mortgage amount: You can find this on the first line of the Loan Terms section of your Closing Disclosure.

-

In how many years do you want to pay off your mortgage? Enter different numbers to see how your payoff timeline affects your overall interest savings.

-

How much do you still owe ? Look for this figure in a recent monthly statement, or contact the mortgage servicer. Or you can use NerdWallet’s mortgage amortization calculator and drag the slider to estimate how much you still owe.

-

Results: Dollar amounts show only the principal and interest portions of your monthly payments. Your full monthly payment may also include other costs such as taxes, homeowners insurance and mortgage insurance .

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

» MORE: Investing vs. paying off your mortgage

How To Calculate Extra Mortgage Payments

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loan’s lifetime.

Recommended Reading: How Do Mortgage Lenders Determine Loan Amount

Early Auto Loan Payoff Calculator Faqs

What is a pay-off car loan early calculator?

A pay-off car loan early calculator is a calculator that helps you know how much time you can shave-off from your car payment and the interest you can save by increasing your monthly car payments.

How will an auto loan calculator help me with extra payments?

Auto loans that span for a long period are great, but they accrue a lot of interest to be paid over time. Our auto loan calculator will show you just how much you can save on these interests by making extra monthly payments.

How do I find out my car loan amortization schedule with extra payments?

You can get an idea of your amortization schedule when you use our auto loan early payment calculator. You will be shown just how much you’ll be owing at any period in the life of the loan for both regular payments and accelerated payment plans that use extra payment.

Is there a ‘remaining car loan payoff calculator’?

Yes, there is a remaining car loan payoff calculator. This auto loan early payment calculator provides you with accurate information about how much money you still have to pay off on a car loan. You will, however, need to supply details on the loan amount, period, and extra payment.

How to pay off car loan calculator faster?

How to pay off a car loan early using a lump sum calculator?

How fast can I pay off my car loan?

When will my car be paid off?

How to determine the payoff amount on my car loan?

What about car loan amortization calculators with extra payments?

How To Use The Calculator:

Fill in the required fields and click on the Calculate button to see the results. Heres what each of the fields means:

- Current loan balance: the current amount left to pay on a loan.

- Annual interest rate: the amount you pay every year to borrow money, including fees, expressed as a percentage.

- Years of term remaining: the remaining length of your loan, expressed in years.

- Extra monthly payment: an additional payment that goes towards the principal part of a loan.

- Interest saved with extra payments: the amount saved in interest by making an extra payment each month.

- Monthly payment: the amount paid to your lender each month in order to repay a loan.

- Months to payoff: how many months are left until the loan is fully paid.

- Total payments: the total amount of money paid towards the loan.

- Total interest: the total amount of money paid in interest.

Our goal at FinMasters is to make every aspect of your financial life easier. We offer expert-driven advice and resources to help you earn, save and grow your money.

Tools & Resources

You May Like: Personal Loan 620 Credit Score