Best Fair Credit Balance Transfer Cards For Consolidation

Although unfortunate, one reality of credit card debt and debt in general is that help is the least available to those with the lowest credit scores who likely need it the most. And this sad pattern extends to the world of balance transfer credit cards.

In general, finding a 0% APR balance transfer offer with fair credit will likely require some digging, especially if you prefer to stick with major banks. Student credit cards and secured credit cards are the most likely to provide a good balance transfer offer.

| $0 | New/Rebuilding |

Many more balance transfer credit card options exist at the local level, with credit unions and small community banks more willing to provide lower APRs even some 0% intro-APRs for those with at least fair credit.

The Aspire Platinum has a low regular APR range of 10.15% to 18%, depending on your credit, and a generous six-month 0% APR introductory offer.

- 0% introductory APR on new purchases and balance transfers for the first 6 months

- Standard 10.15% to 18% APR, depending on creditworthiness

- Pay no annual fee

Youll need to become a member of Aspire Credit Union to apply for its credit cards, but you can become eligible for membership if you work for a Select Employer Group or by joining the American Consumer Council.

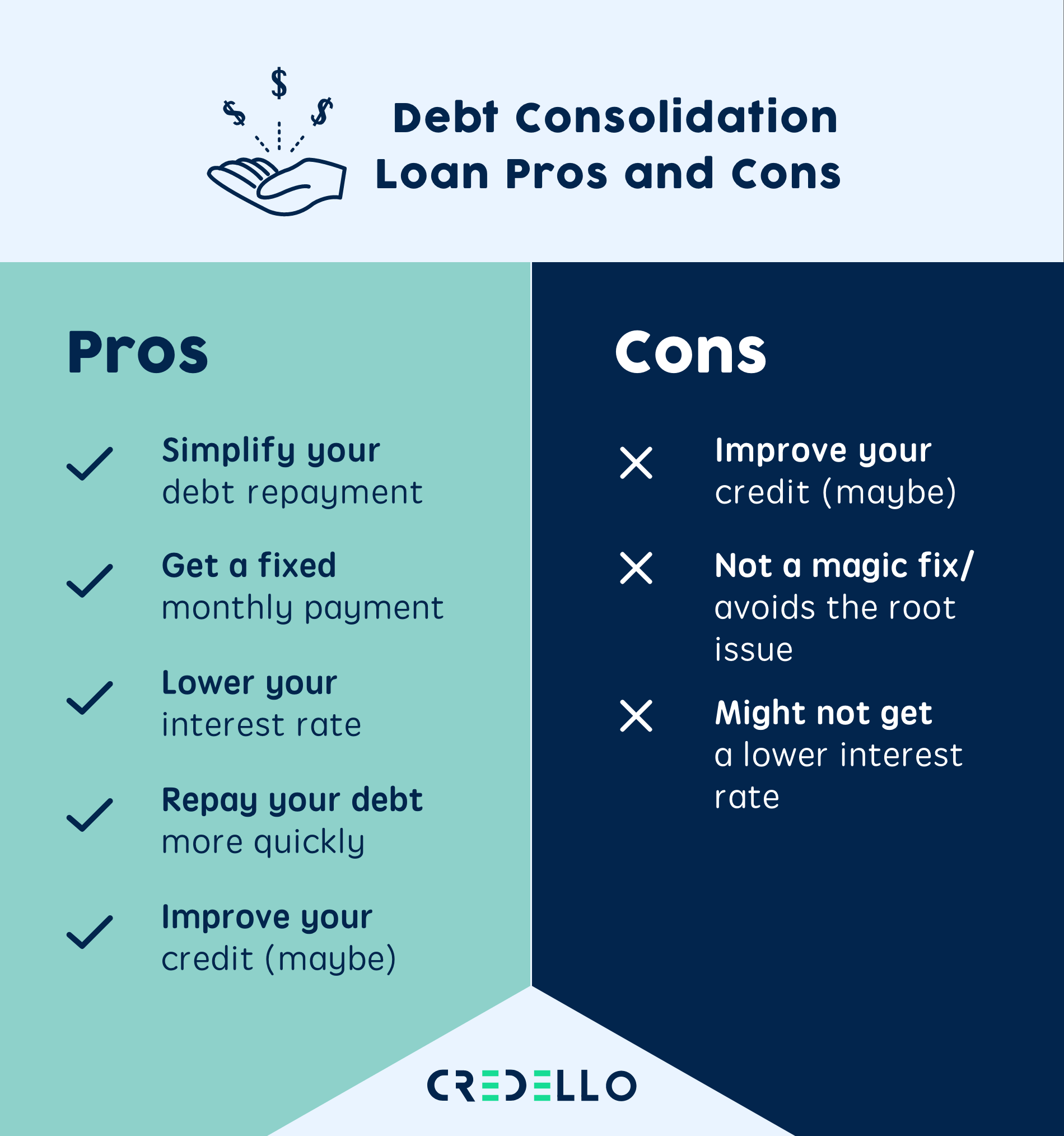

What Are The Pros And Cons Of Debt Consolidation

Debt consolidation comes with various advantages and disadvantages. For instance, it may help you streamline finances, expedite your payoff, lower your interest rates and reduce your monthly payments. However, it may come with added costs, an increase in total interest paid over time and the urge to increase your spending.

How Can I Improve My Credit Score

If you have a low credit score, there are a few things you can do. Making all of your minimum payments on time is a good place to start. If youre using a credit card, try not to use over 50-60% of your credit limit. Over time, the closer you are to your limit, the more it can negatively affect your credit score.

Recommended Reading: What Are The Best Online Personal Loan Lenders

Should I Get A Personal Loan To Pay Off Debt

Falling behind on debt payments can have a damaging effect on your credit score and may ultimately result in repossession of collateral or accounts being sent to collections. If youre struggling to make payments on all of your individual debts, consider taking out a personal loan to streamline your payments and increase the repayment termthereby reducing your monthly payment.

A debt consolidation loan also may be a good option if your credit score has improved since you applied for your loans. By qualifying for a lower interest rate on a debt consolidation loan, youll be able to reduce how much you pay over the life of your loans.

Refine Your Debt Paying Strategy

Once you’ve consolidated your debts into as few loans or payments as possible, you may still have to prioritize the debts you can afford to pay first. There are two schools of thought on this.

Pay off your highest interest loans firstSome financial experts will advise you to tackle the highest-rate debt first because interest is accruing at a brisk pace. If the loan balances on your high-interest debts are within your reach to pay, this can be a good strategy. However, the debt with the highest interest rate may also be the largest loan or debt you have, meaning it will take longer to pay it off and make a dent in your overall debt load.

Pay smaller loans firstEliminating several smaller loans and debts first may be a better solution. You’ll reduce your overall debt load, and get the satisfaction of having some initial success.

Don’t Miss: How Much House Loan Do I Qualify For

Advantages Of Consolidation Loans

One monthly payment

Juggling bills can be a challenge, especially when you have multiple credit cards. Its easier to miss payments or overdraft your bank account. With consolidation, you no longer need to worry about sending payments to several different banks and creditors. You only have one bill due date to remember.

Lower interest rates

In the right circumstances, a consolidation loan can provide you will a much lower fixed interest rate. This reduces the amount of each payment that gets used to cover accrued monthly interest charges. As a result, you can pay down the principal faster.

Lower monthly payments

In many cases, consolidation will lower your monthly payment. The term of the loan determines the monthly payment requirement. A longer term will offer lower monthly payments.

Good for your credit

All the debts paid off with the loan will show that they were paid in full. You avoid credit damage that can be caused by missed payments when youre juggling bills. As long as you keep up with the loan payments, consolidation should have a positive effect on your credit score.

Less pressure from creditors

If youve fallen behind on some or any of your minimum payment requirements, creditors and collectors may be calling. They all want to be paid promptly. Consolidation pays off all those existing debts, reducing your financial stress. Any calls seeking payment will stop.

Better budgeting

Which Debt Should I Start To Pay Off First

As a good rule-of-thumb, tackle the debt with the highest interest rate first. This is also called the avalanche method. However, if this doesnt work for you and you have many smaller debts you want to get out of the way, paying those off first may give you the momentum and focus you need to handle the larger debt.

Also Check: How Much Interest Will I Pay Student Loan

Balance Transfer Credit Card Vs Debt Consolidation Loan

One other option we didnt discuss above is a balance transfer credit card. Heres a quick look:

| 2-7 years | Post-promotional 30-day repayment schedule |

Debt consolidation loans are better if you have multiple types of debt, like student debt, various credit cards, and outstanding bills.

Balance transfer credit cards, on the other hand, are a better option if you currently have a lot of credit card debt sitting on a high APR card. Its easy enough to fix just switch over to a 0% APR introductory rate with a low or no balance transfer fee, but be sure to pay off the transferred balance within the promotional period as afterwards the interest rates become quite high.

Tips For Comparing Personal Loans For Debt Consolidation

Personal loans often are available online through traditional banks, credit unions and alternative lending platforms so you can apply quickly and conveniently, without having to visit a bank branch. Many of these lenders also offer competitive interest rates and flexible repayment terms, meaning you may be able to save money by consolidating your other debts.

Consider these tips when comparing personal loans:

You May Like: Will Personal Loan Hurt My Credit

Can I Pay Off A Debt Consolidation Loan Early

Yes. The beauty of acquiring a Symple Loan is our flexible, no fee, early payment plan. With no early payment penalties you have several options to pay off your loan in partial or in full at any time by contacting our customer service team at or call us directly at

If you meet the below requirements, you are eligible for a Symple Loan:1. Be at least 18 years old 2. Be employed and receiving employment or retirement income over $50k annually3. Be a Canadian Citizen or Permanent Resident4. Residing in Canada 5. Have no previous bankruptcies

Warning: Debt Settlement Is Not Consolidation

Debt consolidation should not be confused with debt settlement. Consolidation solutions pay back everything you owe more efficiently with lower interest. Settlement options work by focusing on paying back only a percentage of the principal you owe. This results in greater damage to your credit that lasts for six years.

Some companies purposely try to mislead consumers into thinking theyre signing up for debt consolidation. If youre seeking professional help to pay off your debt, make sure you know what youre signing up for before you sign up for anything and start making payments.

Also Check: Federal Student Loans Vs Private

What Is A Credit Card Consolidation Loan

A credit card consolidation loan is an unsecured personal loan that you take out to pay off your current credit card debt. Youll then begin making monthly payments on the new loan.

You can also consolidate other forms of debt with a personal loan, but many lenders offer loans specifically for debt consolidation, and some personal loan lenders will pay your creditors for you directly.

How Consolidation Loans Are Issued

When you receive a traditional debt consolidation loan, the company lending you the money either uses the funds to pay out the debts you jointly agree will be paid off, or they deposits the funds it in your bank account and it is then your responsibility to pay out the debts or bills you wish to consolidate with the loan proceeds.

Also Check: How To Calculate Extra Payments On Car Loan

Keep Up With Payments And Make A Plan To Stay Out Of Debt

Though consolidation can be a smart move, it’s only successful if you pay off the new debt and resist the temptation to run up a balance on your newly freed cards.

Build a budget that prioritizes your new monthly payment so you’re not charged a late fee. Late payments can hurt your credit score if reported to the credit bureaus.

Also, plan how you’ll stay out of debt in the future. Grant says most of her clients aren’t in debt because of poor spending habits but because they couldn’t cover unexpected expenses, such as car repairs or medical bills.

Grant recommends building up to a $1,000 emergency fund to prevent a cash shortage. And don’t wait till you’re out of debt to start, she says, since unexpected expenses can pop up anytime, causing you to backslide.

Instead, set aside whatever cash you can manage into an interest-earning savings account while still making your new monthly payment.

“Maybe it might take a little longer, but you can do both, and in most situations, that’s ideal,” Grant says.

About the author:Jackie Veling covers personal loans for NerdWallet.Read more

Consolidate Via A Personal Loan

The process starts by obtaining a personal loan, using the proceeds to pay off your credit card balances, and then repaying the loan with fixed monthly payments for the loan duration. Personal loans typically provide you with a lower interest rate and a smaller monthly payment compared to credit card interest rates.

You can use the money you save to pay your other bills, make needed purchases or add to your savings. Consider keeping all but one of your credit cards in the drawer while repaying the loan, and only use that one card for purchases that youll pay off in full on the next payment due date.

In this way, your total debt will decline, and your credit rating will rise. Thats a good idea.

Don’t Miss: What’s The Biggest Business Loan I Can Get

Before Taking Out A Consolidation Loan

Get free support from anonprofit credit counselor. can advise you on how to manage your money and pay off your debts, so you can better avoid issues in the future.

Get to the bottom of why youre in debt. Its important to understand why you are in debt. If you have accrued a lot of debt because youre spending more than youre earning, a debt consolidation loan probably wont help you get out of debt unless you reduce your spending or increase your income.

Make a budget. Figure out if you can pay off your existing debt by adjusting the way you spend for a period of time.

Tryreaching out to your individual creditors to see if they will agree to lower your payments.Some creditors might be willing to accept lower minimum monthly payments, waive certain fees, reduce your interest rate, or change your monthly due date to match up better to when you get paid, to help you pay back your debt.

Is Credit Card Refinancing Better Than Credit Card Debt Consolidation Loans

A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there may be an origination fee, all of the guesswork is taken out as everything is determined at the time the loan is taken out. The rate would likely be higher than a promotional rate from a credit card, but if the balance is being carried beyond this time period, the consolidation loan rate would likely be less than the average APR from the credit card.

Don’t Miss: How Long Does An Auto Loan Approval Take

Best Loans To Consolidate Credit Card Debt

If you have a sizable amount of debt and may need several years to pay it down, then a personal installment loan is likely your best bet.

Depending on your credit, most personal installment loans can be obtained with interest rates lower than a typical credit card, and with term lengths of up to six years.

Using an online lending network is one of the simplest ways to compare your loan options, as you can obtain quotes from multiple lenders at once. Our top picks have hundreds of lending partners from which to choose.

If you decide to use an online lending network, remember that it isnt the network with which youll be doing business.

The individual lender that you select will be the party that provides your financing and to which you will make your payments.

These Are The Five Factors That Can Derail Plans To Eliminate Your Debt

| Why Credit Card Debt Consolidation Fails | The Bad Results It Causes |

|---|---|

| Interest rate is too high | Payments get eaten up by accrued monthly interest charges, which slows any progress, making it impossible to reach zero. |

| Repayment term is too long | Increases total cost, making debt elimination inefficient and increasing the chances youll drop off. |

| Monthly payments still dont fit your budget | You cant keep up with the payments, leading to default and collections. |

| You take on new debt too early. | If you start charging before you complete your consolidation plan, you end up with more debt instead of less. |

| Your situation changes, due to job loss or a medical emergency. | Any change in your income can prevent you from keeping up with your elimination plan. |

Recommended Reading: Interest Rates For Boat Loan

What Is A Debt Consolidation Loan

A debt consolidation loan is cash you can access that is used to pay off all your debt from previous loans, overdue bills, credit card balances, and any other outstanding payments due. Debt consolidation loans in Canada are available for both private and business use, and they are a promising way for both use cases to settle an unstable financial situation.

Know Your Balance: Can You Meet Your Minimum Payments

Using your minimum credit card payments, add up each of your monthly credit card bills. Is your monthly bill total larger than your monthly income or does your income out earn your bills? Use your knowledge of your overall balance to select a credit card debt consolidation solution that fits your situation:

Read Also: How Do You Spell Loan

Are There Any Hidden Fees

Absolutely not! Origination fees may be applicable on your Symple Loan and help us provide you with the best customer experience from the comfort of your home, while keeping your interest rates low. These fees are a one-time charge of 0-5% and are added to your loan principal which can be paid off over your loan term. Late payment fees of $45.00 will apply for missed or late scheduled payments.

How To Consolidate Your Debt

There are two primary ways to consolidate debt, both of which concentrate your debt payments into one monthly bill.

-

Get a 0% interest, balance-transfer credit card: Transfer all your debts onto this card and pay the balance in full during the promotional period. You will likely need good or excellent credit to qualify.

-

Get a fixed-rate debt consolidation loan: Use the money from the loan to pay off your debt, then pay back the loan in installments over a set term. You can qualify for a loan if you have bad or fair credit , but borrowers with higher scores will likely qualify for the lowest rates.

Two additional ways to consolidate debt are taking out a home equity loan or 401 loan. However, these two options involve risk to your home or your retirement. In any case, the best option for you depends on your credit score and profile, as well as your debt-to-income ratio.

Use the calculator below to see whether or not it makes sense for you to consolidate.

Read Also: How Much Is House Loan Interest

Cons Of A Balance Transfer Credit Card

Balance transfer credit cards arent without their drawbacks. Consider these main features before using a balance transfer card to manage your debt:

- Transfer fees: Youll be charged a fee for your transfertypically 3%-5% of the total amount. In other words, if you transfer $3,000, youll be charged a fee of $90-$150.

- Interest charges: You wont pay interest on your balance during the introductory period, unless you add new charges. If you do so, youll be charged the full interest rate until every dollar you owe is paid off, including the transfer amount. You might also have to start paying interest early if you make late payments.

- Your credit scores will help determine if you qualify for a balance transfer credit card. If your scores are below 670, you may have trouble qualifying.

- Every time you apply for a new credit card you risk losing a few points from your credit scores. You can minimize the loss of points by making all of your applications for a new credit card within 14 days.